Power Nickel Closes $0.90 per share Flow-Through Financing of $2.75 Million

- None.

- The private placement is subject to the Company's completion of its filing requirements with the TSX Venture Exchange and TSXV approval.

- The report constitutes a base case study, and the very positive impacts that the CVMR process will bring to this project down the road are not shown in this base case.

- The ongoing work with CVMR suggests sharply higher recovery rates using the CVMR process, but the benchmark studies from CVMR are yet to be released.

The financing was completed with investors secured for Power Nickel by Wealth Creation Preservation & Donation Inc. ("Wealth" or "WCPD"). To ensure this process was done in the least dilutive way possible, Power Nickel arranged to have WCPD Group organize a consortium of

CVMR is a shareholder of Power Nickel and is currently conducting several studies on the Nisk Nickel Sulfide PGM project in

Last week Power Nickel announced their inaugural NI 43-101 mineral resources estimate (see Table 1 below) that demonstrated it had more than 5.4 million tonnes of Indicated mineral resources grading

The Mineral Resource Estimate presented herein in Table 1 is either constrained within a pit shell developed from a pit optimization analysis or presented as underground mineral resources using an appropriate cut-off grade and reasonable potential mining shapes which include must-take material.

Table 1 - 2023 Nisk Project Mineral Resource Estimate at a cut-off grade of

Potential | In-Situ Grade | Calculated | |||||

Class | Tonnage | Ni | Co | Cu | Pd | NiEq | |

t | % | % | % | g/t | % | ||

Indicated | Open Pit | 519,000 | 0.63 | 0.04 | 0.30 | 0.56 | 0.84 |

Underground | 4,910,000 | 0.78 | 0.05 | 0.42 | 0.78 | 1.07 | |

Inferred | Underground | 1,787,000 | 0.98 | 0.06 | 0.45 | 1.11 | 1.35 |

Potential | In-Situ Material Content | Calculated | |||||

Class | Tonnage | Ni | Co | Cu | Pd | NiEq | |

t | t | t | t | t | t | ||

Indicated | Open Pit | 519,000 | 3,300 | 200 | 1,600 | 9,400 | 4,400 |

Underground | 4,910,000 | 38,300 | 2,400 | 20,500 | 123,100 | 52,300 | |

Inferred | Underground | 1,787,000 | 17,500 | 1,100 | 8,100 | 64,000 | 24,100 |

Please Refer to the Notes to Table 1 below at the end of this news release

"This report constitutes a base case study which assumes that Power Nickel would make a concentrate from the material extracted. In this base case study, metallurgical work suggests that our concentrate would show recovery rates of

Ongoing work with CVMR suggests sharply higher recovery rates using the CVMR process which, rather than making a typical concentrate, is optimized at producing a finished product. The CVMR process also would create Iron and Platinum by-products, further increasing the potential yield.

Power Nickel would expect to release prior to year-end benchmark studies from CVMR that provide insight into these enhanced recoveries. Based on data gathered through their multiple plants around the world and initial work done on Nisk Main, the CVMR process is expected to show recoveries 25

The objective of the CVMR process is to develop finished products like powders, nano powders, wire, anodes, and other precursors. These finished products show typical command prices that are 2-3 times the LME pricing that Power Nickel would expect to get from production of a concentrate.

"Since August, Power Nickel has drilled 4,700 metres over seven holes and the 2023 MRE only includes the first hole of this program, PN-23-036. We are planning to add a second rig in January to test the Platinum-rich Wildcat Target area, while continuing to expand on Nisk Main. We expect to drill about 2,000 metres a month and plan to drill through the end of April 2024.

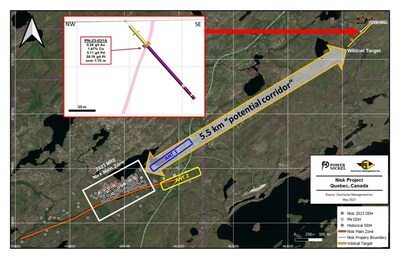

More specifically, the second rig will be targeting step-out drilling of our impressive PN-23-031A hole that had over one ounce of PGMs over 7.75 metres. The Wildcat Target is located at a full 5.5 kilometres away from Nisk Main, where the 2023 MRE noted above has been reported (see Figure 1 below)."

The Fleet Ambient Noise Tomography program (see release dated January 31, 2023) has identified several targets that have similar signatures to Nisk Main that occur within this 5.5-kilometre corridor, potentially connecting Nisk Main with the Wildcat Target area discussed above.

"We have continued to hit significant Ni-PGMs mineralization at Nisk and we look forward to accelerating its exploration in the coming months," Mr. Lynch commented.

Kenneth Williamson, Géo, M.Sc., VP Exploration at Power Nickel, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold and battery metal prospects in

On February 1, 2021 Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Nickel, formerly Chilean Metals is focused on confirming and expanding its current high-grade nickel-copper PGE mineralization historical resource by preparing a new Mineral Resource Estimate in accordance with NI 43-101, identifying additional high-grade mineralization, and developing a process to potentially produce nickel sulphates responsibly for batteries to be used in the electric vehicles industry.

