Rubric Capital Management Sends Letter to Radius Health Board of Directors

Outlines Value Enhancing Initiatives to Address Company’s Underperformance and Poor Corporate Governance

Intends to Support Velan-Repertoire Director Slate at Upcoming Annual Meeting

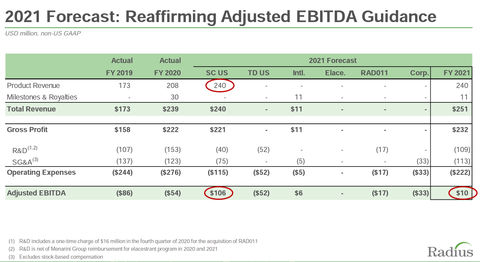

2021 Forecast: Reaffirming Adjusted EBITDA Guidance (Graphic:

In its letter, Rubric outlines the following value enhancing initiatives to address the Company’s underperformance and poor corporate governance:

- Maximize the value of Tymlos

- Maximize the value of the elacestrant royalty

- Generate cash flows to maximize the value of the Company’s tax attributes

- Put in place and empower the best possible team

Due to a lack of confidence in the Company’s current Board and management team to execute on these initiatives, Rubric intends to vote for the three director candidates nominated by

The full text of the letter follows:

The Board of Directors

7th Floor

Attention:

Dear Members of the Board of Directors (the “Board”):

I am writing you on behalf of

We believe that unlocking the value potential in Radius will result from:

- Maximizing the value of Tymlos

- Maximizing the value of the elacestrant royalty

- Generating cash flows to maximize the value of the Company’s tax attributes

- Putting in place and empowering the best possible team

1. Maximizing the value of Tymlos

We believe Tymlos to be a strong asset, sustainably differentiated from other anabolic agents, with robust economics and a longer patent life than the market appreciates. These characteristics should warrant a premium valuation, even absent rapid growth, but have been hidden within Radius due to the Company’s constant (and to date, fruitless) efforts in R&D (first the transdermal patch program, and now RAD011), which prevent those economics from generating cash flows.

Along with Q2 2021 earnings, the current management team presented the following slide which we found helpful at showing the underlying financial profile of Tymlos.

See 2021 Forecast: Reaffirming Adjusted EBITDA Guidance slide

This year, according to sell side estimates, subcutaneous Tymlos is expected to generate

2. Maximizing the value of the elacestrant royalty

Considering the above, we think the market is significantly undervaluing the elacestrant royalty and Radius should consider, over time, strategic alternatives to bring this value to the fore. Again, we will refer to the Company’s own slides to demonstrate the value potential here:

See Monotherapy - Illustrative Net Revenue Scenarios slide

Distilling this slide into value for Radius shareholders, if we take the net present value of these cash flow streams, while adding the present value of a portion of the milestones (which comprise a total of

3. Generating cash flows to maximize the value of the Company’s tax attributes

Radius has over

Combining our value for the Tymlos franchise, our range of values for the NPV of the royalty, and

4. Putting in place and empowering the best possible team

As with all the companies we invest in, we aspire to see the best possible team put on the field every day and expect that team to be overseen by a board of diverse, capable, and independent directors. Independence has been a core principle of good corporate governance for decades, and in recent years that principle has been lacking at Radius. This has been outlined in one of Velan-Repertoire’s missives, but it is worth repeating here: after Mr. Martin’s appointment as CEO and director of Radius, the three directors subsequently appointed all have clear connections to

To be clear, we have no affiliation with Velan or Repertoire and are not acting in concert with either. Before the filing of their 13D, we had never heard of either firm. That said, we suspected an activist might appear in Radius based on the interactions we had with the Company in early

You agree that you will not, directly or indirectly, for one (1) year after the date hereof:

make, participate in or encourage any “solicitation” (as such term is used in the proxy rules of the

We view this NDA standstill clause—delivered to us before we had heard of Velan-Repertoire or their 13D had been filed with the SEC—to be a pre-emptive attempt on the part of Radius to muzzle its second largest shareholder in the event of a proxy contest. In our view, this is the behavior of a Board and management team that are not aligned with their shareholders and is unacceptable at any company.

For these reasons and more, we intend to vote for the Velan-Repertoire slate.

Sincerely,

Disclaimer

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this press release and the material contained herein are for general information only, and are not intended to provide investment advice. All statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “will,” “anticipate,” “believe,” “expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained in this press release and the material contained herein that are not historical facts are based on current expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be materially different. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to assist the recipient of this material in evaluating the matters described herein may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should also not be viewed as factual and also should not be relied upon as an accurate prediction of future results. All figures are unaudited estimates and subject to revision without notice. Rubric disclaims any obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future results.

Contacts

1 https://www.sec.gov/Archives/edgar/data/1428522/000119312522167901/d312837ddefa14a.htm at p.4

View source version on businesswire.com: https://www.businesswire.com/news/home/20220616005207/en/

(212) 257-4170

Source: