Regions Bank Gives Customers More Time to Avoid Overdrafts

New Regions Overdraft Grace feature provides an extra business day for deposits to avoid overdraft charges.

Regions Overdraft Grace automatically applies as of June 15, 2023, to all Regions Consumer Banking and Private Wealth Management personal checking accounts.

Specifically, Regions Overdraft Grace gives customers until 8 p.m. Central Time the following business day if they have overdrawn their account’s available balance by more than

No enrollment is required. Regions Overdraft Grace automatically applies as of June 15, 2023, to all Regions Consumer Banking and Private Wealth Management personal checking accounts. The exception is Regions Now Checking, which is not eligible for Regions Standard Overdraft Coverage and does not carry any overdraft fees.

“Helping customers build financial wellness is a top priority for Regions Bank, and the additional breathing room offered by Regions Overdraft Grace is the latest example of our commitment and the benefit of a banking relationship with us,” said Kate Danella, head of Regions’ Consumer Banking Group. “Regions Overdraft Grace builds on the enhancements we made throughout the last two years and will make it even easier for customers to manage their accounts, cover overdrafts and avoid fees.”

Danella said research involving the bank’s own customers went into the development of Regions Overdraft Grace. The service joins customized Regions Greenprint® financial plans, no-cost Next Step financial wellness education, and the My GreenInsights digital personal financial management tool as ways the bank is helping customers optimize cash flow, safeguard against surprises and improve financial health.

In recent months, Regions has shown customers how the bank is here to help them manage the “IFs” in life. And overdrafts are a common financial “IF” that affect customers at various income levels. The Financial Health Network found that

Customers can reduce the likelihood of overdraft fees by:

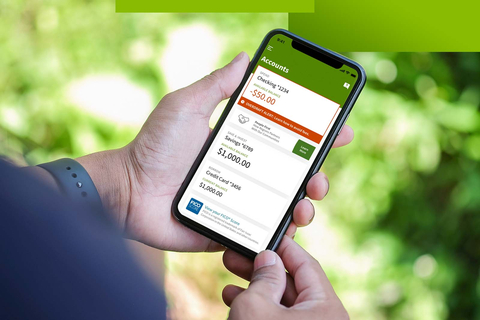

| 1.) | Checking their available checking account balance anytime using the Regions Mobile App, Online Banking, a Regions ATM or by calling 1-800-REGIONS (734-4667); and then |

|

| 2.) | Subtracting any outstanding transactions, such as checks that are not yet posted, to determine the total negative available balance that might need to be covered. |

Regions encourages customers to subscribe to Mobile and Online Banking alerts for consistently updated account information. Available overdraft alerts now include grace messages to help customers stay on track financially. Regions will send grace notifications to customers by email even if they are not enrolled in Mobile or Online Banking and currently receive emailed updates from the bank at an active email address.

For the best Overdraft Grace experience, customers should enroll in the Negative Balance and Overdraft alerts to receive messages before – and after – overdrafts so they can take action.

In addition to Regions Overdraft Grace, other customer-focused changes the bank has made over the last 18 months include:

- Eliminating overdraft protection transfer fees, which makes Regions Overdraft Protection a no-cost option customers can use to link accounts for automatic transfers to cover overdrafts, avoid fees and minimize disruptions to purchases

- Eliminating non-sufficient funds (NSF), or returned item, fees

- Further reducing the bank’s caps on overdraft fees to a maximum of three per day

- Launching Early Pay, which allows Regions customers who have direct deposit linked to a Regions checking, savings or money market account – or a Regions Now Card® – to receive qualifying payroll and government direct deposits up to two days early

-

Launching the digital, invitation-only Regions Protection Line of Credit, which provides

$50 $500

1 Deposits and transfers are subject to applicable account, product and service terms and conditions, funds availability policies, cutoff times, and the terms of Regions Overdraft Grace. Fees may apply to certain deposit and transfer options. |

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with

Forward-Looking Statements

This release may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objective,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results, or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made, and are subject to various known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from the views, beliefs, and projections expressed in such statements. Factors that could cause actual results to differ from those described in forward-looking statements include those risks identified in Regions’ Annual Report on Form 10-K for the year ended December 31, 2022, and our subsequent filings with the Securities and Exchange Commission. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230615350095/en/

Jeremy D. King

Regions Bank

205-264-4551

Regions News Online: regions.doingmoretoday.com

Regions News on Twitter: @Regions News

Source: Regions Financial Corporation