Riot Announces July 2024 Production and Operations Updates

Riot Platforms, Inc. (NASDAQ: RIOT) announced its July 2024 production and operations updates. Key highlights include:

- Produced 370 Bitcoin, a 45% increase from June

- Expanded operations into Kentucky through acquisition of Block Mining

- Increased total deployed hash rate to 23.3 EH/s, up 6% month-over-month and 118% year-over-year

- Raised 2024 deployed hash rate guidance from 31 EH/s to 36 EH/s

- Anticipates reaching 56 EH/s total self-mining capacity by 2025

The company continues to develop its Corsicana Facility and participates in ERCOT's Four Coincident Peak Program for power management.

Riot Platforms, Inc. (NASDAQ: RIOT) ha annunciato gli aggiornamenti sulla produzione e le operazioni per il luglio 2024. I punti salienti includono:

- Produzione di 370 Bitcoin, un aumento del 45% rispetto a giugno

- Espansione delle operazioni in Kentucky attraverso l'acquisizione di Block Mining

- Aumento del hash rate totale a 23,3 EH/s, +6% mese su mese e +118% anno su anno

- Aumento della previsione del hash rate per il 2024 da 31 EH/s a 36 EH/s

- Previsione di raggiungere una capacità totale di auto-mining di 56 EH/s entro il 2025

L'azienda continua a sviluppare il proprio impianto di Corsicana e partecipa al programma Four Coincident Peak di ERCOT per la gestione dell'energia.

Riot Platforms, Inc. (NASDAQ: RIOT) anunció sus actualizaciones de producción y operaciones de julio de 2024. Los aspectos destacados incluyen:

- Producción de 370 Bitcoin, un aumento del 45% en comparación con junio

- Expansión de operaciones en Kentucky mediante la adquisición de Block Mining

- Aumento del hash rate total a 23.3 EH/s, un 6% más mes a mes y un 118% más año sobre año

- Aumento de la guía de hash rate desplegado para 2024 de 31 EH/s a 36 EH/s

- Se anticipa alcanzar una capacidad total de auto-minería de 56 EH/s para 2025

La empresa continúa desarrollando su instalación de Corsicana y participa en el Programa de Cuatro Picos Coincidentes de ERCOT para la gestión de energía.

Riot Platforms, Inc. (NASDAQ: RIOT)는 2024년 7월 생산 및 운영 업데이트를 발표했습니다. 주요 내용은 다음과 같습니다:

- 370 비트코인을 생산하였으며, 이는 6월 대비 45% 증가한 수치입니다.

- Block Mining의 인수를 통해 켄터키에서 운영을 확대했습니다.

- 전체 해시레이트를 23.3 EH/s로 증가시켰으며, 이는 월 대비 6%, 연 대비 118% 증가한 수치입니다.

- 2024년 해시레이트 가이드를 31 EH/s에서 36 EH/s로 상향 조정했습니다.

- 2025년까지 56 EH/s의 자가 채굴 총 용량에 도달할 것으로 예상하고 있습니다.

회사는 Corsicana 시설을 계속 개발하고 있으며, 전력 관리를 위해 ERCOT의 네 번의 동시 최대 프로그램에 참여하고 있습니다.

Riot Platforms, Inc. (NASDAQ: RIOT) a annoncé ses mises à jour de production et d'exploitation pour juillet 2024. Les points clés incluent :

- Production de 370 Bitcoin, soit une augmentation de 45 % par rapport à juin

- Extension des opérations au Kentucky grâce à l'acquisition de Block Mining

- Augmentation du taux de hash total à 23,3 EH/s, en hausse de 6 % par rapport au mois précédent et de 118 % par rapport à l'année précédente

- Augmentation des prévisions du taux de hash déployé pour 2024 de 31 EH/s à 36 EH/s

- Prévision d'atteindre une capacité totale d'auto-extraction de 56 EH/s d'ici 2025

L'entreprise continue de développer son usine de Corsicana et participe au programme Four Coincident Peak d'ERCOT pour la gestion de l'énergie.

Riot Platforms, Inc. (NASDAQ: RIOT) hat seine Produktions- und Betriebsaktualisierungen für Juli 2024 bekannt gegeben. Zu den wichtigsten Punkten gehören:

- Produktion von 370 Bitcoin, was einen Anstieg von 45 % im Vergleich zum Juni darstellt

- Erweiterung der Betriebe nach Kentucky durch die Übernahme von Block Mining

- Erhöhung der gesamt eingesetzten Hashrate auf 23,3 EH/s, was einen Anstieg von 6 % im Monatsvergleich und 118 % im Jahresvergleich bedeutet

- Erhöhung der Prognose für die eingesetzte Hashrate für 2024 von 31 EH/s auf 36 EH/s

- Erwartung, bis 2025 eine Gesamt-Selbst-Mining-Kapazität von 56 EH/s zu erreichen

Das Unternehmen entwickelt weiterhin sein Corsicana-Werk und beteiligt sich am Four Coincident Peak-Programm von ERCOT zur Energiemanagement.

- 45% increase in Bitcoin production from June to July (370 BTC)

- 6% increase in total deployed hash rate to 23.3 EH/s

- Acquisition of Block Mining, adding 1 EH/s and expanding into Kentucky

- Raised 2024 deployed hash rate guidance to 36 EH/s

- Anticipates reaching 56 EH/s total self-mining capacity by 2025

- 10% decrease in Bitcoin production compared to July 2023

- 35% decrease in total power credits from $5.2 million in June to $3.4 million in July

- 33% increase in all-in power cost from 2.6c/kWh in June to 3.4c/kWh in July

Insights

Riot's July 2024 update reveals mixed results. The company's Bitcoin production increased by

Financially, Riot's decision to hold all produced Bitcoin this month, compared to selling 400 BTC in July 2023, suggests confidence in future price appreciation. The company's Bitcoin holdings increased by

Riot's aggressive expansion plans, aiming for 36 EH/s by end of 2024 and 56 EH/s by 2025, indicate strong growth potential but also increased capital expenditure requirements. Investors should monitor the company's ability to finance this growth and manage rising operational costs.

Riot's power strategy as a flexible consumer is noteworthy. By participating in ERCOT's Four Coincident Peak Program, Riot can potentially achieve significant cost savings. However, the

The company's expansion into Kentucky diversifies its energy market exposure beyond Texas. This could provide geographical hedging against regional power issues. However, the all-in power cost in Kentucky (3.6c/kWh) is higher than Riot's Texas operations, which may impact profitability in this new market.

The rising power costs across all operations are a red flag. With total all-in power costs increasing by

Riot's technological advancements are impressive. The company has more than doubled its deployed hash rate year-over-year, reaching 23.3 EH/s. The Corsicana Facility's immersion cooling systems and MicroBT miners are showing strong performance, which bodes well for future efficiency gains.

The acquisition of Block Mining not only adds immediate hash rate but also brings new technological expertise in vertically-integrated mining operations. This could lead to synergies and improved operational efficiencies across Riot's portfolio.

However, the gap between deployed and average operating hash rates remains significant. In July, the average operating hash rate was only 15.5 EH/s out of 23.3 EH/s deployed. Improving this utilization rate will be important for maximizing returns on Riot's substantial infrastructure investments. The company's ability to scale operations effectively while maintaining technological edge will be key to its competitive position in the rapidly evolving Bitcoin mining landscape.

Riot Produces 370 Bitcoin in July 2024 and Expands into

Riot Platforms, Inc. (NASDAQ: RIOT) ("Riot" or "the Company"), an industry leader in vertically integrated Bitcoin ("BTC") mining, announces unaudited production and operations updates for July 2024.

Bitcoin Production and Operations Updates for July 2024 | |||||||||

Comparison (%) | |||||||||

Metric | July 2024 1 | June 2024 1 | July 2023 | Month/Month | Year/Year | ||||

Bitcoin Produced | 370 | 255 | 410 | 45 % | -10 % | ||||

Average Bitcoin Produced per Day | 11.9 | 8.5 | 13.2 | 40 % | -10 % | ||||

Bitcoin Held 2 | 9,704 | 9,334 | 7,275 | 4 % | 33 % | ||||

Bitcoin Sold | - | - | 400 | N/A | N/A | ||||

Bitcoin Sales - Net Proceeds | - | - | N/A | N/A | |||||

Average Net Price per Bitcoin Sold | N/A | N/A | N/A | N/A | |||||

Deployed Hash Rate - | 14.7 EH/s | 14.7 EH/s | 10.7 EH/s | 0 % | 37 % | ||||

Deployed Hash Rate - | 7.6 EH/s | 7.3 EH/s | - | 4 % | N/A | ||||

Deployed Hash Rate - | 1.0 EH/s | N/A | N/A | N/A | N/A | ||||

Deployed Hash Rate - Total 2 | 23.3 EH/s | 22.0 EH/s | 10.7 EH/s | 6 % | 118 % | ||||

Avg. Operating Hash Rate - | 9.6 EH/s | 7.7 EH/s | 5.4 EH/s | 24 % | 78 % | ||||

Avg. Operating Hash Rate - | 5.7 EH/s | 3.6 EH/s | - | 57 % | N/A | ||||

Avg. Operating Hash Rate - | 0.9 EH/s | N/A | N/A | N/A | N/A | ||||

Avg. Operating Hash Rate - Total 4 | 15.5 EH/s | 11.4 EH/s | 5.4 EH/s | 37 % | 188 % | ||||

Power Credits 6 | -32 % | -47 % | |||||||

Demand Response Credits 7 | -59 % | -89 % | |||||||

Total Power Credits | -35 % | -57 % | |||||||

All-in Power Cost - | 3.0c/kWh | 2.4c/kWh | 1.6c/kWh | 26 % | 79 % | ||||

All-in Power Cost - | 3.9c/kWh | 3.7c/kWh | N/A | 5 % | N/A | ||||

All-in Power Cost - | 3.6c/kWh | N/A | N/A | N/A | N/A | ||||

All-in Power Cost - Total 8 | 3.4c/kWh | 2.6c/kWh | 1.6c/kWh | 33 % | 109 % | ||||

1. | Unaudited, estimated. | ||||||||

2. | As of month-end. | ||||||||

3. | Includes self-mining capacity hosted outside of | ||||||||

4. | Average over the month. | ||||||||

5. | Average from July 24 to 31, where Riot held | ||||||||

6. | Estimated power curtailment credits. | ||||||||

7. | Estimated credits received from participation in ERCOT and MISO demand response programs. | ||||||||

8. | Estimated. Inclusive of all transmission and distribution charges, fees, adders, and taxes. Net of Total Power Credits. | ||||||||

9. | All-in power cost from July 24 to 31, for | ||||||||

"July was a major step forward for Riot, as we increased our Bitcoin production

"During July, Riot also announced the acquisition of Block Mining, a vertically-integrated private miner operating in

Riot's Power Strategy Overview

Riot's power strategy is based on being a flexible consumer of power. The Company typically consumes power when it is low-cost and abundant, as opposed to residential consumers, who typically increase power usage during peak periods of demand. When demand increases and/or supply decreases, causing prices to rise, the Company can either power down to reduce power costs, or bid competitively to provide the grid operator with visibility into, and control over, Riot's power utilization. This control gives the grid operator the ability to either absorb excess power when supply is high or to curtail Riot's operations in order to reduce demand when beneficial to the grid, and ultimately, to all consumers.

During July, Riot continued its participation in ERCOT's Four Coincident Peak Program ("4CP"). The 4CP program is an opportunity for users of power to curtail usage during periods of highest demand on the grid in each of the four summer months of the year. Riot curtailed operations in July during peak periods of demand within ERCOT and will continue to do so throughout the summer. These periods of curtailment occur whenever total demand on the grid could reach its peak point for each month and does not depend on the current price for power, which fluctuates due to a variety of factors and may be lower or higher than anticipated. As part of Riot's participation in this voluntary program, the Company can achieve substantial savings on future costs, and participation is a key part of the Company's partnership-driven approach with the grid and all consumers of power in ERCOT.

Infrastructure Update

Riot is currently developing Phase 1 of the Company's second large-scale facility, the Corsicana Facility, which is expected to total 400 megawatts ("MW") of developed mining capacity upon completion of this initial phase. Once fully developed, the Corsicana Facility is expected to total 1 gigawatt (1,000 MWs) in total developed mining capacity.

Buildings A1 and A2 are fully energized and operational, while deployment and energization continues in Building B1. Building B2 is currently under construction and miner deployment is expected to begin in September.

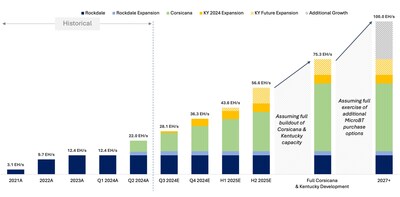

Estimated Hash Rate Growth

Riot anticipates achieving a total self-mining hash rate capacity of 36 EH/s by the end of 2024.

On April 18th, Riot announced the successful energization of the Corsicana Facility substation. The Corsicana Facility will have a total capacity of 1 GW when fully developed, at which point it is expected to be the largest known Bitcoin mining facility in the world by developed capacity. The recently energized substation will power the initial 400 MW phase of development of the Corsicana Facility. This initial phase is expected to add 16 EH/s to Riot's self-mining capacity by the end of 2024.

On July 23rd, Riot announced the acquisition of Block Mining. The transaction immediately increases Riot's hash rate by 1 EH/s and establishes an additional arm of growth for Riot in new jurisdictions and energy markets, starting in

Following the Block Mining acquisition, Riot raised its 2024 deployed hash rate guidance from 31 EH/s to 36 EH/s, and upon full deployment in 2025, Riot now anticipates a total self-mining hash rate capacity of 56 EH/s.

Human Resources Update

Riot is currently recruiting for positions across the Company. Join our team in building, expanding, and securing the Bitcoin network.

Open positions are available at: https://www.riotplatforms.com/careers.

About Riot Platforms, Inc.

Riot's (NASDAQ: RIOT) vision is to be the world's leading Bitcoin-driven infrastructure platform. Our mission is to positively impact the sectors, networks, and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has Bitcoin mining operations in central

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts are forward-looking statements that reflect management's current expectations, assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as "anticipates," "believes," "plans," "expects," "intends," "will," "potential," "hope," and similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the benefits of acquisitions, including financial and operating results, and the Company's plans, objectives, expectations, and intentions. Among the risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements include, but are not limited to: unaudited estimates of Bitcoin production; our future hash rate growth (EH/s); the anticipated benefits, construction schedule, and costs associated with the

Investor Contact:

Phil McPherson

303-794-2000 ext. 110

IR@Riot.Inc

Media Contact:

Alexis Brock

303-794-2000 ext. 118

PR@Riot.Inc

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/riot-announces-july-2024-production-and-operations-updates-302213800.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/riot-announces-july-2024-production-and-operations-updates-302213800.html

SOURCE Riot Platforms, Inc.