SolGold PLC Announces Blanca-Nieves Project Update

- None.

- None.

Blanca-Nieves Project Update - Outcrop results 6.15m @ 7.46 g/t Au

BISHOPSGATE, LONDON / ACCESSWIRE / March 19, 2024 / SolGold (LSE:SOLG)(TSX:SOLG) is pleased to provide an update on the Blanca-Nieves Project ("Project"). SolGold holds a

- Exploration identified a significant porphyry target at El Cielto Norte covering approximately 2.5 x 2.5 km and is greater in extent than the Alpala system to the south at the Cascabel Project

- At Florida, new assays from channel samples of gold-bearing epithermal quartz vein outcrops with up to 6.15m true thickness, returned results of 6.15m @ 7.46 g/t Au, including 2.2m @ 21.1 g/t Au

- Advancing new target areas towards drill-ready status

- Potential for future integration of Blanca-Nieves with the Tier 1 Cascabel Project, due to the proximity of approximately 8 km

Santiago Vaca, SolGold's Chief Geologist, commented:

"Our team is excited about the overall prospect of the Blanca-Nieves Project, including the potential for future integration with the Cascabel Project. The district scale opportunity reinforces our view that mining has the potential to be a significant, multi-generational sector in Ecuador."

Further Information

The Blanca-Nieves Project is situated approximately 8 km north of the Company's Tier 1 Cascabel Project in northern Ecuador, which holds 3.7 Bt of ore, 12.4 Mt of copper and 31.3 Moz of gold in the measured plus indicated category, and 854 Mt of ore, 2.0 Mt of copper and 5.3 Moz of gold in the inferred category. The Cascabel Project is the largest undeveloped copper-gold resource in South America and one of the largest in the world; with its recently published pre-feasibility study indicating an initial capex of

High-grade "bonanza-style" gold and silver mineralisation with visible gold has been discovered outcropping at numerous locations within the Blanca-Nieves Project area. This includes the previously reported presence of epithermal quartz veins with over 100 g/t gold grades at Cielito and Florida. The ongoing exploration efforts at the Blanca-Nieves epithermal gold-silver vein field continue to demonstrate significant potential for complex high-grade epithermal vein systems, and recent work has also identified the potential for a parent mineralised porphyry body beneath the outcropping gold system.

SolGold is advancing new target areas towards drill-ready status as exploration continues with both epithermal vein and porphyry gold-copper as objectives. SolGold intends ultimately to extend the definition of the gold-bearing epithermal veins at Cielito and Quiroz beyond the range of previous historical artisanal mining and drilling to date and to extend the size of the discovery at Florida, further demonstrating the Company's commitment to realising the full potential of the Blanca-Nieves Project with a view to integration with Cascabel.

Recent and historic exploration at the Blanca-Nieves Project, immediately north of the Company's Cascabel Project, has identified a widespread epithermal gold and silver precious metal field which covers more than 80 square kilometres.

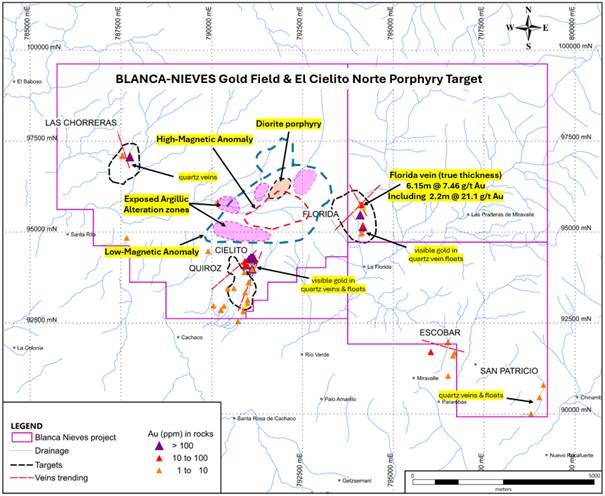

New assays of channel samples from gold-bearing epithermal quartz vein outcrops, with up to 6.15m true thickness, returned 6.15m @ 7.46 g/t Au at Florida, including 2.2m @ 21.1 g/t Au ( Figure 1 ). A significant thickening of quartz veins is observed along with an increase in clay alteration at Florida, and more recent fieldwork has identified a significant porphyry target at El Cielito Norte, immediately west of Florida.

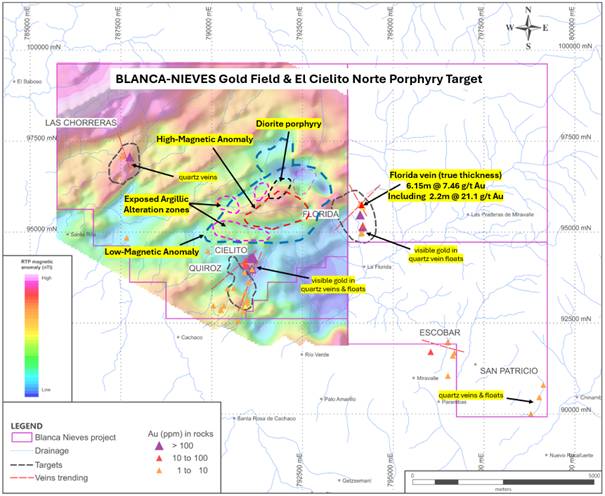

El Cielito Norte lies central to peripheral high-grade gold-silver and base metal vein occurrences at Cielito, Florida, Quiroz and Las Chorreras. The El Cielito Norte porphyry target is characterised by a central magnetic high anomaly, surrounded by an annular magnetic low, typical of the inner potassic and outer hydrothermal alteration zones observed in many large porphyry deposits around the globe ( Figure 2 ).

High-grade quartz-gold-silver epithermal vein systems at Cielito, Florida, Quiroz, and Las Chorreras occur peripheral to the El Cielito Norte porphyry target defined by a central diorite porphyry intrusion coincident with a kilometre scale RTP magnetic high with annular magnetic low. Zones of argillic clay alteration lie coincident with the magnetic low ( Figure 2 ).

Additional porphyry-style magnetic signatures are evident, overlapping on the northern edge of the main anomaly ( Figure 2 ).

The porphyry target alteration footprint at El Cielito Norte covers approximately 2.5 x 2.5 km and is greater in extent than the Alpala system to the south.

Ongoing surface rock chip float and channel and soil sampling programs are in preparation to map extensions of this exciting discovery and outline drill targets.

Figure 1 : High-grade quartz-gold-silver epithermal vein systems at Cielito, Florida, Quiroz, and Las Chorreras are peripheral to the El Cielito Norte porphyry target which is defined by a central diorite porphyry intrusion coincident with a kilometre-scale magnetic high anomaly with annular magnetic low. Zones of argillic clay alteration lie coincident with the magnetic low.

Figure 2 : High-grade quartz-gold-silver epithermal vein systems at Cielito, Florida, Quiroz, and Las Chorreras peripheral to the El Cielito Norte porphyry target defined by a central diorite porphyry intrusion coincident with a kilometre scale magnetic high anomaly with annular magnetic low. Zones of argillic clay alteration lie coincident with the magnetic low.

Qualified Person: Above information relating to the exploration results is based on data reviewed by Mr Santiago Vaca (M.Sc. P.Geo.). Mr. Vaca joined SolGold in 2014 as Chief Geologist for the Cascabel project and is an Ecuadorian geologist with over 18 years of experience in mineral Exploration and research. Mr Vaca holds a Professional Geoscientist Certification (P.Geo) granted by the Association of Professional Engineers and Geoscientists of Alberta (APEGA) in Canada and is a Qualified Person for the purposes of the relevant LSE and TSX Rules. Mr Vaca consents to the inclusion of the information in the form and context in which it appears. |

CONTACTS

Scott Caldwell SolGold Plc (CEO) | Tel: +44 (0) 20 3807 6996 |

Tavistock (Media) Jos Simson/Gareth Tredway | Tel: +44 (0) 20 7920 3150 |

ABOUT SOLGOLD

SolGold is a leading resources company focused on the discovery, definition, and development of world-class copper and gold deposits and continues to strive to deliver objectives efficiently and in the interests of shareholders.

The Company operates with transparency and in accordance with international best practices. SolGold is committed to delivering value to its shareholders while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace, and minimizing environmental impact.

SolGold is listed on the London Stock Exchange and Toronto Stock Exchange (LSE/TSX: SOLG).

See www.solgold.com.au for more information. Follow us on "X" @SolGold_plc

CAUTIONARY NOTICE

News releases, presentations and public commentary made by SolGold plc (the " Company ") and its Officers may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to interpretations of exploration results to date and the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's Directors, including the plan for developing the Project currently being studied as well as the expectations of the Company as to the forward price of copper. Such forward-looking and interpretative statements involve known and unknown risks, uncertainties and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations or forward-looking statements; and save as required by the exchange rules of the TSX and LSE or by applicable laws, the Company does not accept any obligation to disseminate any updates or revisions to such interpretations or forward-looking statements. The Company may reinterpret results to date as the status of its assets and projects changes with time expenditure, metals prices and other affecting circumstances.

