Pega GenAI Excitement Accelerates Growth in Q2 2024

Pegasystems (NASDAQ: PEGA) reported Q2 2024 results, highlighting a 13% YoY growth in Annual Contract Value (ACV) in constant currency. Total revenue increased by 18% to $351.2M, driven by strong performance in Pega Cloud and Subscription License. The company achieved GAAP net income of $6.6M, reversing a loss of $46.8M in Q2 2023. Non-GAAP net income surged to $45.8M from $1.2M. Free cash flow reached $218M in H1 2024. The Pega Cloud backlog exceeded $1B for the first time. CEO Alan Trefler attributed the success to innovations like Pega GenAI Blueprint and deeper client engagement. CFO Ken Stillwell emphasized improved profitability and AI innovation positioning Pega for future growth. Despite a decline in consulting revenue, the company’s overall outlook remains robust.

Pegasystems (NASDAQ: PEGA) ha riportato i risultati del secondo trimestre del 2024, evidenziando una Crescita del 13% su base annua nel Valore del Contratto Annuale (ACV) a valuta costante. Il fatturato totale è aumentato del 18% raggiungendo i 351,2 milioni di dollari, sostenuto da una forte performance in Pega Cloud e Licenza in Abbonamento. L'azienda ha ottenuto un utile netto GAAP di 6,6 milioni di dollari, invertendo una perdita di 46,8 milioni di dollari nel secondo trimestre del 2023. L'utile netto non GAAP è balzato a 45,8 milioni di dollari da 1,2 milioni. Il flusso di cassa libero ha raggiunto i 218 milioni di dollari nel primo semestre del 2024. L'ordine arretrato di Pega Cloud ha superato il miliardo di dollari per la prima volta. Il CEO Alan Trefler ha attribuito il successo a innovazioni come il Pega GenAI Blueprint e a un coinvolgimento più profondo con i clienti. Il CFO Ken Stillwell ha sottolineato il miglioramento della redditività e l'innovazione nell'IA, posizionando Pega per una crescita futura. Nonostante un declino nei ricavi da consulenza, le prospettive complessive dell'azienda rimangono solide.

Pegasystems (NASDAQ: PEGA) ha reportado los resultados del segundo trimestre de 2024, destacando un crecimiento del 13% interanual en el Valor de Contrato Anual (ACV) en moneda constante. Los ingresos totales aumentaron un 18% alcanzando los 351,2 millones de dólares, impulsados por un buen rendimiento en Pega Cloud y Licencias de Suscripción. La empresa logró un ingreso neto GAAP de 6,6 millones de dólares, recuperándose de una pérdida de 46,8 millones de dólares en el segundo trimestre de 2023. El ingreso neto no GAAP se disparó a 45,8 millones de dólares desde 1,2 millones. El flujo de caja libre alcanzó los 218 millones de dólares en la primera mitad de 2024. El backlog de Pega Cloud superó el billón de dólares por primera vez. El CEO Alan Trefler atribuyó el éxito a innovaciones como el Pega GenAI Blueprint y un mayor compromiso con los clientes. El CFO Ken Stillwell enfatizó la mejora en la rentabilidad y la innovación en IA, posicionando a Pega para el crecimiento futuro. A pesar de un declive en los ingresos por consultoría, la perspectiva general de la empresa sigue siendo robusta.

페가시스템즈(Pegasystems, NASDAQ: PEGA)가 2024년 2분기 실적을 발표하며 연간 계약 가치(ACV)가 전년 대비 13% 성장했다고 강조했습니다. 총 수익은 18% 증가한 3억 5,120만 달러에 달했으며, 이는 Pega Cloud와 구독 라이선스에서 발생한 강력한 성과에 기인합니다. 이 회사는 GAAP 기준 순이익 660만 달러를 기록하며, 2023년 2분기 4,680만 달러의 손실에서 회복했습니다. 비GAAP 기준 순이익은 120만 달러에서 4,580만 달러로 급증했습니다. 자유 현금 흐름은 2024년 상반기에 2억 1,800만 달러에 도달했습니다. Pega Cloud의 백로그는 처음으로 10억 달러를 초과했습니다. CEO 알란 트레플러는 Pega GenAI Blueprint와 고객과의 더 깊은 관계가 성공의 원인이라고 밝혔습니다. CFO 켄 스틸웰은 개선된 수익성과 인공지능 혁신이 Pega의 미래 성장을 위해 자리잡을 것이라고 강조했습니다. 비록 컨설팅 수익이 감소했지만, 회사의 전반적인 전망은 여전히 탄탄합니다.

Pegasystems (NASDAQ: PEGA) a déclaré les résultats du deuxième trimestre de 2024, mettant en évidence une croissance de 13% d'une année sur l'autre de la valeur du contrat annuel (ACV) en monnaie constante. Le chiffre d'affaires total a augmenté de 18% pour atteindre 351,2 millions de dollars, soutenu par de solides performances dans Pega Cloud et licences par abonnement. L'entreprise a réalisé un bénéfice net GAAP de 6,6 millions de dollars, inversant une perte de 46,8 millions de dollars au deuxième trimestre 2023. Le bénéfice net non-GAAP a bondi à 45,8 millions de dollars contre 1,2 million de dollars. Le flux de trésorerie libre a atteint 218 millions de dollars au premier semestre 2024. Le carnet de commandes de Pega Cloud a dépassé 1 milliard de dollars pour la première fois. Le PDG Alan Trefler a attribué ce succès à des innovations comme le Pega GenAI Blueprint et à un engagement client plus profond. Le CFO Ken Stillwell a souligné l'amélioration de la rentabilité et l'innovation en IA, positionnant Pega pour une croissance future. Malgré une diminution des revenus de conseil, les perspectives globales de l'entreprise restent solides.

