Recursion Provides Business Updates and Reports Second Quarter 2024 Financial Results

Recursion (RXRX) announced a definitive agreement to combine with Exscientia, enhancing its drug discovery capabilities. Key highlights include:

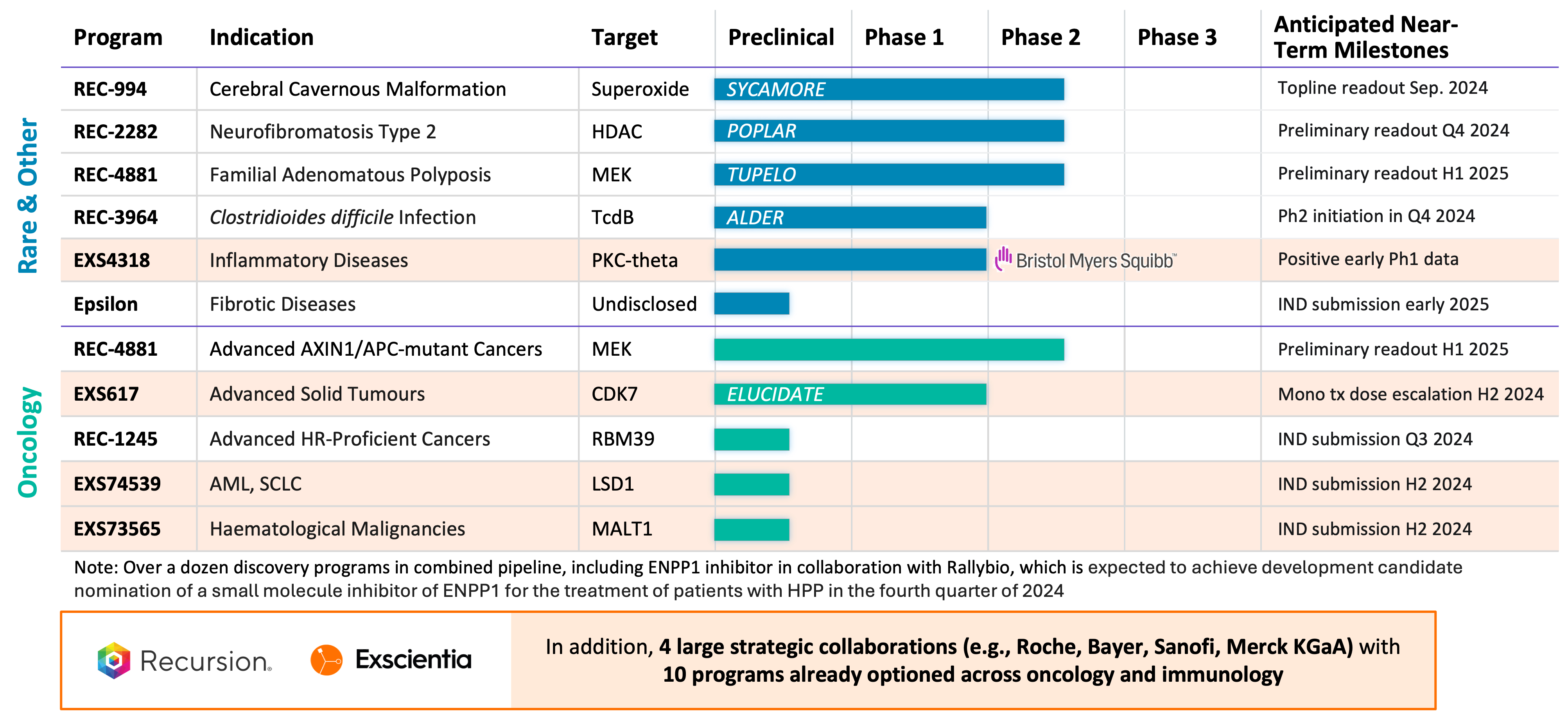

1. 7 clinical trial readouts expected for Recursion and 10 collectively with Exscientia over the next 18 months.

2. First neuroscience phenomap optioned by Roche and Genentech, triggering a $30 million payment.

3. Combined deals have potential for over $20 billion in milestones plus royalties.

4. Q2 2024 financial results: Revenue of $14.4 million, up from $11.0 million in Q2 2023. Net loss of $97.5 million, compared to $76.7 million in Q2 2023.

5. Cash position of $474.3 million as of June 30, 2024.

6. Completed a follow-on public offering, raising net proceeds of $216.4 million.

Recursion (RXRX) ha annunciato un accordo definitivo per unirsi a Exscientia, potenziando le sue capacità di scoperta di farmaci. I punti salienti includono:

1. 7 risultati di studi clinici previsti per Recursion e 10 in totale con Exscientia nei prossimi 18 mesi.

2. Prima opzione di fenomeno neuroscientifico concessa da Roche e Genentech, che attiva un pagamento di 30 milioni di dollari.

3. Gli accordi combinati hanno il potenziale per oltre 20 miliardi di dollari in traguardi più royalties.

4. Risultati finanziari del Q2 2024: Ricavi di 14,4 milioni di dollari, in aumento rispetto agli 11,0 milioni di dollari nel Q2 2023. Perdita netta di 97,5 milioni di dollari, rispetto ai 76,7 milioni di dollari nel Q2 2023.

5. Posizione di cassa di 474,3 milioni di dollari al 30 giugno 2024.

6. Completata un'offerta pubblica di follow-on, raccogliendo proventi netti di 216,4 milioni di dollari.

Recursion (RXRX) anunció un acuerdo definitivo para fusionarse con Exscientia, mejorando sus capacidades de descubrimiento de fármacos. Los aspectos más destacados incluyen:

1. Se esperan 7 resultados de ensayos clínicos para Recursion y 10 en total con Exscientia en los próximos 18 meses.

2. Primera opción de fenotipo neurocientífico otorgada por Roche y Genentech, activando un pago de 30 millones de dólares.

3. Los acuerdos combinados tienen el potencial para más de 20 mil millones de dólares en hitos más regalías.

4. Resultados financieros del Q2 2024: Ingresos de 14,4 millones de dólares, en aumento desde los 11,0 millones de dólares en Q2 2023. Pérdida neta de 97,5 millones de dólares, en comparación con los 76,7 millones de dólares en Q2 2023.

5. Posición de efectivo de 474,3 millones de dólares a 30 de junio de 2024.

6. Se completó una oferta pública de seguimiento, recaudando ingresos netos de 216,4 millones de dólares.

Recursion (RXRX)는 Exscientia와의 합병을 위한 최종 계약을 발표했습니다, 약물 발견 능력을 강화합니다. 주요 내용은 다음과 같습니다:

1. Recursion에 대해 7건의 임상 시험 결과가 예상되며 Exscientia와 함께 총 10건이 향후 18개월 동안 진행됩니다.

2. Roche와 Genentech가 선택한 첫 번째 신경과학 페노맵이 있으며, 3000만 달러의 지급이 발생합니다.

3. 결합된 거래는 200억 달러 이상의 이정표와 로열티가 될 가능성이 있습니다.

4. 2024년 2분기 재무 결과: 매출 1440만 달러, 2023년 2분기의 1100만 달러에서 증가. 순손실 9750만 달러, 2023년 2분기의 7670만 달러와 비교됩니다.

5. 2024년 6월 30일 기준 현금 보유액 4억 7430만 달러.

6. 후속 공개 제공이 완료되어 순수익 2억 1640만 달러를 모집했습니다.

Recursion (RXRX) a annoncé un accord définitif pour fusionner avec Exscientia, renforçant ainsi ses capacités de découverte de médicaments. Les points forts incluent :

1. 7 résultats d'essais cliniques attendus pour Recursion et 10 au total avec Exscientia au cours des 18 prochains mois.

2. Première option de phénotype en neurosciences obtenue par Roche et Genentech, déclenchant un paiement de 30 millions de dollars.

3. Les accords combinés ont le potentiel pour plus de 20 milliards de dollars en jalons plus des redevances.

4. Résultats financiers du T2 2024 : Revenus de 14,4 millions de dollars, en hausse par rapport à 11,0 millions de dollars au T2 2023. Perte nette de 97,5 millions de dollars, contre 76,7 millions de dollars au T2 2023.

5. Position de trésorerie de 474,3 millions de dollars au 30 juin 2024.

6. Offre publique de suivi réussie, avec un produit net de 216,4 millions de dollars.

Recursion (RXRX) hat eine endgültige Vereinbarung zur Fusion mit Exscientia angekündigt, um seine Fähigkeiten zur Medikamentenentdeckung zu verbessern. Zu den wichtigsten Punkten gehören:

1. Für Recursion werden 7 Ergebnisse klinischer Studien erwartet und zusammen mit Exscientia 10 insgesamt in den nächsten 18 Monaten.

2. Die erste Neurowissenschafts-Phänotyp-Option wurde von Roche und Genentech vergeben, was eine Zahlung von 30 Millionen Dollar auslöst.

3. Kombinierte Geschäfte haben das Potenzial für über 20 Milliarden Dollar an Meilensteinen plus Lizenzgebühren.

4. Finanzielle Ergebnisse Q2 2024: Einnahmen von 14,4 Millionen Dollar, ein Anstieg von 11,0 Millionen Dollar im Q2 2023. Nettoverlust von 97,5 Millionen Dollar, verglichen mit 76,7 Millionen Dollar im Q2 2023.

5. Liquiditätsposition von 474,3 Millionen Dollar am 30. Juni 2024.

6. Durchführung eines Folgeangebots mit einem netto Ertrag von 216,4 Millionen Dollar.

- Definitive agreement to combine with Exscientia, enhancing drug discovery capabilities

- First neuroscience phenomap optioned by Roche and Genentech, triggering a $30 million payment

- Combined deals have potential for over $20 billion in milestones plus royalties

- Revenue increased to $14.4 million in Q2 2024, up from $11.0 million in Q2 2023

- Completed a follow-on public offering, raising net proceeds of $216.4 million

- Strong cash position of $474.3 million as of June 30, 2024

- Net loss increased to $97.5 million in Q2 2024, compared to $76.7 million in Q2 2023

- Research and development expenses rose to $73.9 million, up from $55.1 million in Q2 2023

- Net cash used in operating activities increased to $82.2 million, up from $67.5 million in Q2 2023

Insights

Recursion's Q2 2024 results reveal a mixed financial picture. Revenue increased to

The proposed merger with Exscientia is a game-changer, potentially creating a powerhouse in AI-driven drug discovery. The combined entity would have a diverse clinical pipeline, significant partnerships with pharma giants and estimated annual synergies of

Recursion's strategic moves in Q2 2024 position it as a frontrunner in the TechBio sector. The Exscientia merger would create a full-stack, technology-enabled drug discovery platform, potentially revolutionizing the industry. With 10 clinical readouts expected in the next 18 months and partnerships with major pharma companies, the combined entity could significantly accelerate drug development timelines.

The

Recursion's clinical pipeline shows promising progress across multiple indications. The upcoming readouts for CCM (REC-994) in September 2024 and NF2 (REC-2282) in Q4 2024 are critical milestones that could validate the company's AI-driven approach to drug discovery. The diverse pipeline spanning rare diseases, oncology and infectious diseases demonstrates the platform's versatility.

The potential combination with Exscientia would further strengthen the clinical portfolio, particularly in oncology. With no overlap in clinical indications and complementary approaches (first-in-class vs. best-in-class), the merged entity could have a higher probability of clinical success. The expected 10 clinical readouts in the next 18 months provide multiple catalysts that could significantly impact the company's valuation and attract further partnership opportunities.

- Recursion entered into a definitive agreement to combine with Exscientia to add its technology-enabled clinical pipeline, sector-leading partnerships, and precision chemistry capabilities

- Recursion expects 7 clinical trial readouts for itself over the next 18 months and approximately 10 clinical readouts collectively over the same time period as part of a combined company with Exscientia

- The first neuroscience phenomap under Recursion’s collaboration with Roche and Genentech has been optioned, triggering a

$30 million payment and highlighting Recursion’s ability to deliver on success-based mapping and data options

SALT LAKE CITY, Aug. 08, 2024 (GLOBE NEWSWIRE) -- Recursion (Nasdaq: RXRX), a leading clinical stage TechBio company decoding biology to industrialize drug discovery, today reported business updates and financial results for its second quarter ended June 30, 2024.

“Our mission at Recursion is to decode biology to radically improve lives. We are leading the industry by integrating technology to map and navigate biology and chemistry to achieve this ambitious aim,” said Chris Gibson, Ph.D., Co-founder and CEO of Recursion. “Today, with the announcement of our proposed combination with Exscientia, we leap closer to our vision of a full-stack technology-enabled small molecule discovery platform that we are confident has the potential to meaningfully improve the efficiency of drug discovery in the coming decade. The culmination of this vision, which we will build together with the team from Exscientia, will be the broader availability of high quality medicines and lower prices for consumers.”

The proposed business combination with Exscientia provides deep complementarity on many levels.

- Recursion will augment its scaled biology exploration and translational capabilities with Exscientia’s demonstrated precision chemistry tools and capabilities, including its newly commissioned automated small molecule synthesis platform. Once integrated, the updated and evolved Recursion OS will enable the discovery and translation of higher quality medicines more efficiently and at a higher scale.

- The proposed combination augments Recursion’s first-in-class focused pipeline spanning rare disease, precision oncology, and infectious diseases with Exscientia’s best-in-class focused precision oncology pipeline, giving the proposed combination the potential to read out approximately 10 clinical trials in the next 18 months. Importantly, there is no overlap in the clinical indications being pursued by the two companies.

- The proposed business combination will execute significant therapeutic discovery collaborations with prominent biopharma companies, including Roche-Genentech, Sanofi, Bayer, and Merck KGaA. The combined deals have the potential for more than

$20 billion in milestones before royalties on net-sales of partnership programs which range from mid single-digit to double-digit royalties over the course of the partnership.

Chris Gibson, Ph.D., Co-founder and CEO of Recursion went on to say, “Additionally, we are thrilled that our first neuroscience phenomap has been optioned under our collaboration with Roche and Genentech. We believe that this industry-first milestone showcases Recursion’s scientific approach to mapping and navigating biology as well as our ability to deliver value to our partners.”

Strategic Rationale for Recursion-Exscientia Combination

- Pipeline: We believe that a combination with Exscientia would create a diverse portfolio of clinical and near-clinical programs (approximately 10 clinical readouts in the next 18 months) where most of these programs, if successful, could have annual peak sales opportunities in excess of

$1 billion . In addition to Recursion’s internal pipeline, Exscientia has wholly-owned oncology programs associated with targets CDK7 (clinical), LSD1, and MALT1 as well as partnered programs associated with targets PKC-Theta (clinical) and ENPP1. Across the combined pipeline there is no competitive overlap, with Recursion’s pipeline focusing on first-in-class drug candidates within oncology, rare disease, and infectious disease and Exscientia’s focus on best-in-class drug candidates within oncology. Additionally, for both companies there are many research and discovery stage pipeline programs that would benefit from the complementary combination of the two platforms. - Partnerships: The proposed business combination would bring together transformational partnerships with leading large pharma companies with a total of 10 programs already optioned across oncology and immunology. In addition to Recursion’s transformational partnerships with Roche-Genentech (neuroscience and a gastrointestinal oncology indication) and Bayer (undruggable oncology), Exscientia has partnerships with Sanofi (immunology and oncology) and Merck KGaA (oncology and immunology). In addition, Exscientia has a partnership with BMS (oncology and immunology) where an optioned program related to PKC-Theta has already shown positive early Phase 1 results. Furthermore, the combined company expects potential additional milestone payments of approximately

$200 million over the next 2 years from its current partnerships. - Platform: We believe that a combination with Exscientia will help enable a full-stack technology-enabled platform spanning patient-centric target discovery, structure based drug design including hotspot analysis, quantum mechanics and molecular dynamics modeling, 2D and 3D generative AI design, encode and automate design-make-test-learn cycles with active learning, automated chemical synthesis, predictive ADMET and translation, biomarker selection, clinical development, and more. Furthermore, Exscientia’s automated chemistry design and synthesis capabilities are expected to allow Recursion to more rapidly and effectively run SAR cycles during hit to lead and lead optimization, generating the diverse chemistry to experimentally improve the generalizability of our predictive maps of biology and chemistry.

- Business Synergies: Together, Recursion and Exscientia held approximately

$850 million in cash and cash equivalents at the end of Q2 2024. The combined company is expected to have estimated annual synergies of approximately$100 million and the combined business is expected to have a cash runway extending into 2027. - Cultural Synergies: Recursion and Exscientia have been defining and leading the inclusion of technology within the life sciences for over 10 years. There is a shared vision to leverage technology to discover and develop high quality medicines efficiently and at scale.

- Transaction Details: Exscientia shareholders will receive 0.7729 shares of Recursion Class A common stock for each Exscientia ordinary share, with fractional shares paid in cash. Recursion shareholders will own approximately

74% of the combined company. Exscientia shareholders will own approximately26% of the combined company assuming no additional issuance by either company before closing. Recursion will be the go-forward entity. Recursion Co-Founder & CEO Chris Gibson, Ph.D., will be CEO of the combined company. Exscientia Interim CEO David Hallett, Ph.D., plans to join the combined company as Chief Scientific Officer. We expect this transaction to complete by early 2025.

Summary of Recursion Business Highlights

- Partnerships

- Roche and Genentech: The goal of the collaboration is to use unimodal and multiomics maps in order to discover and develop potential therapeutic treatments for up to 40 programs in neuroscience and a single indication in gastrointestinal oncology. This recent mapping effort supports the discovery and development of therapeutic programs in neuroscience which is a disease domain characterized by few treatment options and a need for novel biological targets. Recursion and Genentech collaborated to adapt a hiPSC-derived neuronal cell model for map building, and since 2022, Recursion has built cell manufacturing technologies and produced over 1 trillion hiPSC-derived neuronal cells to enable this effort. We are also building additional maps in other neural cell contexts that will further investigate genome scale genetic and diverse chemical perturbations for use under the collaboration.

- Bayer: We continue to advance efforts to discover potential new therapeutics against undruggable oncology targets with Bayer. In June 2024, we announced that the parties have selected the first project under this partnership. In addition, we gave guidance that we expect to complete the delivery of up to 25 multi-modal data packages to Bayer by the end of Q3 2024 to support further project nominations. Moreover, we announced that Bayer would be the first beta-user of LOWE (Recursion’s LLM-Orchestrated Workflow Engine) which will be integrated across the collaboration and offer a more exploratory and comprehensive research environment for scientists from both sides of the partnership to interact with data, models, analyses, and visualizations pertaining to the drug discovery scope of the collaboration.

- Pipeline

- Cerebral Cavernous Malformation (CCM) (REC-994): Our Phase 2 SYCAMORE clinical trial is a randomized, double-blind, placebo-controlled, study of two doses of REC-994 in participants with CCM. The primary endpoint of the study is safety and tolerability. Secondary and exploratory endpoints, including clinician measured outcomes, imaging of CCM lesions, patient reported outcomes, and selected biomarkers, will be evaluated. Since fully enrolling in June 2023, the vast majority of participants who completed 12 months of treatment have entered the long-term extension study. We expect to share Phase 2 data in September 2024.

- Neurofibromatosis Type 2 (NF2) (REC-2282): Our adaptive Phase 2/3 POPLAR clinical trial is an open label, two part study of REC-2282 in participants with progressive NF2-mutated meningiomas. Part 1 of the study explores two doses of REC-2282 in adult and pediatric participants. Enrollment of adult patients in Part 1 of the study is complete (n=24). We expect to share preliminary safety and efficacy results from the adult cohort in Q4 2024.

- APC or AXIN1 Mutant Cancers (REC-4881): Our Phase 2 LILAC clinical trial is an open label, multicenter study of REC-4881 in participants with unresectable, locally advanced or metastatic cancer with AXIN1 or APC mutations. We expect to share Phase 2 safety, tolerability, and preliminary efficacy data in H1 2025

- Familial Adenomatous Polyposis (FAP) (REC-4881): Our Phase 1b/2 TUPELO clinical trial is an open label, multicenter, two part study of REC-4881 in participants with FAP. Part 1 is complete and enrollment in Part 2 has commenced. We expect to share Phase 2 safety, tolerability, and preliminary efficacy data in H1 2025.

- Clostridioides difficile Infection (REC-3964): Full Phase 1 data from our healthy volunteers study was presented at the World Congress on Infectious Diseases in Paris in June 2024. Our Phase 2 ALDER clinical trial is an open-label, multicenter randomized study designed to evaluate rates of recurrence with REC-3964 at two doses compared with an observational cohort after patients have achieved initial cure with vancomycin. We expect to initiate a Phase 2 study in patients at high risk for C. difficile infection recurrence in Q4 2024 with a preliminary readout expected by the end of 2025.

- Advanced HR-Proficient Cancers, Target RBM39 (REC-1245): RBM39 is a novel CDK12-adjacent target identified by the Recursion OS. REC-1245 will be evaluated for the potential treatment of advanced HR-proficient cancers such as ovarian, prostate, breast, and pancreatic cancers. We expect to submit an IND in Q3 2024 and anticipate initiating a monotherapy Phase 1/2 open label study of REC-1245 in participants with unresectable, locally advanced, or metastatic cancer in Q4 2024. Phase 1 data from the dose-escalation portion of the study is expected by the end of 2025.

- Undisclosed Indication in Fibrosis, Target Epsilon: This program originated under our initial fibrosis collaboration with Bayer. We have since in-licensed all rights to this program from Bayer. We are advancing our lead candidate through IND-enabling studies with IND submission expected in early 2025 with a Phase 1 healthy volunteer readout by the end of 2025.

- Platform

- BioHive-2 Supercomputer and Pipeline Growth: We operationalized and benchmarked BioHive-2, our next generation supercomputer that we designed and built with our partner NVIDIA. According to the TOP500 List from June 2024, BioHive-2 is ranked the 35th most powerful supercomputer in the world across any industry. Our computational resources paired with LLM-driven tools and causal models built using multimodal patient data from Tempus has resulted in the first programs already entering the early-stage of our internal pipeline.

- Whole-Genome Transcriptomics Map: In June 2024, we announced completing the first version of a genome-scale transcriptomics CRISPR knockout map in HUVEC cells. With our computational resources and the generation and curation of scaled and relatable multiomics datasets, we are developing multiomics foundation models.

Additional Corporate Updates

- L(earnings) Call: We will host a L(earnings) Call on Aug 8, 2024 at 5:00 pm Eastern Time / 3:00 pm Mountain Time. We will broadcast the live stream from Recursion’s X (formerly Twitter), LinkedIn, and YouTube accounts and there will be opportunities to ask questions of the company.

- Download Day: On June 24, 2024 at its headquarters in Salt Lake City, we hosted Download Day, its investor and R&D day that expounds upon Recursion's value proposition across its platform, pipeline, partnerships, and people. This year's programming had external speakers, including Jensen Huang (Co-Founder and CEO at NVIDIA), Deepak Nijhawan, M.D., Ph.D., (Distinguished Chair in Biomedical Science at UT Southwestern), and John Marioni, Ph.D., (SVP and Head of Computational Sciences at Genentech). Learn more at www.Recursion.com/Download-Day.

- Follow-on Public Offering: We completed a follow-on public offering in late June 2024, raising gross and net proceeds of

$230 million and$216.4 million , respectively.

Second Quarter 2024 Financial Results

- Cash Position: Cash and cash equivalents were

$474.3 million as of June 30, 2024. - Revenue: Total revenue was

$14.4 million for the second quarter of 2024, compared to$11.0 million for the second quarter of 2023. The increase was due to revenue recognized from our partnership with Roche, as our mix of work on the three performance obligations shifted towards higher cost processes including the progression of work related to our gastrointestinal cancer performance obligation. - Research and Development Expenses: Research and development expenses were

$73.9 million for the second quarter of 2024, compared to$55.1 million for the second quarter of 2023. The increase in research and development expenses was driven by our platform and personnel costs as we continue to expand and upgrade our platform, including our chemical technology, machine learning, and transcriptomics platform. - General and Administrative Expenses: General and administrative expenses were

$31.8 million for the second quarter of 2024, compared to$28.3 million for the second quarter of 2023. The small increase in general and administrative expenses was primarily driven by an increase in salaries and wages of$1.5 million and increases in software and lease expense. - Net Loss: Net loss was

$97.5 million for the second quarter of 2024, compared to a net loss of$76.7 million for the second quarter of 2023. - Net Cash: Net cash used in operating activities was

$82.2 million for the second quarter of 2024, compared to net cash used in operating activities of$67.5 million for the second quarter of 2023. The increase in net cash used in operating activities compared to the same period last year was due to higher operating costs incurred for research and development and general and administrative due to Recursion’s expansion and upgraded capabilities.

About Recursion

Recursion is a clinical stage TechBio company leading the space by decoding biology to industrialize drug discovery. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously expands one of the world’s largest proprietary biological, chemical and patient-centric datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale — up to millions of wet lab experiments weekly — and massive computational scale — owning and operating one of the most powerful supercomputers in the world, Recursion is uniting technology, biology, chemistry and patient-centric data to advance the future of medicine.

