Sending Payments in Real Time: Regions Bank Launches Digital Solution for Business Clients

Real-time payments broaden the efficiency and innovation of digital payment solutions.

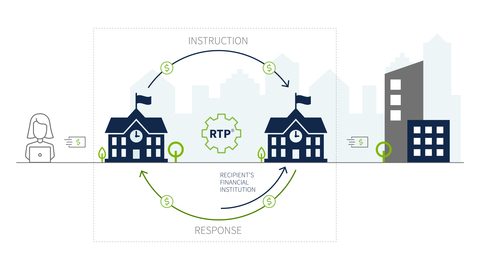

The ability to send real-time payments is one of many enhancements Regions has made over time to its Treasury Management services. (Photo: Business Wire)

“This latest enhancement is part of our commitment to providing a seamless and intuitive customer experience,” said

Currently, Treasury Management clients can receive payments in real time. Now, with the added ability to send payments in real time through Regions iTreasury®, clients can instantly process digital payments for any number of needs, ranging from payroll and insurance, to facilitating business-to-business payments, delivering broker commissions, and providing other disbursements. This brief video illustrates how the system works efficiently and effectively.

Clients access Regions iTreasury in their office or on the go through Regions OnePass®, the bank’s secure, central sign-on application. The ability to send real-time payments is one of many enhancements Regions has made over time to its Treasury Management services. Those enhancements extend beyond payments and include modernized file delivery methods, secure application programming interface (API) connections, and other emerging technologies.

Further enhancements on the horizon for Regions’ Treasury Management clients include the upcoming launch of Regions CashFlowIQSM. This new tool, scheduled to launch in 2023, is designed to improve cash flow for clients by providing seamless accounts payable, accounts receivable, invoicing, and business bill payment capabilities for small and mid-sized businesses.

“We are driven by a mindset that’s focused on continuous improvement – consistently envisioning ways we can deliver greater value through tailored services, insights, and guidance,” Ford concluded. “In many ways, our team serves as an extension of our clients’ teams by connecting businesses with options to help them maximize efficiency. Sending payments in real time is the latest example, and we look forward to delivering even more enhanced solutions in the near future.”

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20221011005096/en/

205-264-4551

Regions News Online: regions.doingmoretoday.com

Source: