Cirium’s 2023 Fleet Forecast Predicts Annual Passenger Aircraft Deliveries to Exceed $100 Billion in 2024

The forecast shows that between 2023-2042, 45,200 new passenger aircraft will be delivered at an estimated value of

Freight capacity is forecast to grow

Airbus and Boeing remain the two dominant commercial aircraft OEMs, between them delivering an estimated

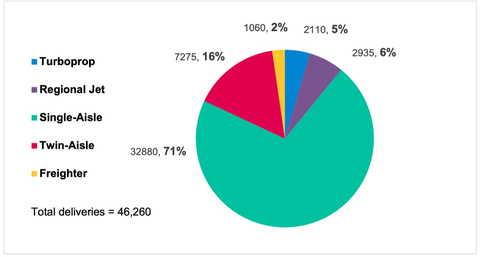

Figure 1: Forecast deliveries 2023-2042 (Graphic: Business Wire)

The forecast, which enters its eleventh year of publication, also predicts that freight capacity will grow

Airbus and Boeing will continue to dominate the commercial aircraft manufacturing space, with a combined delivery projection of

Rob Morris, Head of Consultancy, at Cirium Ascend Consultancy, said: “With global traffic almost back to 2019 levels, the increased levels of order activity in 2023 shows that the airline industry’s new growth cycle is gaining momentum. The 2023 Cirium Fleet Forecast predicts new deliveries will total

The CFF capacity modelling gives an independent view of future demand for aircraft and questions such as: are higher single-aisle production volumes justified? What will be shares between A321neo and 737-10, A350-1000 and 777-9, A350F and 777-8F? Airbus and Boeing are forecast to take almost

From a regional perspective,

North American airlines follow with

The Cirium Fleet Forecast adopts a scenario-based approach that favours examining the most up to date information available, combined with expert commentary and analysis. This year’s forecast is based on the recently adjusted version of Ascend’s 2022 Recovery Scenario 7, which is detailed in the full Fleet Forecast report.

To download the executive summary, please visit: https://www.cirium.com/solutions/cirium-fleet-forecast/ or contact Cirium to purchase the full report: https://www.cirium.com/about/contact-us/

About Cirium

Cirium is the world’s most trusted source of aviation analytics. Through powerful data and analytics, coupled with decades of industry experience, Cirium is enabling airlines, airports, travel companies, aircraft manufacturers, and financial institutions, amongst others, to make intelligent and informed decisions that improve operations, grow revenues, and enhance customer experiences.

Cirium is part of RELX, a global provider of information-based analytics and decision tools for professional and business customers. The shares of RELX PLC are traded on the

For further information please follow Cirium updates on LinkedIn or visit www.cirium.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240111094841/en/

Source: Cirium