Dr. Reddy’s Q4 & FY23 Financial Results

- Q4 revenue up 16% YoY

- Gross margin at 57.2%

- EBITDA up 26% YoY

- Profit before tax up 434% YoY

- Profit after tax up 996% YoY

- Q4 revenue down 7% QoQ

- EBITDA down 17% QoQ

- Profit before tax down 19% QoQ

- Profit after tax down 23% QoQ

Insights

Analyzing...

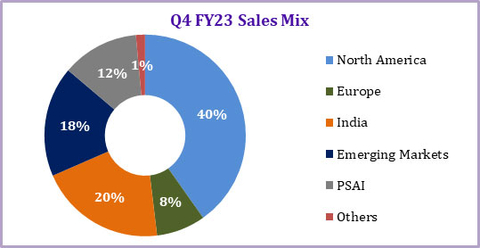

Q4 FY23 Sales Mix (Graphic: Business Wire)

| Q4 Performance Summary | FY23 Performance Summary | |

| Revenue | Revenue | |

| [Up: |

[Up: |

|

|

|

|

| Gross Margin | Gross Margin | |

| [Q4 FY22: |

[FY22: |

|

| SGNA expenses | SGNA expenses | |

| [ |

[ |

|

| R&D expenses | R&D expenses | |

| [ |

[ |

|

| EBITDA | EBITDA | |

| [ |

[ |

|

| Profit before Tax | Profit before Tax | |

| [Up: |

[Up: |

|

| Profit after Tax | Profit after Tax | |

| [Up: |

[Up: |

|

* Excluding impairments in current & previous periods, Q4 FY 23 PBT is |

||

Commenting on the results, Co-Chairman & MD, G V Prasad said: “FY 23 has been a year of record sales, profits and cash flow, driven by our performance in US Generics. We progressed well in our productivity and sustainability agenda. We will continue to deliver on our purpose, invest in growth drivers and promote a culture that is innovative and collaborative ensuring the future of our business.”

All amounts in millions, except EPS. All US dollar amounts based on convenience translation rate of

Dr. Reddy’s Laboratories Limited and Subsidiaries |

||||||||

Consolidated Income Statement |

||||||||

Particulars |

Q4 FY23 |

Q4 FY22 |

YoY

|

Q3 FY23 |

QoQ

|

|||

($) |

(Rs.) |

($) |

(Rs.) |

($) |

(Rs.) |

|||

Revenues |

766 |

62,968 |

661 |

54,368 |

16 |

824 |

67,700 |

(7) |

Cost of Revenues |

328 |

26,971 |

312 |

25,625 |

5 |

336 |

27,607 |

(2) |

Gross Profit |

438 |

35,997 |

350 |

28,743 |

25 |

488 |

40,093 |

(10) |

Operating Expenses |

|

|

|

|

|

|

|

|

Selling, General & Administrative expenses |

219 |

17,992 |

191 |

15,674 |

15 |

219 |

17,981 |

0 |

Research and Development expenses |

65 |

5,366 |

53 |

4,326 |

24 |

59 |

4,821 |

11 |

Impairment of non-current assets |

7 |

540 |

91 |

7,515 |

(93) |

2 |

134 |

303 |

Other operating (income)/expense |

(3) |

(281) |

(4) |

(291) |

(3) |

9 |

732 |

(138) |

Results from operating activities |

151 |

12,380 |

18 |

1,519 |

715 |

200 |

16,425 |

(25) |

Net finance (income)/expense |

(10) |

(799) |

(10) |

(859) |

(7) |

2 |

139 |

(675) |

Share of profit of equity accounted investees |

(1) |

(76) |

(1) |

(105) |

(28) |

(1) |

(60) |

27 |

Profit before income tax |

161 |

13,255 |

30 |

2,483 |

434 |

199 |

16,346 |

(19) |

Income tax expense |

45 |

3,663 |

20 |

1,608 |

128 |

47 |

3,875 |

(5) |

Profit for the period |

117 |

9,592 |

11 |

875 |

996 |

152 |

12,471 |

(23) |

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Share (EPS) |

0.70 |

57.62 |

0.06 |

5.26 |

995 |

0.91 |

74.95 |

(23) |

As % to revenues |

Q4 FY23 |

Q4 FY22 |

Q3 FY23 |

||||

Gross Profit |

57.2 |

|

52.9 |

|

|

59.2 |

|

SG&A |

28.6 |

|

28.8 |

|

|

26.6 |

|

R&D |

8.5 |

|

8.0 |

|

|

7.1 |

|

EBITDA |

25.9 |

|

23.9 |

|

|

29.0 |

|

PBT |

21.1 |

|

4.6 |

|

|

24.1 |

|

PAT |

15.2 |

|

1.6 |

|

|

18.4 |

EBITDA Computation |

||||||||

Particulars |

Q4 FY23 |

Q4 FY22 |

Q3 FY23 |

|||||

($) |

(Rs.) |

($) |

(Rs.) |

($) |

(Rs.) |

|||

Profit before Income Tax |

161 |

13,255 |

|

30 |

2,483 |

|

199 |

16,346 |

Interest (income) / expense - Net* |

(8) |

(673) |

|

0 |

24 |

|

(1) |

(93) |

Depreciation |

27 |

2,213 |

|

25 |

2,039 |

|

27 |

2,245 |

Amortization |

12 |

977 |

|

11 |

920 |

|

12 |

1,026 |

Impairment |

7 |

540 |

|

91 |

7,515 |

|

2 |

134 |

EBITDA |

198 |

16,312 |

|

158 |

12,980 |

|

239 |

19,658 |

* Includes income from Investments |

||||||||

All amounts in millions, except EPS. All US dollar amounts based on convenience translation rate of

Revenue Mix by Segment |

|||||

Segment |

Q4 FY23 |

Q4 FY22 |

YoY

|

Q3 FY23 |

QoQ

|

(Rs.) |

(Rs.) |

(Rs.) |

|||

Global Generics |

54,257 |

46,118 |

18 |

59,241 |

(8) |

|

25,321 |

19,971 |

27 |

30,567 |

(17) |

|

4,960 |

4,444 |

12 |

4,303 |

15 |

|

12,834 |

9,689 |

32 |

11,274 |

14 |

Emerging Markets |

11,142 |

12,013 |

(7) |

13,097 |

(15) |

Pharmaceutical Services and Active Ingredients (PSAI) |

7,787 |

7,557 |

3 |

7,758 |

0 |

Others |

924 |

693 |

33 |

701 |

32 |

Total |

62,968 |

54,368 |

16 |

67,700 |

(7) |

All amounts in millions, except EPS. All US dollar amounts based on convenience translation rate of

Dr. Reddy’s Laboratories Limited and Subsidiaries Consolidated Income Statement |

|||||||

Particulars |

FY23 |

FY22 |

Gr % |

||||

($) |

(Rs.) |

% |

($) |

(Rs.) |

% |

||

Revenue |

2,992 |

2,45,879 |

100.0 |

2,608 |

2,14,391 |

100.0 |

15 |

Cost of revenues |

1,296 |

1,06,536 |

43.3 |

1,223 |

1,00,551 |

46.9 |

6 |

Gross profit |

1,695 |

1,39,343 |

56.7 |

1,385 |

1,13,840 |

53.1 |

22 |

Operating Expenses |

|

|

|

|

|

|

|

Selling, General & Administrative expenses |

828 |

68,026 |

27.7 |

755 |

62,081 |

29.0 |

10 |

Research and Development expenses |

236 |

19,381 |

7.9 |

213 |

17,482 |

8.2 |

11 |

Impairment of non-current assets |

9 |

699 |

0.3 |

92 |

7,562 |

3.5 |

(91) |

Other operating income |

(72) |

(5,907) |

(2.4) |

(34) |

(2,761) |

(1.3) |

114 |

Results from operating activities |

695 |

57,144 |

23.2 |

359 |

29,476 |

13.7 |

94 |

Net finance income |

(35) |

(2,853) |

(1.2) |

(26) |

(2,119) |

(1.0) |

35 |

Share of profit of equity accounted investees |

(5) |

(370) |

(0.2) |

(9) |

(703) |

(0.3) |

(47) |

Profit before income tax |

734 |

60,367 |

24.6 |

393 |

32,298 |

15.1 |

87 |

Income tax expense |

186 |

15,300 |

6.2 |

106 |

8,730 |

4.1 |

75 |

Profit for the period |

548 |

45,067 |

18.3 |

287 |

23,568 |

11.0 |

91 |

|

|

|

|

|

|

|

|

Diluted EPS |

3.30 |

270.85 |

|

1.72 |

141.69 |

|

91 |

EBITDA Computation |

||||

Particulars |

FY23 |

FY22 |

||

($) |

(Rs.) |

($) |

(Rs.) |

|

Profit before Income Tax |

734 |

60,367 |

393 |

32,298 |

Interest income - Net* |

(8) |

(621) |

(3) |

(284) |

Depreciation |

105 |

8,614 |

99 |

8,152 |

Amortization |

49 |

4,022 |

45 |

3,672 |

Impairment |

9 |

699 |

92 |

7,562 |

EBITDA |

889 |

73,081 |

625 |

51,400 |

* Includes income from Investments |

||||

Key Balance Sheet Items |

||||||

Particulars |

As on 31st Mar 2023 |

As on 31st Dec 2022 |

As on 31st Mar 2022 |

|||

($) |

(Rs.) |

($) |

(Rs.) |

($) |

(Rs.) |

|

Cash and cash equivalents and other investments |

760 |

62,456 |

610 |

50,164 |

584 |

48,033 |

Trade receivables (current & non-current) |

882 |

72,486 |

913 |

75,046 |

813 |

66,818 |

Inventories |

592 |

48,670 |

600 |

49,326 |

619 |

50,884 |

Property, plant and equipment |

809 |

66,462 |

791 |

64,996 |

756 |

62,169 |

Goodwill and Other Intangible assets |

427 |

35,094 |

431 |

35,401 |

385 |

31,664 |

Loans and borrowings (current & non-current) |

164 |

13,472 |

215 |

17,663 |

412 |

33,845 |

Trade payables |

322 |

26,444 |

317 |

26,023 |

311 |

25,572 |

Equity |

2,810 |

2,30,991 |

2,680 |

2,20,273 |

2,318 |

1,90,527 |

All amounts in millions, except EPS. All US dollar amounts based on convenience translation rate of

Revenue Mix by Segment [year on year] |

|||||||

Segment |

FY23 |

FY22 |

Gr % |

||||

($) |

(Rs.) |

% |

($) |

(Rs.) |

% |

||

Global Generics |

2,601 |

2,13,768 |

|

2,180 |

1,79,170 |

|

|

|

1,237 |

1,01,704 |

|

911 |

74,915 |

|

|

|

214 |

17,603 |

|

202 |

16,631 |

|

|

|

595 |

48,932 |

|

510 |

41,957 |

|

|

Emerging Markets |

554 |

45,529 |

|

556 |

45,667 |

|

|

Pharmaceutical Services and Active Ingredients (PSAI) |

354 |

29,069 |

|

374 |

30,740 |

|

- |

Others |

37 |

3,042 |

|

55 |

4,481 |

|

- |

Total |

2,992 |

2,45,879 |

|

2,608 |

2,14,391 |

|

|

Revenue Analysis [Q4 FY23 and FY23]

Global Generics (GG)

-

FY23 revenue for GG segment at

Rs. 213.8 billion higher by19% over FY22. This growth was driven byNorth America ,Europe andIndia , while Emerging markets remained flat. -

Q4 revenue at

Rs. 54.3 billion , YoY growth of18% and QoQ decline of8% . YoY growth was driven by growth inNorth America ,Europe andIndia markets; however, partially impacted due to a decline in revenues in Emerging Markets. QoQ decline was mainly due to decline inNorth America and Emerging Markets, partially offset by growth inEurope andIndia

-

FY23 revenue from North America Generics for the year at

Rs. 101.7 billion , YoY growth of36% . The growth was contributed by new launches, scale up of existing products and favorable forex rates movement, which was partially offset by price erosion. -

Q4 revenue at

Rs. 25.3 billion , YoY growth of27% and QoQ decline of17% . YoY growth was primarily on account of new product launches and favorable forex rates movement, partly offset by price erosion. QoQ decline was due to fluctuation in demand for our new launches. - During the quarter, we launched 6 new products – Difluprednate, Lurasidone Tablets, Lubiprostone Capsules, Sunitinib Capsules, Nelarabine Injection and Timolol Gel. This takes our full year launch count to 25 products.

- During the year, we filed 12 new Abbreviated New Drug Applications (ANDAs) with the US Food and Drug Administration (USFDA). As of 31st March 2023, cumulatively 86 generic filings are pending for approval with the USFDA (81 ANDAs and 5 NDAs under 505(b)(2) route). Out of the pending 86 ANDAs, 45 are Para IVs, and we believe 18 have ‘First to File’ status.

-

FY23 revenue from

Europe atRs. 17.6 billion . YoY growth of6% , driven by volume traction in base business and new product launches, which was partially offset by price erosion in some of our products. -

Q4 revenue at

Rs. 5.0 billion , YoY growth of12% and QoQ growth of15% . YoY growth was primarily on account of new product launches and traction in base business volumes, partly offset by price erosion in the base business. QoQ growth was driven by traction in base business volumes and favourable forex rates movement.

-

FY23 revenue from

India atRs. 48.9 billion . YoY growth of17% was primarily attributable to increase in prices of our existing products, along with additional revenues from the launch of new products. The growth was also aided by divestment of a few non-core brands during the year. During the year, we launched 9 new brands inIndia . -

Q4 revenue at

Rs. 12.8 billion , YoY growth of32% and QoQ growth of14% . YoY growth primarily driven by favorable price variance, new product launches, and non-core brand divestments while QoQ growth was primarily due to divestment of a few non-core brands, partially offset by decline in volumes of some of our products.

Emerging Markets

-

FY23 revenue from Emerging Markets at

Rs. 45.5 billion , remained flat over the previous year. However, this grew by13% adjusted for the covid related product sales and divestment income realized in the last year.-

Revenue from

Russia for the year atRs. 21.2 billion , YoY growth of2% impacted due to higher base of FY 22, which included revenues from divestment of few non-core brands. The base business grew by11% net of divestment income, driven by favorable price variance and beneficial forex rates movement, partially offset by a decrease in volumes. -

Revenue from other CIS countries and

Romania for the year atRs. 8.6 billion , YoY growth of4% . Growth was on account of favorable price variance, partly offset by a decrease in volumes of base business and adverse movement in forex rates. -

Revenue from Rest of World (RoW) territories for the year at

Rs. 15.7 billion , YoY decline of5% primarily on account of revenues from covid related products in the FY 22. The revenues were also impacted by an adverse price variance, partly offset by new product launches.

-

Revenue from

-

Q4 revenue at

Rs. 11.1 billion , YoY decline of7% and QoQ decline of15% .-

Revenue for

Russia for Q4 atRs. 5.2 billion , both YoY and QoQ decline of24% . YoY decline was mainly attributable to divestment income & higher channel inventory in Q4 of last year. QoQ decline was primarily due to reduction in base business volumes and adverse forex rates movement. -

Revenue from other CIS countries and

Romania for the quarter areRs. 2.3 billion , remained flat YoY while showing an increase of2% QoQ. Benefits from favorable price variance were set off with reduction in base business volumes. -

Revenue from Rest of World (RoW) territories for Q4 at

Rs. 3.7 billion , YoY growth of28% and QoQ decline of8% . The YoY growth was primarily driven by an increase in base business volumes, new product launches and favorable forex rates movement, partially offset by adverse price variance. QoQ decline was mainly due to adverse price variance and reduction in base business volumes.

-

Revenue for

Pharmaceutical Services and Active Ingredients (PSAI)

-

FY23 revenue from PSAI at

Rs. 29.1 billion . YoY decline of5% . The decline was mainly on account of decline in base business volumes and price erosion in some of our products, partially offset by new product launches and favorable forex rate movements. FY22 included higher contribution from sales of covid related portfolio. -

Q4 revenue at

Rs. 7.8 billion , with growth of3% YoY, while it remained flat QoQ. YoY growth was primarily driven by new product launches and favourable forex rates movement. These were offset by a reduction in base business volumes and adverse price variance. - During the year, we have filed 12 DMFs in the US, of which 7 DMFs were filed in Q4FY23.

Income Statement Highlights:

-

FY 23 gross margin at

56.7% , an increase of ~360 bps over previous year. The increase was driven by new product sales of certain products with higher gross margins, higher government incentives and favourable foreign exchange. This was partially offset with price erosion in certain of our products, primarily inthe United States andEurope . The gross profit margin for GG and PSAI business segments are at62.1% and16.2% respectively.

Q4 gross margin at57.2% (GG:61.7% , PSAI:25.2% ). Gross margin increased by ~430 bps YoY, while it declined by ~210 bps QoQ. YoY increase was driven by new product sales of certain products with higher gross margins, and favourable foreign exchange, partially offset by price erosion, primarily inUnited States andEurope . QoQ decline was primarily due to lower government incentives and product mix, which was partly offset by income from divestment of non-core brands. -

Selling, general & administrative (SG&A) expenses for FY23 at

Rs. 68.0 billion , an increase of10% on a YoY basis. SG&A as a % to sales for FY23 was27.7% , a decline of 130 basis points over FY22. SG&A expenses for Q4 atRs. 18.0 billion , YoY increase of15% and remained flat QoQ. The SG&A spend increase is largely on account of investments in sales & marketing and adverse impact of forex rates. -

Impairment charge for FY23 at

Rs. 0.7 billion and for Q4 atRs. 0.5 billion . This is mainly due to decrease in market potential of products acquired from Nimbus Health GmbH and certain other product-related intangibles due to adverse market conditions. -

Research & development (R&D) expenses in FY23 at

Rs. 19.4 billion . As % to Revenues – FY23:7.9% | FY22:8.2% . Q4 R&D expenses atRs. 5.4 billion ,8.5% of revenue. We continue our focus on investing in R&D to build a healthy pipeline of new products across our markets for both small molecules and biosimilars. -

Other operating income for FY23 at

Rs. 5.9 billion compared toRs. 2.8 billion in FY22. The net other income was higher primarily on account of recognition of income ofRs. 5.6 billion from a settlement agreement, with Indivior Inc., IndiviorUK Limited, and Aquestive Therapeutics, Inc., resolving all claims between the parties relating to the Company’s generic buprenorphine and naloxone sublingual film. Other operating income for Q4 wasRs. 0.3 billion . -

Net Finance income for FY23 at

Rs. 2.9 billion compared toRs. 2.1 billion in FY22. The increase is primarily on account of higher foreign exchange gain in current year as compared to FY22 and increase in profit on sale of mutual funds compared to FY22. Net finance income in Q4 wasRs. 0.8 billion . -

Profit before Tax for FY23 at

Rs. 60.4 billion , YoY growth of87% . Profit before Tax for Q4 is atRs. 13.3 billion . -

Profit after Tax for FY23 at

Rs. 45.1 billion and for Q4 atRs. 9.6 billion . The effective tax rate for the year has been25.3% as compared to27.0% in FY22, due to changes in the Company’s jurisdictional mix of earnings. The effective tax rate for the quarter has been at27.6% as compared to64.8% in Q4FY22. The previous year ETR was higher due to impairment charge impact. -

Diluted earnings per share for FY23 is

Rs. 270.9 . Diluted earnings per share for Q4 isRs. 57.6 .

Other Highlights:

-

EBITDA for FY23 at

Rs. 73.1 billion and the EBITDA margin is29.7% . EBITDA for Q4 at 16.3 billion and the EBITDA margin at25.9% . -

Capital expenditure for FY23 at

Rs. 11.3 billion . Capital expenditure for Q4 atRs. 2.6 billion . -

Free cash-flow for FY23 at

Rs. 40.1 billion and for Q4 it atRs. 16.0 billion . -

Net cash surplus for the company at

Rs. 50.5 billion as on March 31, 2023. -

The Board has recommended payment of a dividend of

Rs. 40 per equity share of face valueRs 5 /- each (800% of face value) for the year ended March 31, 2023 subject to approval of the members of the company.

All amounts in millions, except EPS

About key metrics and non-GAAP Financial Measures

This press release contains non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP financial measures are measures of our historical performance, financial position or cash flows that are adjusted to exclude or include amounts, as the case may be, from the most directly comparable financial measure calculated and presented in accordance with IFRS.

The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with IFRS. Our non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. These measures may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes.

We believe these non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating our business.

For more information on our non-GAAP financial measures and a reconciliation of GAAP to non-GAAP measures, please refer to "Reconciliation of GAAP to Non-GAAP Results" table in this press release.

All amounts in millions, except EPS

Reconciliation of GAAP measures to Non-GAAP measures |

||

Free Cash Flow |

||

|

Three months Ended March 31, 2023 |

Year Ended March 31, 2023 |

Net cash generated from operating activities |

23,376 |

69,587 |

Less: |

|

|

Taxes |

(3,697) |

(10,714) |

Investments in PPE and Intangibles |

(3,722) |

(18,782) |

Free Cash Flow |

15,957 |

40,091 |

Operating working capital |

|

|

Year Ended March 31, 2023 |

Inventories |

48,670 |

Trade Receivables |

72,485 |

Less: |

|

Trade Payables |

26,444 |

Operating Working Capital |

94,711 |

Net cash surplus |

|

|

Year Ended March 31, 2023 |

Cash and cash equivalents |

5,779 |

Investments |

56,678 |

Short-term borrowings |

(7,390) |

Long-term borrowings, current portion |

(4,804) |

Less: |

|

Restricted cash balance |

89 |

Lease liabilities (included in Long-term borrowings, current portion) |

(1,004) |

Equity Investments (included in Investments) |

716 |

Net Cash Surplus |

50,462 |

All amounts in millions, except EPS

Computation of Return on Capital Employed |

|

|

Year Ended March 31, 2023 |

Profit before tax |

60,367 |

Less: |

|

Interest and Investment Income (Excluding forex gain/loss) |

627 |

Earnings Before Interest and taxes [A] |

59,740 |

|

|

Average Capital Employed [B] |

1,72,602 |

|

|

Return on Capital Employed (A/B) (Ratio) |

|

Computation of capital employed |

||

|

Year Ended March 31, 2023 |

Year Ended March 31, 2022 |

Property Plant and Equipment |

66,462 |

62,169 |

Intangibles |

30,849 |

27,246 |

Goodwill |

4,245 |

4,418 |

Investment in equity accounted associates |

4,702 |

4,318 |

Other Current Assets |

20,069 |

13,902 |

Other investments |

660 |

3,668 |

Other non-current assets |

800 |

894 |

Inventories |

48,670 |

50,884 |

Trade Receivables |

72,485 |

66,818 |

Derivative Financial Instruments |

1,095 |

1,427 |

Less: |

|

|

Other Liabilities |

42,320 |

36,414 |

Provisions |

5,513 |

4,315 |

Trade payables |

26,444 |

25,572 |

Operating Capital Employed |

1,75,760 |

1,69,443 |

Average Capital Employed |

1,72,602 |

|

Computation of EBITDA

Refer page no. 2 and 4 for EBITDA computations.

Earnings Call Details (07:30 pm IST, 10:00 am EDT, May 10, 2023)

The management of the Company will host an earnings call to discuss the Company’s financial performance and answer any questions from the participants.

Conference Joining Information |

Option 1: Express Join with DiamondPass™ |

Pre-register with the below link and join without waiting for the operator.

https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=8728481&linkSecurityString=2cca7c8d18

Option 2: Join through below Dial-In Numbers |

|

Universal Access Number:

|

+91 22 6280 1219 +91 22 7115 8120 |

International Toll Free Number: |

|

No password/pin number is necessary to dial in to any of the above numbers. The operator will provide instructions on asking questions before and during the call.

Play Back: The play back will be available after the earnings call, till May 17th, 2023. For play back dial in phone No: +91 22 7194 5757, and Playback Code is 65827.

Transcript: Transcript of the Earnings call will be available on the Company’s website: www.drreddys.com

About Dr. Reddy’s: Dr. Reddy’s Laboratories Ltd. (BSE: 500124, NSE: DRREDDY, NYSE: RDY, NSEIFSC: DRREDDY) is an integrated pharmaceutical company, committed to providing affordable and innovative medicines for healthier lives. Through its businesses, Dr. Reddy’s offers a portfolio of products and services including APIs, custom pharmaceutical services, generics, biosimilars and differentiated formulations. Our major therapeutic areas of focus are gastrointestinal, cardiovascular, diabetology, oncology, pain management and dermatology. Dr Reddy’s operates in markets across the globe. Our Major markets include –

Disclaimer: This press release may include statements of future expectations and other forward-looking statements that are based on the management’s current views and assumptions and involve known or unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words "may", "will", "should", "expects", "plans", "intends", "anticipates", "believes", "estimates", "predicts", "potential", or "continue" and similar expressions identify forward-looking statements. Actual results, performance or events may differ materially from those in such statements due to without limitation, (i) general economic conditions such as performance of financial markets, credit defaults , currency exchange rates , interest rates, persistency levels and frequency / severity of insured loss events (ii) mortality and morbidity levels and trends, (iii) changing levels of competition and general competitive factors, (iv) changes in laws and regulations and in the policies of central banks and/or governments, (v) the impact of acquisitions or reorganization, including related integration issues, (vi) the susceptibility of our industry and the markets addressed by our, and our customers’, products and services to economic downturns as a result of natural disasters, epidemics, pandemics or other widespread illness, including coronavirus (or COVID-19), and (vii) other risks and uncertainties identified in our public filings with the Securities and Exchange Commission, including those listed under the "Risk Factors" and "Forward-Looking Statements" sections of our Annual Report on Form 20-F for the year ended March 31, 2022. The company assumes no obligation to update any information contained herein.”

View source version on businesswire.com: https://www.businesswire.com/news/home/20230510005650/en/

INVESTOR RELATIONS

RICHA PERIWAL

richaperiwal@drreddys.com

MEDIA RELATIONS

USHA IYER

ushaiyer@drreddys.com

Source: Dr. Reddy’s Laboratories Ltd.