Puma Welcomes Kinross Gold as Strategic Investor to Explore and Develop the Williams Brook Project

Puma Exploration announces a strategic partnership with Kinross Gold through an option agreement for the Williams Brook Project in Northern New Brunswick. Kinross can earn a 65% interest by funding $16.75 million in exploration over five years, including a firm commitment of $2 million with 5,000 metres of drilling in the first 18 months. Kinross will also acquire a 9.9% stake in Puma through a $1.01 million private placement at $0.06 per share. Puma will serve as the operator, receiving management fees and maintaining a 35% interest upon joint venture formation. The Lynx Gold Zone has shown promising results, including intersections of 5.55 g/t Au over 50.15m and 2.49 g/t Au over 63.05m.

Puma Exploration annuncia una partnership strategica con Kinross Gold attraverso un accordo di opzione per il Progetto Williams Brook nel nord del New Brunswick. Kinross può acquisire un interesse del 65% finanziando $16,75 milioni in esplorazione nell'arco di cinque anni, inclusa una committenza fissa di $2 milioni con 5.000 metri di perforazione nei primi 18 mesi. Kinross acquisirà anche una partecipazione del 9,9% in Puma tramite un collocamento privato di $1,01 milioni a $0,06 per azione. Puma fungerà da operatore, ricevendo commissioni di gestione e mantenendo un interesse del 35% al momento della formazione della joint venture. La Zona Lynx Gold ha mostrato risultati promettenti, inclusi intersezioni di 5,55 g/t Au su 50,15 m e 2,49 g/t Au su 63,05 m.

Puma Exploration anuncia una asociación estratégica con Kinross Gold a través de un acuerdo de opción para el Proyecto Williams Brook en el norte de New Brunswick. Kinross puede obtener un interés del 65% financiando $16.75 millones en exploración durante cinco años, incluida un compromiso firme de $2 millones con 5,000 metros de perforación en los primeros 18 meses. Kinross también adquirirá una participación del 9.9% en Puma a través de un colocación privada de $1.01 millones a $0.06 por acción. Puma actuará como operador, recibiendo honorarios de gestión y manteniendo un interés del 35% en la formación de la empresa conjunta. La Zona Lynx Gold ha mostrado resultados prometedores, incluidas intersecciones de 5.55 g/t Au sobre 50.15 m y 2.49 g/t Au sobre 63.05 m.

Puma Exploration은 Kinross Gold와 북부 뉴브런즈윅의 윌리엄스 브룩 프로젝트에 대한 옵션 계약을 통해 전략적 파트너십을 발표했습니다. Kinross는 향후 5년 동안 1,675만 달러를 탐사에 투자하여 65%의 지분을 확보할 수 있으며, 그중 200만 달러는 초기 18개월 동안 5,000미터의 시추 작업에 대한 확약입니다. Kinross는 또한 주당 0.06달러에 101만 달러의 사모펀드를 통해 Puma의 9.9% 지분을 취득할 것입니다. Puma는 운영자로서 관리 수수료를 받고 조인트 벤처 형성 시 35%의 지분을 유지하게 됩니다. Lynx Gold 구역은 50.15m에서 5.55 g/t Au와 63.05m에서 2.49 g/t Au의 교차점 등 유망한 결과를 보여주었습니다.

Puma Exploration annonce un partenariat stratégique avec Kinross Gold via un accord d'option pour le projet Williams Brook dans le nord du Nouveau-Brunswick. Kinross peut acquérir un intérêt de 65 % en finançant 16,75 millions USD en exploration sur cinq ans, y compris un engagement ferme de 2 millions USD avec 5 000 mètres de forage au cours des 18 premiers mois. Kinross acquérira également une participation de 9,9 % dans Puma grâce à un placement privé de 1,01 million USD à 0,06 USD par action. Puma agira en tant qu'opérateur, recevant des frais de gestion et maintenant un intérêt de 35 % lors de la formation de la coentreprise. La zone Lynx Gold a montré des résultats prometteurs, y compris des intersections de 5,55 g/t Au sur 50,15 m et de 2,49 g/t Au sur 63,05 m.

Puma Exploration kündigt eine strategische Partnerschaft mit Kinross Gold durch einen Optionsvertrag für das Williams Brook Projekt im Norden von New Brunswick an. Kinross kann durch die Finanzierung von 16,75 Millionen USD über einen Zeitraum von fünf Jahren einen Anteil von 65% erwerben, einschließlich einer festen Verpflichtung von 2 Millionen USD mit 5.000 Metern Bohrungen in den ersten 18 Monaten. Kinross wird auch einen 9,9% Anteil an Puma durch eine Private Placement von 1,01 Millionen USD zu einem Preis von 0,06 USD pro Aktie erwerben. Puma wird als Betreiber fungieren, Verwaltungsgebühren erhalten und einen 35%-Anteil bei der Gründung des Joint Ventures behalten. Die Lynx Gold Zone zeigt vielversprechende Ergebnisse, darunter Schnittstellen von 5,55 g/t Au über 50,15 m und 2,49 g/t Au über 63,05 m.

