OneSoft Solutions Reports Q4 and Annual Results for Fiscal 2023 and Reiterates Fiscal 2024 Guidance

- Revenue for Fiscal 2023 increased by 51% to $10.4 million, with a 33% increase in Q4 2023.

- Gross profit improved by 60% to $7.8 million, with gross margin increasing to 75% for Fiscal 2023.

- Net loss decreased to $1.4 million in Fiscal 2023, with cash and cash equivalents increasing to $4.9 million.

- Adjusted EBITDA improved to a near-breakeven loss of $0.1 million in Fiscal 2023.

- The Company's CIM platform is being adopted by O&G pipeline companies, with new functionality modules and strong customer relationships.

- Fiscal 2024 revenue guidance is $15-16 million, aiming for a 44-54% increase over Fiscal 2023.

- Management anticipates no need to raise additional capital for executing the current business plan.

- None.

Q4 and Fiscal 2023 Revenues Increased

EDMONTON, AB / ACCESSWIRE / April 1, 2024 / OneSoft Solutions Inc. (the "Company" or "OneSoft") (TSX-V:OSS)(OTCQB:OSSIF), a North American developer of cloud-based business solutions, announces its financial results for the year ended December 31, 2023 ("Fiscal 2023").

Please refer to the Audited Consolidated Financial Statements, Management's Discussion and Analysis ("MD&A") and the Annual Information Form for the year ended December 31, 2023, filed on SEDAR+ for more information. The MD&A contains a comprehensive analysis of Fiscal 2023, the financial quarter ended December 31, 2023 ("Q4 2023") and other information. Unless otherwise specified, all dollar amounts are denominated in Canadian dollars.

Management will host an investor call (details below) on April 2, 2024 at 11am ET / 9am MT to discuss the financial results and answer investor questions.

Financial Results

Financial Highlights

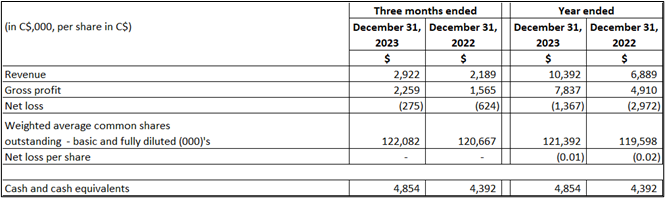

- Revenue for Fiscal 2023 was

$10.4 million , a51% or$3.5 million increase over Fiscal 2022. Revenue in Q4 2023 was$2.9 million , a33% increase over Q4 2022. - Gross profit for Fiscal 2023 increased

60% from$4.9 million to$7.8 million . Gross margin for Fiscal 2023 increased to75% from71% as is explained later in this report. Gross profit for Q4 2023 increased44% or$0.7 million , from$1.6 million in Q4 2022 to$2.3 million in Q4 2023. Gross margin improved quarter over quarter from71% to77% . - The Fiscal 2023 net loss improved by

$1.6 million , from$3.0 million in Fiscal 2022 to$1.4 million in Fiscal 2023. The net loss in Q4 2023 improved by$0.3 million from$0.6 million in Q4 2022 to$0.3 million in Q4 2023. - Cash and cash equivalents increased by

$0.5 million to$4.9 million in Fiscal 2023, an improvement from Fiscal 2022 where these assets decreased by$1.2 million from the previous year. - Adjusted EBITDA, a Non-GAAP measure, improved from a loss of

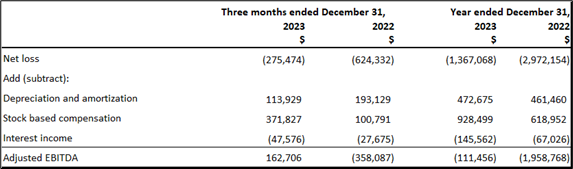

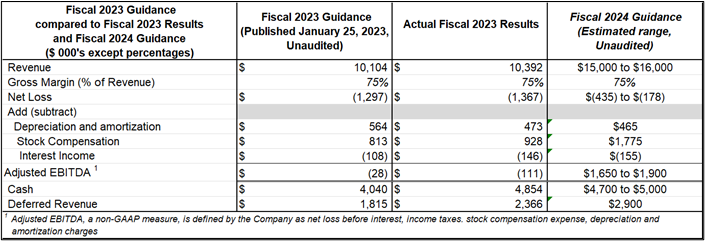

$2.0 million in Fiscal 2022 to a near-breakeven loss of$0.1 million in Fiscal 2023. In Q4 2023, Adjusted EBITDA improved by$0.5 million from a loss of$0.4 million in Q4 2022 to positive$0.2 million . The following table is a reconciliation of Adjusted EBITDA to net loss for each of the periods presented.

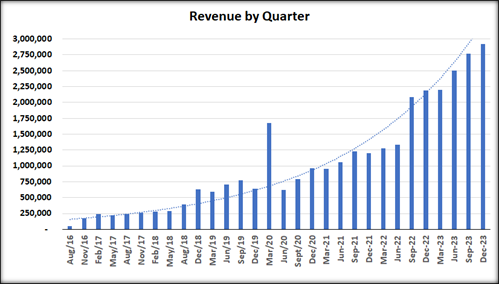

Quarterly Revenue Historical Growth

The chart below shows revenue for the past thirty quarters (7.5 years). Quarterly revenue increased as a result of continued addition of new customers, expanded use of CIM by existing customers and augmented by the acquisition of IM Operations' customers acquired June 30, 2022. Management's objective is to continue to increase revenues to drive cash flow and profitability which we believe will increase future Company value for shareholders.

Fiscal 2023 Operational Update

- The Company's customer relationships continued to strengthen, supporting Management's beliefs that customer retention is expected to remain near

100% and its current and new software-as-a-service ("SaaS") products under development will continue to be adopted by existing and new customers. - The Cognitive Integrity Management ("CIM") SaaS platform is currently being used as the primary integrity management solution for oil and gas ("O&G") pipeline companies who collectively operate approximately

20% of the piggable pipeline infrastructure in the U.S.A. Management believes that use of the Company's solutions for the balance of non-piggable pipelines that are currently managed using legacy systems and processes represents significant future opportunity for the Company. - The Company's CIM platform includes core CIM and various functionality modules that integrate with CIM, including Internal Corrosion Management ("ICM"), External Corrosion Management ("ECM"), Crack Management ("CM"), Probabilistic Risk Management ("RM") and Geohazard Strain Management ("GS"). Management's optimism for the business is bolstered by expressions of interest from customers and from the formalized steering committee initiated at the October 2023 CIM user group event, comprised of senior industry personnel whose roles generally direct integrity management functions and control the associated budgets.

- The Company invested resources in Fiscal 2023 to advance marketing, sales and product development initiatives, with a view to enhance its competitive moat and maintain its global technology lead by leveraging cloud computing, data science and machine learning to assist O&G pipeline operators to mitigate failure threats and reduce operating costs.

- The Company attended several key O&G industry tradeshow and exhibition events during Fiscal 2023, participated in industry educational events wherein Company personnel presented white paper research learnings and hosted its first annual User Group Conference, in collaboration with the Microsoft team that focuses on O&G customers. OneBridge benefits from being a Microsoft "managed partner" whose O&G sales team members participate in joint sales efforts to pursue sales opportunities involving the Company's solutions that operate on Microsoft's Azure cloud platform.

- Use of the CIM platform by customers increased essentially in accordance with Management's expectations during Fiscal 2023, with higher pipeline miles operated by customers and miles under SaaS subscriptions driving revenue. OneBridge onboarded five additional pipeline operators during Fiscal 2023, who became new CIM users due to direct sales efforts or after being acquired by existing CIM customers. Some customers expanded their use of the CIM platform to include ICM and other new functionality modules, a trend we believe will generate recurring revenue in future periods.

- The Company's development team had a highly productive year in 2023, having released 6 major CIM platform updates, evolved the ICM, ECM, CM, RM and GS functionality modules and advanced various data science and machine learning projects. This team also addressed 221 User Stories, 180 Bugs and 2,496 commitments for customers and upgraded the CIM platform to .NET 6 status. Development staff trained in new Microsoft technologies and systems during Fiscal 2023 and this, together with our new customer additions, resulted in the Company earning the Microsoft Solutions Partner designation for "Digital and App Innovation (Azure)". This provides the Company access to accelerated support and discounted or free internal user rights for a wide swath of Microsoft products.

- The Company's client services team addressed 17 projects during Fiscal 2023, primarily involving 6 clients and 5 core CIM platform implementations, collectively involving 15 divisional operators and more than 700 pipeline systems. Projects included work associated with integrity management and compliance, geographic information system ("GIS") integrations, loading of more than 3,700 ILI assessments and 67 million anomalies into CIM, migrating data from legacy systems into CIM, integrating with various customer software applications and training.

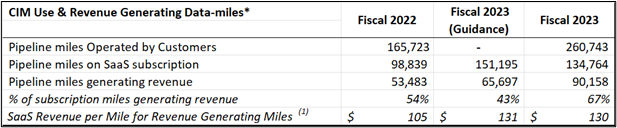

- The following table estimates the aggregate pipeline miles operated by all customers, miles of customers' pipeline assets that are subject to multi-year SaaS agreements and miles of pipeline data ingested into our CIM platform, for which revenue was earned ("data-miles") in Fiscal 2023. Please refer to the MD&A for more information regarding data-mile.

1: The revenue per mile (Cdn $) for revenue generating miles includes CIM revenue only and excludes IM Operations revenue.

- The Company published its Fiscal 2024 financial guidance on February 20,2024.

FISCAL 2024 outlook

Fiscal 2023 was a pivotal year for OneSoft, with the Company achieving its key objectives of: (a) exceeding

We reiterate our Fiscal 2024 revenue guidance of

The Company is also investigating alternatives to accelerate revenue growth and business development, potentially through synergistic M&A activities. Management is optimistic that OneSoft is well positioned to capitalize on its first mover technology advantage to deliver enhanced benefits to customers and increase value for shareholders.

Given the current business and operational plans for fiscal 2024, management does not anticipate raising additional capital to execute its current business plan.

WEBCAST: FISCAL 2023 FINANCIAL RESULTS CONFERENCE CALL:

| When: | APRIL 2, 2024 9:00 AM Mountain Time |

| Webcast URL: | https://www.webcaster4.com/Webcast/Page/3031/50264 |

| Participant Numbers: | Toll Free: 888-506-0062 Participants will be greeted by an operator and asked for the access code. If a caller does not have the code, they can reference the company name. Use of the access code speeds entry into the call. |

| Duration: | 60 Minutes |

Callers should dial in 5 - 10 min prior to the scheduled start time.

About OneSoft and OneBridge

OneSoft has developed software technology and products that have capability to transition legacy, on-premises licensed software applications to operate on the Microsoft Azure Cloud Platform. Our business strategy is to seek opportunities to incorporate Data Science and Machine Learning, business intelligence and predictive analytics to create cost-efficient, subscription-based software-as-a-service solutions. Visit www.onesoft.ca for more information.

OneSoft's wholly owned subsidiaries, OneBridge Solutions Canada Inc. and OneBridge Solutions, Inc., develop and market revolutionary new SaaS solutions that use advanced Data Sciences and Machine Learning to analyze big data using predictive analytics to assist Oil & Gas pipeline operators to predict pipeline failures and thereby save lives, protect the environment, reduce operational costs, and address regulatory compliance requirements. Visit www.onebridgesolutions.com for more information.

OneSoft Shares held by OneSoft's Investor Relations Advisor.

Sophic Capital Inc., OneSoft's Investor relations advisor, holds 144,000 shares of OneSoft Solutions.

For more information, please contact.

| OneSoft Solutions Inc. Dwayne Kushniruk, CEO dkushniruk@onesoft.ca 587-416-6787 | Sean Peasgood, Investor Relations Sean@SophicCapital.com 647-494-7710 |

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of OneSoft Solutions Inc. (the "Company") and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expects", "believe", "will", "intends", "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements, the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers; the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally and which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks. These include but are not limited to the risks associated with the industries in which the Company operates in general such as: costs and expenses; interest rate and exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities within the United States. The securities to be offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of such Act or other laws.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

View the original press release on accesswire.com