This release may contain "forward‑looking information". Forward‑looking information includes, but is not limited to, statements regarding the Company's plans for developing its properties. Generally, forward‑looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward‑looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward‑looking information, including but not limited to: transaction risks; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, risks relating to the ability of exploration activities (including assay results) to accurately predict mineralization; errors in management's geological modelling and/or mine development plan; capital and operating costs varying significantly from estimates; the preliminary nature of visual assessments; delays in obtaining or failures to obtain required governmental, environmental or other required approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further exploration activities, including drilling; delays in the development of projects; environmental risks; community and non-governmental actions; other risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and those risks set out in the Company's public documents filed on SEDAR+ at www.sedarplus.ca . Accordingly, readers should not place undue reliance on forward‑looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The Company and its officers do not endorse, or reject or otherwise comment on the conclusions, interpretations or views expressed in press articles or third-party analysis.

The Company recognises that the term World Class is subjective and for the purpose of the Company's projects the Company considers the drilling results at the Alpala porphyry copper-gold deposit at its Cascabel project to represent intersections of a World Class deposit on the basis of comparisons with other drilling intersections from World Class deposits, some of which have become, or are becoming, producing mines and on the basis of available independent opinions which may be referenced to define the term "World Class" (or "Tier 1").

The Company considers that World Class deposits are rare, very large, long life, low cost, and are responsible for approximately half of total global metals production. World Class deposits are generally accepted as deposits of a size and quality that create multiple expansion opportunities and have or are likely to demonstrate robust economics that ensure development irrespective of position within the global commodity cycles, or whether or not the deposit has been fully drilled out, or a feasibility study completed.

Standards drawn from industry experts (1Singer and Menzie, 2010; 2Schodde, 2006; 3Schodde and Hronsky, 2006; 4Singer, 1995; 5Laznicka, 2010) have characterised World Class deposits at prevailing commodity prices. The relevant criteria for World Class deposits, adjusted to current long run commodity prices, are considered to be those holding or likely to hold more than 5 million tonnes of copper and/or more than 6 million ounces of gold with a modelled net present value of greater than US

The Company cautions that the Cascabel Project remains an early-stage project at this time and there is inherent uncertainty relating to any project at prior to the determination of pre-feasibility study and/or defined feasibility study.

On this basis, reference to the Cascabel Project as "World Class" (or "Tier 1") is considered to be appropriate.

Quality Assurance / Quality Control on Sample Collection, Security and Assaying

SolGold operates according to its rigorous Quality Assurance and Quality Control (QA/QC) protocol, which is consistent with industry best practices.

Primary sample collection involves secure transport from SolGold's concessions in Ecuador, to the ALS certified sample preparation facility in Quito, Ecuador. Samples are then air freighted from Quito to the ALS certified laboratory in Lima, Peru where the assaying of drill core, channel samples, rock chips and soil samples is undertaken. SolGold utilises ALS certified laboratories in Canada and Australia for the analysis of metallurgical samples.

Samples are prepared and analysed using 100g 4-Acid digest ICP with MS finish for 48 elements on a 0.25g aliquot (ME-MS61). Laboratory performance is routinely monitored using umpire assays, check batches and inter-laboratory comparisons between ALS certified laboratory in Lima and the ACME certified laboratory in Cuenca, Ecuador.

In order to monitor the ongoing quality of its analytical database, SolGold's QA/QC protocol encompasses standard sampling methodologies, including the insertion of certified powder blanks, coarse chip blanks, standards, pulp duplicates and field duplicates. The blanks and standards are Certified Reference Materials supplied by Ore Research and Exploration, Australia.

SolGold's QA/QC protocol also monitors the ongoing quality of its analytical database. The Company's protocol involves Independent data validation of the digital analytical database including search for sample overlaps, duplicate or absent samples as well as anomalous assay and survey results. These are routinely performed ahead of Mineral Resource Estimates and Feasibility Studies. No material QA/QC issues have been identified with respect to sample collection, security and assaying.

Reviews of the sample preparation, chain of custody, data security procedures and assaying methods used by SolGold confirm that they are consistent with industry best practices and all results stated in this announcement have passed SolGold's QA/QC protocol.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com .

SOURCE: SolGold PLC

View the original press release on accesswire.com