U.S. Consumers Continue to Shop and Switch Auto Insurance at Higher Rates, Dragging Down Carriers' Retention Rates

- None.

- None.

Insights

The report from the LexisNexis Insurance Demand Meter indicates a significant shift in consumer behavior within the U.S. auto insurance market. The observed increase in shopping and policy switching suggests a more competitive environment, where customer retention has become more challenging. Insurers' response to these market dynamics, primarily through rate adjustments and marketing strategies, particularly in the direct distribution channel, can lead to a reshuffling of market share. As such, understanding regional trends and consumer preferences becomes crucial for insurers to tailor their offerings and maintain or improve profitability.

From a market research perspective, the double-digit growth in certain states and the contrasting negative growth in others like Texas, which had previously seen positive developments, underscore the importance of localized strategy. Insurers will need to analyze these state-by-state variations to optimize their rate strategies and marketing spend. The direct distribution channel's 27% growth, in contrast to agent-based channels, highlights a consumer shift towards digital platforms for insurance shopping and may indicate a broader trend in consumer purchasing behavior.

Looking forward, insurers must balance rate competitiveness with customer acquisition costs to capitalize on the current 'hot' market conditions. The focus on profitability and potential re-underwriting of policies could lead to further increases in shopping behavior as consumers seek cost-effective options.

The 'Hot' Q4 2023 as described by the LexisNexis Insurance Demand Meter has significant implications for the financial health of auto insurers. The reported improvement in combined ratios, which measure incurred losses and expenses against earned premiums, suggests that insurers are becoming more effective at underwriting and expense management. This improvement is critical for returning to profitability, particularly given the pressures of increased claims costs and vehicle repair expenses that have previously detracted from profitability gains.

The trend of consumers switching carriers at an increasing rate could pressure insurers to offer more competitive rates, potentially affecting their underwriting margins. However, the increase in shopping and policy growth presents an opportunity for insurers to expand their customer base, provided they can do so without incurring unsustainable acquisition costs. The 9.8% year-over-year annual policy growth indicates a robust demand that, if capitalized upon effectively, could lead to market share gains and improved financial performance for the insurers that navigate this environment successfully.

Investors should monitor insurers' strategies for customer acquisition and retention, as well as their ability to manage rate increases without sacrificing market share. The state-level data provided by the report could be instrumental in predicting which insurers are better positioned to thrive in this evolving market.

The data presented by the LexisNexis Insurance Demand Meter reflects broader economic trends, such as inflationary pressures manifesting in increased vehicle repair costs and the impact of unfavorable reserve development. The auto insurance industry's response to these economic pressures, through rate increases and strategic marketing, is indicative of insurers attempting to maintain profitability in a challenging economic environment.

The increased shopping and policy switching behavior may also reflect consumer sensitivity to price changes and a willingness to seek better deals, a behavior often seen in periods of economic uncertainty or when disposable incomes are under pressure. The shift towards direct distribution channels could be associated with broader digital transformation trends and a consumer preference for convenience and immediacy in purchasing decisions.

From an economic standpoint, the insurance industry's ability to achieve rate adequacy while maintaining customer satisfaction and retention will be a delicate balance that could influence the sector's stability and growth. The potential for increased market segmentation, as suggested by the varied growth rates across different states, could lead to a more dynamic and possibly fragmented market structure in the long term.

According to the LexisNexis Insurance Demand Meter, a "Hot" Q4 2023 spelled continued rate increases, along with improved combined ratios, and now opens a window for insurers to capitalize on continued shopping as they seek a return to profitability in 2024

Key takeaways

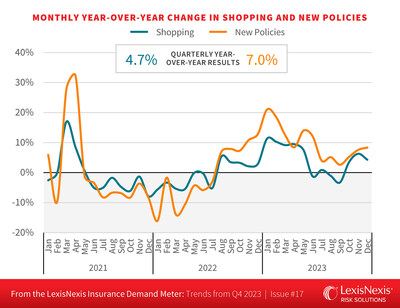

U.S. auto insurance shopping and new policies posted positive year-over-year growth and record volumes for the final quarter of the year, both registering as 'Hot' on the LexisNexis® Insurance Demand Meter.- Year-over-year shopper growth showed the strongest Q4 growth since 2020.

- Quarterly year-over-year growth for new policies outpaced shopper growth for the sixth consecutive quarter, meaning consumers continue to switch carriers at an increasing rate when they shop.

- Not resigned to higher rates,

41% of insured households shopped their auto insurance at least once in 2023. - Retention levels have dropped a staggering three percentage points since Q1 2022 as consumers hit the market

Heightened new policy and shopping activity counters traditional fourth quarter lulls.

- In an already "hot" shopping market, consumers actively shopped their auto insurance policies.

- Year-over-year shopper growth rebounded from -

1.2% in Q3 to4.7% in Q4. - Quarterly year-over-year growth for new policies rose from

3.9% to7.0%

2023 year in review.

- Overall, shopping and new business volumes exploded in the first months of the year, as rate increases impacted the market.

- Claims costs, inflated vehicle repair costs and unfavorable reserve development slowed growth by detracting from profitability gains.

- Insurers walked back new customer acquisition efforts during the summer, resulting in a short-lived dip in shopping in Q3.

- In Q4, activity bounced back, brought on by elevated rates and increased market efforts, creating prime conditions for a hot market.

- In the final quarter of the year, insurer marketing spend, particularly in the direct distribution channel, increased shopping and switching and brought the year-over-year annual policy growth to

9.8% .

"As the industry sees rates spike and expands marketing to prime consumers for increased shopping, it will be key to observe activity on a state-by-state level," said Adam Pichon, senior vice president,

Direct distribution stages a comeback with increased market activity.

As market dynamics shift, the direct distribution channel single-handedly drove Q4 growth. This sits in contrast to the previous quarter when independent agents zeroed in on consumer desires to shop policies from multiple carriers.

- Direct distribution channel growth exploded, increasing by

27% . - The direct distribution channel offset the negative growth in the agent-based channels.

Western and Midwestern regions led shopping growth in Q4.

Twelve of the 15 fastest-growing states are located in the West and Midwest regions.

- Across the

U.S. , 39 states saw positive growth; of that, 15 experienced double-digit growth. - Top-performing states for shopping growth included:

Hawaii (67% ),West Virginia (44% ),Iowa (41% ),South Dakota (29% ) andUtah (23% ). - States that saw negative growth year-over-year included

Washington D.C. (-15% ),Oklahoma andNew York (-7% ),Rhode Island (-6% ),New Hampshire (-5% ) andTexas (-4% ).

Looking ahead

With 2024 already underway, insurers have an opportunity to seize market share, particularly evident in the direct channel where factors like marketing expenditure and rate adjustments are prompting increased shopping behavior.

"With profitability top of mind in 2024, we expect to see many insurers taking a closer look at their portfolios and in some cases re-underwriting certain policies," said Pichon. "This could yield continued increases in shopping as consumers seek the most affordable policies."

Download the latest Insurance Demand Meter.

LexisNexis Insurance Demand Meter

The LexisNexis® Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data, sophisticated analytics platforms and technology solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta,

Media Contacts:

Chas Strong

LexisNexis Risk Solutions

Phone: +1.706.714.7083

Charles.Strong@lexisnexisrisk.com

Dean Carney

Brodeur Partners for LexisNexis Risk Solutions

Phone: +1.646.746.5607

Dcarney@brodeur.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/us-consumers-continue-to-shop-and-switch-auto-insurance-at-higher-rates-dragging-down-carriers-retention-rates-302067822.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/us-consumers-continue-to-shop-and-switch-auto-insurance-at-higher-rates-dragging-down-carriers-retention-rates-302067822.html

SOURCE LexisNexis Risk Solutions