SCHWAZZE CLOSES NEW MEXICO ACQUISITION

Schwazze (OTCQX: SHWZ) has completed the acquisition of operating assets from Reynold Greenleaf & Associates and Elemental Kitchen & Laboratories for a total of $42 million. The deal includes $25 million in cash and a $17 million seller note at 5% interest. With this acquisition, Schwazze expands its operations into New Mexico, becoming a multi-state operator with a total of 32 dispensaries and multiple cultivation facilities. The New Mexico cannabis market is projected to grow by 300% in the next five years, enhancing Schwazze's growth potential.

- Acquired assets from Reynold Greenleaf & Associates and Elemental Kitchen & Laboratories increase market presence in New Mexico.

- Expansion into New Mexico marks Schwazze's transition to a multi-state operator with 32 total dispensaries.

- New Mexico's cannabis market expected to grow 300% in the next five years, providing significant revenue growth potential.

- None.

Achieves Regional Operator Status with Acquisition of: Reynold Greenleaf & Associates, R. Greenleaf Organics, Medzen Services, Elemental Kitchen & Laboratories

DENVER, Feb. 8, 2022 /PRNewswire/ - Schwazze, (OTCQX: SHWZ) ("Schwazze" or the "Company"), one of the largest vertically integrated cannabis operators in Colorado, is pleased to announced that it has closed the transaction to acquire substantially all the operating assets of Reynold Greenleaf & Associates, LLC, and the equity of Elemental Kitchen & Laboratories, LLC. As part of the transaction, the Company will also have a right to purchase or acquire cannabis licenses held by Medzen Services, Inc., ("Medzen") and R. Greenleaf Organics, Inc. ("RGO"), not-for-profit organizations that hold medical cannabis licenses in New Mexico (the assets and licenses described herein are referenced collectively as "Greenleaf").

Total consideration for the acquisition was

Greenleaf is a licensed medical cannabis provider with ten dispensaries, four cultivation facilities – three operating and one in development – and one manufacturing location. The dispensaries are located in Albuquerque, Santa Fe, Roswell, Las Cruces, Grants and Las Vegas, New Mexico. Greenleaf's approximately 70,000 square feet of cultivation as well as 6,000 square feet of manufacturing space are located in Albuquerque. The State of New Mexico currently allows medical cannabis and has approved adult use recreational cannabis sales which by law begin no later than April 2022. The New Mexico market is expected to grow approximately

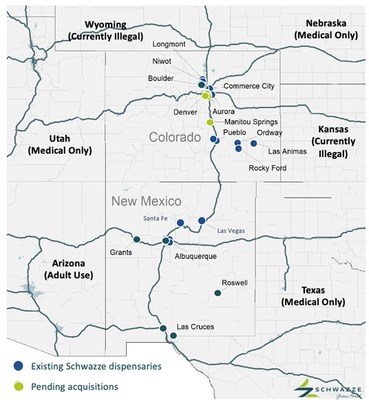

With this acquisition, Schwazze is now a multi-state operator ("MSO") with a total of 32 announced and acquired dispensaries, seven cultivation facilities and two manufacturing operations located in either Colorado or New Mexico. (see Figure #1)

"With our regional expansion into New Mexico now complete, we have firmly graduated to the MSO category but with a differentiated regional focus which we and our stakeholders believe will be successful as we continue to position the Company for rapid expansion as the market opens for adult use consumption. We welcome the Greenleaf team to Schwazze, particularly Willie Ford who joins us in an advisory capacity, and are excited about our future together," stated Justin Dye, CEO & Chairman.

Willie Ford, Managing Director and Founder of Greenleaf added; "We are very excited to work with Schwazze given the depth of the team, their strong experience in retail and cannabis and their commitment to regional growth. This will be critical for us as New Mexico makes the move into legalization of cannabis for recreational use in April of this year."

About Schwazze

Schwazze (OTCQX: SHWZ) is building a premier vertically integrated regional cannabis company with assets in Colorado and New Mexico and will continue to take its operating system to other states where it can develop a differentiated regional leadership position. Schwazze is the parent company of a portfolio of leading cannabis businesses and brands spanning seed to sale. The Company is committed to unlocking the full potential of the cannabis plant to improve the human condition. Schwazze is anchored by a high-performance culture that combines customer-centric thinking and data science to test, measure, and drive decisions and outcomes. The Company's leadership team has deep expertise in retailing, wholesaling, and building consumer brands at Fortune 500 companies as well as in the cannabis sector. Schwazze is passionate about making a difference in our communities, promoting diversity and inclusion, and doing our part to incorporate climate-conscious best practices. Medicine Man Technologies, Inc. was Schwazze's former operating trade name. The corporate entity continues to be named Medicine Man Technologies, Inc.

Schwazze derives its name from the pruning technique of a cannabis plant to enhance plant structure and promote healthy growth.

Forward-Looking Statements

This press release contains "forward-looking statements." Such statements may be preceded by the words "plan," "will," "may,", "predicts," or similar words. Forward-looking statements are not guarantees of future events or performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company's control and cannot be predicted or quantified. Consequently, actual events and results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) our inability to manufacture our products and product candidates on a commercial scale on our own or in collaboration with third parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size and nature of our competition; (iv) loss of one or more key executives or scientists; (v) difficulties in securing regulatory approval to market our products and product candidates; (vi) our ability to successfully execute our growth strategy in Colorado and outside the state, (vii) our ability to consummate the acquisition described in this press release or to identify and consummate future acquisitions that meet our criteria, (viii) our ability to successfully integrate acquired businesses and realize synergies therefrom, (ix) the ongoing COVID-19 pandemic, * the timing and extent of governmental stimulus programs, (xi) the uncertainty in the application of federal, state and local laws to our business, and any changes in such laws, and * out ability to satisfy the closing conditions for the private finding described in this press release. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company's filings with the Securities and Exchange Commission (SEC), including the Company's Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC's website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise except as required by law.

(1) | BDSA estimate |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/schwazze-closes-new-mexico-acquisition-301477352.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/schwazze-closes-new-mexico-acquisition-301477352.html

SOURCE Schwazze

FAQ

What was the total value of Schwazze's acquisition of Reynold Greenleaf & Associates?

How many dispensaries does Schwazze currently operate after the acquisition?

What is the expected growth of the New Mexico cannabis market?

When does recreational cannabis sales begin in New Mexico?