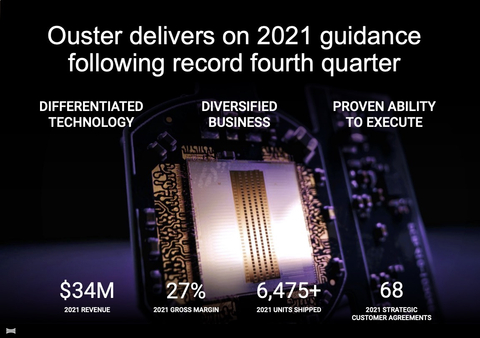

Ouster Delivers on 2021 Guidance with $34 Million in Revenue and 27% Gross Margins; Q4 Revenue Up 53%; Aims to Double Revenue for 2022

Ouster, Inc. (NYSE: OUST) reported Q4 2021 revenue of $11.9 million, a 53% sequential increase and 86% year-over-year growth, achieving 30% gross margins. The company shipped over 2,400 sensors, nearly tripling its shipments from the previous year. Full-year 2021 revenue reached $34 million with 27% gross margins. Ouster signed 68 Strategic Customer Agreements, representing around $500 million in potential revenue through 2025. For 2022, the company aims to double its revenue, targeting between $65 million to $85 million, while maintaining gross margins between 25% to 30%.

- Q4 revenue of $11.9 million, up 86% year-over-year.

- 30% gross margins in Q4, up from 24% in Q3 2021.

- Record shipment of over 2,400 sensors in Q4, nearly tripling year-over-year.

- 68 Strategic Customer Agreements signed, representing approximately $500 million in contracted revenue opportunity through 2025.

- Aim to double revenue in 2022, targeting $65 million to $85 million.

- Net loss of $28 million in Q4, though improved from $57 million in Q4 2020.

- Adjusted EBITDA loss increased to $24 million from $9 million in Q4 2020.

Insights

Analyzing...

Record shipments of over 2,400 sensors in Q4, nearly tripling year-over-year

Delivers on Full Year 2021 guidance with

Ouster delivers on 2021 guidance following record fourth quarter (Graphic: Business Wire)

Fourth Quarter 2021 Financial Highlights

-

$11.9 million 86% year over year. -

30% gross margins, compared to31% in fourth quarter 2020, and24% in third quarter 2021. -

Shipped over 2,400 sensors in the fourth quarter, up

198% year over year. -

Increased the number of Strategic Customer Agreements to 68, up from 62 in the prior quarter, collectively representing approximately

$500 million -

Net loss decreased to

$28 million $57 million -

Adjusted EBITDA2 loss increased to

$24 million $9 million

Investments in scaling the commercial organization as well as advancements in hardware and firmware were key drivers of revenue growth in the fourth quarter. The Company signed 68 Strategic Customer Agreements (SCAs) through the end of the fourth quarter, up from 10 SCAs as of the end of 2020. Ouster successfully launched its new OS sensors equipped with the L2X chip, which unlocks new customer opportunities across all verticals. The Company achieved positive gross margins of

Full Year 2021 Financial Highlights

-

Achieved full year 2021 guidance with

$34 million 27% gross margins. - Shipped over 6,475 sensors in 2021, totaling over 10,000 sensors shipped to date.

-

Net loss decreased to

$94 million $107 million -

Adjusted EBITDA loss of

$67 million $36 million

“This year was a turning point for Ouster as we scaled up our commercial engine, proved our high-volume manufacturing capabilities, accelerated our automotive roadmap, and won key customers across each of our target vertical markets. We expect 2022 to be even stronger, with important product and customer milestones that we are excited to share throughout the year,” said Ouster CEO

Business Updates

Accelerated Automotive Momentum: Ouster established

Continued Customer Traction: In 2021, Ouster sold sensors to over 600 customers3, including 40 distributors, and signed 58 additional multi-year SCAs. In 2021, the automotive vertical accounted for

Delivered on Product Roadmap: Ouster reached a substantial milestone with the introduction of its L2X chip, which doubled both the processing power and data output of its OS sensors, opening up additional market opportunities and revenue in the fourth quarter and beyond. The Company also introduced the Ouster Automotive DF series, its true solid-state lidar sensors for high-volume automotive programs for anticipated start of production in 2025.

2022 Outlook

For the full year 2022, Ouster aims to double revenue, targeting a range of

Ouster expects key catalysts for growth to drive product volume and increase revenue in 2022 and subsequent years. This includes at least one OEM production program award expected this year, the upcoming launch of its L3 chip, critical safety certifications to displace legacy sensors across its verticals, and a more robust software ecosystem, all of which is expected to accelerate lidar adoption, expand market opportunities and provide customized solutions for its customers.

“Ouster had a breakout year in 2021, reinforcing our view that we chose the right technology with CMOS digital lidar, and the right strategy with our multi-market approach,” said Ouster CFO

Conference Call Information

Ouster will host a conference call and live webcast for analysts and investors at

Upon registering, each participant will be provided with call details and a registrant ID. The webcast and related presentation materials will be accessible for at least 30 days on Ouster’s investor relations website at https://investors.ouster.com/. A telephonic replay of the conference call will be available through

About Ouster

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding Ouster’s technological advancements, competitive edge, strategic partnerships and outlook, its ability to meet its revenue goals and guidance, supply requirements, the scalability of its production, its strategy, and market positioning as it relates to its brand and competitors. Forward-looking statements give Ouster’s current expectations and projections relating to its financial condition, competitive position, future results of operations, plans, objectives, future orders whether binding or non-binding, and business. You may identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim”, “anticipate”, “estimate”, “expect”, “project”, “plan”, “forecast”, “intend”, “believe”, “may”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including but not limited to Ouster’s limited operating history and history of losses; the negotiating power and product standards of its customers; fluctuations in its operating results; supply chain constraints and challenges; cancellation or postponement of contracts or unsuccessful implementations; the adoption of its products and the growth of the lidar market generally; its ability to grow its sales and marketing organization; substantial research and development costs needed to develop and commercialize new products; the competitive environment in which it operates; selection of its products for inclusion in target markets; its future capital needs and ability to secure additional capital on favorable terms or at all; its ability to use tax attributes; its dependence on key third party suppliers, in particular Benchmark Electronics, Inc., and manufacturers; ability to maintain inventory and the risk of inventory write-downs; inaccurate forecasts of market growth; its ability to manage growth; the creditworthiness of customers; risks related to acquisitions; risks related to international operations; risks of product delivery problems or defects; costs associated with product warranties; its ability to maintain competitive average selling prices or high sales volumes or reduce product costs; conditions in its customers’ industries; its ability to recruit and retain key personnel; its use of professional employer organizations; its ability to adequately protect and enforce its intellectual property rights; its ability to effectively respond to evolving regulations and standards; risks related to operating as a public company; risks related to the COVID-19 pandemic; and other important factors discussed in the Company’s final prospectus dated

The financials herein are unaudited and subject to the finalization of year-end audit procedures. In addition see information below concerning non-GAAP financial measures:

Non-GAAP Financial Measures

In addition to its results determined in accordance with generally accepted accounting principles in

1 "Strategic Customer Agreements” or “SCAs” establish a multi-year purchase and supply framework for Ouster and the customer, and include details about customer programs and applications where the customer intends to use Ouster products. SCAs also include multi-year non-binding customer forecasts (typically of three to five years in length) giving Ouster visibility to the customer's long-term purchasing requirements, mutually agreed upon pricing over the duration of the agreement, and in certain cases include multi-year binding purchase commitments. “Contracted revenue opportunity” represents the sum of both binding purchase commitments and non-binding forecasts. No assurances can be given that non-binding forecasts will mature into binding purchase commitments, or that any contracted revenue opportunity will result in revenue. No additional revenue opportunity beyond the customer’s actual forecast has been imputed.

2 Adjusted EBITDA loss is a non-GAAP financial measure. See Non-GAAP Financial Measures for additional information and a reconciliation to Net loss, the most directly comparable financial measure calculated in accordance with

3 "Customer” is defined as having purchased a sensor within the past twelve months ended

| CONSOLIDATED BALANCE SHEETS | ||||||||

| (unaudited) | ||||||||

| (in thousands) | ||||||||

|

2021 |

|

|

|

2020 |

|

||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ |

182,644 |

|

$ |

11,362 |

|

||

| Restricted cash, current |

|

977 |

|

|

276 |

|

||

| Accounts receivable, net |

|

10,723 |

|

|

2,327 |

|

||

| Inventory |

|

7,448 |

|

|

4,817 |

|

||

| Prepaid expenses and other current assets |

|

5,566 |

|

|

2,441 |

|

||

| Total current assets |

|

207,358 |

|

|

21,223 |

|

||

| Property and equipment, net |

|

10,054 |

|

|

9,731 |

|

||

| Operating lease, right-of-use assets |

|

15,156 |

|

|

11,071 |

|

||

|

51,076 |

|

|

— |

|

|||

| Intangible assets, net |

|

22,652 |

|

|

— |

|

||

| Restricted cash, non-current |

|

1,035 |

|

|

1,004 |

|

||

| Other non-current assets |

|

371 |

|

|

3,385 |

|

||

| Total assets | $ |

307,702 |

|

$ |

46,414 |

|

||

| Liabilities, redeemable convertible preferred stock and stockholder's deficit | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ |

4,863 |

|

$ |

6,894 |

|

||

| Accrued and other current liabilities |

|

14,173 |

|

|

4,121 |

|

||

| Short-term debt |

|

— |

|

|

7,130 |

|

||

| Operating lease liability, current portion |

|

3,067 |

|

|

2,772 |

|

||

| Total current liabilities |

|

22,103 |

|

|

20,917 |

|

||

| Operating lease liability, long term portion |

|

16,208 |

|

|

11,908 |

|

||

| Warrant liabilities |

|

7,626 |

|

|

49,293 |

|

||

| Other non-current liabilities |

|

1,065 |

|

|

978 |

|

||

| Total liabilities |

|

47,002 |

|

|

83,096 |

|

||

| Commitments and contingencies | ||||||||

| Redeemable convertible preferred stock |

|

— |

|

|

39,225 |

|

||

| Stockholders' equity (deficit): | ||||||||

| Common stock |

|

17 |

|

|

— |

|

||

| Additional paid-in capital |

|

564,045 |

|

|

133,468 |

|

||

| Accumulated deficit |

|

(303,356 |

) |

|

(209,375 |

) |

||

| Accumulated other comprehensive loss |

|

(6 |

) |

|

— |

|

||

| Total stockholder's equity (deficit) |

|

260,700 |

|

|

(75,907 |

) |

||

| Total liabilties, redeemable convertible preferred stock, and stockholder's deficit | $ |

307,702 |

|

$ |

46,414 |

|

||

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS | |||||||||||||||

| (unaudited) | |||||||||||||||

| (in thousands, except share and per share data) | |||||||||||||||

| Three Months Ended |

Year Ended |

||||||||||||||

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

| Revenue | |||||||||||||||

| Product revenue | $ |

11,852 |

|

$ |

6,362 |

|

$ |

33,578 |

|

$ |

16,886 |

|

|||

| Service revenue |

|

- |

|

|

14 |

|

|

— |

|

|

2,018 |

|

|||

| Total revenue |

|

11,852 |

|

|

6,376 |

|

|

33,578 |

|

|

18,904 |

|

|||

| Cost of revenue | |||||||||||||||

| Cost of product |

|

8,280 |

|

|

4,403 |

|

|

24,492 |

|

|

17,365 |

|

|||

| Cost of services |

|

- |

|

|

- |

|

|

— |

|

|

26 |

|

|||

| Total cost of revenue |

|

8,280 |

|

|

4,403 |

|

|

24,492 |

|

|

17,391 |

|

|||

| Gross profit |

|

3,572 |

|

|

1,973 |

|

|

9,086 |

|

|

1,513 |

|

|||

| Operating expenses: | |||||||||||||||

| Research and development |

|

15,003 |

|

|

4,289 |

|

|

34,579 |

|

|

23,317 |

|

|||

| Sales and marketing |

|

7,481 |

|

|

2,693 |

|

|

22,258 |

|

|

8,998 |

|

|||

| General and administrative |

|

15,782 |

|

|

9,104 |

|

|

51,959 |

|

|

20,960 |

|

|||

| Total operating expenses |

|

38,266 |

|

|

16,086 |

|

|

108,796 |

|

|

53,275 |

|

|||

| Loss from operations |

|

(34,694 |

) |

|

(14,113 |

) |

|

(99,710 |

) |

|

(51,762 |

) |

|||

| Other (expense) income: | |||||||||||||||

| Interest income |

|

166 |

|

|

- |

|

|

471 |

|

|

24 |

|

|||

| Interest expense |

|

- |

|

|

(321 |

) |

|

(504 |

) |

|

(2,517 |

) |

|||

| Other income (expense), net |

|

3,390 |

|

|

(42,351 |

) |

|

2,968 |

|

|

(52,150 |

) |

|||

| Total other expense, net |

|

3,556 |

|

|

(42,672 |

) |

|

2,935 |

|

|

(54,643 |

) |

|||

| Loss before income taxes |

|

(31,138 |

) |

|

(56,785 |

) |

|

(96,775 |

) |

|

(106,405 |

) |

|||

| Provision for (benefit from) income taxes |

|

(2,794 |

) |

|

375 |

|

|

(2,794 |

) |

|

375 |

|

|||

| Net loss |

|

(28,344 |

) |

|

(57,160 |

) |

|

(93,981 |

) |

|

(106,780 |

) |

|||

| Other comprehensive loss | |||||||||||||||

| Foreign currency translation adjustments |

|

(6 |

) |

|

— |

|

|

(6 |

) |

|

- |

|

|||

| Total comprehensive loss |

|

(28,350 |

) |

|

(57,160 |

) |

|

(93,987 |

) |

|

(106,780 |

) |

|||

| Net loss per common share, basic | $ |

(0.17 |

) |

$ |

(2.37 |

) |

$ |

(0.70 |

) |

$ |

(5.98 |

) |

|||

| Weighted-average common shares outstanding, basic |

|

165,853,915 |

|

|

24,130,953 |

|

|

133,917,571 |

|

17,858,976 |

|

||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||

| (unaudited) | |||||||

| (in thousands) | |||||||

For the Years Ended |

|||||||

|

2021 |

|

|

2020 |

|

||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||

| Net loss | $ |

(93,981 |

) |

$ |

(106,780 |

) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

| Depreciation and amortization |

|

5,477 |

|

|

3,718 |

|

|

| Stock-based compensation |

|

25,363 |

|

|

12,057 |

|

|

| Deferred income taxes |

|

(2,477 |

) |

|

- |

|

|

| Change in right-of-use asset |

|

2,180 |

|

|

1,887 |

|

|

| Interest expense on notes and convertible debt |

|

36 |

|

|

1,030 |

|

|

| Amortization of debt issuance costs and debt discount |

|

250 |

|

|

258 |

|

|

| Change in fair value of warrant liabilities |

|

(2,947 |

) |

|

48,440 |

|

|

| Change in fair value of derivative liability |

|

- |

|

|

5,308 |

|

|

| Gain on extinguishment of tranche right liability |

|

- |

|

|

(1,610 |

) |

|

| Provision for doubtful accounts |

|

379 |

|

|

67 |

|

|

| Inventory write down |

|

808 |

|

|

797 |

|

|

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable |

|

(8,007 |

) |

|

(1,457 |

) |

|

| Inventory |

|

(3,440 |

) |

|

(3,146 |

) |

|

| Prepaid expenses and other assets |

|

854 |

|

|

(1,442 |

) |

|

| Accounts payable |

|

(2,442 |

) |

|

144 |

|

|

| Accrued and other liabilities |

|

9,060 |

|

|

(417 |

) |

|

| Operating lease liability |

|

(1,670 |

) |

|

(971 |

) |

|

| Net cash used in operating activities |

|

(70,557 |

) |

|

(42,117 |

) |

|

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||

| Purchases of property and equipment |

|

(4,283 |

) |

|

(3,509 |

) |

|

| Acquisition, net of cash acquired |

|

(10,946 |

) |

|

- |

|

|

| Net cash used in investing activities |

|

(15,229 |

) |

|

(3,509 |

) |

|

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||

| Proceeds from the merger and private offering |

|

291,442 |

|

|

- |

|

|

| Payment of offering costs |

|

(27,124 |

) |

|

- |

|

|

| Repayment of debt |

|

(7,000 |

) |

|

(3,000 |

) |

|

| Proceeds from issuance of promissory notes to related parties |

|

5,000 |

|

|

- |

|

|

| Repayment of promissory notes to related parties |

|

(5,000 |

) |

|

- |

|

|

| Repurchase of common stock |

|

(45 |

) |

|

- |

|

|

| Proceeds from exercise of stock options |

|

526 |

|

|

1,337 |

|

|

| Proceeds from exercise of warrants |

|

1 |

|

|

- |

|

|

| Proceeds from issuance of redeemable convertible preferred stock, net off issuance cost of |

|

- |

|

|

41,526 |

|

|

| Net cash provided by financing activities |

|

257,800 |

|

|

39,863 |

|

|

| Net increase (decrease) in cash, cash equivalents and restricted cash |

|

172,014 |

|

|

(5,763 |

) |

|

| Cash, cash equivalents and restricted cash at beginning of period |

|

12,642 |

|

|

18,405 |

|

|

| Cash, cash equivalents and restricted cash at end of period | $ |

184,656 |

|

$ |

12,642 |

|

|

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands) | ||||||||||||||||

| Three Months Ended |

Year Ended |

|||||||||||||||

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

||

| GAAP net loss | $ |

(28,344 |

) |

$ |

(57,160 |

) |

$ |

(93,981 |

) |

$ |

(106,780 |

) |

||||

| Interest expense (income), net |

|

(166 |

) |

|

321 |

|

|

33 |

|

|

2,493 |

|

||||

| Other expense (income), net |

|

(3,390 |

) |

|

42,351 |

|

|

(2,968 |

) |

|

52,150 |

|

||||

| Stock-based compensation |

|

6,805 |

|

|

4,166 |

|

|

25,363 |

|

|

12,057 |

|

||||

| Income taxes |

|

(2,794 |

) |

|

375 |

|

|

(2,794 |

) |

|

375 |

|

||||

| Non-GAAP operating loss |

|

(27,889 |

) |

|

(9,947 |

) |

|

(74,347 |

) |

|

(39,705 |

) |

||||

| Depreciation and amortization expense |

|

2,049 |

|

|

1,013 |

|

|

5,477 |

|

|

3,718 |

|

||||

| Non-recurring acquisition expense |

|

1,535 |

|

|

- |

|

|

1,535 |

|

|

- |

|

||||

| Adjusted EBITDA | $ |

(24,306 |

) |

$ |

(8,934 |

) |

$ |

(67,336 |

) |

$ |

(35,987 |

) |

||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20220215006123/en/

For Investors

investors@ouster.io

For Media

press@ouster.io

Source: