Skeena Completes Acquisition of QuestEx and Concurrent Sale of Assets to Newmont

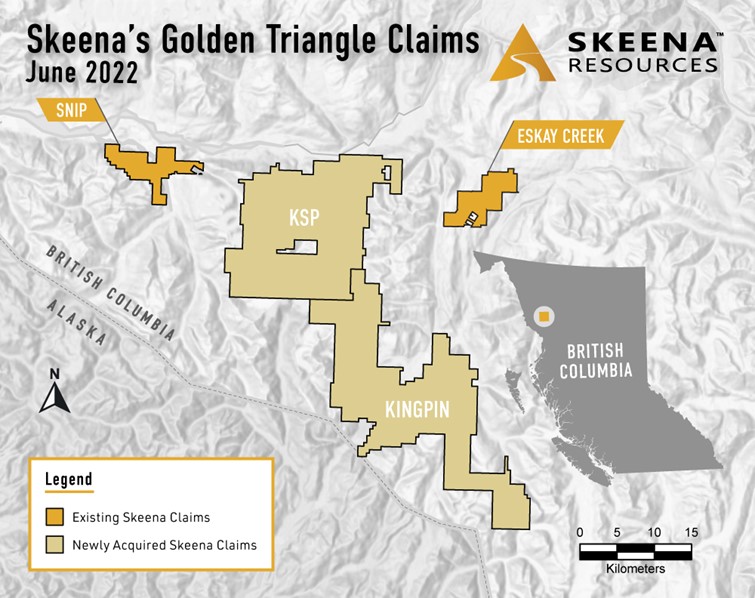

Skeena Resources Limited (TSX:SKE)(NYSE:SKE) announced the completion of its acquisition of QuestEx Gold & Copper Ltd. through a plan of arrangement, valued at approximately C$18.7 million. QuestEx shareholders received C$0.65 and 0.0367 of a Skeena share per share. Additionally, Skeena sold certain QuestEx properties to Newmont Corporation for about C$27 million, fully funding the acquisition. This strategic move expands Skeena's land position in the Golden Triangle and enhances exploration potential at its KSP and Kingpin projects.

- Strengthened land position in the Golden Triangle.

- Exploration synergies expected at KSP and Kingpin properties.

- Acquisition funded entirely through asset sale to Newmont.

- None.

Insights

Analyzing...

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESSWIRE / June 1, 2022 / Skeena Resources Limited (TSX:SKE)(NYSE:SKE) ("Skeena" or "the Company") is pleased to announce that it has completed the previously announced plan of arrangement (the "Arrangement") to acquire all of the issued and outstanding shares of QuestEx Gold & Copper Ltd. ("QuestEx"). Following the closing of the Arrangement, Skeena also completed the previously announced sale of certain QuestEx properties (the "Asset Sale") to an affiliate of Newmont Corporation (NEM)(NGT) ("Newmont").

Walter Coles, CEO & Director of Skeena commented, "The acquisition of QuestEx positions Skeena with one of the largest land positions held for mining in the prolific Golden Triangle. We expect to realize exploration synergies at the KSP and Kingpin properties which are proximal to our Eskay Creek and Snip projects. We would like to thank the teams at Newmont and QuestEx for working together with us on these transactions and we would also like to thank the Tahltan Nation for their continued support. We look forward to exploring these exciting new tenements while we continue to advance Eskay Creek."

