National Survey: Middle-Income Families Are Feeling Increasingly Negative About Personal Finances Despite an Uptick in Purchasing Power

Households continue to slowly climb out of the pandemic-era financial hole caused by inflation

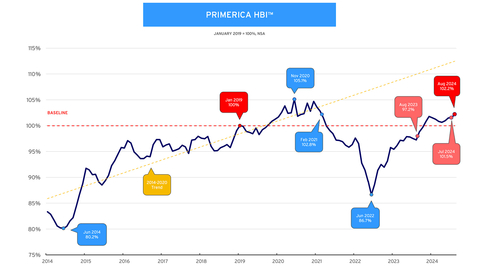

Primerica Household Budget Index™ - Spending power reached its highest level since February 2021 in August 2024. The average purchasing power for middle-income families was

“For the first time in a year, a majority of middle-income households are feeling negative about their personal finances. In fact, this latest report represents the highest negative rating we’ve seen since we began fielding the survey exactly four years ago,” said Glenn Williams, CEO of Primerica. “Families continue to list inflation as their No. 1 concern, with the stress it brings spilling over into worry about being able to afford everyday essentials like food or groceries and going to the doctor as well as managing their rising credit card debt.”

In contrast, Primerica’s latest Household Budget Index™ (HBI™) indicates middle-income households experienced an uptick in purchasing power in August 2024 with the index climbing to

“The economy has turned more favorable in recent months, but it will take time for the effects of lower interest rates, declining prices on necessities and rising wages to have a real impact on the bottom lines of middle-income families,” said Amy Crews Cutts, Ph.D., CBE®, economic consultant to Primerica. “The financial challenges these households are grappling with are poised to persist through the end of this year — and likely beyond. It's clear this is a marathon, not a sprint."

Key Findings from Primerica’s Q3

-

Middle-income Americans’ perceptions of their personal and community financial health continue to decline. A majority of households (

55% ) now rate their personal financial situation negatively — a 6-point increase from the previous survey. Significant majorities also view the economic health beyond just their own personal finances in a grim light – their community (63% negative, up 5 points), the nation (73% negative, up 1 point), and their ability to save for the future (73% negative, up 5 points).

-

Credit card debt — and concern over it — is rising. More than one-third (

35% ) of middle-income Americans say their credit card debt has risen in the past three months — a 5-point jump from the previous survey — and less than one-third (31% ) are paying off their credit card in full each month. In addition, nearly half (44% ) are more worried about their credit card debt than they were a year ago — a 9-point jump from the last survey and the highest level of concern since the question was first introduced in March 2023. Still, more than two-thirds (69% ) say they have reduced overall spending in the past couple years.

-

Uncertainty over the country’s economic future is running high. The share of households expecting the American economy to worsen in the next year has dropped significantly, with just

25% holding that view — down 15 points from the previous survey. However, much of the shift is driven by growing uncertainty, as one-third (34% ) of respondents — up 15 points — are unsure about the economy’s direction. Still, optimism also ticked up, with25% now believing the economy will improve over the next year, a 7-point increase.

-

Inflation, paying for food or groceries are stressing families out. Inflation remains the No. 1 concern for middle-income Americans, with over one-third (

40% ) citing it as a major worry — an 8-point increase since the last survey. Close behind, one-third (33% ) now rank paying for food and groceries as their second biggest concern, up 7 points. Moreover, when asked to describe their feelings about their finances, a majority (58% ) chose “stressed,” while nearly half (43% ) selected “discouraged.”

-

Half of middle-income Americans can’t afford to go to the doctor. When asked to choose what they could afford from a list, only half (

51% ) said they could cover the cost of a doctor’s visit — a disconcerting figure given that more than a quarter (27% ) expressed concern about their health or getting sick, making it the third top worry for these households.

Primerica Financial Security Monitor™ (FSM™) Topline Trends Data

Sept

|

Jun

|

Mar

|

Dec

|

Sept

|

Jun

|

Mar

|

Dec

|

Sept

|

|

How would you rate the condition of your personal finances? Share reporting “Excellent” or “Good.” |

|

|

|

|

|

|

|

|

|

Analysis: Respondents are increasingly negative in their assessment of their personal finances. |

|||||||||

Overall, would you say your income is…? Share reporting “Falling behind the cost of living” |

|

|

|

|

|

|

|

|

|

Share reporting “Stayed about even with the cost of living” |

|

|

|

|

|

|

|

|

|

Analysis: Concern about meeting the increased cost of living remained steady with |

|||||||||

And in the next year, do you think the American economy will be…? Share reporting “Worse off than it is now” |

|

|

|

|

|

|

|

|

|

Share reporting “Uncertain” |

|

|

|

|

|

|

|

|

|

Analysis: While fewer respondents think the economy will definitely get worse over the next year, the rising share that are uncertain about its direction accounts for most of the change. |

|||||||||

Do you have an emergency fund that would cover an expense of |

|

|

|

|

|

|

|

|

|

Analysis: The percentage of Americans who have an emergency fund that would cover an expense of |

|||||||||

How would you rate the economic health of your community? (Reporting “Not so good” and “Poor” responses.) |

|

|

|

|

|

|

|

|

|

Analysis: Respondents’ rating of the economic health of their communities has gotten worse over the past year. |

|||||||||

How would you rate your ability to save for the future? (Reporting “Not so good” and “Poor” responses.) |

|

|

|

|

|

|

|

|

|

Analysis: A significant majority continue to feel it is difficult to save for the future. |

|||||||||

In the past three months, has your credit card debt…? (Reporting “Increased” responses.) |

|

|

|

|

|

|

|

|

|

Analysis: Credit card debt has remained about the same over the past year. |

|||||||||

About Primerica’s Middle-Income Financial Security Monitor™ (FSM™)

Since September 2020, the Primerica Financial Security Monitor™ has surveyed middle-income households quarterly to gain a clear picture of their financial situation, and it coincides with the release of the monthly HBI™ four times annually. Polling was conducted online from September 10-13, 2024. Using Dynamic Online Sampling, Change Research polled 999 adults nationwide with incomes between

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from

The HBI™ is presented as a percentage. If the index is above

Periodically, prior HBI™ values may be revised due to revisions in the CPI series and Consumer Expenditure Survey releases by the

About Primerica, Inc.

Primerica, Inc., headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20241008472706/en/

Public Relations

Gana Ahn, 678-431-9266

gana.ahn@primerica.com

Investor Relations

Nicole Russell, 470-564-6663

nicole.russell@primerica.com

Source: Primerica, Inc.