Rocket Lab Announces Closing of Upsized Offering of $355 Million Convertible Senior Notes

- None.

- None.

Insights

The closing of Rocket Lab's private offering of convertible senior notes is a significant financial maneuver that highlights the company's strategic approach to capital raising. With a principal amount of $355 million at an interest rate of 4.25%, this move is indicative of Rocket Lab's ability to attract institutional investment, showcasing investor confidence in the company's growth trajectory. The choice of convertible notes, which can be turned into equity, suggests a balance between obtaining immediate funding and potential future equity dilution.

From a financial analysis standpoint, the use of proceeds to repay existing debt under the equipment financing agreement demonstrates prudent financial management. It indicates a focus on optimizing the capital structure by reducing higher-cost debt, which could improve the company's interest coverage ratio and overall financial health. Additionally, the allocation of funds for working capital and strategic transactions, including potential M&A, signals an aggressive growth strategy that may enhance Rocket Lab's market position and operational scale.

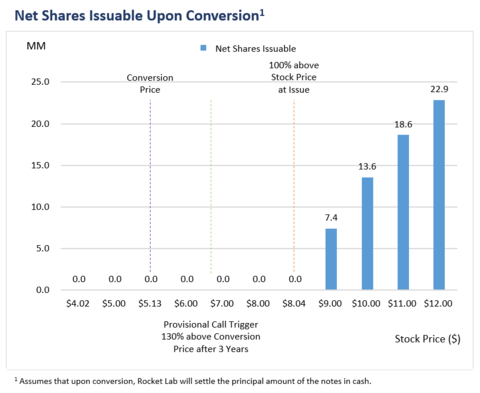

The capped call transactions associated with this offering serve to minimize dilution from the future conversion of notes, which is a strategic move to protect current shareholders' interests. The effective conversion price of $8.04, after accounting for the capped call transactions, provides a premium to the current stock price, which could be favorable for investors if the company's stock price appreciates.

In the context of the aerospace and defense industry, Rocket Lab's recent financial activity is a reflection of the sector's increasing capital demands for innovation and expansion. The company's decision to upsell the offering due to oversubscription is a testament to the market's appetite for space-related investment opportunities.

As a market research analyst, it's important to consider the competitive landscape in which Rocket Lab operates. The space industry is becoming increasingly crowded, with both established players and new entrants vying for market share. Rocket Lab's capital raising efforts could provide the necessary resources to solidify its position in the market, potentially through strategic acquisitions that expand its capabilities and service offerings.

Furthermore, the allocation of funds towards strategic growth and scaling investments could enable Rocket Lab to accelerate its development of new technologies and infrastructure, which is crucial for maintaining a competitive edge. The company's performance following these investments will be a key indicator of its ability to capitalize on the growing demand for commercial launch services and space systems.

The legal implications of Rocket Lab's offering are noteworthy, particularly the reliance on Rule 144A under the Securities Act of 1933. This rule allows for the sale of securities to qualified institutional buyers without the need for a public registration, thus facilitating a quicker and potentially less costly capital raise. However, it also limits the pool of potential investors and the liquidity of the notes, as they cannot be offered or sold to the general public.

The absence of registration under the Securities Act means that the notes and any shares of common stock issuable upon conversion, are subject to restrictions on transfer. This could impact the marketability of the notes and the ease with which they can be converted into equity. Investors and the company alike must be mindful of the compliance requirements and limitations associated with unregistered securities.

Finally, the announcement explicitly states that the press release is not an offer to sell or a solicitation of an offer to buy the notes or shares, underlining the importance of adhering to securities laws and avoiding any potential misinterpretations that could lead to legal complications.

(Graphic: Rocket Lab)

Rocket Lab founder and CEO, Peter Beck, said: “Closing today’s transaction is another exciting step for Rocket Lab as we continue our growth trajectory, and upsizing the offering due to oversubscription is a strong show of confidence. This strategic move has added additional funding to the Rocket Lab balance sheet at what we view as the most attractive cost of capital available and least dilutive path for our existing shareholders. We look forward to deploying this capital efficiently and expediently towards a mix of opportunities including potential M&A and other strategic growth and scaling investments.”

Key Elements of the Transaction

-

$300.3 million $43.2 million $11.5 million -

Interest rate of

4.25% per year, payable semi-annually in arrears on February 1 and August 1 of each year, beginning August 1, 2024 -

Initial conversion rate of 195.1029 shares of common stock per

$1,000 $5.13 - The notes will not be redeemable before February 1, 2027

-

Effective conversion price of

$8.04

Use of Net Proceeds

-

Approximately

$40m - Working capital or other general corporate purposes, which may include potential acquisitions and other strategic transactions

The notes were offered only to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act. The offer and sale of the notes and any shares of common stock issuable upon conversion of the notes have not been, and will not be, registered under the Securities Act or any other securities laws, and the notes and any such shares cannot be offered or sold absent registration or except pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and any other applicable securities laws. This press release does not constitute an offer to sell, or the solicitation of an offer to buy, the notes or any shares of common stock issuable upon conversion of the notes, nor will there be any sale of the notes or any such shares, in any state or other jurisdiction in which such offer, sale or solicitation would be unlawful.

About Rocket Lab

Rocket Lab is a global leader in launch and space systems. Rocket Lab’s Electron launch vehicle is the second most frequently launched

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this press release other than statements of historical fact, including, without limitation, express or implied statements regarding our intentions with respect to the use of proceeds and outcomes from the offering of notes, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “strategy,” “future,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including but not limited to the factors, risks and uncertainties included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as such factors may be updated from time to time in our other filings with the Securities and Exchange Commission (the “SEC”), accessible on the SEC’s website at www.sec.gov, which could cause our actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240207769898/en/

Rocket Lab Investor Relations Contact:

Colin Canfield

investors@rocketlabusa.com

Rocket Lab Media Contact:

Morgan Bailey

media@rocketlabusa.com

Source: Rocket Lab USA, Inc.