Recursion is headquartered in Salt Lake City, where it is a founding member of BioHive, the Utah life sciences industry collective. Recursion also has offices in Toronto, Montreal and the San Francisco Bay Area. Learn more at www.Recursion.com, or connect on X (formerlyTwitter) and LinkedIn.

Media Contact

Media@Recursion.com

Investor Contact

Investor@Recursion.com

Consolidated Statements of Operations

| Recursion Pharmaceuticals, Inc. | ||||||||||||||

| Condensed Consolidated Statements of Operations (unaudited) | ||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||

| Three months ended | Six months ended | |||||||||||||

| June 30, | June 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Revenue | ||||||||||||||

| Operating revenue | $ | 14,404 | $ | 11,016 | $ | 27,895 | $ | 23,150 | ||||||

| Grant revenue | 13 | 1 | 316 | 1 | ||||||||||

| Total revenue | 14,417 | 11,017 | 28,211 | 23,151 | ||||||||||

| Operating costs and expenses | ||||||||||||||

| Cost of revenue | 9,199 | 9,382 | 20,365 | 21,829 | ||||||||||

| Research and development | 73,928 | 55,060 | 141,488 | 101,737 | ||||||||||

| General and administrative | 31,833 | 28,290 | 63,241 | 51,165 | ||||||||||

| Total operating costs and expenses | 114,960 | 92,732 | 225,094 | 174,731 | ||||||||||

| Loss from operations | (100,543 | ) | (81,715 | ) | (196,883 | ) | (151,580 | ) | ||||||

| Other income, net | 2,480 | 4,989 | 6,668 | 9,527 | ||||||||||

| Loss before income tax benefit | (98,063 | ) | (76,726 | ) | (190,215 | ) | (142,053 | ) | ||||||

| Income tax benefit | 523 | - | 1,302 | - | ||||||||||

| Net loss and comprehensive loss | $ | (97,540 | ) | $ | (76,726 | ) | $ | (188,913 | ) | $ | (142,053 | ) | ||

| Per share data | ||||||||||||||

| Net loss per share of Class A, B and Exchangeable common stock, basic and diluted | $ | (0.40 | ) | $ | (0.38 | ) | $ | (0.79 | ) | $ | (0.71 | ) | ||

| Weighted-average shares (Class A, B and Exchangeable) outstanding, basic and diluted | 242,196,409 | 201,415,475 | 239,107,879 | 198,957,804 | ||||||||||

Consolidated Balance Sheets

| Recursion Pharmaceuticals, Inc. | ||||||||

| Condensed Consolidated Balance Sheets (unaudited) | ||||||||

| (in thousands) | ||||||||

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 474,341 | $ | 391,565 | ||||

| Restricted cash | 1,783 | 3,231 | ||||||

| Other receivables | 2,526 | 3,094 | ||||||

| Other current assets | 43,725 | 40,247 | ||||||

| Total current assets | 522,375 | 438,137 | ||||||

| Restricted cash, non-current | 6,629 | 6,629 | ||||||

| Property and equipment, net | 83,633 | 86,510 | ||||||

| Operating lease right-of-use assets | 44,088 | 33,663 | ||||||

| Financing lease right-of-use assets | 28,562 | - | ||||||

| Intangible assets, net | 38,210 | 36,443 | ||||||

| Goodwill | 52,056 | 52,056 | ||||||

| Other assets, non-current | 308 | 261 | ||||||

| Total assets | $ | 775,861 | $ | 653,699 | ||||

| Liabilities and stockholders’ equity | ||||||||

| Accounts payable | $ | 3,762 | $ | 3,953 | ||||

| Accrued expenses and other liabilities | 33,401 | 46,635 | ||||||

| Unearned revenue | 32,204 | 36,426 | ||||||

| Notes payable and financing lease liabilities | 8,109 | 41 | ||||||

| Operating lease liabilities | 8,607 | 6,116 | ||||||

| Total current liabilities | 86,083 | 93,171 | ||||||

| Unearned revenue, non-current | 29,169 | 51,238 | ||||||

| Notes payable and financing lease liabilities, non-current | 22,921 | 1,101 | ||||||

| Operating lease liabilities, non-current | 50,239 | 43,414 | ||||||

| Deferred tax liabilities | - | 1,339 | ||||||

| Other liabilities, non-current | 3,000 | - | ||||||

| Total liabilities | 191,412 | 190,263 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Common stock (Class A, B and Exchangeable) | 3 | 2 | ||||||

| Additional paid-in capital | 1,740,981 | 1,431,056 | ||||||

| Accumulated deficit | (1,156,535 | ) | (967,622 | ) | ||||

| Total stockholder's equity | 584,449 | 463,436 | ||||||

| Total liabilities and stockholders’ equity | $ | 775,861 | $ | 653,699 | ||||

Forward-Looking Statements

This document contains information that includes or is based upon statements that are not historical facts that may be considered "forward-looking statements'' within the meaning of the Securities Litigation Reform Act of 1995 and may be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “enables” or words of similar meaning, including, without limitation, those statements regarding the option exercise by Roche-Genentech as validating our scientific approach and ability to deliver value to partners; the potential future revenue related to the option of the neuroscience phenomap and the potential creation, delivery, and option of future maps; whether such mapping effort will support the discovery and development of therapeutic programs in neuroscience; the completion and uses of additional maps being built; continuing to advance efforts to discover new therapeutics for undruggable oncology targets with Bayer; Bayer becoming the first external beta-user of LOWE and integrating software across the collaboration; the timing for completing 25 unique multi-modal data packages; expectations related to early and late stage discovery, preclinical, and clinical programs, including timelines for enrollment in studies, data readouts, and progression toward IND-enabling studies; developments with Recursion OS and other technologies, including construction of foundation models and augmentation of our dataset; developments of our transcriptomics technology, including the timing of development of a whole-genome knockout transcripts map; expectations and developments with respect to licenses and collaborations, including option exercises by partners and additional partnerships; prospective products and their potential future indications and market opportunities; expectations for business and financial plans and performance, including cash runway; outcomes and benefits expected from the Tempus partnership, including the development of causal AI models and biomarker and patient stratification strategies; Recursion’s plan to maintain a leadership position in data generation and aggregation and advancing the future of medicine; and

many other statements. Such statements also include statements regarding the proposed business combination of Recursion and Exscientia and the outlook for Recursion’s or Exscientia’s future business and financial performance, including the combined company’s first-in-class and best-in-class opportunities; potential for sales from successful programs with peak sales opportunities of over

Other important factors and information are contained in Recursion’s most recent Annual Report on Form 10-K and Exscientia’s most recent Annual Report on Form 20-F, including the risks summarized in the section entitled “Risk Factors,” Recursion’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31 and June 30, 2024 and Exscientia’s filing on Form 6-K filed May 21, 2024, and each company’s other filings with the U.S. Securities and Exchange Commission (the “SEC”), which can be accessed at https://ir.recursion.com in the case of Recursion, http://investors.exscientia.ai in the case of Exscientia, or www.sec.gov. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. Neither Recursion nor Exscientia undertakes any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

This communication relates to a proposed business combination of Recursion and Exscientia that will become the subject of a joint proxy statement to be filed by Recursion with the SEC. The joint proxy statement will provide full details of the proposed combination and the attendant benefits and risks, including the terms and conditions of the scheme of arrangement and the other information required to be provided to Exscientia’s shareholders under the applicable provisions of the U.K. Companies Act 2006. This communication is not a substitute for the joint proxy statement or any other document that Recursion or Exscientia may file with the SEC or send to their respective stockholders in connection with the proposed combination. Investors and security holders are urged to read the definitive joint proxy statement and all other relevant documents filed with the SEC or sent to Recursion’s stockholders or Exscientia’s shareholders as they become available because they will contain important information about the proposed combination. All documents, when filed, will be available free of charge at the SEC’s website (www.sec.gov). You may also obtain these documents by contacting Recursion’s Investor Relations department at investor@recursion.com; or by contacting Exscientia’s Investor Relations department at investors@exscientia.ai. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

Participants in the Solicitation

Recursion, Exscientia and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies in connection with the proposed business combination. Information about Recursion’s directors and executive officers is available in Recursion’s proxy statement dated April 23, 2024 for its 2024 Annual Meeting of Stockholders. Information about Exscientia’s directors and executive officers is available in Exscientia’s Annual Report on Form 20-F dated March 21, 2024. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement and all other relevant materials to be filed with the SEC regarding the proposed combination when they become available. Investors should read the joint proxy statement carefully when it becomes available before making any voting or investment decisions.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/78597b92-04fb-4dcf-b0dc-ca6eda79252b