PAN GLOBAL REPORTS POSITIVE COPPER METALLURGY RESULTS FOR THE LA ROMANA COPPER-TIN-SILVER DISCOVERY, SPAIN

TSXV: PGZ | OTCQX: PGZFF | FSE: 2EU

- Copper metallurgy tests confirm saleable concentrate grades are achievable across the deposit through a simple conventional flotation process flowsheet

- Excellent recoveries up to

88% copper - Concentrate grades up to

32.5% copper, with payable silver content and low deleterious elements - Positive results advance La Romana to the preliminary design phase of the metallurgical process

"The new copper metallurgy test results for the La Romana deposit are further confirmation that simple conventional froth flotation can produce a high-value, high-quality, and clean copper concentrate at potentially lower cost than the average within the pyrite belt. These characteristics are highly desirable for smelters and potentially attractive for blending with lesser quality concentrates to increase the value and reduce penalty costs. The results are an important project development step to determine optimum process economics, metal recoveries, cash flow projections, and economic studies," said Tim Moody, Pan Global's President & CEO.

The metallurgical test program is being conducted by Wardell Armstrong International (

Minepro Solutions SL reported on March 19, 2024: "As compared to the average of deposits within the Pyrite Belt, the La Romana mineral deposit has demonstrated lower energy requirements for both crushing and grinding, coarser liberation sizes, as well as superior performance in the flotation process for copper. This includes higher concentrate grades and improved recoveries using conventional circuits and chemical agents, which indicates an anticipation of moderate operating costs related to the process."

- A simple conventional flotation flowsheet can achieve saleable concentrate grades and good recoveries for La Romana copper mineralization.

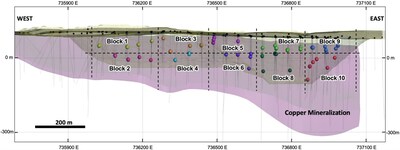

- A series of open circuit rougher and cleaner flotation tests were performed on composites from 10 blocks distributed across the deposit (see Figure 1 below) and compared to a reference sample from previous test work:

- Head grades ranged from

0.33% Cu to0.54% Cu (average0.40% Cu) - Flotation tests for seven of the blocks (blocks 1-5, 8 and 10) established attractive concentrate grades ranging from

26.8% to32.5% Cu (average29.1% Cu) and overall recoveries from73.5% to88.3% Cu (average81.4% Cu) - Additional tests with finer regrinding indicate target concentrate grades and good recoveries for the other three blocks (blocks 6, 7 and 9)

- Where concentrates exceeded

30% Cu, the number of cleaning cycles were reduced from 3 to 2, simplifying and improving copper recovery - Results indicate copper concentrate grades and recoveries increase with higher head grades

- Head grades ranged from

- Locked Cycle Tests (LCT) conducted on four of the 10 blocks resulted in Cu recoveries to concentrates ranging from

72% to88.7% Cu and concentrate grades of22.7% to30.6% Cu. These compare closely to the83.54% recovery and concentrate grade of28.54% Cu for the reference sample used as the baseline for comparison. - Multi-element analyses on the final concentrates from the four LCT confirmed low concentrations of deleterious elements (As, Sb, Bi, Hg, Cl, and F) and the potential for a silver credit with grades from 88 to 102g/t Ag, contributing to a higher Net Smelter Return potential.

- Tests to determine energy required for milling ore returned Bond Ball Mill Work Index (BBMWi) results ranging from 12.23 to 16.97 kWh/t (average 14.99 kWh/t). The average energy requirement is a slight improvement on the reference sample (15.48 kWh/t), and is classified as medium to hard.

- Additional optimization of the flotation processing and costing will be undertaken to enhance potential economics.

The primary objective of the La Romana metallurgical test program is to determine the optimal mineral processing flowsheet and treatment plant design to produce marketable copper and tin concentrates.

The metallurgical variability study and new BBMWi tests were carried out using drill core sample composites selected from 10 blocks distributed throughout the La Romana deposit, and at different depths to help simulate different mining extraction phases. Applying the same test conditions, the results for all the blocks were compared with a reference sample ("REF") from previous successful metallurgical test work reported on April 11, 2023.

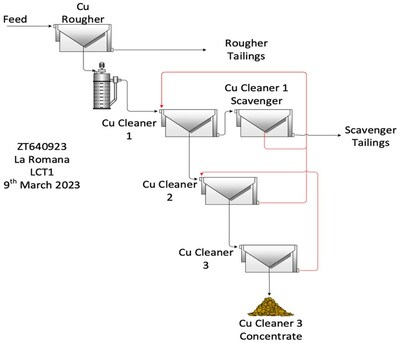

The processing flowsheet for the variability tests replicated the flowsheet and chemical reagents used for the reference sample. Specifically:

- Each composite consisted of a minimum 30 kg of material from selected drill core

- Initial crush to reduce the material to 1mm for head grade assay and comminution tests, including ball milling amenability and net power requirements

