RF Industries Reports 38% Sequential Sales Growth in Third Quarter of Fiscal 2021; Expects Sequential Revenue Growth in Fourth Quarter

RF Industries, Ltd. (NASDAQ:RFIL) reported strong financial results for Q3 of fiscal 2021, ending July 31, 2021, with net sales rising 38% sequentially and 60% year-over-year, reaching $15.3 million. The company achieved a backlog of $31.5 million, with operating income of $1.2 million, influenced by $800,000 in Employee Retention Tax Credits. Net income stood at $926,000 or $0.09 per diluted share. Looking ahead, the company anticipates further revenue growth in Q4.

- Net sales increased 38% sequentially and 60% year-over-year to $15.3 million.

- Backlog at quarter-end reached $31.5 million, indicating strong demand.

- Gross profit margin improved to 33%, up from 27% in the previous quarter.

- Operating income was $1.2 million, showing positive operating performance.

- Company expects Q4 sales to exceed Q3, driven by strong momentum.

- Backlog decreased to $27.2 million since quarter-end, which could suggest future revenue challenges.

SAN DIEGO, CA / ACCESSWIRE / September 13, 2021 / RF Industries, Ltd, (NASDAQ:RFIL), a national manufacturer and marketer of interconnect products and systems, today announced its financial results for the third quarter of fiscal 2021 ended July 31, 2021. As noted below, these financial results include the impact of

Third Quarter Fiscal 2021 Highlights and Operating Results:

- Net sales increased

38% sequentially and60% year over year to$15.3 million . - Backlog of

$31.5 million at July 31, 2021 on third quarter bookings of$31.2 million . As of today, backlog stands at$27.2 million . - Gross profit margin was

33% , which includes the impact of the ERC received during the quarter. Excluding the impact of ERC, gross profit margin was28% , up from27% in the preceding second quarter. - Operating income was

$1.2 million , which includes the impact of ERC. Excluding the impact of ERC, operating income was$393,000. - Net income was

$926,000 , or$0.09 per diluted share, which includes the impact of ERC. - Non-GAAP net income was

$1.3 million , or$0.13 per diluted share, which includes the impact of ERC. - Adjusted EBITDA was

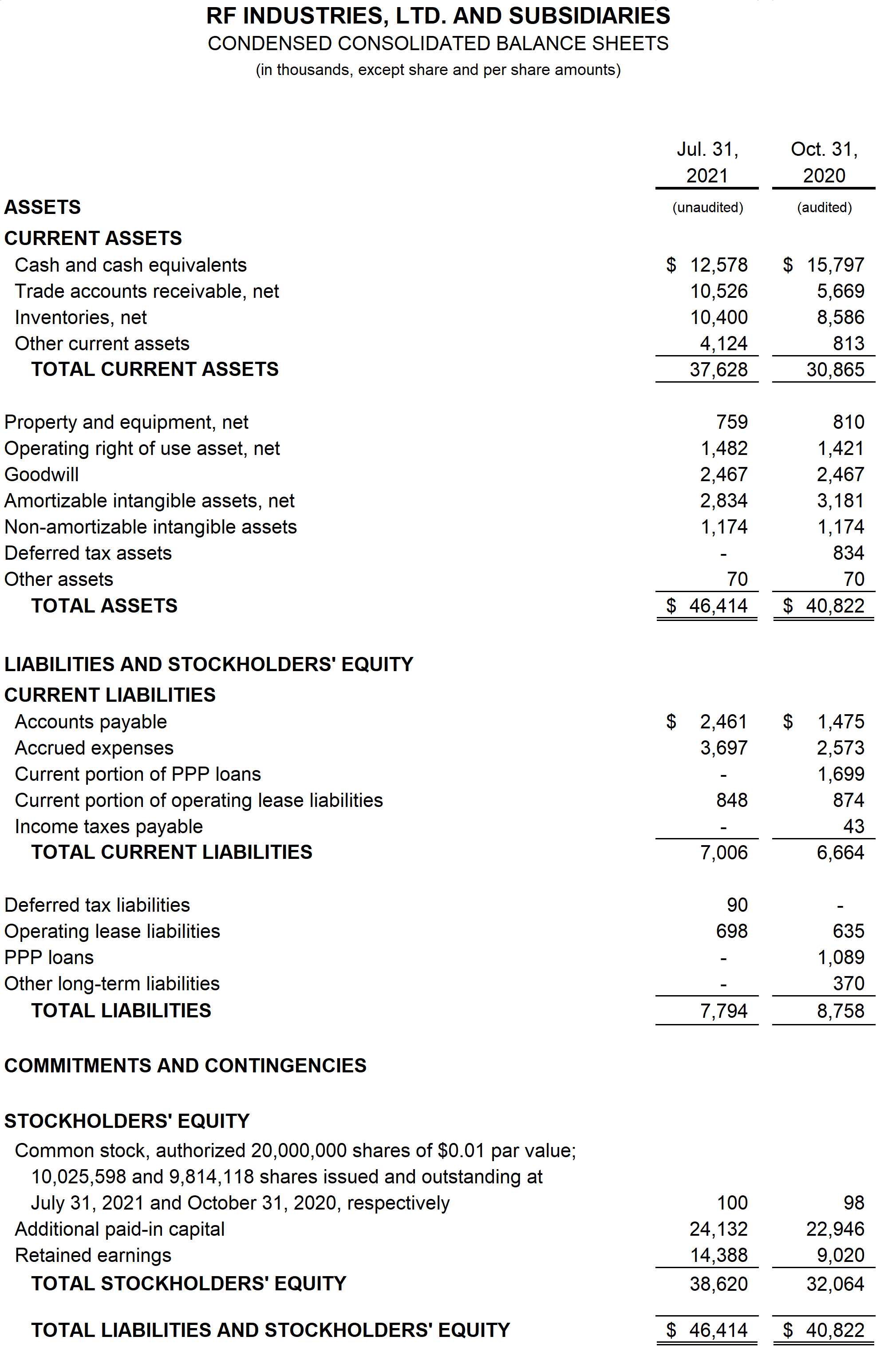

$1.0 million , which excludes the impact of the ERC. - Cash and cash equivalents were

$12.6 million .

Robert Dawson, President and CEO of RF Industries, commented:

"We are pleased to report strong sequential and year-over-year revenue growth for the third quarter, and the highest backlog in company history of

Conference Call and Webcast

RF Industries will host a conference call and live webcast today at 1:30 p.m. Pacific Time (4:30 p.m. ET) to discuss its third quarter fiscal 2021. To access the conference call, dial 844-407-9500 (US and Canada) or 862-298-0850 (International) and ask for the RF Industries third quarter call. In addition, a live and archived webcast of the conference call will be accessible on the investor relations section of the Company's website at www.rfindustries.com. A phone replay of the conference call will also be available beginning approximately two hours after conclusion of the call and will remain available for two weeks. To access the phone replay, dial 877-481-4010 (US and Canada) or 919-882-2331(International). The replay conference ID is 42581.

About RF Industries

RF Industries designs and manufactures a broad range of interconnect products across diversified, growing markets including wireless/wireline telecom, data communications and industrial. The Company's products include RF connectors, coaxial cables, data cables, wire harnesses, fiber optic cables, custom cabling, energy-efficient cooling systems and integrated small cell enclosures. The Company is headquartered in San Diego, California with additional operations in Long Island, New York, Vista, California, Milford, Connecticut and North Kingstown, Rhode Island. Please visit the RF Industries website at www.rfindustries.com.

Forward-Looking Statements

This press release contains forward-looking statements with respect to future events, including the return of delayed project-based business and the Company's long-term growth, which are subject to a number of factors that could cause actual results to differ materially. Factors that could cause or contribute to such differences include, but are not limited to: the duration and continuing impact of the coronavirus pandemic on the U.S. economy and the Company's customers; changes in the telecommunications industry; the Company's reliance on certain distributors and customers for a significant portion of anticipated revenues; the impact of existing and additional future tariffs imposed by U.S and foreign nations; the Company's ability to execute on its new go-to-market strategies and channel models; its ability to expand its OEM relationships; its ability to continue to deliver newly designed and custom fiber optic and cabling products to principal customers; its ability to maintain strong margins and diversify its customer base; and its ability to address the changing needs of the market. Further discussion of these and other potential risk factors may be found in the Company's public filings with the Securities and Exchange Commission (www.sec.gov) including its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. All forward-looking statements are based upon information available to the Company on the date they are published and the Company undertakes no obligation to publicly update or revise any forward-looking statements to reflect events or new information after the date of this release.

Note Regarding Use of Non-GAAP Financial Measures

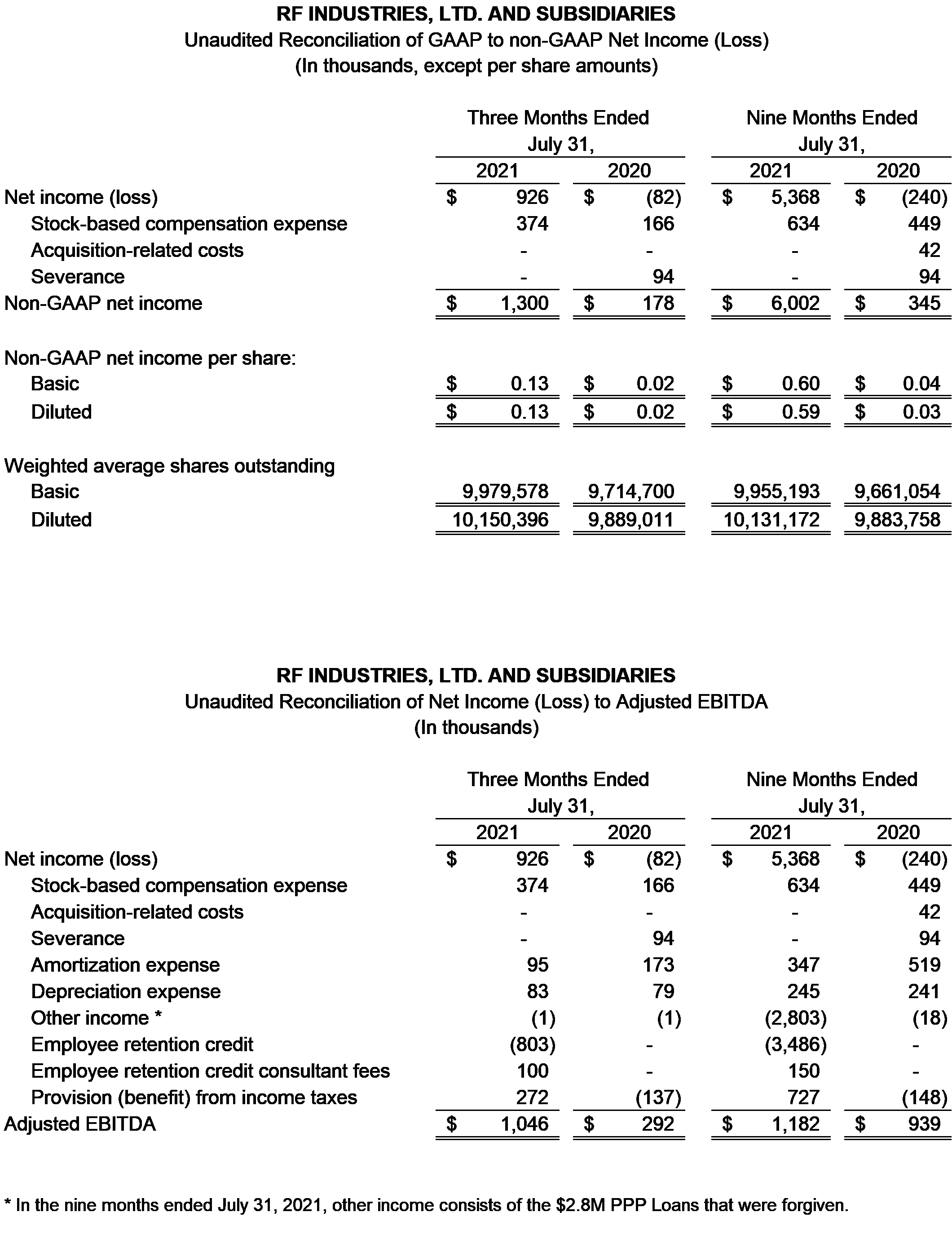

To supplement our condensed financial statements presented in accordance with U.S. generally accepted accounting principles (GAAP), this earnings release and the accompanying tables and the related earnings conference call contain certain non-GAAP financial measures, including adjusted earnings before interest, taxes, depreciation, amortization (Adjusted EBITDA), non-GAAP net income and non-GAAP earnings per diluted share (non-GAAP EPS). We believe these financial measures provide useful information to investors with which to analyze our operating trends and performance.

In computing Adjusted EBITDA, non-GAAP net income, and non-GAAP EPS, we exclude stock-based compensation expense, which represents non-cash charges for the fair value of stock options and other non-cash awards granted to employees, acquisition related costs and expenses, and severance. For Adjusted EBITDA we also exclude depreciation, amortization, and provision for income taxes. Because of varying available valuation methodologies, subjective assumptions, and the variety of equity instruments that can impact a company's non-cash operating expenses, we believe that providing non-GAAP financial measures that exclude non-cash expense and non-recurring costs and expenses allows for meaningful comparisons between our core business operating results and those of other companies, as well as providing us with an important tool for financial and operational decision-making and for evaluating our own core business operating results over different periods of time.

Our Adjusted EBITDA, non-GAAP net income, and non-GAAP EPS measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently, particularly related to non-recurring, unusual items. Our Adjusted EBITDA, non-GAAP Net income, and non-GAAP EPS are not measurements of financial performance under GAAP, and should not be considered as an alternative to operating or net income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. We do not consider these non-GAAP measures to be a substitute for, or superior to, the information provided by GAAP financial results. A reconciliation of specific adjustments to GAAP results is provided in the last two tables at the end of this press release.

Contacts:

RF Industries, Ltd.

Peter Yin

SVP/ CFO

(858) 549-6340

rfi@rfindustries.com

MKR Investor Relations

Todd Kehrli

Analyst/ Investor Contact

(213) 277-5550

rfil@mkr-group.com

SOURCE: RF Industries, Ltd.

View source version on accesswire.com:

https://www.accesswire.com/663851/RF-Industries-Reports-38-Sequential-Sales-Growth-in-Third-Quarter-of-Fiscal-2021-Expects-Sequential-Revenue-Growth-in-Fourth-Quarter

FAQ

What were RF Industries' Q3 2021 net sales?

How much did RF Industries' backlog amount to in Q3 2021?

What was the operating income for RF Industries in Q3 2021?

What is the expected sales outlook for RF Industries in Q4 2021?