S&P Global Mobility: Supply Constraints, Lack of Inventory Cap US Light Vehicle Sales in September

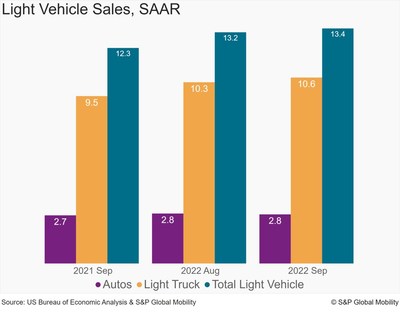

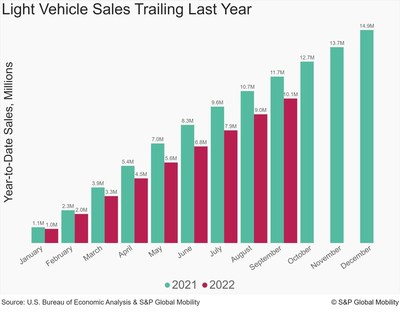

S&P Global Mobility forecasts US light vehicle sales in September at 1.105 million units, with a projected annual rate of 13.4 million units for 2022. Ongoing supply chain challenges, particularly semiconductor shortages, continue to restrict inventory levels to below-average thresholds. Despite these limitations, consumer demand for vehicles remains high, evidenced by rising prices. Year-to-date sales are down by 1.6 million units compared to 2021, with total 2022 sales expected to reach 14.0 million units, though risks remain. Manufacturer volume comparisons show minor month-over-month fluctuations.

- Consumer demand for vehicles remains strong despite high prices.

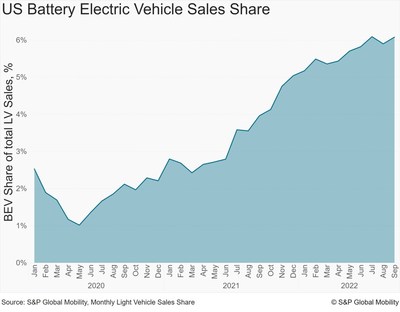

- The battery-electric vehicle (BEV) segment is gaining market share.

- Automakers are launching new BEV models, indicating a shift towards electrification.

- US light vehicle sales are projected to be down 1.6 million units year-to-date compared to 2021.

- Supply shortages, especially for semiconductors, are causing ongoing inventory constraints.

- Forecast for 2022 total sales may face risks to the downside, potentially impacting revenue.

13.4 million-unit SAAR Expected for 2022

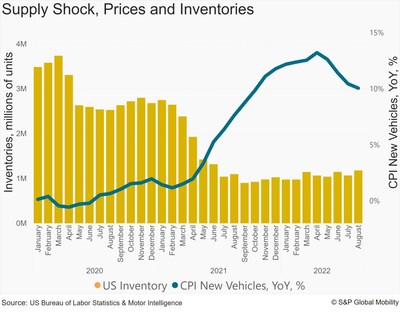

SOUTHFIELD, Mich., Sept. 26, 2022 /PRNewswire/ -- S&P Global Mobility analysts expect US light vehicle sales to be limited to 1.105 million units in September, marking an annual rate of 13.4 million units. The cumulative impacts of supply shocks on auto manufacturing in North America and globally continue to severely constrain sales by limiting the availability of new inventory to consumers. While wholesale prices for new vehicles are up a subdued

"Production issues relating to ongoing shortages, especially for semiconductors, and other supply chain, labor, and logistics issues will continue to translate into US inventory remaining at below-average levels, under 2.0 million units or a 40 days' supply, well into 2023," said Joe Langley, associate director, US production analysis, S&P Global Mobility.

Despite the tight inventory picture industrywide, the battery-electric vehicle (BEV) segment continues to see share gains. Numerous automakers are introducing BEV models in new body style segments, spreading the technological impact of electric vehicles to an increasing population of buyers. BEVs sitting beside legacy internal combustion engine vehicles in dealer showrooms are enticing more consumers to the new segment. The importance of the transition to BEVs was highlighted at the recent Detroit Auto Show.

"The event embodied the dynamics of today's auto market and the interplay between needing to support current demand for ICE products and the need for helping consumers along the path of transitioning to electrification and EVs," added Stephanie Brinley, principal research analyst, S&P Global Mobility.

Through September year-to-date 2022, volumes will likely be down an estimated 1.6 million units compared to the 11.7 million units year-to-date in 2021. Through the end of the year, the S&P Global Mobility forecast for 2022 sits at 14.0 million units, although risks to the downside remain.

On a manufacturer level, September volumes will remain consistent with recent results. One less selling day in September compared to August will result in slow m/m volume comparisons but expected manufacturer performances for the month reflect the ongoing market conditions.

Sales Parent | Volume (Thousands) | M/M% ∆ |

General Motors | 181K | -3.0 % |

Toyota | 169K | -0.4 % |

Ford | 152K | -3.3 % |

Hyundai-Kia | 131K | -3.2 % |

Stellantis | 121K | -5.0 % |

Honda | 74K | +2.9 % |

Volkswagen | 52K | -2.3 % |

Renault-Nissan-Mitsubishi | 49K | -1.9 % |

Others | 176K | -0.1 % |

Total Estimated Volume | 1,105K | -2.0 % |

Source: S&P Global Mobility © 2022 S&P Global Mobility | ||

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-supply-constraints-lack-of-inventory-cap-us-light-vehicle-sales-in-september-301633137.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-supply-constraints-lack-of-inventory-cap-us-light-vehicle-sales-in-september-301633137.html

SOURCE S&P Global Mobility

FAQ

What are the September 2022 US light vehicle sales projections for SGPI?

How does the supply chain affect SGPI's vehicle sales?

What is the annual light vehicle sales forecast for SGPI in 2022?