Skeena Completes PFS for Eskay Creek: After-Tax NPV(5%) of C$1.4B, 56% IRR and 1.4 Year Payback

Skeena Resources Limited announced the results of a Prefeasibility Study (PFS) for its Eskay Creek gold-silver project in British Columbia, highlighting a high-grade open-pit mine with proven and probable mineral reserves of 3.88 million ounces AuEq. Key metrics include an after-tax NPV5% of C$1.4 billion and an IRR of 56%, with a payback period of 1.4 years. The project, requiring C$488 million in pre-production capital, aims to average 249,000 oz Au and 7.2 million oz Ag annually over a 9.8-year lifespan, with competitive cash costs and AISC.

- After-tax NPV5% of C$1.4 billion (US$1.1 billion) indicating strong project viability.

- IRR of 56% and a payback period of 1.4 years demonstrate favorable economics.

- Proven and Probable Mineral Reserves of 3.88 million ounces AuEq indicating significant resource potential.

- Projected average annual production of 249,000 oz Au and 7.2 million oz Ag over a 9.8-year mine life.

- None.

VANCOUVER, BC / ACCESSWIRE / July 22, 2021 / Skeena Resources Limited (TSX:SKE)(OTCQX:SKREF) ("Skeena" or the "Company") is pleased to announce the results of the Prefeasibility Study ("PFS") completed by Ausenco Engineering Canada Inc. ("Ausenco"), supported by SRK Consulting (Canada), and AGP Mining Consultants, for the Eskay Creek gold-silver project ("Eskay Creek" or the "Project") located in the Golden Triangle of British Columbia.

Eskay Creek 2021 PFS Highlights:

- High-grade open-pit averaging 3.37 g/t Au, 94 g/t Ag (4.57 g/t AuEq) (diluted)

- Proven and Probable Mineral Reserves of 3.88 Moz AuEq (26.4 Mt at 3.37 g/t Au and 94 g/t Ag).

- After-tax NPV5% of C

$1.4 billion , (US$1.1 billion ) and56% IRR at US$1,550 /oz Au and US$22 /oz Ag - After-tax payback period of 1.4 years

- Pre-production capital expenditures (CAPEX) of C

$488M (US$381M ) - After-tax NPV:CAPEX Ratio of 2.9:1

- Life of mine ("LOM") average annual production of 249,000 oz Au, 7,222,000 oz Ag (352,000 oz AuEq) over a 9.8-year mine life

- LOM all-in sustaining costs ("AISC") of C

$702 /oz (US$548 /oz) AuEq recovered - LOM cash costs of C

$651 /oz (US$509 /oz) AuEq recovered - 7,945 tonne per day ("tpd") mill and flotation plant producing saleable concentrate

- LOM average greenhouse gas ("GHG") emissions of 0.18 t CO2e/oz AuEq

- Exchange Rate (US$/C$) of 0.78

- Cash costs are inclusive of mining costs, processing costs, site G&A, treatment and refining charges and royalties

- AISC includes cash costs plus estimated corporate G&A, sustaining capital and closure costs

- t CO2e = tonnes of carbon dioxide equivalent

Skeena's CEO, Walter Coles Jr. commented, "Eskay Creek has a rare combination of attributes: scale, impressive grade and location in a tier one mining jurisdiction with strong First Nations support. In the first 5 years of operation, it is anticipated that Eskay Creek will produce, on average, 450,000 gold equivalent ounces per year. We expect further increases to the annual production profile as we move to the Feasibility Study in Q1 of 2022, and beyond. Our goal is to create a mine producing 500,000 gold equivalent ounces per year for 10 years. The PFS is only based on the current open-pit resources. Skeena has a 35,000-metre exploration program underway at Eskay Creek to continue to grow the open-pit resources, and we have yet to focus on the considerable underground exploration potential."

