Skeena Announces Discovery of New 23 Zone at Eskay Creek: 2.33 g/t AuEq over 59.91 metres and 1.08 g/t AuEq over 90.00 metres

Skeena Resources Limited (TSX:SKE)(NYSE:SKE) announced a significant discovery at its Eskay Creek gold-silver project in British Columbia, revealing a new zone of near-surface mineralization, referred to as the 23 Zone. Notable drilling results include:

- 0.99 g/t Au, 6.5 g/t Ag (1.08 g/t AuEq) over 90.00 m

- 1.30 g/t Au, 31.4 g/t Ag (1.72 g/t AuEq) over 43.39 m

- 2.14 g/t Au, 14.6 g/t Ag (2.33 g/t AuEq) over 59.91 m

The mineralization, discovered just 15 m below the surface, remains open for expansion and complements existing plans for throughput enhancement.

- Significant gold-silver mineralization discovered in the new 23 Zone.

- Drilling results indicate high Au and Ag grades, enhancing resource potential.

- The 23 Zone remains open for expansion in all directions.

- Strong complement to existing mine plans and potential throughput expansion.

- None.

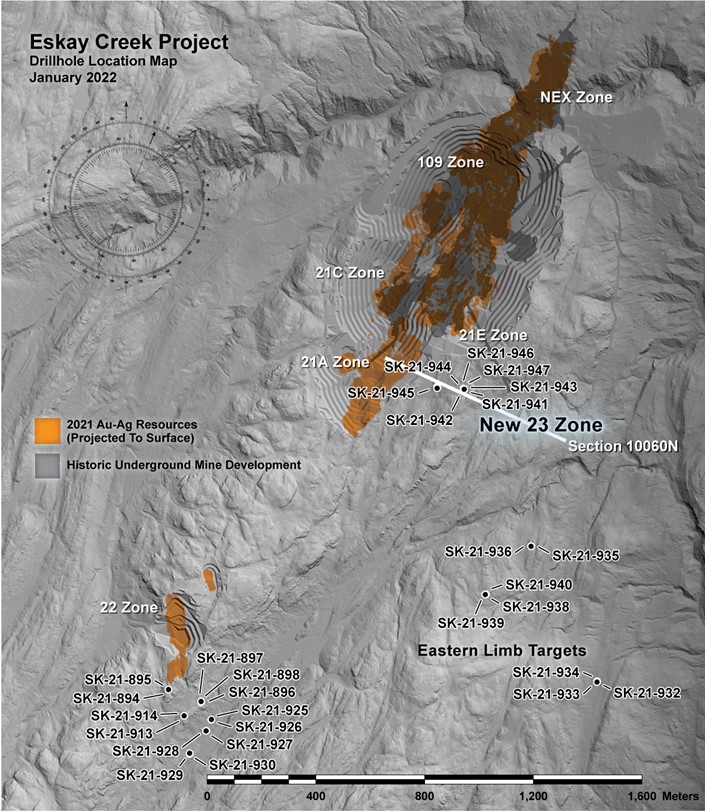

VANCOUVER, BC / ACCESSWIRE / January 19, 2022 / Skeena Resources Limited (TSX:SKE)(NYSE:SKE) ("Skeena" or the "Company") is pleased to announce the discovery of a significant zone of near surface, footwall style mineralization, the 23 Zone. This new zone is outside the limits of the Company's current pit-constrained mineral resources at the Eskay Creek gold-silver project ("Eskay Creek" or the "Project") located in the Golden Triangle of British Columbia. Analytical results from the recently completed drill holes are detailed in this release. Reference images are presented at the end of this release as well as on the Company's website.