Power Nickel (then called Chilean Metals) announced on June 8th, 2021 that an agreement has been made to complete the

Power Nickel is 100-per-cent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern

- The independent qualified persons for the 2023 MRE, as defined by National Instrument 43-101 guidelines, are Pierre-Luc Richard, P.Geo. of PLR Resources; Jeffrey Cassoff, P.Eng. of BBA is the independent qualified person for the Pit shell analysis and cut-off grade calculations; Gordon Marrs, P.Eng. of XPS is the independent qualified person for Metallurgy and Smelter Costs. The effective date of the 2023 MRE is November 26, 2023.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Mineral Resources in this MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as Indicated or Measured; however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Mineral resources are presented as undiluted and in-situ for an open-pit and underground scenario and are considered to have reasonable prospects for economic extraction. Reasonable potential mining shapes were modeled, and must-takes were included. The constraining pit shell was developed using overall pit slopes of 45 degrees in bedrock and 25 degrees in overburden. Mineral resources show sufficient continuity and isolated blocks were discarded.

- The MRE was prepared using Leapfrog Edge version 2023.2.0 and is based on 117 surface drillholes and 3,835 samples, of which 96 drillholes were intercepting in the Nisk Main Zone. The cut-off date for the drillhole database was November 26, 2023 with hole PN-23-036 being the last hole being included.

- The MRE encompasses one mineralized zone defined by a constraining solid with a minimum true thickness of 2.0 m. A value of zero grade was applied where core has not been assayed.

- High-grade capping was done on the composited assay data. Capping grades are as follow:

2% for Nickel,1.5% for Copper,0.15% for Cobalt, 1.2 g/t for Platinum, and 3 g/t for Palladium. - Density values were calculated for the Main Zone from the density of the host rock, adjusted by the amount of Nickel as determined by metal assays. A formula was calculated and validated using a database of measured densities. Country rock density vary from 2.70 g/cm3 to 2.85 g/cm3. The Main Zone density vary from 2.63 g/cm3 to 3.96 g/cm3.

- Grade model mineral resource estimation was calculated from drillhole data using an Ordinary Kriging interpolation method in sub-block model using blocks measuring 5 m x 5 m x 5 m in size.

- Nickel equivalency grade was calculated using metal prices (see below), metallurgical recoveries, smelter payables and charges. Metallurgical recoveries are

70% for Nickel,44% for Copper,79% for Cobalt, and67% for Palladium. Payables are73% for Nickel,69% for Copper,27% for Cobalt, and78% for Palladium. NiEq = Ni grade + (0.2359 x Cu grade) + (0.9388 x Co grade) + (0.1810 x Pd grade) - The estimate is reported using a NiEq cut-off grade of

0.20% for open-pit mineral resources and0.55% for underground mineral resources. The cut-off grade was calculated using the following parameters (amongst others): Nickel price:USD10.00 /lb; Copper price:USD4.00 /lb; Cobalt price:USD22.50 /lb; Palladium price:USD1,215.00 /oz; CAD:USD exchange rate = 1.30. The cut-off grade will be re-evaluated in light of future prevailing market conditions and costs. The pit shell optimization used the same parameters. - The pit shell includes 3.6M tonnes of overburden and waste rock resulting in a strip ratio of 7:1.

- The MRE presented herein is categorized as Inferred and Indicated Mineral Resources. The Inferred Mineral Resource category is constrained to areas where drill spacing is less than 150 metres and the Indicated Mineral Resource category is constrained to areas where drill spacing is less than 80 metres. In both cases, reasonable geological and grade continuity were also a criteria during the classification process.

- Calculations used metric units (metre, tonne). Metal contents are presented in percent, tonnes, or ounces. Metric tonnages were rounded and any discrepancies in total amounts are due to rounding errors.

- CIM definitions and guidelines for Mineral Resource Estimates have been followed.

- The QP is not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical or marketing issues, or any other relevant issues that could materially affect this MRE.

- The QP is not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical or marketing issues, or any other relevant issues that could materially affect this MRE.

Neither the TSX Venture Exchange nor it's Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

This message contains certain statements that may be deemed "forward-looking statements" concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "indicates," "opportunity," "possible" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others, the timing for various drilling plans; the timing for various activities being conducted by CVMR and potential recovery rates by CVMR processes; the ability to raise sufficient capital to fund its obligations under its property agreements going forward and conduct drilling and exploration; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company's plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/power-nickel-closes-0-90-per-share-flow-through-financing-of-2-75-million-302004820.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/power-nickel-closes-0-90-per-share-flow-through-financing-of-2-75-million-302004820.html

SOURCE Power Nickel Inc.

FAQ

What was the value and price per share of the flow-through financing recently closed by Power Nickel Inc. (PNPN)?

Who secured the investors for Power Nickel Inc.'s flow-through financing?

What is the shareholder acquisition by CVMR Inc. related to?

What did Power Nickel Inc.'s inaugural NI 43-101 mineral resources estimate display?

What are the positive impacts that the CVMR process will bring to Power Nickel Inc.'s project?