Under the terms of the Arrangement, QuestEx shareholders received C

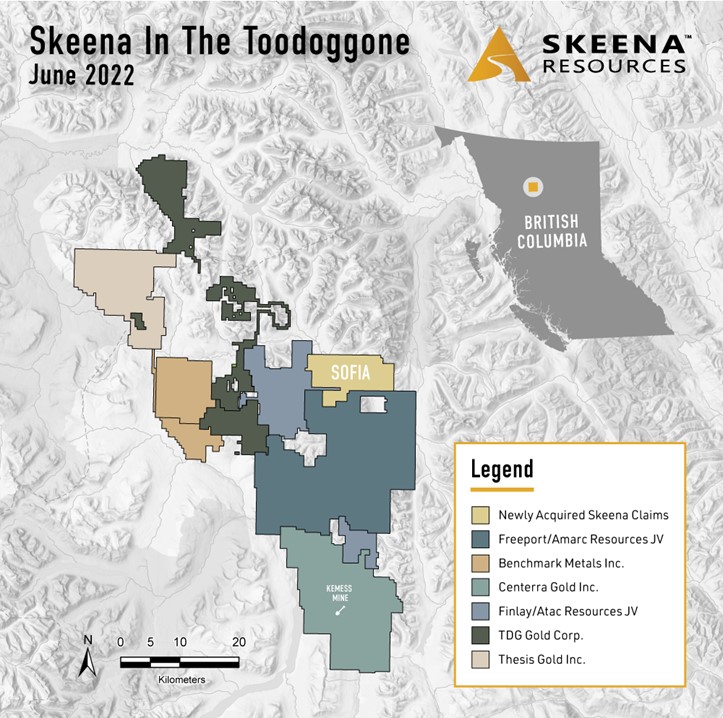

Under the terms of the Asset Sale, Newmont acquired

Advisors and Counsel

Agentis Capital Mining Partners acted as financial advisor to Skeena with regard to both the Arrangement and Asset Sale. Blake, Cassels & Graydon LLP acted as legal counsel to Skeena.

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the past-producing Eskay Creek gold-silver mine located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Prefeasibility Study for Eskay Creek in July 2021 which highlights an open-pit average grade of 4.57 g/t AuEq, an after-tax NPV5% of C

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles

CEO & Director

Contact Information:

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

The scientific and technical information in this press release was approved by Paul Geddes, P.Geo., a Qualified person as defined under National Instrument 43-101 and Vice President, Exploration and Resource Development for the Company.

Cautionary note regarding forward-looking statements

Certain statements made and information contained herein may constitute "forward looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates", "believes", "targets", "estimates", "plans", "expects", "may", "will", "could" or "would" and, in this press release, include, without limitation: statements regarding the QuestEx Transaction and Newmont Transaction, including the closing thereof and the timing and receipt of approvals and fulfillment of the conditions therefor, and the source of reimbursement for the cash portion of the Arrangement Consideration; the expected synergies arising from the QuestEx Transaction; and the exploration potential and geological hallmarks of the QuestEx properties to be retained by Skeena. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the closing of the QuestEx Transaction and the Newmont Transaction, including the receipt of approvals and fulfillment of the conditions therefor, that the purchase price pursuant to the Newmont Transaction will be sufficient to reimburse Skeena for the cash portion of the Arrangement Consideration, that the Company will recognize the expected synergies from its acquisition of QuestEx, that the Company will be able to realize the exploration potential of the QuestEx properties it intends to retain, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the receipt of regulatory approvals, environmental risks, title disputes and other matters. Forward-looking statements are subject to known and unknown risks which may cause actual results to vary significantly from the results implied by forward-looking statements, including, that the Company may not close the QuestEx Transaction or the Newmont Transaction, on the timeline anticipated, or at all; that the purchase price payable pursuant to the Newmont Transaction may not be sufficient to fund the cash portion of the Arrangement Consideration, and the Company may be required to utilize funds from treasury to fund the outstanding cash required; that the Company may not be able to realize upon the expected synergies arising from the completion of the QuestEx Transaction, or the exploration potential of the QuestEx properties it intends to retain, and the other risks and uncertainties set out in the Company's most recent annual information form, which is available on the Company's SEDAR profile at www.sedar.com. Note that for acquisition accounting purposes, the shares issued to acquire QuestEx will be valued at the date of close. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither TSX nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Not for distribution to U.S. Newswire Services or for dissemination in the United States of America. Any failure to comply with this restriction may constitute a violation of U.S. Securities laws.

SOURCE: Skeena Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/703639/Skeena-Completes-Acquisition-of-QuestEx-and-Concurrent-Sale-of-Assets-to-Newmont