Sitka Drills 292.0 m of 1.00 g/t Gold Including 75.0 m of 2.04 g/t Gold at Its RC Gold Project, Yukon

Preliminary assay highlights from DDRCCC-23-041 include:

- 292.0 metres (m) of 1.00 g/t Au from 200.0 m to 492.0 m including:

- 203.9 m of 1.28 g/t Au from 243.0 m,

- 75.0 m of 2.04 g/t Au from 273.0 m,

- 30.0 m of 3.11 g/t Au from 320.0 m.

- 19.9 m of 1.04 g/t Au from 418.0 m

"Step out drilling at our Blackjack gold deposit continues to impress with Hole 41 returning some of our best gold intercepts to date," said Cor Coe, P.Geo., CEO and Director of Sitka. "This hole demonstrates that the higher grade mineralization intersected at surface in this deposit continues to depth as highlighted by the 2.04 g/t Au over 75 m subinterval. The Blackjack deposit is higher grade than the typical low grade, heap-leach deposits within these reduced intrusion-related gold systems. This hole adds significant tonnage with high gold grades and demonstrates that gold mineralization with high grades is persistent and continues to the southeast of the current deposit boundary. Visible gold and significant vein densities were observed in all three drill holes completed so far this year (see news release dated April 12th and May 8th, 2023) and we are optimistic that the assay results from the remaining two drill holes completed during the 1500 metre winter drilling program will continue to endorse the expansive gold endowment of this area.

"Both the Blackjack and Eiger gold deposits, comprising the initial mineral resource of 1.34 million ounces gold announced earlier this year, remain open in all directions and, with step out drilling continuing to demonstrate that significant ounces can be added to these near/on-surface gold deposits, we believe this area has the potential to expand to a district-scale gold resource. Drilling this season will be focused on further demonstrating this potential with aggressive step out drilling at the Blackjack and Eiger deposits and drilling along the 1.5 km mineralized corridor that could potentially link these deposits together."

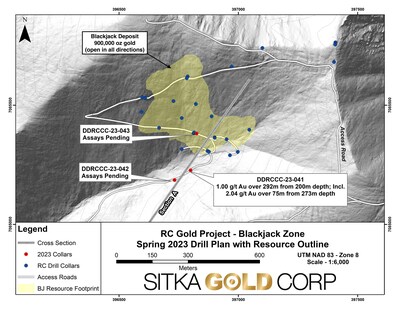

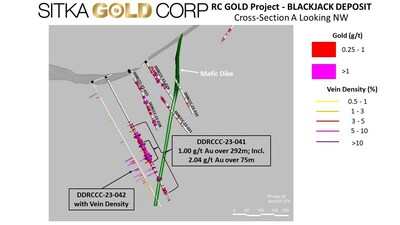

DDRCCC-23-041 ("Hole 41"), the first drill hole completed in 2023, was collared 160 metres south of discovery drill hole DDRCCC-21-021 (see news release dated December 13, 2021) and was drilled at a northeast azimuth with a -60 degree dip (see Figures 1 and 2). The drill hole was designed to test for an extension of high-grade gold mineralization at depth and southeast of drill holes DDRCCC-22-025 and DDRCCC-22-038 (see news releases dated June 13, 2022 & November 30, 2022).

