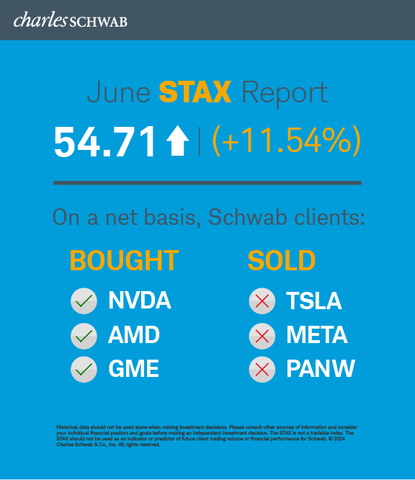

Schwab Trading Activity Index™: Score Moves Significantly Higher During the June Period, Returning to Moderate Levels

The Schwab Trading Activity Index™ (STAX) rose to 54.71 in June from 49.05 in May, indicating a moderate level compared to historical averages. Schwab clients were net buyers, increasing their positions in information technology, consumer discretionary, and consumer staples sectors.

During June, interest surged in 'meme stocks,' with top buys including NVIDIA (NVDA), Advanced Micro Devices (AMD), GameStop (GME), Amazon (AMZN), and Apple (AAPL). Conversely, clients net sold Tesla (TSLA), Meta Platforms (META), Palo Alto Networks (PANW), Walt Disney (DIS), and AT&T (T).

The S&P 500 and Nasdaq Composite achieved new all-time highs, driven by AI sector interest. Inflation showed signs of cooling, with CPI at 0.2% and PPI declining by 0.2%. Employment data revealed nonfarm payrolls up by 272,000, though the unemployment rate rose to 4.0%. The 10-year Treasury yield fell by over 3%, while the U.S. Dollar Index rose by 1.15% and crude oil prices increased by 5.91%.

- STAX increased to 54.71 in June, up from 49.05 in May.

- Clients were net buyers, increasing exposure in key sectors like technology and consumer goods.

- S&P 500 and Nasdaq Composite posted new all-time highs.

- Inflation showed signs of cooling, with CPI at 0.2% and PPI declining by 0.2%.

- Nonfarm payrolls increased by 272,000, surpassing expectations.

- Unemployment rate edged higher to 4.0%.

Insights

The Schwab Trading Activity Index (STAX) provides an insightful snapshot of retail investor sentiment and behavior on the Charles Schwab platform. A significant increase from 49.05 in May to 54.71 in June indicates heightened trading activity and a more optimistic market outlook among Schwab clients.

Investors increased positions in technology, consumer discretionary and consumer staples sectors, reflecting confidence in these areas, especially amid growing interest in AI-related stocks. This suggests a bullish sentiment towards companies perceived to benefit from technological advancements and changing consumer behaviors.

Notably, popular stocks such as NVIDIA (NVDA) and Advanced Micro Devices (AMD) saw increased purchases, aligning with the broader interest in AI. However, retail investors divested from Tesla (TSLA) and Meta Platforms (META), which could hint at concerns over valuations or shifting interest towards other sectors.

Investors should note that the S&P 500 and Nasdaq Composite reaching all-time highs may signal a broader market optimism, despite mixed economic indicators such as a higher unemployment rate and cooling inflation. The dip in the CBOE Volatility Index (VIX) suggests reduced market fear, possibly making for a favorable investment environment in the short term.

However, the long-term implications remain uncertain given the ongoing economic pressures. Retail investors must stay informed about potential changes in investor sentiment and economic conditions.

Schwab clients were net buyers in June, increasing their exposure in information technology, consumer discretionary and consumer staples

Schwab Trading Activity Index June 2024 (Graphic: Charles Schwab)

The reading for the four-week period ending June 28, 2024, ranks “moderate” compared to historic averages.

“Interestingly, unlike last month, excitement appeared to build around ‘meme stocks’ during the June STAX period and we saw that reflected in the month’s top buys across the general STAX population,” said Joe Mazzola, Head Trading & Derivatives Strategist at Charles Schwab. “We’ll need to see whether that trend extends into July. On the whole, though, Schwab clients were net buyers of equities in June as they increased exposure to technology-related names and particularly those that are part of the increasing wave of interest in Artificial Intelligence (AI).”

During the June STAX period

On June 7, the

The June Consumer Price Index (CPI) and Producer Price Index (PPI) reports both came in below expectations, showing inflation cooling, but still above the Fed’s target goal of

Popular names bought by Schwab clients during the period included:

- NVIDIA Corp. (NVDA)

- Advanced Micro Devices Inc. (AMD)

- GameStop Corp. (GME)

- Amazon.com Inc. (AMZN)

- Apple Inc. (AAPL)

Names net sold by Schwab clients during the period included:

- Tesla Inc. (TSLA)

- Meta Platforms Inc. (META)

- Palo Alto Networks Inc. (PANW)

- Walt Disney Co. (DIS)

- AT&T Inc. (T)

About the STAX

The STAX value is calculated based on a complex proprietary formula. Each month, Schwab pulls a sample from its client base of millions of funded accounts, which includes accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly STAX.

For more information on the Schwab Trading Activity Index, please visit www.schwab.com/investment-research/stax. Additionally, Schwab clients can chart the STAX using the symbol $STAX in either the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past performance is no guarantee of future results.

Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The STAX is not a tradable index. The STAX should not be used as an indicator or predictor of future client trading volume or financial performance for Schwab.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on X, Facebook, YouTube, and LinkedIn.

0724-BMMA

View source version on businesswire.com: https://www.businesswire.com/news/home/20240708835055/en/

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com

Source: The Charles Schwab Corporation