Piedmont Lithium Announces Q3’24 North American Lithium Operational Results

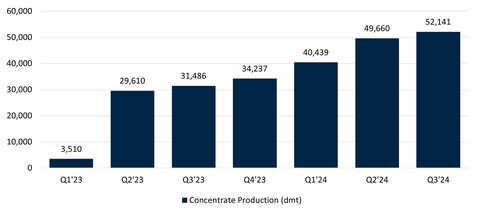

Piedmont Lithium (NASDAQ:PLL) reported Q3'24 operational results from its North American Lithium (NAL) joint venture. The company shipped approximately 31,500 dmt of spodumene concentrate in Q3'24 and targets 55,000 dmt for Q4. NAL achieved record quarterly production of 52,141 dmt, up 5% from Q2'24, with mill utilization reaching 91% and lithium recovery at 67%. Due to a customer request, a planned cargo will shift from Q4'24 to early Q1'25, adjusting 2024 guidance from 126,000 dmt to approximately 116,000 dmt. The company reported improved unit operating costs, declining 15% quarter-over-quarter.

Piedmont Lithium (NASDAQ:PLL) ha riportato i risultati operativi del terzo trimestre '24 dalla sua joint venture North American Lithium (NAL). L'azienda ha spedito circa 31.500 dmt di concentrato di spodumene nel terzo trimestre '24 e punta a 55.000 dmt per il quarto trimestre. NAL ha raggiunto una produzione trimestrale record di 52.141 dmt, con un aumento del 5% rispetto al secondo trimestre '24, mentre l'utilizzo del forno ha raggiunto il 91% e il recupero del litio si attesta al 67%. A causa di una richiesta di un cliente, un carico pianificato sarà spostato dal quarto trimestre '24 all'inizio del primo trimestre '25, adattando le previsioni del 2024 da 126.000 dmt a circa 116.000 dmt. L'azienda ha riportato costi operativi unitari migliorati, con una diminuzione del 15% rispetto al trimestre precedente.

Piedmont Lithium (NASDAQ:PLL) reportó los resultados operativos del tercer trimestre '24 de su empresa conjunta North American Lithium (NAL). La compañía envió aproximadamente 31,500 dmt de concentrado de espodumena en el tercer trimestre '24 y tiene como objetivo 55,000 dmt para el cuarto trimestre. NAL alcanzó una producción trimestral récord de 52,141 dmt, un aumento del 5% con respecto al segundo trimestre '24, con una utilización del molino del 91% y una recuperación de litio del 67%. Debido a una solicitud de un cliente, una carga planificada se trasladará del cuarto trimestre '24 a principios del primer trimestre '25, ajustando la guía para 2024 de 126,000 dmt a aproximadamente 116,000 dmt. La compañía reportó costos operativos unitarios mejorados, disminuyendo un 15% de un trimestre a otro.

피에몬트 리튬 (NASDAQ:PLL)은 북미 리튬(NAL) 합작 투자의 2024년 3분기 운영 결과를 발표했습니다. 이 회사는 2024년 3분기에 약 31,500 dmt의 스포듐 광석을 배송했으며, 4분기에는 55,000 dmt를 목표로 하고 있습니다. NAL은 3개월 동안 52,141 dmt의 기록적인 분기 생산을 달성했으며, 이는 2024년 2분기 대비 5% 증가하였고, 밀 가동률은 91%, 리튬 회수율은 67%에 달했습니다. 고객 요청에 따라, 계획된 화물은 2024년 4분기에서 2025년 1분기 초로 이동하게 되어 2024년 가이드를 126,000 dmt에서 약 116,000 dmt로 조정했습니다. 이 회사는 분기별로 운영 비용이 15% 감소하였음을 보고했습니다.

Piedmont Lithium (NASDAQ:PLL) a annoncé les résultats opérationnels du troisième trimestre '24 de sa coentreprise North American Lithium (NAL). L'entreprise a expédié environ 31 500 dmt de concentré de spodumène au troisième trimestre '24 et vise 55 000 dmt pour le quatrième trimestre. NAL a atteint une production trimestrielle record de 52 141 dmt, en hausse de 5 % par rapport au deuxième trimestre '24, avec une utilisation du moulin atteignant 91 % et un taux de récupération du lithium de 67 %. En raison d'une demande d'un client, une cargaison planifiée sera déplacée du quatrième trimestre '24 au début du premier trimestre '25, ajustant ainsi les prévisions pour 2024 de 126 000 dmt à environ 116 000 dmt. L'entreprise a signalé une amélioration des coûts d'exploitation unitaires, en baisse de 15 % par rapport au trimestre précédent.

Piedmont Lithium (NASDAQ:PLL) berichtete über die Betriebsergebnisse des dritten Quartals '24 aus seinem Joint Venture North American Lithium (NAL). Das Unternehmen lieferte im dritten Quartal '24 etwa 31.500 dmt Spodumenkonzentrat aus und strebt für das vierte Quartal 55.000 dmt an. NAL erzielte eine rekordverdächtige Quartalsproduktion von 52.141 dmt, was einem Anstieg von 5 % gegenüber dem zweiten Quartal '24 entspricht, wobei die Mühlen-Auslastung 91 % erreichte und die Lithium-Rückgewinnung bei 67 % lag. Aufgrund einer Kundenanfrage wird eine geplante Lieferung vom vierten Quartal '24 auf Anfang des ersten Quartals '25 verschoben, was die Prognose für 2024 von 126.000 dmt auf etwa 116.000 dmt anpasst. Das Unternehmen berichtete von verbesserten Betriebskosten pro Einheit, die im Quartalsvergleich um 15 % gesunken sind.

- Record quarterly production of 52,141 dmt, up 5% from Q2'24

- Mill utilization reached record high of 91%, up from 83% in Q2'24

- Unit operating costs decreased by 15% quarter-over-quarter

- YTD concentrate shipments up 110% compared to 2023

- Lithium recovery declined marginally to 67% from 68% in Q2'24

- 2024 guidance reduced from 126,000 dmt to 116,000 dmt due to cargo shift

Insights

The Q3'24 operational results from NAL demonstrate significant progress in production efficiency and scale. The 5% increase in quarterly production to 52,141 dmt and 91% mill utilization mark important operational milestones. The

The 67% lithium recovery rate remains stable despite slight feed grade reduction. While the adjustment of 2024 shipment guidance from 126,000 dmt to 116,000 dmt due to cargo timing might appear concerning, it's merely a timing issue that should benefit 2025 numbers. The doubling of year-over-year concentrate shipments to 60,900 dmt YTD indicates strong execution of the production ramp-up strategy.

The incident-free safety performance in September is particularly noteworthy as it demonstrates operational maturity and reduced operational risk. The recent Mineral Resource Estimate upgrade suggests potential for production expansion, though this would require careful evaluation of market conditions.

-

Piedmont shipped approximately 31,500 dmt of spodumene concentrate in Q3’24; targets 55,000 dmt in Q4 -

Record quarterly production of 52,141 dmt, up

5% from Q2’24 as NAL continues to increase production -

NAL achieved mill utilization of

91% and lithium recovery of67% in Q3’24 - Incident-free safety performance records achieved at NAL in September 2024

Figure 1: NAL Concentrate Production (Graphic: Business Wire)

In response to a customer request, the Company will shift a planned cargo from Q4’24 to early Q1’25. As a result, Piedmont is targeting shipments of approximately 55,000 dmt of spodumene concentrate in Q4 for total 2024 shipments of approximately 116,000 dmt. While this single cargo push into early 2025 will cause a nominal adjustment from our prior guidance of 126,000 dmt for 2024, we expect this shift to be accretive to our 2025 shipments totals and does not impact Piedmont’s total offtake quantities at NAL.2

Q3’24 Operational Results Summary

Piedmont Lithium |

Units |

Q3’24 |

Q2’24 |

QoQ Variance |

2024 YTD |

2023 YTD |

YoY Variance |

Concentrate Shipped |

kt dmt |

31.5 |

15.5 |

|

60.9 |

29.0 |

|

Average Grade |

% Li2O |

~ |

~ |

( |

~ |

~ |

|

NAL1 |

Units |

Q3’24 |

Q2’24 |

QoQ Variance |

2024 YTD |

2023 YTD |

YoY Variance |

Ore Mined |

kt wmt |

240.3 |

233.7 |

|

825.1 |

562.8 |

|

Concentrate Produced |

kt dmt |

52.1 |

49.7 |

|

142.2 |

64.6 |

|

Plant (Mill) Utilization |

% |

|

|

|

|

|

|

Lithium Recovery |

% |

|

|

( |

|

|

|

Concentrate Shipped |

kt dmt |

49.0 |

27.7 |

|

134.8 |

48.2 |

|

In Q3’24, NAL produced 52,141 dmt and shipped 48,992 dmt, of which approximately 31,500 dmt of spodumene concentrate were sold to

NAL increased quarterly production by

“We are pleased to see the benefits from investments made at NAL during the last quarter, with the increase in quarterly production cementing NAL’s status as the largest spodumene producing mine in North America,” said Keith Phillips, President and CEO of Piedmont Lithium. “Operational performance continues to improve on a quarterly basis and Sayona’s recent announcement of the increase to the Mineral Resource Estimate lays the foundation for a potential growth at NAL in the future.”

1 All references to information about or related to NAL are from the September 2024 Quarterly Activities Report filed with the ASX by Sayona Mining Limited on 24 October 2024.

2 The timing of shipments is subject to shipping logistics, port and weather conditions, and customer requirements.

About Piedmont Lithium

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in

Cautionary Note to U.S. Investors

Piedmont’s public disclosures are governed by the

The statements in the link below were prepared by, and made by, NAL. The following disclosures are not statements of

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in

View source version on businesswire.com: https://www.businesswire.com/news/home/20241028917492/en/

Erin Sanders

SVP, Corporate Communications & Investor Relations

T: +1 704 575 2549

E: esanders@piedmontlithium.com

Source: Piedmont Lithium Inc.