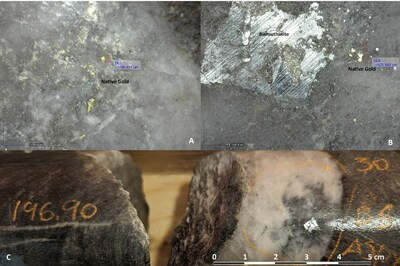

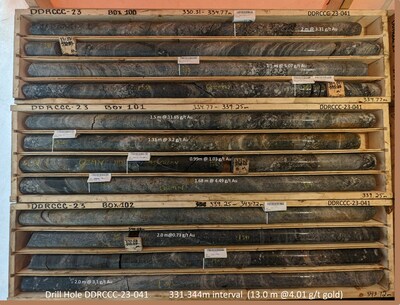

Hole 41 encountered the expected metasedimentary country rock unit with weak quartz-sulphide veining from collar to 184 metres. The hole then transitioned through a series of narrow intrusive dikes and sills within the metasediments with markedly increased vein density and visible gold occurrences (see Figures 3 and 4), which continues into the main megacrystic intrusive from 232 metres to 347 metres. From 347 metres to 438 metres another zone of transitional intrusive dikes and sills was encountered with significant densities of quartz-sulphide veins similar to above, and comparable to the core of the Blackjack deposit. At 438 metres, the hole crossed a 17 metre wide post-mineral dike followed by more intrusive rocks with variable quartz-sulphide veining to the end of the hole at 518.8 metres.

Hole 041 contained significant gold mineralization from the first instance of intrusive dykes within the metasediments to the end of the hole, with the interval from 200.0 m to 492 m returning 292 m of 1.00 g/t Au. The highest gold mineralization occurred within a larger megacrystic intrusive body, with the interval 273.0 m to 348.0 m returning 75.0 m of 2.04 g/t Au including 30.0 m of 3.11 g/t Au and 1.5 m of 11.65 g/t Au. Further significant mineralized intervals are highlighted in Table 1 below.

Table 1 – Preliminary Assay Highlights for DDRCCC-23-041

Drillhole ID | Azimuth | Dip | Length | From | To | Interval | Au (g/t) |

DDRCCC-23-041 | 28 | -60 | 518.8 | 200.0 | 492.0 | 292.0 | 1.00 |

including | 234.0 | 437.9 | 203.9 | 1.28 | |||

including | 273.0 | 348.0 | 75.0 | 2.04 | |||

including | 320.0 | 350.0 | 30.0 | 3.11 | |||

including | 334.5 | 336.0 | 1.5 | 11.65 | |||

including | 418.0 | 437.9 | 19.9 | 1.04 | |||

and | 467.0 | 492.0 | 25.0 | 0.64 |

*Intervals are drilled core length, as insufficient drilling has been completed at this time to determine true widths |

On receipt from the drill site, the HQ-sized drill core was systematically logged for geological attributes, photographed and sampled at Sitka's 2022 field camp. Sample lengths as small as 0.3 m were used to isolate features of interest, otherwise a default 2 m downhole sample length was used. Core was cut in half lengthwise along a predetermined line, with one-half (same half, consistently) collected for analysis and one-half stored as a record. Standard reference materials, blanks and duplicate samples were inserted by Sitka personnel at regular intervals into the sample stream. Bagged samples were placed in secure bins to ensure integrity during transport. They were delivered by Sitka personnel or a contract expeditor to ALS Laboratories' preparatory facility in

ALS is accredited to ISO 17025:2005 UKAS ref. 4028 for its laboratory analysis. Samples were crushed by ALS to over 70 per cent passing below two millimetres and split using a riffle splitter. One-thousand-gram splits were pulverized to over 85 per cent passing below 75 microns. Gold determinations are by fire assay with an inductively coupled plasma mass spectroscopy (ICP-MS) finish on 50 g subsamples of the prepared pulp (ALS code: Au-ICP-22). Any sample returning over 10 g/t Au was re-analyzed by fire assay with a gravimetric finish on a 50 g subsample (ALS code: Au-GRA21). In addition, a 51-element analysis was performed on a 0.5 g subsample of the prepared pulps by an aqua regia digestion followed by an inductively coupled plasma mass spectroscopy (ICP-MS) finish (ALS code: ME-MS41).

The results of DDRCCC-23-041 reported above are considered preliminary following receipt of a slightly elevated blank sample inserted by the Company into the sample sequence as part of its standard QA QC protocol. A sequence of 10 samples containing the blank sample are currently being re-analyzed. These results will be reported if a significant difference is identified between the current assays and the re-run samples. Considering the widespread and consistent nature of mineralization encountered throughout Hole 41, the Company does not expect the difference between the original and re-analyzed samples will materially affect the mineralized intervals reported above.

The RC Gold Project (RC Gold) consists of a 376 square kilometre contiguous district-scale land package located in the newly road accessible

On January 19, 2023 Sitka Gold announced an Initial Mineral Resource Estimate prepared in accordance with National Instrument 43-101 ("NI 43-101") guidelines for the RC Gold Property of 1,340,000 ounces of gold(1). The road accessible, pit constrained Mineral Resource is classified as inferred and is contained in two near/on-surface zones: The Blackjack and Eiger deposits. The Mineral Resource estimate is presented in the following table at a base case cut-off grade of 0.25 g/t Au:

Table 1: RC Gold Inferred Mineral Resource Estimate

COG g/t | Blackjack Zone | Eiger Zone | Combined | ||||||||

Tonnes | Au g/t | 0z Au | Tonnes | Au g/t | 0z Au | Tonnes | Au g/t | 0z Au | |||

0.20 | 35,798 | 0.80 | 921 | 32,523 | 0.45 | 471 | 68,321 | 0.63 | 1,391 | ||

0.25 | 33,743 | 0.83 | 900 | 27,362 | 0.50 | 440 | 61,105 | 0.68 | 1,340 | ||

0.30 | 31,282 | 0.88 | 885 | 22,253 | 0.55 | 393 | 53,535 | 0.74 | 1,279 | ||

0.35 | 29,065 | 0.92 | 860 | 17,817 | 0.60 | 344 | 46,882 | 0.80 | 1,203 | ||

0.40 | 26,975 | 0.96 | 833 | 14,506 | 0.66 | 308 | 41,481 | 0.86 | 1,140 | ||

Notes | |

1. | Mineral resource estimate prepared by Ronald G. |

2. | The cut-off grade of 0.25 g/t Au is believed to provide a reasonable margin over operating and sustaining costs for open-pit |

3. | Mineral resources are constrained by an optimised pit shell using the following assumptions: |

4. | Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

5. | Totals may not sum due to rounding. |

The Initial Mineral Resource Estimate of 1,340,000 ounces of gold at the RC Gold Project is comprised of two deposits: the Blackjack deposit containing 900,000 ounces of gold at a grade of 0.83 g/t gold and the Eiger deposit containing 440,000 ounces of gold at a grade of 0.50 g/t gold (see news release dated January 19, 2023). Both of these deposits are at/near surface, are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating that the gold is not refractory and has high gold recoveries of up to

The Blackjack and Eiger deposits are in close proximity to highway and power infrastructure, are road accessible year-round, remain open in all directions and are respectively located at the western and eastern end of a large, 500 metre by 2 kilometre intrusion related gold system that was recently discovered on the Property. To date, just 41 diamond drill holes have been drilled into this system for a total of approximately 14,500 metres with results of up to 201.0 m of 1.26 g/t gold from surface, including 82.0 m of 2.04 g/t gold and 19.5 m of 4.87 g/t gold at Blackjack (drill hole DDRCCC-22-040; see news release dated January 11, 2023) and 354 m of 0.41 g/t gold including 72 m of 0.72 g/t gold at Eiger (drill hole DDRCCC-21-09; see news release date August 19, 2021).

Several high priority intrusion related gold targets exist at RC Gold with nine outcropped intrusions identified to date over the 376 sq km property, however Sitka's main focus at the RC Gold Project has been on the underlying Clear Creek Property where a large 500 metre by 2000 metre intrusion related gold system covering the area over the Blackjack, Saddle and Eiger zones was identified. Prior to the onset of the 2023 winter drilling program, the Company had drilled 38 diamond drill holes into this system for a total of approximately 13,000 metres. This drilling culminated in the discovery of the Blackjack and Eiger deposits with an initial inferred mineral resource estimate of 1,340,000 gold ounces(1).

Sitka Gold inherited a wealth of historical and current data from these properties from work spanning the last 40 years. Recent exploration work and the compilation of historical data have defined several mineralized zones with both bulk tonnage, intrusion-related gold deposit targets and high-grade, vein- and breccia-hosted gold targets. The RC Gold Project also has a common border with Victoria Gold's

(1) |

|

*For more detailed information on the underlying properties please visit our website at www.sitkagoldcorp.com.

Exploration on the Property has mainly focused on identifying an intrusion-related gold system ("IRGS"). The property is part of the Tombstone Gold Belt which is the prominent host to IRGS deposits within the Tintina Gold Province in

(1) | Sims J. Fort Knox Mine Fairbanks North Star Borough, Alaska, USA National Instrument 43-101 Technical

|

(2) | Harvey N., Gray P., Winterton J., Jutras M., Levy M.,Technical Report for the Eagle Gold Mine,

|

(3) | Hulse D, Emanuel C, Cook C. NI43-101 Technical Report on Mineral Resources. Gustavson Associates. May

|

(4) | Simpson R. Florin Gold Project NI43-101 Technical Report. Geosim Services Inc. April 21, 2021.

|

(5) | Banyan Gold News Release Dated May 17, 2022 (Technical Report to be filed within 45 days of news release) |

Sitka Gold Corp. is a well-funded mineral exploration company headquartered in

Sitka recently announced a 43-101 compliant Initial Mineral Resource Estimate of 1,340,000 ounces of gold(1) beginning at surface and grading 0.68 g/t (see news release dated January 19, 2023). A resource expansion diamond drilling program is currently underway.

The Company is also planning additional drilling at its Alpha Gold Property in

(1) |

|

Sitka Gold will be attending and/or presenting at the following events:

- TakeStock Calgary Capital Event,

Calgary, AB : July 5, 2023 - YMA Property Tours,

Dawson City ,Yukon : July 16-22, 2023 - Precious Metals Summit,

Beaver Creek, Colorado : September 12 - 15, 2023

All events are subject to change.

The scientific and technical content of this news release has been reviewed and approved by Cor Coe, P.Geo., Director and CEO of the Company, and a Qualified Person (QP) as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SITKA GOLD CORP.

"Donald Penner"

President and Director

This news release contains forward-looking statements and forward looking information within the meaning of applicable securities laws. These statements relate to future events or future performance. All statements other than statements of historical fact may be forward-looking statements or information. Forward-looking statements and information are often, but not always, identified by the use of words such as "appear", "seek", "anticipate", "plan", "continue", "estimate", "approximate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe", "would" and similar expressions.

Forward-looking statements and information are provided for the purpose of providing information about the current expectations and plans of management of the Company relating to the future. Readers are cautioned that reliance on such statements and information may not be appropriate for other purposes, such as making investment decisions. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, the expected timing and terms of the private placement, use of proceeds, anticipated work program, required approvals in connection with the work program and the ability to obtain such approvals. Accordingly, readers should not place undue reliance on the forward-looking statements, timelines and information contained in this news release. Readers are cautioned that the foregoing list of factors is not exhaustive.

The forward-looking statements and information contained in this news release are made as of the date of this news release and no undertaking is given to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws or the CSE. The forward-looking statements or information contained in this news release are expressly qualified by this cautionary statement.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sitka-drills-292-0-m-of-1-00-gt-gold-including-75-0-m-of-2-04-gt-gold-at-its-rc-gold-project-yukon-301833066.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sitka-drills-292-0-m-of-1-00-gt-gold-including-75-0-m-of-2-04-gt-gold-at-its-rc-gold-project-yukon-301833066.html

SOURCE Sitka Gold Corp.