Riot Announces January 2024 Production and Operations Updates

- None.

- None.

Insights

The report of Riot Platforms, Inc. producing 520 Bitcoin in January 2024 reflects a significant month-over-month and year-over-year decrease in production, which could potentially raise concerns among investors about the company's operational efficiency and future profitability. The reduction in Bitcoin sold and the corresponding decrease in net proceeds, despite a higher average net price per Bitcoin sold, suggests a strategic shift in the company's sales approach. This shift seems to be in anticipation of the upcoming Bitcoin halving event, which historically has impacted the supply and price of Bitcoin.

The company's development of the Corsicana Facility, aiming to add substantial capacity, indicates a strategic expansion that could position Riot as a more dominant player in the Bitcoin mining industry. However, this expansion comes with significant capital expenditure risks and the uncertainty of future Bitcoin market conditions. The increase in hash rate capacity to 29 EH/s by the end of 2024 and 38 EH/s upon full deployment in 2025 indicates a clear growth trajectory, but it also intensifies the need for operational excellence to manage the increased complexity and scale.

Riot Platforms' announcement of increased Power and Demand Response Credits, amounting to $3.3 million, highlights an effective power management strategy that contributes to the company's revenue streams. This strategy not only offsets some of the costs associated with Bitcoin mining but also provides a competitive edge in terms of operational sustainability and cost management. Investors should consider the impact of such credits on the company's overall financial health and how it might cushion the effects of market volatility.

The anticipated halving event could lead to increased market volatility, potentially affecting Riot's stock price and the broader cryptocurrency market. Investors should closely monitor the company's liquidity position and its ability to navigate through the halving event without compromising its growth strategy. The company's decision to retain a greater proportion of its monthly Bitcoin production could be seen as a bullish signal on the long-term value of Bitcoin, but it also exposes the company to higher market risk should Bitcoin prices decline.

Riot's focus on energy efficiency and cost-effective mining operations through its unique power strategy is particularly relevant given the energy-intensive nature of Bitcoin mining. Their ability to generate additional revenue through Power and Demand Response Credits during periods of high energy demand, especially in the context of Texas' energy market and ERCOT's demand response programs, showcases an innovative approach to managing operational costs and contributing to grid stability.

As the company expands its operations with the new Corsicana Facility, the energy requirements and the potential impact on local energy grids become increasingly important. The energy sector's response to such large-scale mining operations and the potential regulatory changes that could arise as a result, are critical factors that could influence Riot's operational costs and sustainability efforts in the long term.

Riot Produces 520 Bitcoin in January 2024 and Updates Bitcoin Sales Strategy

CASTLE ROCK, Colo., Feb. 05, 2024 (GLOBE NEWSWIRE) -- Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an industry leader in vertically integrated Bitcoin (“BTC”) mining, announces unaudited production and operations updates for January 2024.

Bitcoin Production and Operations Updates for January 2024

| Comparison (%) | ||||||||

| Metric | January 2024 | December 2023 | January 2023 | Month/Month | Year/Year | |||

| Bitcoin Produced | 520 | 619 | 740 | - | - | |||

| Average Bitcoin Produced per Day | 16.8 | 20.0 | 23.9 | - | - | |||

| Bitcoin Held1 | 7,648 | 7,362 | 6,978 | 4% | 10% | |||

| Bitcoin Sold | 212 | 590 | 700 | - | - | |||

| Bitcoin Sales - Net Proceeds | - | - | ||||||

| Average Net Price per Bitcoin Sold | 5% | 129% | ||||||

| Deployed Hash Rate1 | 12.4 EH/s | 12.4 EH/s | 9.3 EH/s | - | 33% | |||

| Deployed Miners1 | 112,944 | 112,944 | 82,656 | - | 37% | |||

| Power Credits2 | n/a | 435% | ||||||

| Demand Response Credits3 | 98% | 116% | ||||||

1. As of month-end. 2. Power curtailment credits. 3. Credits received from participation in ERCOT demand response programs. 4. Unaudited, estimated. | ||||||||

“Riot had a strong month in January, mining 520 Bitcoin while utilizing our unique power strategy,” said Jason Les, CEO of Riot. “Texas experienced extreme cold during the month, which led to increased demand for power. During periods of high demand, Riot’s power curtailment efforts helped to stabilize the grid and generated

“As we approach the halving, which is expected to occur in April 2024, Riot also intends to leverage our ability to obtain Bitcoin at a significant discount to its current market price by retaining a greater proportion of our monthly Bitcoin production in the near term. This is made possible by our strong liquidity profile, and will further cement our position as one of the largest holders of Bitcoin.”

Infrastructure Update

Riot is currently developing Phase 1 of the Company’s second large-scale facility, the Corsicana Facility, which will add an additional 400 megawatts (“MW”) of capacity upon completion of this initial phase. Once fully developed, the Corsicana Facility will have up to 1 gigawatt in total capacity.

The 400 MW substation is expected to be energized by the end of March 2024, and the first 100 MW building, A1, will commence operations immediately thereafter. The additional buildings comprising the 400 MW Phase 1 buildout of the Corsicana Facility will be energized, and hashing will commence, in stages over the course of 2024.

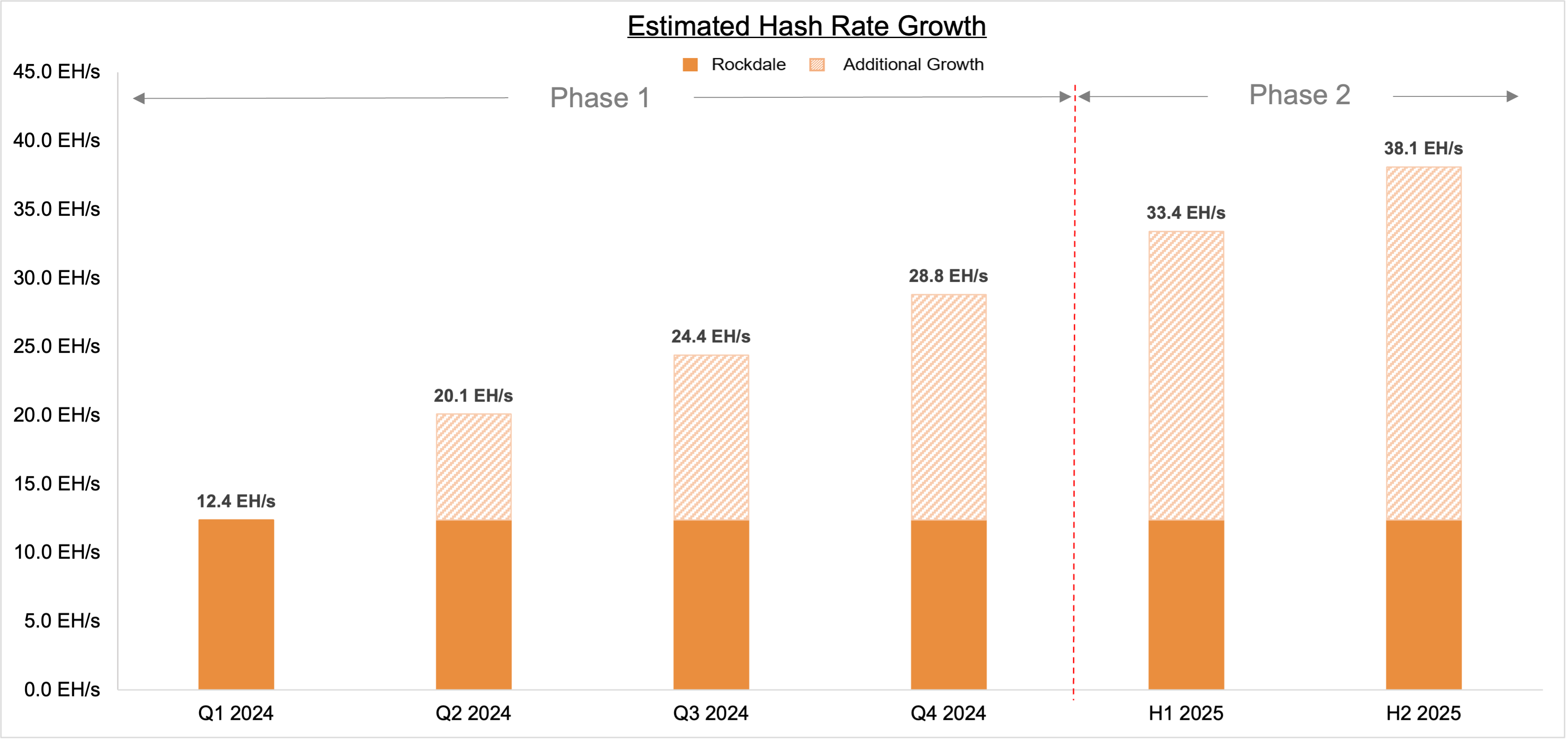

Estimated Hash Rate Growth

Riot anticipates achieving a total self-mining hash rate capacity of 29 EH/s by the end of 2024.

In June 2023, Riot entered into a long-term purchase agreement with MicroBT, which included an initial order of 33,280 Bitcoin miners for the Corsicana Facility. Effective December 1, 2023, Riot executed a second order under the MicroBT long-term purchase agreement for an additional 66,560 Bitcoin miners, primarily for the Corsicana Facility.

Collectively, the two purchase orders will add 26 EH/s to Riot’s self-mining capacity. Deployment of these miners is expected to begin in Q1 2024 and to be completed by the second half of 2025.

Upon full deployment in 2025, Riot anticipates a total self-mining hash rate capacity of 38 EH/s.

Human Resources Update

Riot is currently recruiting for positions across the Company. Join our team in building, expanding, and securing the Bitcoin network.

Open positions are available at: https://www.riotplatforms.com/careers.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading Bitcoin-driven infrastructure platform. Our mission is to positively impact the sectors, networks, and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has data center hosting operations in central Texas, Bitcoin mining operations in central Texas, and electrical switchgear engineering and fabrication operations in Denver, Colorado.

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts are forward-looking statements that reflect management’s current expectations, assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the benefits of acquisitions, including financial and operating results, and the Company’s plans, objectives, expectations, and intentions. Among the risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements include, but are not limited to: unaudited estimates of Bitcoin production; our future hash rate growth (EH/s); the anticipated benefits, construction schedule, and costs associated with the Corsicana site expansion; our expected schedule of new miner deliveries; the impact of weather events on our operations and results; our ability to successfully deploy new miners; the variance in our mining pool rewards may negatively impact our results of Bitcoin production; megawatt (“MW”) capacity under development; we may not be able to realize the anticipated benefits from immersion-cooling; the integration of acquired businesses may not be successful, or such integration may take longer or be more difficult, time-consuming or costly to accomplish than anticipated; failure to otherwise realize anticipated efficiencies and strategic and financial benefits from our acquisitions; and the impact of COVID-19 on us, our customers, or on our suppliers in connection with our estimated timelines. Detailed information regarding the factors identified by the Company’s management which they believe may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this press release may be found in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the risks, uncertainties and other factors discussed under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as amended, and the other filings the Company makes with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements included in this press release are made only as of the date of this press release, and the Company disclaims any intention or obligation to update or revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter becomes aware, except as required by law. Persons reading this press release are cautioned not to place undue reliance on such forward-looking statements.

Investor Contact:

Phil McPherson

303-794-2000 ext. 110

IR@Riot.Inc

Media Contact:

Alexis Brock

303-794-2000 ext. 118

PR@Riot.Inc

Images accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/366f925d-b061-4bba-af32-482daa1e6ff2

https://www.globenewswire.com/NewsRoom/AttachmentNg/64c72944-4cf9-4361-8d18-853dcf0ac990