- Primary grind size of 106 microns, followed by a copper rougher flotation stage to maximize recovery of the copper minerals to a concentrate at a coarse particle size

- Regrinding of the rougher concentrate down to 20 or 15 microns, contingent upon the cleaner performance

- Further extraction and upgrading of the copper concentrates through a series of two to three cleaner flotation stages

- Locked Cycle Tests on 4 of the 10 blocks

- Recoveries calculated from correlating locked cycle tests results with open circuit flotation results

Approximately 50 additional drill holes were completed at La Romana after the samples for the variability test program were selected in May 2023, and the copper deposit has been extended to the west at surface by 400 meters and remains open for further expansion. Consideration will be given to extending the metallurgical test work to the western extension of La Romana.

Tin metallurgy results are expected to be reported shortly, and results are pending for additional drill holes at the Cañada Honda discovery. Additional drilling is planned at both La Romana and Cañada Honda as part of the 2024 drilling program.

Table 1 – Summary Locked Cycle Test results and reference sample (REF)

Head Grade | Concentrate Grade | Recovery | |

BLOCK | Cu % | Cu % | Cu % |

REF | 0.39 | 28.54 | 86.40 |

2 | 0.37 | 30.60 | 87.61 |

5 | 0.38 | 22.71 | 78.23 |

6 | 0.34 | 25.45 | 71.98 |

10 | 0.37 | 23.86 | 88.68 |

Table 2 – Head grades, Open Circuit concentrate grades and recoveries

Block | Cycles | Head Grade | Grind | Regrind | Open Circuit | Interpolated LCT |

Cu % | µm | µm | Cu % | Cu % Recovery | ||

REF | 1 Ro + 3 Cl | 0.39 | 106 | 20 | 30.18 | 86.15 |

B.1 | 1 Ro + 2 Cl | 0.33 | 106 | 20 | 32.49 | 76.40 |

B.2 | 1 Ro + 2 Cl | 0.37 | 106 | 20 | 31.17 | 88.83 |

B.3 | 1 Ro + 2 Cl | 0.54 | 106 | 20 | 30.56 | 66.62 |

B.4 | 1 Ro + 3 Cl | 0.47 | 106 | 20 | 28.55 | 84.43 |

B.5 | 1 Ro + 3 Cl | 0.38 | 106 | 20 | 20.64 | 88.18 |

B.6 | 1 Ro + 3 Cl | 0.34 | 106 | 15 | 21.51 | 74.34 |

B.7 | 1 Ro + 3 Cl | 0.35 | 106 | 20 | 17.03 | 66.59 |

15 | 22.391 | 73.611 | ||||

B.8 | 1 Ro + 2 Cl | 0.41 | 106 | 20 | 28.77 | 82.88 |

B.9 | 1 Ro + 3 Cl | 0.39 | 106 | 20 | 15.90 | 77.91 |

15 | 20.911 | 83.221 | ||||

B.10 | 1 Ro + 3 Cl | 0.37 | 106 | 20 | 25.33 | 87.91 |

Ro = Rougher, Cl = Cleaner |

1 = Estimated |

Table 3 – Bond Ball Mill Work Index comminution test results

BLOCK | kWhr/tonne |

B.1 | 13.91 |

B.2 | 15.78 |

B.3 | 16.67 |

B.4 | 16.97 |

B.5 | 13.70 |

B.6 | 14.92 |

B.7 | 12.23 |

B.8 | 14.87 |

B.9 | 15.16 |

B.10 | 15.66 |

Average | 14.99 |

The Escacena Project comprises a large, contiguous, 5,760-hectare land package controlled

Pan Global Resources Inc. is actively targeting copper-rich mineral deposits, given copper's compelling supply-demand fundamentals and outlook for strong long-term prices as a critical metal for global electrification and energy transition. The Company's flagship Escacena Project is located in the prolific Iberian Pyrite Belt in southern

Álvaro Merino, Vice President Exploration for Pan Global Resources and a qualified person as defined by National Instrument 43-101, has approved the scientific and technical information for this media release. Mr. Merino is not independent of the Company.

Statements which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. It is important to note that actual outcomes and the Company's actual results could differ materially from those in such forward-looking statements. The Company believes that the expectations reflected in the forward-looking information included in this media release are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Risks and uncertainties include, but are not limited to, economic, competitive, governmental, environmental, and technological factors that may affect the Company's operations, markets, products, and prices. Readers should refer to the risk disclosures outlined in the Company's Management Discussion and Analysis of its audited financial statements filed with the British Columbia Securities Commission.

The forward-looking information contained in this media release is based on information available to the Company as of the date of this media release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/pan-global-reports-positive-copper-metallurgy-results-for-the-la-romana-copper-tin-silver-discovery-spain-302095507.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/pan-global-reports-positive-copper-metallurgy-results-for-the-la-romana-copper-tin-silver-discovery-spain-302095507.html

SOURCE Pan Global Resources Inc.