- Strategic partnership with major gold producer Kinross Gold

- $16.75M committed exploration funding over 5 years

- Immediate $1.01M private placement investment from Kinross

- 10% management fees for first $1M expenditure, 5% thereafter

- Retention of significant 35% project interest

- High-grade gold intersections at Lynx Gold Zone

- Potential ownership dilution from 100% to 35% in the project

- 9.9% share dilution from private placement

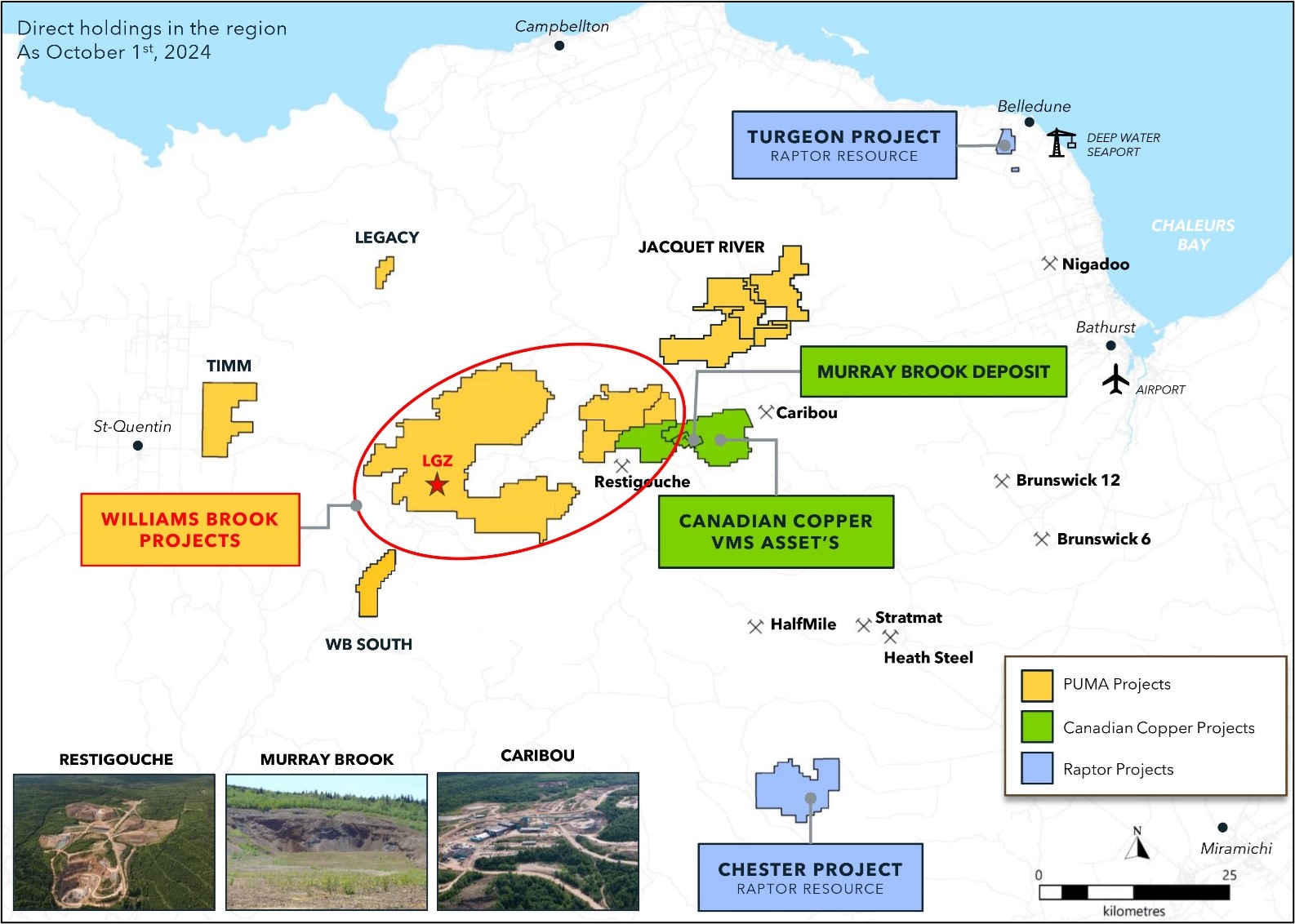

RIMOUSKI, Québec, Oct. 24, 2024 (GLOBE NEWSWIRE) -- Puma Exploration Inc. (TSXV: PUMA, OTCQB: PUMXF) (the “Company” or “Puma”) is pleased to announce the execution on October 23, 2024 of a definitive option agreement (the “Option Agreement’) with KG Exploration (Canada) Inc., a wholly-owned subsidiary of Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross”) with respect to the Williams Brook, Portage and Jonpol properties (collectively, the “Williams Brook Project”) located in Northern New Brunswick, Canada (see Figure 1).

Figure 1. Puma’s land holdings in Northern New Brunswick

Under the terms of the Option Agreement, Kinross will have, subject to certain conditions, the option to earn a

In connection with the Option Agreement, Kinross has also agreed to subscribe under a concurrent private placement for treasury common shares of the Company, representing approximately

Puma’s President and CEO Marcel Robillard stated, “We believe in the region’s potential to host Canada’s next major gold camp. I am delighted to welcome Kinross, the first major gold producer to establish a presence in New Brunswick. I look forward to working with its first-in-class exploration and development team to grow the region’s potential”. Most of the first

He also emphasized the financial benefits of the agreement, “Within four (4) years and with only

Under the Option Agreement, Puma will act as the Operator and will be assisted by a technical committee comprised of two (2) representatives of each company. The Option Agreement confirms Kinross’s trust in Puma’s expertise and skill in driving exploration forward. As Operator, Puma will also receive management fees that will contribute directly to Puma’s treasury.

Option Agreement Highlights

To earn a

$2.0 M in the first 18 months with a commitment for 5,000 metres of drilling (Firm Commitment);$3.0 M in the second year;$3.0M in the third year;$4.0M in the fourth year; and$4.75M in the fifth year.

As Operator, Puma will receive management fees on an annual basis equal to

Upon exercise of the option, Kinross and Puma will form a joint venture on an initial basis of

Concurrent Private Placement of

As part of the Option Agreement, Kinross has agreed to subscribe under a non-brokered private placement for 16,857,891 treasury common shares of the Company at a price of

Puma and Kinross have also agreed on the terms of an investor rights agreement (the “IRA”), pursuant to which, among other things, Kinross will be granted on the closing date of the Offering the right to participate in future equity financings in order to maintain its ownership percentage in the Company or acquire up to

The Option Agreement and Private Placement were negotiated at arms’ length, and there were no finder’s fees associated therewith. Closing of both the Option Agreement and the Offering remains subject to certain closing conditions, including the approval of the TSX Venture Exchange. All securities issued under the Offering will have a statutory hold period of four months and one day.

The transaction with Kinross is aligned with the Company's DEAR business model of Discovery, Exploration, Acquisition and Royalties to generate maximum value for shareholders with low share dilution. The Company expects to release news regarding its short to medium-term strategy for its other

Qualified Person

The content of this press release was prepared by Marcel Robillard, President and Dominique Gagné, P.Geo., qualified persons as defined by NI 43-101, who supervised the preparation of technical information that forms part of this news release.

About Puma’s Assets in New Brunswick

Puma has accumulated an impressive portfolio of prospective gold landholdings in Northern New Brunswick – the Williams Brook, JonPol, Portage, TIMM and Jacquet River properties. They are all located near the Rocky Brook Millstream Fault (“RBMF”), a major regional structure formed during the Appalachian Orogeny and a significant control for gold deposition in the region. Puma’s work to date has focused on the Williams Brook property, but prospecting and surface exploration work on the other properties have confirmed their potential for significant gold mineralization. Puma retains its

About Puma Exploration

Puma Exploration is a Canadian-based mineral exploration company with precious metals projects in New Brunswick, near Canada's Famous Bathurst Mining Camp. Puma has a long history in Northern New Brunswick, having worked on regional projects for over 15 years. Puma’s successful exploration methodology, which combines old prospecting methods with detailed trenching and up-to-date technology such as Artificial Intelligence, has been instrumental in facilitating an understanding of the geology and associated mineralized systems in the region. Armed with geophysical surveys, geochemical data and consultants’ expertise, Puma has developed a perfect low-cost exploration tool to discover gold at shallow depths and maximize drilling results.

Connect with us on Facebook / X/ LinkedIn.

Visit www.explorationpuma.com for more information or contact:

Marcel Robillard, President and CEO.

(418) 750-8510; president@explorationpuma.com

Mia Boiridy, Head of Investor Relations and Corporate Development.

(250) 575-3305; mboiridy@explorationpuma.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This press release may contain forward-looking statements. Such forward-looking statements involve several known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of Puma to be materially different from actual future results and achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made, except as required by law. Puma undertakes no obligation to publicly update or revise any forward-looking statements. The quarterly and annual reports and the documents submitted to the securities administration describe these risks and uncertainties.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bfb62025-70de-4c6a-b9e0-754a207cde17