PFS Overview

The 2021 Eskay Creek PFS considers an open-pit mine with on-site treatment of the mined material by conventional milling and flotation to recover a gold-silver concentrate. The mine will be an owner-operated, standard truck and shovel open-pit, with a leased mining fleet. The plant will process ore at a nominal rate of 2.0 million tonnes per year ("Mt/y") (5,480 tpd) in Year 1 during ramp-up, 2.9 Mt/y (7,945 tpd) for Years 2 to 4 then reduce to 2.7 Mt/y (7,400 tpd) in Year 5 onward as the material increases in hardness and competency over an expected production lifespan of 9.8 years. An additional 30 months of pre-stripping, stockpiling and mine access development is planned prior to the processing facility becoming fully operational in Year 1. The PFS leverages Eskay Creek's extensive existing infrastructure, including all-weather access roads, previously permitted tailing storage facilities ("TSF") and proximity to the 195 MW hydroelectric facilities and linked power grid.

The PFS is derived from the Company's pit-constrained resource estimate (April 7, 2021) and does not include results from the recently initiated and ongoing 2021 drill program. The effective date of the PFS is July 22, 2021, and a technical report will be filed on the Company's website and SEDAR within 45 days of this disclosure.

Table 1: 2021 Eskay Creek PFS Project Parameters

| Economic Assumptions | |

| Gold Price (US$/oz) | |

| Silver Price (US$/oz) | |

| Exchange Rate (US$/C$) | 0.78 |

| Discount Rate | |

| Contained Metals | |

| Contained Gold (koz) | 2,866 |

| Contained Silver ounces (koz) | 80,197 |

| Mining | |

| Mine Life | 9.8 years |

| Strip Ratio (Waste:Ore) | 8:1 |

| Total Material Mined (excl. rehandle) (kt) | 238,030 |

| Total Mineralized Material Mined (kt) | 26,419 |

| Processing | |

| Processing Throughput | 5480 tpd (Yr 1) 7945 tpd (Yr 2-4) 7400 tpd (Yr 5 onwards) |

| Average Diluted Gold Grade | 3.37 g/t |

| Average Diluted Silver Grade | 94 g/t |

| Average Diluted AuEq Grade | 4.57g/t |

| Production | |

| Gold Recovery | |

| Silver Recovery | |

| LOM Gold Production (koz) | 2,448 |

| LOM Silver Production (koz) | 70,902 |

| LOM AuEq Production (koz) | 3,455 |

| LOM Avg. Annual Gold Production (koz) | 249 |

| LOM Avg. Annual Silver Production (koz) | 7,222 |

| LOM Avg. Annual AuEq Production (koz) | 352 |

| Operating Costs Per Tonne | |

| Mining Cost (C$/t Mined) | |

| Mining Cost (C$/t Milled) | |

| Processing Cost (C$/t Milled) | |

| G&A Cost (C$/t Milled) | |

| Total Operating Costs (C$/t Milled) | |

| Other Costs | |

| Transport to Smelter (C$/wmt) | |

| Royalty (NSR %) | |

| Cash Costs and All-in Sustaining Costs | |

| LOM Cash Cost (US$/oz Au) net of silver by product | |

| LOM Cash Cost (US$/oz AuEq) co-product | |

| LOM AISC (US$/oz Au) net of silver by-product | |

| LOM AISC (US$/oz AuEq) co-product | |

| Capital Expenditures | |

| Pre-production Capital Expenditures (C$M) | |

| Sustaining Capital Expenditures (C$M) | |

| Reclamation Cost (C$M) | |

| Economics | |

| After-Tax NPV ( | |

| After-Tax IRR | |

| After-Tax Payback Period (years) | 1.4 |

| After-Tax NPV / Initial Capex | 2.9 x |

| Pre-Tax NPV ( | |

| Pre-Tax IRR | |

| Pre-Tax Payback Period (years) | 1.3 |

| Pre-Tax NPV / Initial Capex | 4.5 x |

| Average Annual After-tax Free Cash Flow (year 1-10) (C$M) | |

| LOM After-tax Free Cash Flow (C$M) |

- Cash costs are inclusive of mining costs, processing costs, site G&A and royalties

- AISC includes cash costs plus corporate G&A, sustaining capital and closure costs

- All dollar ($) figures are presented in CAD unless otherwise stated. Base case metal prices used in this economic analysis are US

$1,550 /oz Au and US$22 /oz Ag. These prices are based on long-term average prices.

Sensitivities

After-tax economic sensitivities to commodity prices, presented in Table 2, illustrate the effects of varying gold and silver prices as compared to the base-case. Additional Project sensitivities will be presented in the Technical Report.

Table 2: After-Tax NPV (

Lower Case | Base Case | Higher Case | Upside Case | |

| Gold Price (US$/oz) | ||||

| Silver Price (US$/oz) | ||||

| After-Tax NPV ( | ||||

| After-Tax IRR(%) | ||||

| After-Tax Payback (Years) | 1.6 | 1.4 | 1.2 | 1.1 |

| After-Tax NPV/Initial Capex | 2.4 x | 2.9 x | 3.4 x | 4.1 x |

| Average Annual After-TaxFree Cash Flow (Years 1-10) (C$M) |

Eskay Creek Mineral Resource Estimate

The Company's current Mineral Resource Estimate ("MRE"; effective date of April 7, 2021) completed by SRK Consulting (Canada) forms the basis for this PFS. The MRE does not include drilling results from the Company's recently initiated and ongoing 2021 drill program.

Table 3: Pit constrained Mineral Resource Statement reported at 0.7 g/t AuEq cut-off:

Grade | Contained Ounces | ||||||

Tonnes (Mt) | AuEq (g/t) | Au (g/t) | Ag (g/t) | AuEq (Moz) | Au (Moz) | Ag (Moz) | |

| Measured | 17.3 | 5.8 | 4.2 | 118.4 | 3.2 | 2.3 | 65.9 |

| Indicated | 20.3 | 2.9 | 2.2 | 52.5 | 1.9 | 1.4 | 34.4 |

| Total M&I | 37.7 | 4.2 | 3.1 | 82.8 | 5.1 | 3.8 | 100.3 |

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. Results

- are reported in-situ and undiluted and are considered to have reasonable prospects for economic extraction.

- As defined by NI 43-101, the Independent and Qualified Person is Ms. S Ulansky, PGeo of SRK Consulting

- (Canada) who has reviewed and validated the Mineral Resource Estimate.

- The effective date of the Mineral Resource Estimate is April 7, 2021.

- The number of metric tonnes and ounces were rounded to the nearest thousand. Any discrepancies in the totals

- are due to rounding.

- Pit constrained Mineral Resources are reported in relation to a conceptual Pit shell.

- Block tonnage was estimated from average specific gravity measurements using lithology groupings.

- All composites have been capped where appropriate.

- Pit mineral resources are reported at a cut- off grade of 0.7 g/t, cut off grades must be revaluated considering prevailing market conditions.

- Cut-off grades are based on a price of US

$1,700 /oz Au, US$23 /oz Ag, and gold recoveries of90% , silver recoveries of80% and without considering revenues from other metals. AuEq = Au (g/t) + [Ag (g/t) / 74] - Estimates use metric units (metres, tonnes and g/t). Metals are reported in troy ounces (metric tonne * grade /

- 31.10348)

- CIM definitions were followed for the classification of mineral resources.

- Neither the company nor SRK is aware of any known environmental, permitted, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect this mineral resource estimate.

Mining Overview

An open-pit mining only scenario is the basis for this PFS. The underground precious metal resource opportunity has not been considered at this time. The owner-operated, leased mining fleet will utilize conventional truck and shovel methods with 22 m3 shovels and 144 tonne haul trucks. Support equipment is comprised of track dozers, graders, and hydraulic excavators; additional support equipment to maintain production during seasonal periods of high snowfall has also been incorporated.

The mine designs and scheduling were engineered to provide 2.9 Mt per year of ore to the process plant in the first 4 years, followed by 2.7 Mt per year for the remainder of the mine life.

A total of 26.4 Mt of diluted mill feed averaging 3.37 g/t gold and 94 g/t silver (4.57 g/t AuEq), is expected to be processed over the life of mine from the main pit area and a smaller satellite pit hosting the 22 Zone.

Mill feed will be trucked to a primary crusher located to the west of the main pit and then conveyed overland to the processing facility. Non-acid generating waste totaling 161 Mt will be stored in a waste storage facility adjacent to the main and satellite open pits with a portion backfilled into the pit as the mining sequence advances towards the north. Potentially acid-generating waste totaling 50 Mt will be hauled to the Tom MacKay storage facility and stored sub-aqueously together with tailings.

Open-pit mining dilution has been estimated to cause a

The reserves for Eskay Creek are based on the conversion of the Measured and Indicated resources within the current Technical Report mine plan. Measured resources are converted to Proven Reserves and Indicated resources are converted directly to Probable Reserves. The total reserves for Eskay Creek are shown in Table 4 below. Some variation may exist due to rounding.

Table 4: 2021 Proven and Probable Reserves (Metric Units)

Reserve Class | Tonnes | Grade | Contained Ounces | ||||

(Mt) | AuEq (g/t) | Au (g/t) | Ag (g/t) | AuEq (Moz) | Au (Moz) | Ag (Moz) | |

| Proven | 13.5 | 5.81 | 4.25 | 124 | 2.53 | 1.85 | 53.7 |

| Probable | 12.9 | 3.26 | 2.46 | 64 | 1.35 | 1.02 | 26.5 |

| Total | 26.4 | 4.57 | 3.37 | 94 | 3.88 | 2.87 | 80.2 |

Note: This mineral reserve estimate is as of June 30th, 2021 and is based on the mineral resource estimate dated April 7, 2021 for Skeena Resources by SRK Consulting. The mineral reserve calculation was completed under the supervision of Willie Hamilton, P.Eng. of AGP, who is a Qualified Person as defined under NI 43-101. Mineral reserves are stated within the final design pit based on a US

Production Profile

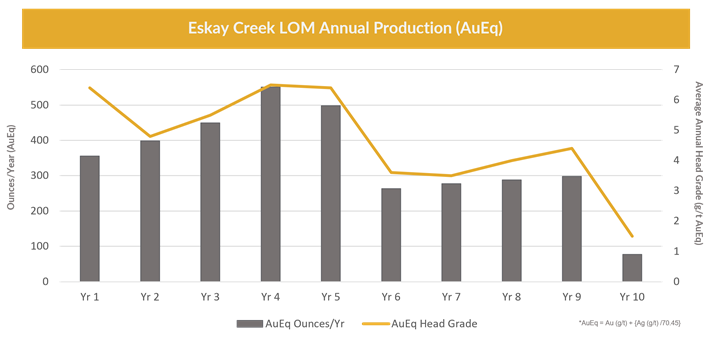

The PFS outlines an average production profile of 450,000 oz AuEq over the first five years of production. Average annual production over the full LOM is expected to be 352,000 oz AuEq. Further optimization or exploration discoveries may increase the production profile or extend the LOM schedule in the future.

It is anticipated that Skeena will have accumulated approximately 500,000 tonnes of mineralized material on surface when the processing plant is expected to reach its designed throughput capacity, providing flexibility in the early stages of production. This ramp-up profile is expected to lower the risk of start-up and minimizes sustaining capital investment at the outset of the production. There is potential for the ramp up profile to be accelerated with further optimization work.

Graph 1: Eskay Creek LOM Production Profile

Metallurgical Optimizations

PFS Test Work

Skeena completed additional Prefeasibility test work in 2020. The samples used in the PFS test program as well as fresh core intervals from the 21A, 21B, 21C, 21E and HW Zones were evaluated by Base Metallurgical Laboratories Ltd. in Kamloops BC. Composite samples representing the first three years of plant feed were also prepared. An extensive flotation testing program was completed, resulting in a modified process flowsheet.

Mineralogical studies indicated a portion of the gold was associated with non-sulphide gangue and flotation performance was negatively influenced by the presence of soft minerals. The solution was to include a desliming stage where these soft minerals were isolated and floated separately. The result was improved flotation response for the coarse material. This mill-float-mill-float circuit ("MF2") is used in platinum processing for fine-grained precious metal recovery.

Improved Metallurgy

The MF2 flowsheet was tested on both the annual composites and variability samples to evaluate its suitability to process a range of Eskay Creek material. The result was the ability to generate a higher concentrate grade without significant loss in gold recovery. This is a significant improvement over the PEA flowsheet.

A 45 g/t Au concentrate is being targeted to maximize gold recovery although samples generated final concentrate grades of more than 55 g/t Au. Concentrate silver grades are expected to be between 900 g/t and 2,400 g/t with the average LOM concentrate grade being 60 g/t AuEq. Arsenic, mercury, and antimony penalties are primarily incurred during the first three years of operation with an average cost of approximately C

Processing Overview

Run-of-mine ("ROM") material is trucked from the mine and either stockpiled or direct fed into the primary crusher. Primary crushed feed material is in turn conveyed to the mill facility and stacked onto a coarse ore stockpile. The ROM material is considered relatively competent with average Bond Rod and Ball Mill Work Indices of 15.8 kWh/t and 17.9 kWh/t, respectively. To achieve the target primary particle P80 (

Concentrate Marketing Studies

Multiple marketing assessments have been completed to support the PFS which indicate that the Eskay Creek concentrate is readily saleable at a target grade of 45 g/t Au. The preferred preliminary contract terms for the concentrate have been provided by Asian smelters, however multiple offtakes are available. Smelters/traders within Europe have also provided draft term sheets, and these have also been identified as potential markets given the high concentrate grades. The Company has been offered several preliminary term sheets for the entire concentrate production, which have been used as the basis for the financial model, and include gold and silver payabilities, industry standard treatment and refining charges, and penalties for impurities. For the purposes of the PFS, smelter payabilities average

Capital Costs

Table 5: Project Capital Cost Estimates (C$M) (totals may differ due to rounding):

Initial | Sustaining | LOM Total | |

| Mine | |||

| Pre-Stripping | |||

| Mining Equipment | |||

| Mine Capital | |||

| Sub-Total Mine | |||

| Processing | |||

| Bulk Earthworks | |||

| Processing | |||

| Reagents & Plant Services | |||

| Onsite Infrastructure | |||

| Sub-Total Processing | |||

| Infrastructure | |||

| Power | |||

| TSF, WaterSupply & Treatment | |||

| Sub-Total Infrastructure | |||

| Total Directs | |||

| Indirects | |||

| Total Directs + Indirects | |||

| Owner's Costs | |||

| Total excluding Contingency | |||

| Project Contingency | |||

| Sub-total including Contingency | |||

| Closure | |||

| Total |

Environmental and Permitting Considerations

Eskay Creek represents a closed mine with existing permits for mine disturbance and development, mine discharge and waste disposal. The site has been maintained in good standing and environmental monitoring has been ongoing during operations and since the site was closed in 2008. There is a substantial database of environmental information for the site and region spanning almost 30 years. To accommodate the mine design contemplated by the PFS, updated environmental assessment and mine permits will be required. The Company is completing environmental and socio-economic baseline studies and recently entered the environmental assessment and permitting process.

Eskay Creek is projected to be one of lowest GHG emission open-pit gold mines worldwide, emitting an average of 0.18 tonnes of CO2e per gold equivalent ounce produced. Several factors contribute to this low number, such as the high-grade nature of the deposit and access to clean, green hydro energy near the site.

Skeena is committed to a further reduction in GHG emissions and is actively working on several initiatives to further reduce emissions, which include:

- Electrification of mine mobile equipment, including shovels, drills, excavators, personnel carriers, and snow removal equipment

- Electrification of all stationary mine equipment, including mine dewatering pumps and pit lighting etc.

- Conversation of the heating of the main facilities such as buildings, camps, administrative, mine offices, plant, and lab buildings from propane to electric.

- Electrification of the transportation of waste from diesel haul trucks to electric overland conveyor systems.

Community Relations

The Project is within the traditional territory of the Tahltan Nation. Eskay Creek has maintained a long-standing relationship with the Tahltan Nation. Previous operators maintained agreements with the Tahltan which included provisions for training, employment, and contracting opportunities. The Company has been working in the Tahltan Territory since 2016 and has developed a strong working relationship with the Nation. Skeena also maintains formal agreements with the Tahltan Central Government which guide communications, environmental practices, and contracting and employment opportunities for projects in Tahltan Territory. Skeena participates in the BC Regional Mining Alliance (BCRMA) which is a partnership between First Nations, the BC Government, AME BC and exploration companies operating in the Golden Triangle region of BC. The BCRMA provides a platform for all parties to collaborate in communications with potential investment partners on opportunities in the region.

Tsetsaut/Skii km Lax Ha Nation has asserted traditional land use in the area of Eskay Creek. Skeena has ongoing engagement with Tsetsaut/Skii km Lax Ha who have expressed interest in business and contracting opportunities associated with the Project.

Highway 37 and 37a and the Port of Stewart will be used for Project Shipping. These facilities lie within the traditional territory of the Gitanyow Nation and the Nass and Nass Wildlife Area defined in the Nisga'a Final Agreement. Skeena has carried out initial engagement with the Gitanyow Hereditary Chiefs office and the Nisga'a Lisims Government regarding planned future use of these facilities.

In preparation for the assessment and permitting process, Skeena has initiated early engagement work with regional stakeholders. Early engagement information sessions have been carried out with the Municipality of Terrace and the Kitimat Stikine Regional District. Additional engagement opportunities with other regional stakeholders will commence shortly. For more information, please visit https://skeenaeskaycreek.com/.

Project Opportunities and Value Enhancements

The 2021 PFS clearly demonstrates that Eskay Creek has the potential to be is an economically viable project and tier one operation.

Additional opportunities and next steps include:

- Continued drill conversion of Inferred resources to the Measured and Indicated categories plus ongoing exploration drilling across the Project

- Mine scheduling and downstream investigations allowing for the further optimization of various blending scenarios

- Throughput optimization studies to potentially increase process plant throughput

- Supplementary geometallurgical modelling to further improve metallurgical performance

- Geotechnical investigations to complement and potentially enhance the current pit slope designs

- Investigation of the potential of ore sorting technology to improve plant head grade and reject waste material

- Commercial discussion with potential concentrate off takers to increase payabilities

- Opportunities to include additional feed sources

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the past-producing Eskay Creek gold-silver mine located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Prefeasibility Study for Eskay Creek in July 2021 which highlights an open-pit average grade of 4.57 g/t AuEq, an after-tax NPV5% of C

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Jr.

President & CEO

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has reviewed, validated and approved the technical and scientific content of this news release.

Sheila Ulansky, P.Geo., Senior Resource Geologist for SRK Consulting (Canada) Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release. Ms. Ulansky is responsible for the 2021 Mineral Resource Estimate for the Eskay Creek Project.

Robert Raponi, P.Eng, Principal Metallurgist for Ausenco Engineering Canada Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release. Mr. Raponi is responsible for processing, process and infrastructure capital and operating cost estimation, financial analysis and marketing.

Scott Elfen, P.E., Global Practice Lead Geotechnical Services - Ausenco Engineering Canada, Inc is an independent Qualified Person as define by NI43-101 and has reviewed and approved the contents of this news release. Mr. Elfen is responsible for site wide geotechnical program, tailings and PAG waste rock storage facility and water management tailings and waste rock storage facilities

Willie Hamilton, P.Eng, Mining Engineer for AGP Mining Consultants Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release. Mr. Hamilton is responsible for the mineral reserve calculation.

Gordon Zurowski, P.Eng, Principal Mining Engineer for AGP Mining Consultants Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release. Mr. Zurowski is responsible for mine capital and operating cost estimation and supervision of the mine design.

Adrian Dance, P.Eng, Principal Consultant (Metallurgy) for SRK Consulting (Canada) Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release. Dr. Dance is responsible for mineral processing and metallurgical testing.

The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration and development activities on its projects.

Cautionary note regarding forward-looking statements

This release contains statements and information which constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation (collectively, "forward-looking statements"). These statements relate to future events or our future performance. The use of words such as "contemplates", "generates", "targets", "is projected", "is planned", "considers", "estimates", "expects", "is expected", "potential" and similar expressions, or statements that certain actions, events or results "may", "might", "will", "could", or "would" be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained herein include, but are not limited to, statements regarding the results of the PFS, completion of a feasibility study, processing capacity of the mine, anticipated mine life, probable reserves, estimated project capital and operating costs, sustaining costs, results of test work and studies, planned environmental assessments, the future price of metals, metal concentrate, and future exploration and development. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. Such forward-looking statements represent the Company's management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on a number of estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables; changes in mine plans and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company's 2020 Annual Information Form dated March 25, 2021, and in the Company's other periodic filings with securities and regulatory authorities that are available on SEDAR at www.sedar.com.

Readers should not place undue reliance on such forward-looking statements. The Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Skeena Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/656556/Skeena-Completes-PFS-for-Eskay-Creek-After-Tax-NPV5-of-C14B-56-IRR-and-14-Year-Payback

FAQ

What are the key highlights of Skeena Resources' Eskay Creek PFS?

What is the required capital expenditure for the Eskay Creek project?

How does the Eskay Creek project impact Skeena Resources stock SKREF?

What are the estimated cash costs for the Eskay Creek project?