Pegasystems (NASDAQ: PEGA) hat die Ergebnisse des zweiten Quartals 2024 veröffentlicht und ein Wachstum des Vertrages jährlich um 13% im jährlichen Vertrauenswert (ACV) in konstanten Währungen hervorgehoben. Der Gesamtumsatz stieg um 18% auf 351,2 Millionen US-Dollar, angetrieben durch starke Leistungen in Pega Cloud und Abonnementlizenzen. Das Unternehmen erzielte einen GAAP-Nettoertrag von 6,6 Millionen US-Dollar und wendete einen Verlust von 46,8 Millionen US-Dollar im zweiten Quartal 2023 um. Der Nicht-GAAP-Nettoertrag stieg auf 45,8 Millionen US-Dollar von 1,2 Millionen US-Dollar. Der freie Cashflow erreichte 218 Millionen US-Dollar im ersten Halbjahr 2024. Der Pega Cloud-Auftragsbestand überstieg zum ersten Mal 1 Milliarde US-Dollar. CEO Alan Trefler führte den Erfolg auf Innovationen wie den Pega GenAI Blueprint und eine tiefere Kundeneinbindung zurück. CFO Ken Stillwell betonte die verbesserte Rentabilität und die Innovationskraft der KI, die Pega für zukünftiges Wachstum positioniert. Trotz eines Rückgangs des Beratungsumsatzes bleibt der Gesamtausblick des Unternehmens robust.

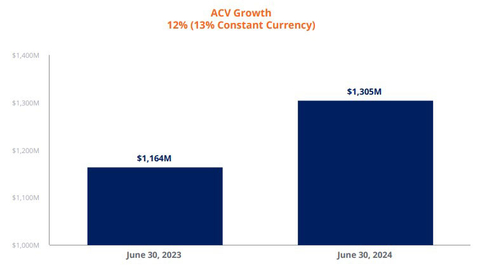

- Annual Contract Value (ACV) grew 13% YoY in constant currency

- Total revenue increased by 18% YoY to $351.2M

- Pega Cloud backlog exceeded $1B

- Free cash flow hit $218M in H1 2024

- GAAP net income of $6.6M, a reversal from a loss of $46.8M in Q2 2023

- Non-GAAP net income surged to $45.8M from $1.2M

- Pega GenAI Blueprint driving deeper client engagement and growth

- Consulting revenue declined by 11% YoY

Insights

Pegasystems' Q2 2024 results demonstrate strong growth and improving profitability, driven by their AI-focused strategy. The 13% year-over-year increase in Annual Contract Value (ACV) to

Key financial highlights include:

- Total revenue up

18% year-over-year to$351.2 million - Non-GAAP net income surged to

$45.8 million , a remarkable3711% increase - Non-GAAP diluted EPS rose to

$0.52 , up5100%

The shift towards a subscription-based model is evident, with subscription revenue now accounting for

The company's focus on AI, particularly generative AI, appears to be paying off. The Pega GenAI Blueprint™ offering has generated significant interest, potentially creating a pipeline for future growth. With Pega Cloud backlog exceeding

However, investors should note the decline in consulting revenue (

Pegasystems' Q2 results underscore the growing importance of AI in enterprise software. The company's strategic focus on both statistical and generative AI is proving to be a key differentiator in the competitive enterprise AI market.

The Pega GenAI Blueprint™ tool, which has facilitated the creation of tens of thousands of blueprints in just a few months, demonstrates strong market traction. This rapid adoption suggests that Pega is successfully addressing a critical need in the enterprise space for AI-driven process optimization and automation.

The

However, the tech landscape is rapidly evolving, especially in the AI space. Pega will need to continue innovating to maintain its competitive edge against both established players and agile startups. The company's ability to integrate generative AI capabilities into its core offerings while ensuring scalability, security and regulatory compliance will be important for long-term success.

Overall, Pega's Q2 results suggest that its AI strategy is gaining traction, positioning the company well in the growing market for enterprise AI solutions.

-

Annual contract value (ACV) grows

13% year over year in constant currency -

Cash flow from operations reaches

$220 million $218 million -

Pega Cloud backlog exceeds

$1 billion

ACV Growth (Graphic: Business Wire)

“Our approach to statistical AI and generative AI continues to be a significant differentiator,” said Alan Trefler, founder and CEO. “The offerings we’ve introduced, especially Pega GenAI Blueprint™, have captured the imagination of clients, prospects, and partners, allowing them to identify new possibilities and helping us drive deeper engagement. With tens of thousands of blueprints created over the last few months, we’re identifying opportunities to accelerate growth and creating additional momentum for Pega Cloud®.”

"I'm really proud to see how our team is improving profitability while driving ACV growth,” said Ken Stillwell, COO and CFO. “Our strong execution and our AI innovation put us in a fantastic position to pursue the massive digital transformation opportunity in front of us.”

Financial and performance metrics (1)

Reconciliation of ACV and Constant Currency ACV

(in millions, except percentages) |

June 30, 2023 |

|

June 30, 2024 |

|

1-Year Change |

|||

ACV |

$ |

1,164 |

|

$ |

1,305 |

|

12 |

% |

Impact of changes in foreign exchange rates |

|

— |

|

|

5 |

|

|

|

Constant currency ACV |

$ |

1,164 |

|

$ |

1,310 |

|

13 |

% |

Note: Constant currency ACV is calculated by applying the June 30, 2023 foreign exchange rates to all periods shown. |

||||||||

______________________________

1 Refer to the schedules at the end of this release for additional information, including a reconciliation of GAAP and non-GAAP measures.

| (Dollars in thousands,

except per share amounts) |

Three Months Ended June 30, |

|

|

|

Six Months Ended June 30, |

|

|

|||||||||||||

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

||||||||||

Total revenue |

$ |

351,153 |

|

$ |

298,268 |

|

|

18 |

% |

|

$ |

681,300 |

|

|

$ |

623,740 |

|

|

9 |

% |

Net income (loss) - GAAP |

$ |

6,613 |

|

$ |

(46,804 |

) |

|

* |

|

$ |

(5,511 |

) |

|

$ |

(67,578 |

) |

|

92 |

% |

|

Net income - non-GAAP |

$ |

45,841 |

|

$ |

1,203 |

|

|

3711 |

% |

|

$ |

87,995 |

|

|

$ |

20,423 |

|

|

331 |

% |

Diluted earnings (loss) per share - GAAP |

$ |

0.07 |

|

$ |

(0.56 |

) |

|

* |

|

$ |

(0.07 |

) |

|

$ |

(0.82 |

) |

|

91 |

% |

|

Diluted earnings per share - non-GAAP |

$ |

0.52 |

|

$ |

0.01 |

|

|

5100 |

% |

|

$ |

1.00 |

|

|

$ |

0.24 |

|

|

317 |

% |

(Dollars in thousands) |

Three Months Ended June 30, |

|

Change |

|

Six Months Ended June 30, |

|

Change |

||||||||||||||||||||||||

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|||||||||||||||||||||||

Pega Cloud |

$ |

134,086 |

38 |

% |

|

$ |

115,063 |

39 |

% |

|

$ |

19,023 |

|

17 |

% |

|

$ |

264,988 |

39 |

% |

|

$ |

222,942 |

36 |

% |

|

$ |

42,046 |

|

19 |

% |

Maintenance |

|

80,344 |

23 |

% |

|

|

82,042 |

27 |

% |

|

|

(1,698 |

) |

(2 |

)% |

|

|

161,345 |

23 |

% |

|

|

161,672 |

26 |

% |

|

|

(327 |

) |

— |

% |

Subscription services |

|

214,430 |

61 |

% |

|

|

197,105 |

66 |

% |

|

|

17,325 |

|

9 |

% |

|

|

426,333 |

62 |

% |

|

|

384,614 |

62 |

% |

|

|

41,719 |

|

11 |

% |

Subscription license |

|

84,647 |

24 |

% |

|

|

41,197 |

14 |

% |

|

|

43,450 |

|

105 |

% |

|

|

147,985 |

22 |

% |

|

|

125,724 |

20 |

% |

|

|

22,261 |

|

18 |

% |

Subscription |

|

299,077 |

85 |

% |

|

|

238,302 |

80 |

% |

|

|

60,775 |

|

26 |

% |

|

|

574,318 |

84 |

% |

|

|

510,338 |

82 |

% |

|

|

63,980 |

|

13 |

% |

Consulting |

|

52,040 |

15 |

% |

|

|

58,387 |

19 |

% |

|

|

(6,347 |

) |

(11 |

)% |

|

|

106,087 |

16 |

% |

|

|

111,420 |

18 |

% |

|

|

(5,333 |

) |

(5 |

)% |

Perpetual license |

|

36 |

— |

% |

|

|

1,579 |

1 |

% |

|

|

(1,543 |

) |

(98 |

)% |

|

|

895 |

— |

% |

|

|

1,982 |

— |

% |

|

|

(1,087 |

) |

(55 |

)% |

|

$ |

351,153 |

100 |

% |

|

$ |

298,268 |

100 |

% |

|

$ |

52,885 |

|

18 |

% |

|

$ |

681,300 |

100 |

% |

|

$ |

623,740 |

100 |

% |

|

$ |

57,560 |

|

9 |

% |

Quarterly conference call

A conference call and audio-only webcast will be conducted at 8:00 a.m. EDT on Thursday, July 25, 2024.

Members of the public and investors are invited to join the call and participate in the question and answer session by dialing 1 (888) 415-4305 (domestic) or 1 (646) 960-0336 (international) and using Conference ID 1559653, or via https://events.q4inc.com/attendee/610142887 by logging onto www.pega.com at least five minutes prior to the event's broadcast and clicking on the webcast icon in the Investors section.

Discussion of non-GAAP financial measures

Our non-GAAP financial measures should only be read in conjunction with our consolidated financial statements prepared in accordance with GAAP. We believe that these measures help investors understand our core operating results and prospects, which is consistent with how management measures and forecasts our performance without the effect of often one-time charges and other items outside our normal operations. Management uses these measures to assess the performance of the company's operations and establish operational goals and incentives. They are not a substitute for financial measures prepared under

Forward-looking statements

Certain statements in this press release may be "forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995.

Words such as expects, anticipates, intends, plans, believes, will, could, should, estimates, may, targets, strategies, intends to, projects, forecasts, guidance, likely, and usually or variations of such words and other similar expressions identify forward-looking statements. These statements represent our views only as of the date the statement was made and are based on current expectations and assumptions.

Forward-looking statements deal with future events and are subject to risks and uncertainties that are difficult to predict, including, but not limited to:

- our future financial performance and business plans;

- the adequacy of our liquidity and capital resources;

- the continued payment of our quarterly dividends;

- the timing of revenue recognition;

- variation in demand for our products and services, including among clients in the public sector;

- reliance on key personnel;

- reliance on third-party service providers, including hosting providers;

- compliance with our debt obligations and covenants;

- the potential impact of our convertible senior notes and Capped Call Transactions;

- foreign currency exchange rates;

- potential legal and financial liabilities, as well as damage to our reputation, due to cyber-attacks;

- security breaches and security flaws;

- our ability to protect our intellectual property rights, costs associated with defending such rights, intellectual property rights claims, and other related claims by third parties against us, including related costs, damages, and other relief that may be granted against us;

- our ongoing litigation with Appian Corp.;

- our client retention rate; and

- management of our growth.

These risks and others that may cause actual results to differ materially from those expressed in such forward-looking statements are described further in Part I of our Annual Report on Form 10-K for the year ended December 31, 2023, and other filings we make with the

Investors are cautioned not to place undue reliance on such forward-looking statements, and there are no assurances that the results included in such statements will be achieved. Although subsequent events may cause our view to change, except as required by applicable law, we do not undertake and expressly disclaim any obligation to publicly update or revise these forward-looking statements, whether as the result of new information, future events, or otherwise.

Any forward-looking statements in this press release represent our views as of July 24, 2024.

About Pegasystems

Pega provides a powerful platform that empowers the world's leading organizations to unlock business-transforming outcomes with real-time optimization. Clients use our enterprise AI decisioning and workflow automation to solve their most pressing business challenges - from personalizing engagement to automating service to streamlining operations. Since 1983, we've built our scalable and flexible architecture to help enterprises meet today's customer demands while continuously transforming for tomorrow. For more information on how Pega (NASDAQ: PEGA) empowers its clients to Build for Change®, https://www.pega.com.

All trademarks are the property of their respective owners.

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) |

|||||||||||||||

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

||||||||||||

|

2024 |

|

2023 |

|

2024 |

|

2023 |

||||||||

Revenue |

|

|

|

|

|

|

|

||||||||

Subscription services |

$ |

214,430 |

|

|

$ |

197,105 |

|

|

$ |

426,333 |

|

|

$ |

384,614 |

|

Subscription license |

|

84,647 |

|

|

|

41,197 |

|

|

|

147,985 |

|

|

|

125,724 |

|

Consulting |

|

52,040 |

|

|

|

58,387 |

|

|

|

106,087 |

|

|

|

111,420 |

|

Perpetual license |

|

36 |

|

|

|

1,579 |

|

|

|

895 |

|

|

|

1,982 |

|

Total revenue |

|

351,153 |

|

|

|

298,268 |

|

|

|

681,300 |

|

|

|

623,740 |

|

Cost of revenue |

|

|

|

|

|

|

|

||||||||

Subscription services |

|

36,238 |

|

|

|

36,783 |

|

|

|

72,062 |

|

|

|

73,647 |

|

Subscription license |

|

477 |

|

|

|

623 |

|

|

|

1,120 |

|

|

|

1,342 |

|

Consulting |

|

60,231 |

|

|

|

58,710 |

|

|

|

118,413 |

|

|

|

119,058 |

|

Perpetual license |

|

— |

|

|

|

24 |

|

|

|

9 |

|

|

|

27 |

|

Total cost of revenue |

|

96,946 |

|

|

|

96,140 |

|

|

|

191,604 |

|

|

|

194,074 |

|

Gross profit |

|

254,207 |

|

|

|

202,128 |

|

|

|

489,696 |

|

|

|

429,666 |

|

Operating expenses |

|

|

|

|

|

|

|

||||||||

Selling and marketing |

|

139,761 |

|

|

|

143,858 |

|

|

|

267,456 |

|

|

|

293,655 |

|

Research and development |

|

75,425 |

|

|

|

73,931 |

|

|

|

147,538 |

|

|

|

149,307 |

|

General and administrative |

|

25,420 |

|

|

|

23,462 |

|

|

|

48,947 |

|

|

|

46,572 |

|

Litigation settlement, net of recoveries |

|

— |

|

|

|

— |

|

|

|

32,403 |

|

|

|

— |

|

Restructuring |

|

635 |

|

|

|

2,167 |

|

|

|

798 |

|

|

|

3,628 |

|

Total operating expenses |

|

241,241 |

|

|

|

243,418 |

|

|

|

497,142 |

|

|

|

493,162 |

|

Income (loss) from operations |

|

12,966 |

|

|

|

(41,290 |

) |

|

|

(7,446 |

) |

|

|

(63,496 |

) |

Foreign currency transaction gain (loss) |

|

437 |

|

|

|

(3,290 |

) |

|

|

(2,825 |

) |

|

|

(5,965 |

) |

Interest income |

|

6,785 |

|

|

|

1,814 |

|

|

|

12,066 |

|

|

|

3,299 |

|

Interest expense |

|

(1,656 |

) |

|

|

(1,778 |

) |

|

|

(3,408 |

) |

|

|

(3,696 |

) |

(Loss) income on capped call transactions |

|

(3,277 |

) |

|

|

(1,361 |

) |

|

|

22 |

|

|

|

1,845 |

|

Other income, net |

|

— |

|

|

|

5,702 |

|

|

|

1,684 |

|

|

|

12,285 |

|

Income (loss) before provision for income taxes |

|

15,255 |

|

|

|

(40,203 |

) |

|

|

93 |

|

|

|

(55,728 |

) |

Provision for income taxes |

|

8,642 |

|

|

|

6,601 |

|

|

|

5,604 |

|

|

|

11,850 |

|

Net income (loss) |

$ |

6,613 |

|

|

$ |

(46,804 |

) |

|

$ |

(5,511 |

) |

|

$ |

(67,578 |

) |

Earnings (loss) per share |

|

|

|

|

|

|

|

||||||||

Basic |

$ |

0.08 |

|

|

$ |

(0.56 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.82 |

) |

Diluted |

$ |

0.07 |

|

|

$ |

(0.56 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.82 |

) |

Weighted-average number of common shares outstanding |

|

|

|

|

|

|

|

||||||||

Basic |

|

85,157 |

|

|

|

83,039 |

|

|

|

84,712 |

|

|

|

82,823 |

|

Diluted |

|

88,500 |

|

|

|

83,039 |

|

|

|

84,712 |

|

|

|

82,823 |

|

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) |

|||||

|

June 30, 2024 |

|

December 31, 2023 |

||

Assets |

|

|

|

||

Current assets: |

|

|

|

||

Cash and cash equivalents |

$ |

258,257 |

|

$ |

229,902 |

Marketable securities |

|

406,819 |

|

|

193,436 |

Total cash, cash equivalents, and marketable securities |

|

665,076 |

|

|

423,338 |

Accounts receivable, net |

|

165,723 |

|

|

300,173 |

Unbilled receivables, net |

|

164,533 |

|

|

237,379 |

Other current assets |

|

76,323 |

|

|

68,137 |

Total current assets |

|

1,071,655 |

|

|

1,029,027 |

Long-term unbilled receivables, net |

|

81,218 |

|

|

85,402 |

Goodwill |

|

81,410 |

|

|

81,611 |

Other long-term assets |

|

302,249 |

|

|

314,696 |

Total assets |

$ |

1,536,532 |

|

$ |

1,510,736 |

Liabilities and stockholders’ equity |

|

|

|

||

Current liabilities: |

|

|

|

||

Accounts payable |

$ |

16,682 |

|

$ |

11,290 |

Accrued expenses |

|

44,875 |

|

|

39,941 |

Accrued compensation and related expenses |

|

81,110 |

|

|

126,640 |

Deferred revenue |

|

352,618 |

|

|

377,845 |

Convertible senior notes, net |

|

500,604 |

|

|

— |

Other current liabilities |

|

20,677 |

|

|

21,343 |

Total current liabilities |

|

1,016,566 |

|

|

577,059 |

Long-term convertible senior notes, net |

|

— |

|

|

499,368 |

Long-term operating lease liabilities |

|

70,202 |

|

|

66,901 |

Other long-term liabilities |

|

14,362 |

|

|

13,570 |

Total liabilities |

|

1,101,130 |

|

|

1,156,898 |

Total stockholders’ equity |

|

435,402 |

|

|

353,838 |

Total liabilities and stockholders’ equity |

$ |

1,536,532 |

|

$ |

1,510,736 |

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) |

|||||||

|

Six Months Ended June 30, |

||||||

|

2024 |

|

2023 |

||||

Net (loss) |

$ |

(5,511 |

) |

|

$ |

(67,578 |

) |

Adjustments to reconcile net (loss) to cash provided by operating activities |

|

|

|

||||

Non-cash items |

|

116,288 |

|

|

|

119,371 |

|

Change in operating assets and liabilities, net |

|

109,466 |

|

|

|

61,959 |

|

Cash provided by operating activities |

|

220,243 |

|

|

|

113,752 |

|

Cash (used in) provided by investing activities |

|

(209,700 |

) |

|

|

15,979 |

|

Cash provided by (used in) financing activities |

|

22,503 |

|

|

|

(86,988 |

) |

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

(2,842 |

) |

|

|

1,010 |

|

Net increase in cash, cash equivalents, and restricted cash |

|

30,204 |

|

|

|

43,753 |

|

Cash, cash equivalents, and restricted cash, beginning of period |

|

232,827 |

|

|

|

145,054 |

|

Cash, cash equivalents, and restricted cash, end of period |

$ |

263,031 |

|

|

$ |

188,807 |

|

PEGASYSTEMS INC. RECONCILIATION OF SELECTED GAAP AND NON-GAAP MEASURES (in thousands, except percentages and per share amounts) |

