Riot Purchases 31,500 Miners From MicroBT to Enhance and Expand Self-Mining Operations at Its Rockdale Facility

- None.

- None.

Insights

The acquisition of 31,500 WhatsMiner M60S miners by Riot Platforms, Inc. represents a strategic move to enhance the company's Bitcoin mining operations. The purchase, amounting to $97.4 million, is significant as it indicates Riot's focus on operational efficiency and cost-effectiveness in the cryptocurrency mining industry. By replacing underperforming miners with more efficient models, Riot is poised to improve its energy efficiency and operational uptime. This is crucial in an industry where electricity costs significantly impact profitability.

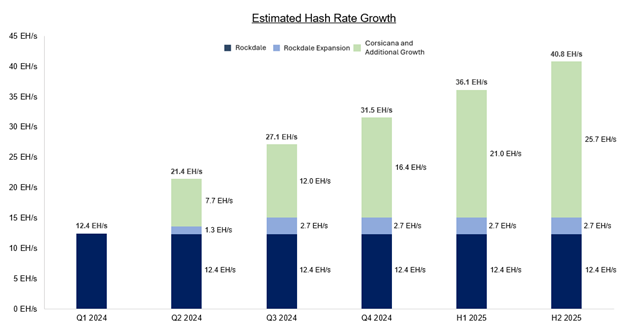

Furthermore, the increase in self-mining hash rate capacity from 12.4 EH/s to 15.1 EH/s at the Rockdale Facility, combined with growth at the new Corsicana Facility, reflects Riot's ambition to expand its mining capabilities. The new 2024 year-end hash rate target of 31 EH/s could potentially position Riot as one of the leading Bitcoin mining entities, which is an important consideration for investors tracking the company's growth trajectory.

Riot Platforms, Inc.'s investment in new mining equipment can be viewed as a capital expenditure aimed at long-term growth. The $97.4 million outlay for the miners must be scrutinized against the backdrop of Bitcoin's price volatility and the overall market conditions for cryptocurrencies. Investors should consider the potential for increased revenue against the cost of the investment and the likely depreciation of the mining equipment over time.

Given the specific cost of approximately $16.50 per terahash, it's important to assess whether this investment will lead to a reduction in the overall cost of mining per Bitcoin, which would be beneficial for Riot's profitability. Additionally, the efficiency rating of 18.5 J/TH of the new miners is an industry-specific metric indicating the energy required to compute one terahash. A lower joules per terahash ratio is desirable as it suggests a lower energy cost per Bitcoin mined, which could improve Riot's margins in an energy-intensive industry.

The strategic partnership with MicroBT and the subsequent upgrade of Riot's mining fleet with the latest M60S miners underscore the company's commitment to maintaining a competitive edge in the Bitcoin mining sector. The operational efficiency improvements, such as a lower joule per terahash (J/TH) ratio, are particularly relevant as the Bitcoin network's difficulty adjustment algorithm could make mining more challenging over time.

For stakeholders, the anticipated increase in hash rate capacity is a double-edged sword. While it positions Riot to potentially increase its Bitcoin mining rewards, it also increases the company's exposure to Bitcoin's market risks. As the cryptocurrency market is known for its volatility, the return on investment is heavily dependent on Bitcoin's price movements and the overall health of the crypto market. Observing the hash rate target of 31 EH/s in contrast to the industry's move towards more sustainable and green mining solutions, Riot's investment could be seen as a commitment to industry leadership, provided that it aligns with environmental considerations.

Riot strengthens its self-mining operations by purchasing 31,500 WhatsMiner M60S miners from MicroBT. This strategic investment replaces underperforming machines, boosts mining efficiency, and adds additional hash rate capacity at the Rockdale Facility

- Order is for 31,500 MicroBT miners with a combined total of 5.9 EH/s purchased for

$97.4 million , equating to approximately$16.50 /TH - Approximately 14,500 miners in this order will add to self-mining capacity, the remaining 17,000 will replace currently under-performing miners at Riot’s Rockdale Facility

- All miners will be deployed at the Rockdale Facility, increasing the Company’s hash rate capacity at this facility to 15.1 EH/s by the end of July 2024

- In combination with hash rate growth at the new Corsicana Facility, Riot’s new 2024 year-end hash rate target is 31 EH/s

CASTLE ROCK, Colo., Feb. 27, 2024 (GLOBE NEWSWIRE) -- Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an industry leader in vertically integrated Bitcoin (“BTC”) mining, announced today that it has entered into a new purchase agreement (the “Agreement”) with Shenzhen MicroBT Electronics Technology Co., LTD, through its manufacturing subsidiaries, (“MicroBT”) a prominent manufacturer of Bitcoin miners. Under the Agreement, Riot has purchased 31,500 next-generation M60S miners from MicroBT for a total consideration of

Miner deliveries are scheduled to occur in May 2024 and June 2024. Once the 31,500 miners are deployed, Riot's Rockdale Facility's self-mining hash rate capacity will increase from 12.4 EH/s to 15.1 EH/s by the end of July 2024.

The M60S miners purchased are MicroBT’s latest generation air-cooled machines featuring an efficiency rating of 18.5 J/TH and produce approximately 186 TH/s per machine.

“We are excited to announce this new order of latest-generation M60S miners from MicroBT, which has the dual purpose of both increasing our deployed hash rate and improving our operational efficiency,” said Jason Les, CEO of Riot. “Through our team’s constant focus on improving operations at our Rockdale Facility, we have identified currently deployed under-performing machines best suited for replacement. Replacing these under-performing miners with the new M60S model will have a positive effect on both our operating uptime and energy efficiency, as these are the most efficient miners ever produced by MicroBT. The investment made in this purchase order strengthens our commitment to be a leading low-cost miner and further enhances our industry leading fleet into the future."

"The MicroBT team is excited to continue growing our partnership with Riot with this new order of miners for its Rockdale Facility,” said Jordan Chen, COO of MicroBT. “This is yet another milestone in Riot's ambitious journey to build a 100+ EH/s mining fleet in the coming years. MicroBT is honored to have been chosen as a strategic partner by Riot for this remarkable undertaking and will provide its unwavering support."

About MicroBT (www.microbt.com)

MicroBT is a technology company based on blockchain, focusing on the R&D, production and sales of integrated circuit chips and products, and provides high performance computing system solutions and technical service. MicroBT has recently commenced its United States-based manufacturing operations of Bitcoin mining hardware.

About WhatsMiner (www.whatsminer.com)

is a leading brand of mining hardware and chip design developed by MicroBT. As one of the most efficient and cost-effective mining brands on the market, WhatsMiner is widely used in retail and institutional mining by customers around the world.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading Bitcoin-driven infrastructure platform. Our mission is to positively impact the sectors, networks, and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has data center hosting operations in central Texas, Bitcoin mining operations in central Texas, and electrical switchgear engineering and fabrication operations in Denver, Colorado.

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts are forward-looking statements that reflect management’s current expectations, assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the benefits of acquisitions, including financial and operating results, and the Company’s plans, objectives, expectations, and intentions. Among the risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements include, but are not limited to: unaudited estimates of Bitcoin production; our future hash rate growth (EH/s); the anticipated benefits, construction schedule, and costs associated with the Corsicana site expansion; our expected schedule of new miner deliveries; the impact of weather events on our operations and results; our ability to successfully deploy new miners; the variance in our mining pool rewards may negatively impact our results of Bitcoin production; megawatt (“MW”) capacity under development; we may not be able to realize the anticipated benefits from immersion-cooling; the integration of acquired businesses may not be successful, or such integration may take longer or be more difficult, time-consuming or costly to accomplish than anticipated; failure to otherwise realize anticipated efficiencies and strategic and financial benefits from our acquisitions; and the impact of COVID-19 on us, our customers, or on our suppliers in connection with our estimated timelines. Detailed information regarding the factors identified by the Company’s management which they believe may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this press release may be found in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the risks, uncertainties and other factors discussed under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as amended, and the other filings the Company makes with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements included in this press release are made only as of the date of this press release, and the Company disclaims any intention or obligation to update or revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter becomes aware, except as required by law. Persons reading this press release are cautioned not to place undue reliance on such forward-looking statements.

Investor Contact:

Phil McPherson

303-794-2000 ext. 110

IR@Riot.Inc

Media Contact:

Alexis Brock

303-794-2000 ext. 118

PR@Riot.Inc

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b0332537-8408-4567-b692-3066a7b06681