New 23 Zone Discovery Highlights:

- 0.99 g/t Au, 6.5 g/t Ag (1.08 g/t AuEq) over 90.00 m (SK-21-945)

- 1.30 g/t Au, 31.4 g/t Ag (1.72 g/t AuEq) over 43.39 m (SK-21-946)

- 2.14 g/t Au, 14.6 g/t Ag (2.33 g/t AuEq) over 59.91 m (SK-21-947)

Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 75]. True widths and zone geometries cannot be definitively determined at this time. Grade-capping of individual assays has not been applied to the Au and Ag assays informing the length-weighted AuEq composites. Metallurgical processing recoveries have not been applied to the AuEq calculation and are taken at

New 23 Zone Discovered Outside Current Resources

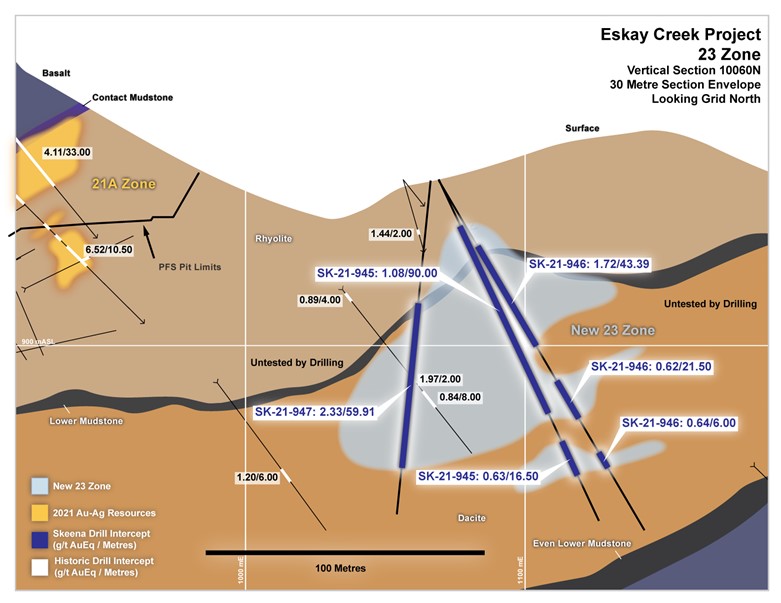

Situated beyond the extents of the currently defined pit-constrained resources at Eskay Creek, the Company has discovered a new zone of near surface Au-Ag mineralization beginning only 15 m vertically below surface. This new 23 Zone was revealed by Q4 2021 drilling as part of the ongoing regional exploration program.

Positioned 200 m east of the high-grade 21A Zone, the area was historically drilled from surface by previous operators on widely spaced drill centers. Selective drill hole sampling during this era meant that the discovery of the larger and more robust mineralized widths observed as a result of the 2021 drilling program, were missed historically. This lack of non-continuous historical sampling is evidenced by 2021 drill hole SK-21-947 which intersected 2.14 g/t Au, 14.6 g/t Ag (2.33 g/t AuEq) over 59.91 m only metres away from historical 1990 drill hole CA90-511 which due to non-continuous sampling only reported 1.97 g/t AuEq and 0.84 g/t AuEq over 2.00 and 8.00 m, respectively.

Mineralization in the 23 Zone is almost exclusively hosted within dacitic volcanic rocks and to a lesser degree, the overlying Lower Mudstone unit. As such, the Au-Ag tenor is consistent with that observed in footwall mineralization elsewhere on the property (21A, 21B, 21C, 22 Zones). Concentrations of the epithermal suite of elements (As, Hg, Sb) are negligible, as is the case with this style of footwall mineralization across Eskay Creek.

Drilling to date indicates a shallow, westerly dipping geometry and the 23 Zone remains open for expansion in all directions. Proximity to surface, in addition to the grades and widths of this evolving zone are a perfect complement to the existing mine plan and potential throughput expansion.

22 Zone and Eastern Limb Targets

Drilling along the southeastern strike extension of the 22 Zone was performed on 50 m spacings. Most notably, 2021 drill hole SK-21-927 intersected 3.39 g/t Au, 4.8 g/t Ag (3.45 g/t AuEq) over 21.55 m in the Even Lower Mudstone (ELM) approximately 200 metres southeast of the 22 Zone. This broader interval included a visible gold bearing subinterval grading 59.10 g/t Au, 61.5 g/t Ag (59.92 g/t AuEq) over 0.65 m and 19.55 g/t Au, 7.4 g/t Ag (19.65 g/t AuEq) over 0.95 m.

Gold in soil anomalies supported by geological considerations were targeted by nine drill holes on the eastern limb of the property. Despite intersecting highly altered host rocks, no significant grades were returned in these specific locations.

Current Status - Exploration

The regional exploration drilling program was designed to pragmatically test near surface targets across the property with the goal of delineating additional near surface resources to supplement the existing mine plan. To date, 72 drill holes totaling 12,890 m have been completed representing ~

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the past-producing Eskay Creek gold-silver mine located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Prefeasibility Study for Eskay Creek in July 2021 which highlights an open-pit average grade of 4.57 g/t AuEq, an after-tax NPV5% of C

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Jr.

President & CEO

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

Qualified Persons

Exploration activities at the Eskay Creek Project are administered on site by the Company's Exploration Managers, Raegan Markel, P.Geo., John Tyler and Director of Exploration, Adrian Newton P.Geo. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration activities on its projects.

Quality Assurance - Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently securely stored on site. Numbered security tags are applied to lab shipments for chain of custody requirements. The Company inserts quality control (QC) samples at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd., and is overseen by the Company's Qualified Person, Paul Geddes, P.Geo, Vice President Exploration and Resource Development.

Drill core samples are submitted to ALS Geochemistry's analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed and 1 kg is pulverized. Analysis for gold is by 50 g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 50 g fire assay fusion with gravimetric finish. Analysis for silver is by 50 g fire assay fusion with gravimetric finish with a lower limit of 5ppm and upper limit of 10,000 ppm. Samples with silver assays greater than 10,000 ppm are re-analyzed using a gravimetric silver concentrate method. A selected number of samples are also analyzed using a 48 multi-element geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS) and also for mercury using an aqua regia digest with Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) finish. Samples with sulfur reporting greater than

Cautionary note regarding forward-looking statements

Certain statements and information contained or incorporated by reference in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation (collectively, "forward-looking statements"). These statements relate to future events or our future performance. The use of words such as "anticipates", "believes", "proposes", "contemplates", "generates", "targets", "is projected", "is planned", "considers", "estimates", "expects", "is expected", "potential" and similar expressions, or statements that certain actions, events or results "may", "might", "will", "could", or "would" be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained herein include, but are not limited to, statements regarding the results of the PFS, completion of a feasibility study, processing capacity of the mine, anticipated mine life, probable reserves, estimated project capital and operating costs, sustaining costs, results of test work and studies, planned environmental assessments, the future price of metals, metal concentrate, and future exploration and development. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and the assumptions set forth herein and in the Company's Management's Discussion and Analysis ("MD&A") for the year ended December 31, 2020, and the Company's Annual Information Form ("AIF") dated March 25, 2021. Such forward-looking statements represent the Company's management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this press release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables; changes in mine plans and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company's 2020 MD&A and AIF, and in the Company's other periodic filings with securities and regulatory authorities in Canada and the United States that are available on SEDAR at www.sedar.com or on EDGAR at www.sec.gov.

Readers should not place undue reliance on such forward-looking statements. The Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

Cautionary note to U.S. Investors concerning estimates of mineral reserves and mineral resources

Skeena's mineral reserves and mineral resources included or incorporated by reference herein have been estimated in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") as required by Canadian securities regulatory authorities, which differ from the requirements of U.S. securities laws. The terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") "CIM Definition Standards - For Mineral Resources and Mineral Reserves" adopted by the CIM Council (as amended, the "CIM Definition Standards"). The U.S. Securities and Exchange Commission (the "SEC") has mineral property disclosure rules in Regulation S-K Subpart 1300 applicable to issuers with a class of securities registered under the Securities Exchange Act of 1934 (the "Exchange Act"), which rules were updated effective February 25, 2019 (the "SEC Mineral Property Rules") with compliance required for the first fiscal year beginning on or after January 1, 2021. Skeena is not required to provide disclosure on its mineral properties under the SEC Mineral Property Rules or their predecessor rules under SEC Industry Guide 7 because it is a "foreign private issuer" under the Exchange Act and entitled to file reports with the SEC under MJDS.

