U.S. Home Price Appreciation Increases Again, Radian Home Price Index Reports

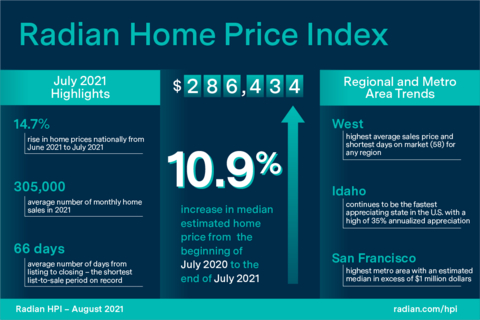

Radian Home Price Index (HPI) Infographic

The Radian HPI also rose 10.9 percent year-over-year (

“The addition of more active home listings into the market inventory has not slowed the path of home price gains. Nationally and in most local markets, homes sales volume remains at all-time highs while supply is far below historic norms,” noted

NATIONAL DATA AND TRENDS

-

Median home price in the

U.S. rose to$286,434 - Home prices rose an annualized 13.1 percent over the last three months

Nationally, the median estimated price for single-family and condominium homes rose to

With the exceptions of only 2015 and 2020, in every year since before the Great Recession, June has been the most active sales contract month and July was the second most active. The same pattern has emerged in 2021.

The average number of monthly home sales thus far in 2021 has reached 305,000 per month. That is more than 10 percent higher per month than the average 275,000 homes sold in each of the first seven months of 2020.

And while listing volume has increased in each of the last eight months, the number of listings remains significantly below prior years.

REGIONAL DATA AND TRENDS

- July gains were solid across all regions

- Regional sales and listing activity sets records

Similar to our national reporting, all six

Demand was consistently strong across all regions as all six regions notched record low days on market for sold properties. The West region which carries the highest average sales price and the highest estimated median sales price also recorded the shortest days on market at 58. The MidAtlantic region took the longest to sell, but still logged a record at 85 days.

Among the 51 states and territories the Radian HPI tracks,

METROPOLITAN AREA DATA AND TRENDS

- Pace of metro area gains eased in July

Across the 20-largest metro areas of the

ABOUT THE RADIAN HPI

Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers the Radian HPI data set along with a client access portal for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk.

Visit http://www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210826005669/en/

For Investors

Email: john.damian@radian.com

For the Media

Email: rashi.iyer@radian.com

Source: