U.S. Auto Insurance Shopping Shows Positive Growth in Q3 Despite August Slowdown

Rhea-AI Summary

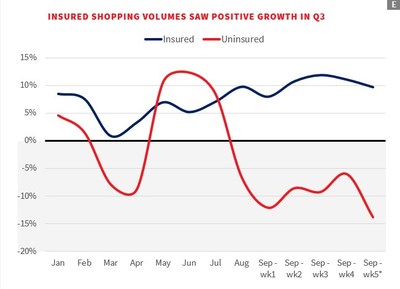

LexisNexis® Risk Solutions released its Q3 Insurance Demand Meter, indicating that U.S. auto insurance shopping volumes increased overall, despite a slowdown in August. The report attributes this dip to the expiration of CARES Act benefits and extreme weather events, including hurricanes and wildfires. Insured shopping grew by nearly 10%, while uninsured shopping decreased by 10% from mid-August through September. New business growth reached 5.7%, nearly doubling previous rates. The report suggests future market recovery tied to economic improvements and reduced unemployment.

Positive

- Insured shopping volumes increased by nearly 10% in Q3.

- New business growth rose to 5.7%, nearly twice the previous year's rate.

Negative

- Shopping volumes fell 18% after Hurricane Marco and 36% after Hurricane Laura.

- Uninsured shopping experienced a steady -10% growth from mid-August through September.

News Market Reaction

On the day this news was published, RELX declined 2.28%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

ATLANTA, Nov. 17, 2020 /PRNewswire/ -- To help carriers understand the ever-changing market and offer them benchmark insights, LexisNexis® Risk Solutions released its latest Insurance Demand Meter, reporting on Q3 U.S. auto insurance shopping activity. The Meter shows that both shopping and new business policy volumes increased overall in the third quarter, but slowed in August, likely impacted by the end of the Coronavirus Aid, Relief and Economic Security (CARES) Act benefits, significant hurricane activity, and the wildfires in the West.

Extreme weather events

Destructive hurricanes in the Gulf, including hurricanes Laura and Marco, which both made landfall in Louisiana less than a week apart, and an unusually large number of wildfires across the West seemingly significantly impacted auto insurance shopping on a regional level.

- Comparing shopping volumes against those days in 2019, shopping volumes fell

18% from last year's volumes after Hurricane Marco hit; then volumes fell off36% after Hurricane Laura's impact a few days later. - California fires appear to have caused a reduction in shopping volumes for two consecutive weeks in mid-August (-

9.2% , -8.0% , respectively) and Washington saw a drop in growth by -8.2% in late-August, correlating with the peak of fire activity within those states.

Uninsured and Insured Shopping

Insured shopping volumes saw a positive growth of nearly

"Despite a challenging Q3 for many consumers, as the economy continues to improve and unemployment levels normalize, we expect consumers to return to the auto insurance market, which will accelerate new policy growth and ultimately help to decrease uninsured motorist claim frequency," said Tanner Sheehan, associate vice president of auto insurance at LexisNexis Risk Solutions. "Extreme weather events also proved to disrupt the auto insurance market this quarter and if no improvement is shown, we could see continued negative implications for insurance carriers down the line."

Additional key insights from Q3 include:

- New policyholders, new revenue opportunities: The auto insurance shopping quarterly growth rate averaged 6.1 % in Q3, ending the quarter at

7.6% . New business growth also increased to5.7% during the quarter, which was nearly twice the growth rate of both the previous year and the 5-year quarterly average. - Trends by shopping channels: The reduction in shopping among the uninsured impacted each of the distribution channels differently. For example, direct channel volumes remained flat to negative, which tends to be most preferred by shoppers without insurance.

"Given the unprecedented impact we've seen thus far, the COVID-19 pandemic will likely continue to influence the auto insurance shopping market throughout 2020 and continue to affect market dynamics into 2021. As of now, potential stimulus and Americans eventually returning to work in-person will be the biggest drivers of results in the insurance market in the near term," Sheehan continued.

About the LexisNexis Insurance Demand Meter

The LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly

To download the latest Insurance Demand Meter, click here.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental entities reduce risk and improve decisions to benefit people around the globe. We provide data and technology solutions for a wide range of industries including insurance, financial services, healthcare and government. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information and analytics for professional and business customers across industries. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

Media Contacts:

Rocio Rivera

LexisNexis Risk Solutions

Phone: +1.678.694.2338

rocio.rivera@lexisnexisrisk.com

Mollie Holman

Brodeur Partners for LexisNexis Risk Solutions

Phone: +1.646.746.5611

mholman@brodeur.com

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/us-auto-insurance-shopping-shows-positive-growth-in-q3-despite-august-slowdown-301174143.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/us-auto-insurance-shopping-shows-positive-growth-in-q3-despite-august-slowdown-301174143.html

SOURCE LexisNexis Risk Solutions