Recursion and Exscientia Enter Definitive Agreement to Create a Global Technology-Enabled Drug Discovery Leader with End-to-End Capabilities

Rhea-AI Summary

Recursion (RXRX) and Exscientia (EXAI) have announced a definitive agreement to merge, creating a global technology-enabled drug discovery leader. The combination aims to leverage Recursion's biology exploration and Exscientia's precision chemistry design capabilities. Key highlights include:

- Expected annual synergies of approximately $100 million

- Combined pipeline with 10 clinical readouts expected in the next 18 months

- Potential for $200 million in milestone payments over 24 months

- Well-capitalized with $850 million in cash and equivalents

- Exscientia shareholders to receive 0.7729 shares of Recursion for each share owned

The merger is expected to close by early 2025, subject to shareholder and regulatory approvals. The combined company will retain the Recursion name and be headquartered in Salt Lake City, Utah.

Positive

- Merger expected to yield annual synergies of approximately $100 million

- Combined pipeline with 10 clinical readouts expected in the next 18 months

- Potential for $200 million in milestone payments over the next 24 months

- Well-capitalized balance sheet with $850 million in cash and cash equivalents

- Potential for over $20 billion in revenue before royalties from partnerships

Negative

- Transaction subject to shareholder and regulatory approvals, which may delay or prevent completion

- Integration risks and potential challenges in combining two distinct company cultures

- Dilution of existing Recursion shareholders' ownership to 74% of the combined company

News Market Reaction 1 Alert

On the day this news was published, RXRX gained 4.24%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Operational complementarities expected to yield annual synergies of approximately

- Brings together Recursion’s scaled biology exploration and translational capabilities with Exscientia’s precision chemistry design and small molecule automated synthesis capabilities to create a leading technology-first, end-to-end drug discovery platform

- Combined business positioned to leverage latest advances in the life sciences and technology to deliver better novel treatments to patients, faster and at a lower cost relative to traditional drug discovery and development methods