|||||||||||||||||||||

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

||||||||||||||||||

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

|||||||||||

Net income (loss) - GAAP |

$ |

6,613 |

|

|

$ |

(46,804 |

) |

|

* |

|

$ |

(5,511 |

) |

|

$ |

(67,578 |

) |

|

92 |

% |

|

Stock-based compensation (1) |

|

36,224 |

|

|

|

36,227 |

|

|

|

|

|

71,005 |

|

|

|

78,784 |

|

|

|

||

Restructuring |

|

635 |

|

|

|

2,167 |

|

|

|

|

|

798 |

|

|

|

3,628 |

|

|

|

||

Legal fees |

|

2,409 |

|

|

|

2,842 |

|

|

|

|

|

4,351 |

|

|

|

4,318 |

|

|

|

||

Litigation settlement, net of recoveries |

|

— |

|

|

|

— |

|

|

|

|

|

32,403 |

|

|

|

— |

|

|

|

||

Amortization of intangible assets |

|

789 |

|

|

|

963 |

|

|

|

|

|

1,753 |

|

|

|

2,012 |

|

|

|

||

Interest on convertible senior notes |

|

619 |

|

|

|

647 |

|

|

|

|

|

1,236 |

|

|

|

1,375 |

|

|

|

||

Capped call transactions |

|

3,277 |

|

|

|

1,361 |

|

|

|

|

|

(22 |

) |

|

|

(1,845 |

) |

|

|

||

Repurchases of convertible senior notes |

|

— |

|

|

|

(5,074 |

) |

|

|

|

|

— |

|

|

|

(7,855 |

) |

|

|

||

Foreign currency transaction (gain) loss |

|

(437 |

) |

|

|

3,290 |

|

|

|

|

|

2,825 |

|

|

|

5,965 |

|

|

|

||

Other |

|

— |

|

|

|

(678 |

) |

|

|

|

|

(1,628 |

) |

|

|

(4,471 |

) |

|

|

||

Income taxes (2) |

|

(4,288 |

) |

|

|

6,262 |

|

|

|

|

|

(19,215 |

) |

|

|

6,090 |

|

|

|

||

Net income - non-GAAP |

$ |

45,841 |

|

|

$ |

1,203 |

|

|

3,711 |

% |

|

$ |

87,995 |

|

|

$ |

20,423 |

|

|

331 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Diluted earnings (loss) per share - GAAP |

$ |

0.07 |

|

|

$ |

(0.56 |

) |

|

* |

|

$ |

(0.07 |

) |

|

$ |

(0.82 |

) |

|

91 |

% |

|

non-GAAP adjustments |

|

0.45 |

|

|

|

0.57 |

|

|

|

|

|

1.07 |

|

|

|

1.06 |

|

|

|

||

Diluted earnings per share - non-GAAP |

$ |

0.52 |

|

|

$ |

0.01 |

|

|

5,100 |

% |

|

$ |

1.00 |

|

|

$ |

0.24 |

|

|

317 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Diluted weighted-average number of common shares outstanding - GAAP |

|

88,500 |

|

|

|

83,039 |

|

|

7 |

% |

|

|

84,712 |

|

|

|

82,823 |

|

|

2 |

% |

Stock-based compensation |

|

— |

|

|

|

1,289 |

|

|

|

|

|

3,218 |

|

|

|

1,026 |

|

|

|

||

Diluted weighted-average number of common shares outstanding - non-GAAP |

|

88,500 |

|

|

|

84,328 |

|

|

5 |

% |

|

|

87,930 |

|

|

|

83,849 |

|

|

5 |

% |

* not meaningful |

|||||||||||||||||||||

Our non-GAAP financial measures reflect the following adjustments:

- Stock-based compensation: We have excluded stock-based compensation from our non-GAAP operating expenses and profitability measures. Although stock-based compensation is a key incentive offered to our employees, and we believe such compensation contributed to our revenues recognized during the periods presented and is expected to contribute to our future revenues, we continue to evaluate our business performance, excluding stock-based compensation.

- Restructuring: We have excluded restructuring from our non-GAAP financial measures. Restructuring fluctuates in amount and frequency and is significantly affected by the timing and size of our restructuring activities. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as these amounts are not representative of our core business operations and ongoing operational performance.

- Legal fees: Legal and related fees arising from proceedings outside the ordinary course of business. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Litigation settlement, net of recoveries: Cost to settle litigation, net of insurance recoveries, arising from proceedings outside the ordinary course of business. See Note 15. Commitments and Contingencies in our Quarterly Report for the three months ended June 30, 2024 for additional information. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Amortization of intangible assets: We have excluded the amortization of intangible assets from our non-GAAP operating expenses and profitability measures. Amortization of intangible assets fluctuates in amount and frequency and is significantly affected by the timing and size of acquisitions. Investors should note that intangible assets contributed to our revenues recognized during the periods presented and are expected to contribute to future revenues. Amortization of intangible assets is likely to recur in future periods. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

- Interest on convertible senior notes: In February 2020, we issued convertible senior notes, due March 1, 2025, in a private placement. We believe that excluding the amortization of issuance costs provides a useful comparison of our operational performance in different periods.

-

Capped call transactions: We have excluded gains and losses related to our capped call transactions held at fair value under

U.S. GAAP. The capped call transactions are expected to reduce common stock dilution and/or offset any potential cash payments we must make, other than for principal and interest, upon conversion of the convertible senior notes. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance. - Repurchases of convertible senior notes: We have excluded gains from the repurchases of Convertible Senior Notes. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Foreign currency transaction (gain) loss: We have excluded foreign currency transaction gains and losses from our non-GAAP profitability measures. Foreign currency transaction gains and losses fluctuate in amount and frequency and are significantly affected by foreign exchange market rates. Foreign currency transaction gains and losses are likely to recur in future periods. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

- Other: We have excluded gains and losses from our venture investments, and incremental expenses incurred integrating acquisitions. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Diluted weighted-average number of common shares outstanding:

- Stock-based compensation: In periods of non-GAAP income, we have included the dilutive impact of stock-based compensation in our non-GAAP weighted-average shares. In periods of GAAP loss, these shares would have been excluded from our GAAP results as they would be anti-dilutive for GAAP. We believe including the dilutive effect of stock-based compensation in our non-GAAP financial measures in periods of income is helpful to investors as this provides a useful comparison of our operational performance in different periods.

(1) Stock-based compensation:

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

||||||||||||

|

2024 |

|

2023 |

|

2024 |

|

2023 |

||||||||

Cost of revenue |

$ |

7,092 |

|

|

$ |

7,174 |

|

|

$ |

13,664 |

|

|

$ |

16,087 |

|

Selling and marketing |

|

13,564 |

|

|

|

15,349 |

|

|

|

27,452 |

|

|

|

33,009 |

|

Research and development |

|

7,825 |

|

|

|

7,851 |

|

|

|

15,471 |

|

|

|

16,911 |

|

General and administrative |

|

7,743 |

|

|

|

5,853 |

|

|

|

14,418 |

|

|

|

12,777 |

|

|

$ |

36,224 |

|

|

$ |

36,227 |

|

|

$ |

71,005 |

|

|

$ |

78,784 |

|

Income tax benefit |

$ |

(554 |

) |

|

$ |

(581 |

) |

|

$ |

(865 |

) |

|

$ |

(1,253 |

) |

(2) Effective income tax rates:

|

Six Months Ended June 30, |

||||

|

2024 |

|

2023 |

||

GAAP |

* |

|

(21 |

)% |

|

non-GAAP |

22 |

% |

|

22 |

% |

* not meaningful. |

|||||

Our GAAP effective income tax rate is subject to significant fluctuations due to several factors, including our stock-based compensation plans, research and development tax credits, gains and losses on our capped call transactions, and the valuation allowance on our deferred tax assets in the

PEGASYSTEMS INC. RECONCILIATION OF FREE CASH FLOW (1) AND OTHER METRICS (in thousands, except percentages) |

||||||||||

|

Six Months Ended June 30, |

|

Change |

|||||||

2024 |

|

2023 |

|

|||||||

Cash provided by operating activities |

$ |

220,243 |

|

|

$ |

113,752 |

|

|

94 |

% |

Investment in property and equipment |

|

(1,857 |

) |

|

|

(13,933 |

) |

|

|

|

Free cash flow (1) |

$ |

218,386 |

|

|

$ |

99,819 |

|

|

119 |

% |

|

|

|

|

|

|

|||||

Supplemental information (2) |

|

|

|

|

|

|||||

Litigation settlement, net of recoveries |

$ |

32,403 |

|

|

$ |

— |

|

|

|

|

Legal fees |

|

2,701 |

|

|

|

2,950 |

|

|

|

|

Restructuring |

|

3,852 |

|

|

|

17,521 |

|

|

|

|

Interest on convertible senior notes |

|

1,884 |

|

|

|

2,250 |

|

|

|

|

Income taxes |

|

25,560 |

|

|

|

6,627 |

|

|

|

|

|

$ |

66,400 |

|

|

$ |

29,348 |

|

|

|

|

(1) Our non-GAAP free cash flow is defined as cash provided by operating activities less investment in property and equipment. Investment in property and equipment fluctuates in amount and frequency and is significantly affected by the timing and size of investments in our facilities. We provide information on free cash flow to enable investors to assess our ability to generate cash without incurring additional external financings. This information is not a substitute for financial measures prepared under

(2) The supplemental information discloses items that affect our cash flows and are considered by management not to be representative of our core business operations and ongoing operational performance.

- Litigation settlement, net of recoveries: Cost to settle litigation, net of insurance recoveries, arising from proceedings outside the ordinary course of business. See Note 15. Commitments and Contingencies in our Quarterly Report for the three months ended June 30, 2024 for additional information.

- Legal fees: Legal and related fees arising from proceedings outside the ordinary course of business.

- Restructuring: Restructuring fluctuates in amount and frequency and is significantly affected by the timing and size of our restructuring activities.

-

Interest on convertible senior notes: In February 2020, we issued convertible senior notes, due March 1, 2025, in a private placement. The convertible senior notes accrue interest at an annual rate of

0.75% , payable semi-annually in arrears on March 1 and September 1. - Income taxes: Direct income taxes paid net of refunds received.

PEGASYSTEMS INC.

ANNUAL CONTRACT VALUE

(in thousands, except percentages)

Annual contract value (“ACV”) - ACV represents the annualized value of our active contracts as of the measurement date. The contract's total value is divided by its duration in years to calculate ACV. ACV is a performance measure that we believe provides useful information to our management and investors.

|

June 30, 2024 |

|

June 30, 2023 |

|

Change |

||||||

Pega Cloud |

$ |

593,752 |

|

$ |

498,860 |

|

$ |

94,892 |

|

19 |

% |

Maintenance |

|

310,608 |

|

|

315,231 |

|

|

(4,623 |

) |

(1 |

)% |

Subscription services |

|

904,360 |

|

|

814,091 |

|

|

90,269 |

|

11 |

% |

Subscription license |

|

400,949 |

|

|

349,713 |

|

|

51,236 |

|

15 |

% |

|

$ |

1,305,309 |

|

$ |

1,163,804 |

|

$ |

141,505 |

|

12 |

% |

PEGASYSTEMS INC.

BACKLOG

(in thousands, except percentages)

Remaining performance obligations (“Backlog”) - Expected future revenue from existing non-cancellable contracts:

As of June 30, 2024:

|

Subscription services |

|

Subscription license |

|

Perpetual license |

|

Consulting |

|

Total |

||||||||||||||||

Pega Cloud |

|

Maintenance |

|

|

|

|

|||||||||||||||||||

1 year or less |

$ |

470,379 |

|

|

$ |

209,655 |

|

|

$ |

23,931 |

|

|

$ |

2,696 |

|

|

$ |

25,953 |

|

|

$ |

732,614 |

|

52 |

% |

1-2 years |

|

301,070 |

|

|

|

63,266 |

|

|

|

10,078 |

|

|

|

— |

|

|

|

2,469 |

|

|

|

376,883 |

|

27 |

% |

2-3 years |

|

152,839 |

|

|

|

30,032 |

|

|

|

2,884 |

|

|

|

— |

|

|

|

2,473 |

|

|

|

188,228 |

|

13 |

% |

Greater than 3 years |

|

90,474 |

|

|

|

17,953 |

|

|

|

97 |

|

|

|

— |

|

|

|

— |

|

|

|

108,524 |

|

8 |

% |

|

$ |

1,014,762 |

|

|

$ |

320,906 |

|

|

$ |

36,990 |

|

|

$ |

2,696 |

|

|

$ |

30,895 |

|

|

$ |

1,406,249 |

|

100 |

% |

% of Total |

|

72 |

% |

|

|

23 |

% |

|

|

3 |

% |

|

|

— |

% |

|

|

2 |

% |

|

|

100 |

% |

|

|

Change since June 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

$ |

152,778 |

|

|

$ |

15,081 |

|

|

$ |

(8,416 |

) |

|

$ |

(4,535 |

) |

|

$ |

(14,755 |

) |

|

$ |

140,153 |

|

|

|

|

|

18 |

% |

|

|

5 |

% |

|

|

(19 |

)% |

|

|

(63 |

)% |

|

|

(32 |

)% |

|

|

11 |

% |

|

|

As of June 30, 2023:

|

Subscription services |

|

Subscription license |

|

Perpetual license |

|

Consulting |

|

Total |

||||||||||||||||

Pega Cloud |

|

Maintenance |

|

|

|

|

|||||||||||||||||||

1 year or less |

$ |

397,183 |

|

|

$ |

214,579 |

|

|

$ |

35,616 |

|

|

$ |

4,979 |

|

|

$ |

37,355 |

|

|

$ |

689,712 |

|

55 |

% |

1-2 years |

|

238,691 |

|

|

|

58,551 |

|

|

|

3,026 |

|

|

|

2,252 |

|

|

|

6,772 |

|

|

|

309,292 |

|

24 |

% |

2-3 years |

|

124,616 |

|

|

|

25,103 |

|

|

|

6,764 |

|

|

|

— |

|

|

|

1,523 |

|

|

|

158,006 |

|

12 |

% |

Greater than 3 years |

|

101,494 |

|

|

|

7,592 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

109,086 |

|

9 |

% |

|

$ |

861,984 |

|

|

$ |

305,825 |

|

|

$ |

45,406 |

|

|

$ |

7,231 |

|

|

$ |

45,650 |

|

|

$ |

1,266,096 |

|

100 |

% |

% of Total |

|

67 |

% |

|

|

24 |

% |

|

|

4 |

% |

|

|

1 |

% |

|

|

4 |

% |

|

|

100 |

% |

|

|

PEGASYSTEMS INC. RECONCILIATION OF GAAP BACKLOG AND CONSTANT CURRENCY BACKLOG (in millions, except percentages) |

||||||||

|

June 30, 2023 |

|

June 30, 2024 |

|

1 Year Growth Rate |

|||

Backlog - GAAP |

$ |

1,266 |

|

$ |

1,406 |

|

11 |

% |

Impact of changes in foreign exchange rates |

|

— |

|

|

7 |

|

|

|

Constant currency backlog |

$ |

1,266 |

|

$ |

1,413 |

|

12 |

% |

Note: Constant currency Backlog is calculated by applying the June 30, 2023 foreign exchange rates to all periods shown. |

||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20240724234135/en/

Press contact:

Lisa Pintchman

VP, Corporate Communications

lisapintchman.rogers@pega.com

617-866-6022

Twitter: @pega

Investor contact:

Peter Welburn

VP, Corporate Development & Investor Relations

PegaInvestorRelations@pega.com

617-498-8968

Source: Pegasystems Inc.