Pacific Bay Brazil Gold Property Update, Trading Resumption

Pacific Bay Minerals (TSXV: PBM) announced the resumption of trading on April 21st, 2025, following a halt since January 7th, 2025. The company is finalizing a definitive option agreement with Appian Capital Advisory to acquire 100% of the Pereira-Velho gold prospect in Alagoas, Brazil.

The project spans 14,596 hectares in the gold-rich Borborema Province. Technical reports confirm gold presence in quartz veins and pyrite-rich zones, with over 6,300 meters of previous drilling. Metallurgical tests indicate strong gold recovery potential from oxidized ores.

The acquisition terms include payments to Appian of CDN$710,000 in cash and CDN$700,000 in either shares or cash, split across two tranches. Appian will retain a 1.5% NSR, which Pacific Bay can buy back for USD $3.5 million. The company has proposed a US$1,560,000 exploration budget including drilling, lab assaying, and metallurgical tests.

Pacific Bay Minerals (TSXV: PBM) ha annunciato la ripresa delle contrattazioni il 21 aprile 2025, dopo una sospensione iniziata il 7 gennaio 2025. L'azienda sta finalizzando un accordo di opzione definitivo con Appian Capital Advisory per acquisire il 100% del progetto aurifero Pereira-Velho in Alagoas, Brasile.

Il progetto copre 14.596 ettari nella ricca di oro provincia di Borborema. I rapporti tecnici confermano la presenza di oro in vene di quarzo e zone ricche di pirite, con oltre 6.300 metri di perforazioni precedenti. I test metallurgici indicano un forte potenziale di recupero dell'oro da minerali ossidati.

I termini dell'acquisizione prevedono pagamenti ad Appian per 710.000 dollari canadesi in contanti e 700.000 dollari canadesi in azioni o contanti, suddivisi in due tranche. Appian manterrà un NSR dell'1,5%, che Pacific Bay potrà riacquistare per 3,5 milioni di dollari USA. La società ha proposto un budget di esplorazione di 1.560.000 dollari USA comprensivo di perforazioni, analisi di laboratorio e test metallurgici.

Pacific Bay Minerals (TSXV: PBM) anunció la reanudación de las operaciones el 21 de abril de 2025, tras una suspensión desde el 7 de enero de 2025. La compañía está finalizando un acuerdo de opción definitivo con Appian Capital Advisory para adquirir el 100% del proyecto aurífero Pereira-Velho en Alagoas, Brasil.

El proyecto abarca 14,596 hectáreas en la rica en oro provincia de Borborema. Los informes técnicos confirman la presencia de oro en vetas de cuarzo y zonas ricas en pirita, con más de 6,300 metros de perforaciones previas. Las pruebas metalúrgicas indican un fuerte potencial de recuperación de oro de minerales oxidados.

Los términos de la adquisición incluyen pagos a Appian por 710,000 dólares canadienses en efectivo y 700,000 dólares canadienses en acciones o efectivo, divididos en dos tramos. Appian mantendrá un NSR del 1.5%, que Pacific Bay podrá recomprar por 3.5 millones de dólares estadounidenses. La compañía ha propuesto un presupuesto de exploración de 1,560,000 dólares estadounidenses que incluye perforación, análisis de laboratorio y pruebas metalúrgicas.

Pacific Bay Minerals (TSXV: PBM)는 2025년 4월 21일 거래 재개를 발표했으며, 2025년 1월 7일부터 중단된 거래가 재개됩니다. 회사는 Appian Capital Advisory와 브라질 알라고아스에 위치한 Pereira-Velho 금 광상 100% 인수를 위한 최종 옵션 계약을 마무리 중입니다.

이 프로젝트는 금이 풍부한 Borborema 지방에 걸쳐 14,596헥타르에 달합니다. 기술 보고서는 석영 광맥과 황철석이 풍부한 구역에서 금 존재를 확인했으며, 이전에 6,300미터 이상의 시추가 이루어졌습니다. 야금학 테스트는 산화 광석에서 금 회수 가능성이 높음을 나타냅니다.

인수 조건에는 Appian에 대한 현금 71만 캐나다 달러와 주식 또는 현금으로 70만 캐나다 달러 지급이 두 차례에 걸쳐 이루어집니다. Appian은 1.5% NSR을 보유하며, Pacific Bay는 이를 미화 350만 달러에 다시 매입할 수 있습니다. 회사는 시추, 실험실 분석 및 야금학 테스트를 포함한 미화 156만 달러 탐사 예산을 제안했습니다.

Pacific Bay Minerals (TSXV : PBM) a annoncé la reprise des négociations le 21 avril 2025, après une suspension depuis le 7 janvier 2025. La société finalise un accord d'option définitif avec Appian Capital Advisory pour acquérir 100 % du projet aurifère Pereira-Velho à Alagoas, au Brésil.

Le projet couvre 14 596 hectares dans la province aurifère riche de Borborema. Les rapports techniques confirment la présence d'or dans des veines de quartz et des zones riches en pyrite, avec plus de 6 300 mètres de forage antérieur. Les tests métallurgiques indiquent un fort potentiel de récupération de l'or à partir de minerais oxydés.

Les modalités de l'acquisition comprennent des paiements à Appian de 710 000 dollars canadiens en espèces et de 700 000 dollars canadiens en actions ou en espèces, répartis en deux tranches. Appian conservera un NSR de 1,5 %, que Pacific Bay pourra racheter pour 3,5 millions de dollars américains. La société a proposé un budget d'exploration de 1 560 000 dollars américains incluant forage, analyses en laboratoire et tests métallurgiques.

Pacific Bay Minerals (TSXV: PBM) gab die Wiederaufnahme des Handels am 21. April 2025 bekannt, nach einer Aussetzung seit dem 7. Januar 2025. Das Unternehmen finalisiert eine verbindliche Optionsvereinbarung mit Appian Capital Advisory zum Erwerb von 100 % des Pereira-Velho Goldprojekts in Alagoas, Brasilien.

Das Projekt erstreckt sich über 14.596 Hektar in der goldreichen Provinz Borborema. Technische Berichte bestätigen das Vorhandensein von Gold in Quarzadern und pyritreichen Zonen, mit über 6.300 Metern vorheriger Bohrungen. Metallurgische Tests zeigen ein hohes Potenzial zur Goldgewinnung aus oxidierten Erzen.

Die Übernahmebedingungen sehen Zahlungen an Appian in Höhe von 710.000 kanadischen Dollar in bar und 700.000 kanadischen Dollar in Aktien oder bar vor, aufgeteilt in zwei Tranchen. Appian behält eine NSR von 1,5 %, die Pacific Bay für 3,5 Millionen US-Dollar zurückkaufen kann. Das Unternehmen hat ein Explorationsbudget von 1.560.000 US-Dollar vorgeschlagen, das Bohrungen, Laboranalysen und metallurgische Tests umfasst.

- Strategic acquisition of 14,596-hectare gold property in established mining region

- Previous drilling campaigns (6,300+ meters) confirmed continuous gold mineralization

- Strong gold recovery potential from oxidized ores confirmed by metallurgical tests

- Visible gold identified in multiple drill cores

- Excellent infrastructure with year-round exploration access

- Additional processing required for sulfide-rich ores, potentially increasing costs

- Significant capital expenditure required (US$1.56M exploration budget)

- Project acquisition and NSR buyback costs create substantial financial obligations

- Technical Report still subject to further review by Exchange

Vancouver, British Columbia--(Newsfile Corp. - April 16, 2025) - Reagan Glazier, President & CEO Pacific Bay Minerals Ltd. (TSXV: PBM) ("Pacific Bay" or, the "Company") reports that the shares of the Company will be reinstated for trading by the TSX Venture Exchange (the "Exchange") on commencement of trading, Monday April 21st, 2025. The shares of the Company were halted upon the Company disclosing in its January 7th, 2025 news release that is had signed a letter of intent to acquire a property in Brazil that was deemed to be a Fundamental Acquisition under Exchange policies and therefore a reviewable transaction. The resumption follows provision to the Exchange of certain information, such as a 43-101 compliant Technical Report on the Pereira-Velho gold prospect (the "Project") in Alagoas State, Brazil, which report remains subject to further comment and review by the Exchange, and a draft of the definitive option agreement with Appian Capital Advisory ("Appian") whereby Pacific Bay proposes to acquire

"Pacific Bay looks forward to completing this transaction as soon as possible and opening an exciting new chapter of gold exploration in Brazil," said Pacific Bay President & CEO Reagan Glazier. "The markets are volatile, but gold has remained strong and I believe this is a great time to be taking on such a promising property."

The Pereira-Velho Gold Prospect

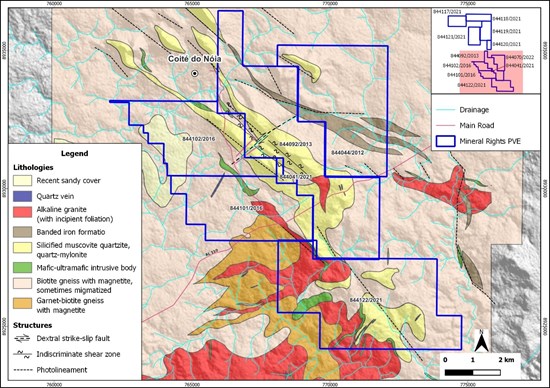

The following are key findings from the Technical Report on the Project, located in Coité do Nóia, Alagoas, Brazil.

Covering 14,596 hectares in the gold-rich Borborema Province, the project benefits from excellent road access and proximity to the commercial hub of Arapiraca, supporting year-round exploration in a tropical climate.

The Technical Report, prepared by RBM Serviços Técnicos Ltda., highlights significant gold discoveries driven by past exploration, including soil sampling, trenching, and two drilling campaigns totaling over 6,300 meters. These efforts confirmed gold in quartz veins and pyrite-rich zones, with continuous mineralization at depth-pointing to a promising orogenic gold system. Sample testing followed strict industry standards, verifying reliable gold grades and visible gold in drill cores.

Metallurgical tests suggest strong gold recovery potential from oxidized ores using methods like cyanidation or heap leaching, though sulfide-rich ores may require additional processing to unlock their value. The project's geology features ancient metamorphic rocks-gneisses, quartzites, and banded iron formations-ideal for hosting gold deposits.

The Technical Report recommends a US

With an eight-month exploration plan proposed, Pacific Bay is poised to unlock the full promise of Pereira Velho, delivering value to shareholders and stakeholders alike.

| Activity | Cost (US$) |

| Drilling | 850,000 |

| Lab assaying | 150,000 |

| Metallurgical tests | 25,000 |

| Resources statement report | 38,000 |

| Vehicles/rent/facilities/IT | 55,000 |

| G&A | 300,000 |

| Continency ( | 142,000 |

| Subtotal |

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_002full.jpg

Figure 2 Hills formed by quartzites, facing southeast

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_003full.jpg

Figure 3 Geological map with the main lithologies and structural features within the Pereira Velho Project area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_004full.jpg

Figure 4 (a) Outcrop of fractured quartzite with the presence of (b) folded structure (flexural?); (c) quartzite with foliation trending to the NE and with boxwork and (d) outcrop of the quartzite with foliation trending to the SW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_005full.jpg

Figure 5 (a, b) Drill core composed of biotite gneiss with propylitic alteration; (c) quartzo-feldspathic gneiss with argillic alteration.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_006full.jpg

Figure 6 (a) Free gold (VG-visible gold) identified in hole PVDH-045, at a depth of 49.50 meters; (b) Free gold (VG-visible gold) in hole PVDH-015, at a depth of 95.65 m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_007full.jpg

Figure 7 Visible gold (VG) in drill core sample, PVDH-007

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_008full.jpg

Figure 8 Map with the compilation of soil geochemistry campaigns carried out by MVV and PVE. First-order anomalies for gold marked in magenta with values between 100 and 1090 ppb.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3362/248745_b369a68ba47c6ac7_009full.jpg

The Agreement

As previously announced, key terms of the Agreement are:

Payment to Appian of CND

- Upon signing the definitive agreement and obtaining necessary approvals:

- CDN

$280,000 in cash. - CDN

$250,000 in cash or common shares.

- CDN

- On the first anniversary of the definitive agreement:

- CDN

$430,000 in cash. - CDN

$450,000 in cash or common shares.

- CDN

Appian is to retain a

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Mr. David Bridge, P.Geo., a consultant of the Company, who is a "Qualified Person" as defined in NI 43-101

Pacific Bay Minerals Ltd.

Per/

Reagan Glazier, President and CEO

reagan@pacificbayminerals.com

(604) 682-2421

pacificbayminerals.com

This News Release contains forward-looking statements, which relate to future events. In some cases, you can identify forward-looking statements by terminology such as "will", "may", "should", "expects", "plans", or "anticipates" or the negative of these terms or other comparable terminology. All statements included herein, other than statements of historical fact, are forward looking statements, including but not limited to the Company's expectations regarding, the closing date of the Financing, the use of proceeds of the Financing and other matters. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking-statements. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith, and reflect the Company's current judgment regarding the direction of its business, actual results will may vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggestions herein. Except as required by applicable law, the Company does not intend to update any forward-looking statements to conform these statements to actual results.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/248745