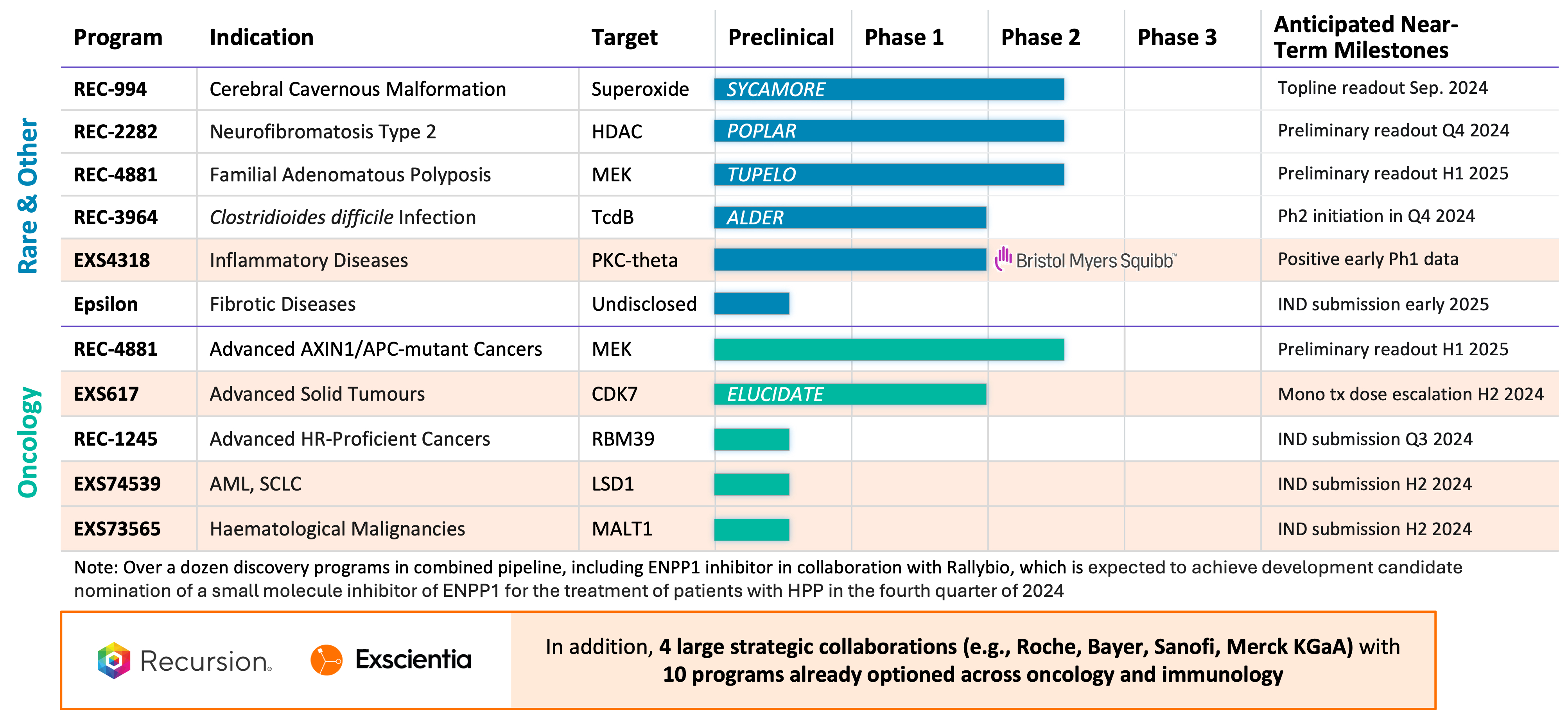

- Highly complementary pipeline with approximately 10 clinical readouts expected over the next 18 months

- Industry-leading portfolio of pharma partnerships with the potential for approximately

$200 million in milestone payments over the next 24 months, and over$20 billion overall before potential royalties over the course of the partnership - Well-capitalized balance sheet with approximately

$850 million in cash and cash equivalents between the two companies as of the end of Q2 2024 - Operational complementarities expected to yield annual synergies in excess of

$100 million

SALT LAKE CITY and OXFORD, United Kingdom, Aug. 08, 2024 (GLOBE NEWSWIRE) -- Recursion (Nasdaq: RXRX) and Exscientia plc (Nasdaq: EXAI) today announced the companies have entered into a definitive agreement, combining Recursion, a leading clinical stage technology-enabled biotech company decoding biology to industrialize drug discovery, with Exscientia, a technology-driven clinical stage drug design and development company, committed to creating more effective medicines for patients, faster.

“We believe the proposed combination is deeply complementary and aligned with our missions to industrialize drug discovery to deliver high quality medicines and lower prices for consumers,” said Chris Gibson, Ph.D., Co-Founder and CEO of Recursion as well as the planned CEO of the combined entity. “Exscientia’s precision chemistry tools and capabilities, including its newly commissioned automated small molecule synthesis platform, will augment our tech-enabled biology and chemistry exploration, hit discovery and translational capabilities. I am excited to continue building the best example of the next generation of biotechnology companies. It still feels like we are just getting started.”

“Adding Exscientia’s best-in-class focused precision oncology internal pipeline to Recursion’s first-in-class focused pipeline spanning rare disease, precision oncology and infectious disease is highly complementary as we look to bring treatments to patients faster,” said David Hallett, Ph.D., Interim Chief Executive Officer and planned Chief Scientific Officer of Recursion post-closing of the transaction. “We look forward to bringing our teams together and integrating Recursion's high throughput and target biology capabilities with Exscientia's highly scalable molecular design and automated chemistry synthesis capabilities to truly accelerate the discovery of better drugs for patients.”

Once integrated, the companies believe the extended and evolved Recursion OS will enable the discovery and translation of higher quality medicines more efficiently and at a higher scale with a full-stack technology-enabled small molecule discovery platform. In addition, the combined company expects to read out approximately 10 clinical trials in the next 18 months.

The proposed business combination will also advance significant therapeutic discovery collaborations with some of the most prominent biopharma companies in the world, including Roche-Genentech, Sanofi, Bayer, and Merck KGaA. Moreover, there is the potential for approximately

Strategic Rationale

- Pipeline: The combination would create a diverse portfolio of clinical and near-clinical programs (approximately 10 clinical readouts expected in the next 18 months) where most of these programs, if successful, could have annual peak sales opportunities in excess of

$1 billion . In addition to Recursion’s internal pipeline, Exscientia has wholly-owned oncology programs associated with targets CDK7 (clinical), LSD1, and MALT1 as well as partnered programs associated with targets PKC-Theta (clinical) and ENPP1. Across the combined pipeline there is no competitive overlap, with Recursion’s pipeline focusing on first-in-class drug candidates within oncology, rare disease, and infectious disease and Exscientia’s focus on best-in-class drug candidates within oncology. Additionally, for both companies there are many research and discovery stage pipeline programs that would benefit from the complementary combination of the two platforms.

- Partnerships: The proposed business combination would bring together transformational partnerships with leading large pharma companies with a total of 10 programs already optioned across oncology and immunology. In addition to Recursion’s transformational partnerships with Roche-Genentech (neuroscience and a gastrointestinal oncology indication) and Bayer (undruggable oncology), Exscientia has partnerships with Sanofi (immunology and oncology) and Merck KGaA (oncology and immunology). In addition, Exscientia has a partnership with BMS (oncology and immunology) where an optioned program related to PKC-Theta has already shown positive early Phase 1 results. Furthermore, the combined company expects potential additional milestone payments of approximately

$200 million over the next 2 years from its current partnerships.

- Platform: The combination will help enable a full-stack technology-enabled platform spanning patient-centric target discovery, structure based drug design including hotspot analysis, quantum mechanics and molecular dynamics modeling, 2D and 3D generative AI design, encode and automate design-make-test-learn cycles with active learning, automated chemical synthesis, predictive ADMET and translation, biomarker selection, clinical development, and more. Furthermore, Exscientia’s automated chemistry design and synthesis capabilities are expected to allow Recursion to more rapidly and effectively run SAR cycles during hit to lead and lead optimization. These capabilities are expected to generate diverse chemistry to experimentally improve our predictive maps of biology and chemistry.

Transaction Details

Under the terms of the transaction agreement, which were unanimously approved by the boards of directors of both companies, Exscientia shareholders will receive 0.7729 shares of Recursion Class A common stock for each Exscientia ordinary share they own, with fractional shares paid in cash. Based on the fixed exchange ratio, Recursion shareholders will own approximately

The combination is expected to be implemented through a court sanctioned scheme of arrangement under English law and is subject to the satisfaction of customary closing conditions, including the approval of Exscientia shareholders, the approval of Recursion’s stockholders, and the sanction of the High Court of Justice of England and Wales, and the receipt of required regulatory approvals. Subject to the satisfaction or waiver of the closing conditions, the transaction is expected to close by early 2025.

Listing, Governance and Management

The combined company, which will be named Recursion, will continue to be headquartered in Salt Lake City, Utah, and trade on the NASDAQ, while maintaining a significant presence in the U.K. Chris Gibson, Ph.D., Co-Founder & CEO of Recursion, will serve as CEO of the combined company and David Hallett, Ph.D., Interim Chief Executive Officer & Chief Scientific Officer of Exscientia, plans to join the combined company as Chief Scientific Officer. Two existing Exscientia directors will join the Board of Recursion following the closing of the transaction.

Advisors

Allen & Company LLC acted as exclusive financial advisor to Recursion and Wilson Sonsini Goodrich & Rosati acted as legal counsel. Centerview Partners LLC acted as exclusive financial advisor to Exscientia and A&O Shearman acted as legal counsel.

About Recursion

Recursion is a leading clinical stage TechBio company decoding biology to industrialize drug discovery. Central to its mission is the Recursion Operating System (OS), a platform built across diverse technologies that continuously expands one of the world’s largest proprietary biological, chemical and patient-centric datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale—up to millions of wet lab experiments weekly—and massive computational scale—owning and operating one of the most powerful supercomputers in the world—Recursion is uniting technology, biology, chemistry and patient-centric data to advance the future of medicine.

Recursion is headquartered in Salt Lake City, where it is a founding member of BioHive, the Utah life sciences industry collective. Recursion also has offices in Toronto, Montreal, the San Francisco Bay Area and London.

About Exscientia

Exscientia is a technology-driven drug design and development company, committed to creating more effective medicines for patients, faster. Exscientia combines precision design with integrated experimentation, aiming to invent and develop the best possible drugs in the most efficient manner. Operating at the interfaces of human ingenuity, artificial intelligence (AI), automation and physical engineering, we pioneered the use of AI in drug discovery as the first company to progress AI-designed small molecules into a clinical setting. We have developed an internal pipeline focused on oncology, while our partnered pipeline extends to many other therapeutic areas. By leading this new approach to drug creation, we believe we can change the underlying economics of drug discovery and rapidly advance the best scientific ideas into medicines for patients.

Recursion Investor Relations

investor@recursion.com

Recursion Media

media@recursion.com

Exscientia Investor Relations

investors@exscientia.ai

Exscientia Media

media@exscientia.ai

Forward Looking Statements

Statements contained herein which are not historical facts may be considered forward-looking statements under federal securities laws and may be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” or words of similar meaning and include, but are not limited to, statements regarding the proposed business combination of Recursion and Exscientia and the outlook for Recursion’s or Exscientia’s future business and financial performance such as delivering better treatments to patients, faster and at a lower cost; the discovery and translation of higher quality medicines more efficiently and at a higher scale; helping to enable a full-stack technology-enabled platform; allowing Recursion to more rapidly and effectively run SAR cycles during hit to lead optimization; generating the diverse chemistry to experimentally improve predictive maps; the number and timing of clinical program readouts over the next 18 months; the combined company’s first-in-class and best-in-class opportunities; potential for sales from successful programs with annual peak sales opportunities of over

Other important factors and information are contained in Recursion’s most recent Annual Report on Form 10-K and Exscientia’s most recent Annual Report on Form 20-F, including the risks summarized in the section entitled “Risk Factors,” Recursion’s most recent Quarterly Reports on Form 10-Q and Exscientia’s filing on Form 6-K filed May 21, 2024, and each company’s other periodic filings with the U.S. Securities and Exchange Commission (the “SEC”), which can be accessed at https://ir.recursion.com in the case of Recursion, http://investors.exscientia.ai in the case of Exscientia, or www.sec.gov. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. Neither Recursion nor Exscientia undertakes any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

This communication relates to a proposed business combination of Recursion and Exscientia that will become the subject of a joint proxy statement to be filed by Recursion with the SEC. The joint proxy statement will provide full details of the proposed combination and the attendant benefits and risks, including the terms and conditions of the scheme of arrangement and the other information required to be provided to Exscientia's shareholders under the applicable provisions of the U.K. Companies Act 2006. This communication is not a substitute for the joint proxy statement or any other document that Recursion or Exscientia may file with the SEC or send to their respective stockholders in connection with the proposed combination. Investors and security holders are urged to read the definitive joint proxy statement and all other relevant documents filed with the SEC or sent to Recursion’s stockholders or Exscientia’s shareholders as they become available because they will contain important information about the proposed combination. All documents, when filed, will be available free of charge at the SEC’s website (www.sec.gov). You may also obtain these documents by contacting Recursion’s Investor Relations department at investor@recursion.com; or by contacting Exscientia’s Investor Relations department at investors@exscientia.ai. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

Participants in the Solicitation

Recursion, Exscientia and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies in connection with the proposed business combination. Information about Recursion’s directors and executive officers is available in Recursion’s proxy statement dated April 23, 2024 for its 2024 Annual Meeting of Stockholders. Information about Exscientia’s directors and executive officers is available in Exscientia’s proxy statement dated March 21, 2024 for its 2024 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement and all other relevant materials to be filed with the SEC regarding the proposed combination when they become available. Investors should read the joint proxy statement carefully when it becomes available before making any voting or investment decisions.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/83e2ee85-7b58-4008-b558-a17965edff48