The SEC Mineral Property Rules include terms describing mineral reserves and mineral resources that are substantially similar, but not always identical, to the corresponding terms under the CIM Definition Standards. The SEC Mineral Property Rules allow estimates of "measured", "indicated" and "inferred" mineral resources. The SEC Mineral Property Rules' definitions of "proven mineral reserve" and "probable mineral reserve" are substantially similar to the corresponding CIM Definition Standards. Investors are cautioned that, while these terms are substantially similar to definitions in the CIM Definition Standards, differences exist between the definitions under the SEC Mineral Property Rules and the corresponding definitions in the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Skeena may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had Skeena prepared the mineral reserve or mineral resource estimates under the standards adopted under the SEC Mineral Property Rules.

In addition, investors are cautioned not to assume that any part or all of Skeena's mineral resources constitute or will be converted into reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any "measured", "indicated", or "inferred" mineral resources that Skeena reports are or will be economically or legally mineable. Further, "inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "inferred mineral resource" will ever be upgraded to a higher category. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or prefeasibility studies, except in rare cases where permitted under NI 43-101.

For these reasons, the mineral reserve and mineral resource estimates and related information presented herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

Table 1: Eskay Creek Project 2021 Exploratory Drilling Campaign Length-Weighted Drill Hole Composites:

| Hole-ID | From (m) | To (m) | Sample Length (m) | Au (g/t) | Ag (g/t) | AuEq (g/t) | Area |

|---|---|---|---|---|---|---|---|

| SK-21-894 | 85.00 | 85.50 | 0.50 | 0.40 | 14.0 | 0.59 | 22 |

| SK-21-894 | 96.15 | 100.31 | 4.16 | 0.47 | 18.8 | 0.72 | 22 |

| SK-21-895 | 20.75 | 22.71 | 1.96 | 0.17 | 25.4 | 0.51 | 22 |

| SK-21-895 | 115.40 | 115.98 | 0.58 | 1.81 | 19.3 | 2.07 | 22 |

| SK-21-895 | 133.50 | 134.64 | 1.14 | 0.83 | 5.2 | 0.90 | 22 |

| SK-21-895 | 160.56 | 163.40 | 2.84 | 0.37 | 21.8 | 0.67 | 22 |

| SK-21-895 | 223.52 | 224.37 | 0.85 | 0.57 | 3.2 | 0.61 | 22 |

| SK-21-895 | 236.50 | 239.00 | 2.50 | 1.97 | 2.9 | 2.01 | 22 |

| SK-21-895 | 284.20 | 287.00 | 2.80 | 3.06 | 7.9 | 3.17 | 22 |

| SK-21-896 | 22.63 | 23.20 | 0.57 | 1.96 | 37.4 | 2.46 | 22 |

| SK-21-896 | 46.14 | 49.00 | 2.86 | 0.56 | 7.5 | 0.66 | 22 |

| SK-21-896 | 65.00 | 68.46 | 3.46 | 6.73 | 22.5 | 7.03 | 22 |

| INCLUDING | 66.50 | 67.50 | 1.00 | 21.50 | 43.1 | 22.07 | 22 |

| SK-21-896 | 79.00 | 80.00 | 1.00 | 0.63 | 18.8 | 0.88 | 22 |

| SK-21-896 | 141.38 | 158.00 | 16.62 | 0.72 | 6.0 | 0.80 | 22 |

| SK-21-896 | 186.50 | 187.50 | 1.00 | 1.01 | 6.8 | 1.10 | 22 |

| SK-21-896 | 212.25 | 213.50 | 1.25 | 0.63 | 2.2 | 0.66 | 22 |

| SK-21-897 | 19.50 | 20.98 | 1.48 | 0.63 | 16.2 | 0.85 | 22 |

| SK-21-897 | 35.50 | 46.40 | 10.90 | 1.04 | 24.4 | 1.37 | 22 |

| SK-21-897 | 97.18 | 98.08 | 0.90 | 0.42 | 69.5 | 1.35 | 22 |

| SK-21-898 | 35.00 | 36.09 | 1.09 | 0.60 | 67.9 | 1.51 | 22 |

| SK-21-898 | 120.05 | 121.00 | 0.95 | 0.23 | 31.2 | 0.65 | 22 |

| SK-21-911 | PENDING | 22 | |||||

| SK-21-912 | ABANDONED | 22 | |||||

| SK-21-913 | 81.83 | 82.50 | 0.67 | 0.56 | 24.3 | 0.88 | 22 |

| SK-21-913 | 93.50 | 101.00 | 7.50 | 0.34 | 5.4 | 0.41 | 22 |

| SK-21-914 | 134.91 | 138.29 | 3.38 | 0.96 | 1.8 | 0.99 | 22 |

| SK-21-922 | PENDING | 22 | |||||

| SK-21-923 | PENDING | 22 | |||||

| SK-21-924 | PENDING | 22 | |||||

| SK-21-925 | 33.00 | 35.45 | 2.45 | 0.97 | 1.5 | 1.00 | 22 |

| SK-21-925 | 85.79 | 86.82 | 1.03 | 0.55 | 3.5 | 0.60 | 22 |

| SK-21-925 | 94.17 | 95.59 | 1.42 | 0.94 | 22.8 | 1.24 | 22 |

| SK-21-925 | 137.50 | 138.50 | 1.00 | 0.95 | 2.1 | 0.98 | 22 |

| SK-21-926 | 32.50 | 37.00 | 4.50 | 1.24 | 2.5 | 1.27 | 22 |

| SK-21-926 | 92.20 | 96.20 | 4.00 | 0.48 | 19.1 | 0.73 | 22 |

| SK-21-926 | 150.50 | 153.50 | 3.00 | 2.68 | 0.6 | 2.68 | 22 |

| SK-21-927 | 13.95 | 35.50 | 21.55 | 3.39 | 4.8 | 3.45 | 22 |

| INCLUDING | 14.90 | 15.55 | 0.65 | 59.10 | 61.5 | 59.92 | 22 |

| AND | 15.55 | 16.50 | 0.95 | 19.55 | 7.4 | 19.65 | 22 |

| SK-21-927 | 83.50 | 85.00 | 1.50 | 0.69 | 2.0 | 0.72 | 22 |

| SK-21-927 | 94.00 | 97.00 | 3.00 | 0.88 | 4.9 | 0.94 | 22 |

| SK-21-927 | 144.00 | 145.05 | 1.05 | 1.56 | 1.1 | 1.57 | 22 |

| SK-21-928 | 14.50 | 36.00 | 21.50 | 0.58 | 1.5 | 0.59 | 22 |

| SK-21-928 | 178.00 | 179.00 | 1.00 | 1.02 | 2.4 | 1.05 | 22 |

| SK-21-929 | 20.80 | 23.50 | 2.70 | 0.64 | 1.7 | 0.66 | 22 |

| SK-21-929 | 59.75 | 66.00 | 6.25 | 0.52 | 4.2 | 0.57 | 22 |

| SK-21-929 | 111.00 | 117.00 | 6.00 | 0.67 | 3.6 | 0.72 | 22 |

| SK-21-929 | 139.00 | 140.50 | 1.50 | 0.52 | 0.5 | 0.52 | 22 |

| SK-21-929 | 194.50 | 196.00 | 1.50 | 0.79 | 0.5 | 0.79 | 22 |

| SK-21-930 | 105.00 | 110.87 | 5.87 | 1.35 | 10.5 | 1.50 | 22 |

| SK-21-930 | 120.50 | 125.00 | 4.50 | 0.56 | 0.5 | 0.56 | 22 |

| SK-21-930 | 132.50 | 134.00 | 1.50 | 0.58 | 0.5 | 0.58 | 22 |

| SK-21-931 | PENDING | ||||||

| SK-21-932 | NSA | EASTERN LIMB | |||||

| SK-21-933 | 203.50 | 204.00 | 0.50 | 0.65 | 3.3 | 0.69 | EASTERN LIMB |

| SK-21-933 | 216.00 | 216.50 | 0.50 | 0.49 | 15.9 | 0.70 | EASTERN LIMB |

| SK-21-934 | NSA | EASTERN LIMB | |||||

| SK-21-935 | NSA | EASTERN LIMB | |||||

| SK-21-936 | NSA | EASTERN LIMB | |||||

| SK-21-937 | PENDING | ||||||

| SK-21-938 | NSA | EASTERN LIMB | |||||

| SK-21-939 | 31.45 | 38.65 | 7.20 | 0.26 | 10.1 | 0.39 | EASTERN LIMB |

| SK-21-940 | 61.60 | 65.30 | 3.70 | 0.26 | 6.4 | 0.35 | EASTERN LIMB |

| SK-21-940 | 112.00 | 112.50 | 0.50 | 0.37 | 21.0 | 0.65 | EASTERN LIMB |

| SK-21-941 | 16.50 | 18.00 | 1.50 | 1.66 | 0.8 | 1.67 | 23 |

| SK-21-941 | 52.00 | 64.92 | 12.92 | 0.69 | 8.9 | 0.81 | 23 |

| SK-21-942 | 48.00 | 49.00 | 1.00 | 0.60 | 4.5 | 0.66 | 23 |

| SK-21-942 | 100.62 | 105.00 | 4.38 | 0.54 | 4.4 | 0.59 | 23 |

| SK-21-942 | 119.00 | 141.50 | 22.50 | 0.55 | 0.6 | 0.55 | 23 |

| SK-21-942 | 167.63 | 168.50 | 0.87 | 0.57 | 0.6 | 0.58 | 23 |

| SK-21-943 | 8.00 | 9.50 | 1.50 | 0.56 | 9.1 | 0.68 | 23 |

| SK-21-943 | 67.50 | 78.00 | 10.50 | 0.36 | 0.9 | 0.37 | 23 |

| SK-21-944 | 42.00 | 54.57 | 12.57 | 0.46 | 16.8 | 0.69 | 23 |

| SK-21-944 | 114.23 | 123.50 | 9.27 | 1.05 | 4.8 | 1.11 | 23 |

| SK-21-944 | 132.50 | 152.50 | 20.00 | 0.64 | 7.1 | 0.73 | 23 |

| SK-21-944 | 188.00 | 190.05 | 2.05 | 0.51 | 22.4 | 0.81 | 23 |

| SK-21-945 | 22.00 | 112.00 | 90.00 | 0.99 | 6.5 | 1.08 | 23 |

| INCLUDING | 22.00 | 23.15 | 1.15 | 17.95 | 23.1 | 18.26 | 23 |

| SK-21-945 | 119.50 | 136.00 | 16.50 | 0.61 | 1.5 | 0.63 | 23 |

| SK-21-946 | 29.00 | 72.39 | 43.39 | 1.30 | 31.4 | 1.72 | 23 |

| SK-21-946 | 80.00 | 101.50 | 21.50 | 0.59 | 2.2 | 0.62 | 23 |

| SK-21-946 | 112.00 | 118.00 | 6.00 | 0.62 | 1.6 | 0.64 | 23 |

| SK-21-947 | 44.58 | 104.49 | 59.91 | 2.14 | 14.6 | 2.33 | 23 |

| INCLUDING | 56.00 | 57.00 | 1.00 | 21.90 | 57.1 | 22.66 | 23 |

| AND | 57.00 | 58.00 | 1.00 | 19.30 | 50.5 | 19.97 | 23 |

| SK-21-947 | 123.43 | 124.00 | 0.57 | 0.50 | 19.5 | 0.76 | 23 |

| SK-21-947 | 172.50 | 173.50 | 1.00 | 0.56 | 13.8 | 0.74 | 23 |

Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 75]. True widths and zone geometries cannot be definitively determined at this time. Grade-capping of individual assays has not been applied to the Au and Ag assays informing the length-weighted AuEq composites. Metallurgical processing recoveries have not been applied to the AuEq calculation and are taken at

Table 2: Mine Grid Drill Hole Locations and Orientations:

| Hole-ID | Easting (m) | Northing (m) | Elevation (m) | Length (m) | Azimuth (°) | Dip (°) |

|---|---|---|---|---|---|---|

| SK-21-894 | 9623.1 | 8649.8 | 1080.2 | 289.5 | 50.0 | -53.0 |

| SK-21-895 | 9622.9 | 8649.6 | 1080.2 | 296.2 | 65.0 | -62.0 |

| SK-21-896 | 9750.3 | 8659.0 | 1032.1 | 233.2 | 250.6 | -72.2 |

| SK-21-897 | 9749.8 | 8660.0 | 1032.0 | 151.8 | 282.0 | -50.0 |

| SK-21-898 | 9751.5 | 8656.3 | 1032.1 | 132.7 | 183.0 | -50.0 |

| SK-21-913 | 9715.2 | 8585.2 | 1040.7 | 103.5 | 265.0 | -50.0 |

| SK-21-914 | 9715.8 | 8585.4 | 1040.7 | 151.2 | 232.0 | -50.0 |

| SK-21-925 | 9812.4 | 8614.3 | 986.2 | 199.3 | 281.1 | -50.1 |

| SK-21-926 | 9812.0 | 8612.9 | 986.2 | 202.0 | 246.0 | -50.0 |

| SK-21-927 | 9811.7 | 8567.8 | 983.0 | 150.0 | 253.8 | -50.1 |

| SK-21-928 | 9812.3 | 8569.0 | 983.1 | 200.0 | 276.8 | -74.1 |

| SK-21-929 | 9790.1 | 8468.1 | 988.9 | 229.0 | 25.0 | -50.0 |

| SK-21-930 | 9790.9 | 8465.4 | 988.9 | 152.0 | 82.1 | -50.1 |

| SK-21-932 | 11049.5 | 9322.5 | 836.6 | 190.0 | 127.3 | -68.2 |

| SK-21-933 | 11049.1 | 9323.8 | 836.6 | 219.0 | 106.8 | -49.6 |

| SK-21-934 | 11048.5 | 9325.5 | 836.6 | 219.0 | 67.0 | -50.1 |

| SK-21-935 | 10623.0 | 9678.2 | 934.1 | 225.0 | 117.2 | -50.5 |

| SK-21-936 | 10622.8 | 9679.1 | 934.0 | 209.1 | 77.2 | -50.6 |

| SK-21-938 | 10542.4 | 9447.3 | 1005.6 | 102.0 | 191.7 | -50.3 |

| SK-21-939 | 10543.9 | 9447.6 | 1005.6 | 162.0 | 127.4 | -50.5 |

| SK-21-940 | 10544.3 | 9449.6 | 1005.6 | 231.0 | 77.2 | -50.0 |

| SK-21-941 | 10161.5 | 10104.3 | 977.0 | 94.6 | 91.8 | -84.9 |

| SK-21-942 | 10159.7 | 10105.1 | 977.0 | 204.0 | 292.0 | -70.0 |

| SK-21-943 | 10161.8 | 10104.1 | 977.0 | 205.2 | 92.0 | -60.2 |

| SK-21-944 | 10158.3 | 10105.6 | 977.0 | 196.0 | 292.1 | -49.9 |

| SK-21-945 | 10069.1 | 10066.6 | 959.0 | 170.5 | 137.2 | -50.1 |

| SK-21-946 | 10069.7 | 10069.3 | 959.0 | 160.0 | 92.5 | -60.0 |

| SK-21-947 | 10066.2 | 10071.8 | 959.0 | 190.5 | 326.5 | -80.1 |

SOURCE: Skeena Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/684440/Skeena-Announces-Discovery-of-New-23-Zone-at-Eskay-Creek-233-gt-AuEq-over-5991-metres-and-108-gt-AuEq-over-9000-metres