OneSoft Solutions Inc. Reports Results for First Quarter ended March 31, 2024

OneSoft Solutions Inc. reported a 32% increase in Q1 2024 revenue compared to Q1 2023. Gross profit grew by 40%, and gross margin improved to 74.8%. The company's net loss rose by $77,000 due to higher costs. Adjusted EBITDA increased by $135,000. Cash reserves surged by 65% to $8 million.

The company expanded its cloud-based CIM platform, launching new modules and hiring key personnel. Despite administrative delays in signing new contracts, the company expects to meet its 2024 revenue guidance of $15-$16 million. Management remains optimistic about ongoing projects and future customer acquisitions.

OneSoft attended industry events, increasing its market presence and continuing business development efforts, including M&A activities. No changes have been made to the fiscal 2024 guidance despite some Q1 revenue shortfalls.

- Revenue increased by 32% compared to Q1 2023.

- Gross profit grew by 40%.

- Gross margin increased to 74.8%.

- Cash and cash equivalents surged by 65% to $8 million.

- Adjusted EBITDA improved by $135,000.

- Several customers expanded their use of the CIM platform.

- New functionality modules were developed and launched.

- Company hired a product manager to accelerate development.

- High employee retention and increased workforce by 8 hires.

- Attended key industry events, increasing market presence.

- Ongoing business development and M&A activities, with $344,000 spent on legal, accounting, and taxation advice.

- Net loss increased by $77,000 due to higher costs.

- Revenue in Q1 was below expectations due to administrative delays in signing new contracts.

- Incurred $344,000 in expenses for M&A activities without concluding new opportunities.

Q1 2024 Revenue up

EDMONTON, AB / ACCESSWIRE / May 23, 2024 / OneSoft Solutions Inc. (the "Company" or "OneSoft") (TSXV:OSS)(OTCQB:OSSIF), a North American developer of cloud-based business solutions, announces its financial results for the three months ended March 31, 2024 ("Q1 2024").

Please refer to the Unaudited Condensed Consolidated Financial Statements and Management's Discussion and Analysis ("MD&A") for the three-month period ended March 31, 2024, filed on SEDAR+ at www.sedarplus.ca for more information. Unless otherwise specified, all dollar amounts are denominated in Canadian dollars.

FINANCIAL RESULTS

FINANCIAL HIGHLIGHTS

- Revenue this quarter increased by

32% over Q1 Fiscal 2023. - Gross profit this quarter increased by

40% over Q1, Fiscal 2023. - Gross margin increased to

74.8% from70.5% . - Net loss increase of

$77,000 is attributed to increased costs. - Adjusted EBITDA, a Non-GAAP measure reconciled to the net loss below, improved by

$135,000 in Q1 2024. - Cash and cash equivalents increased by

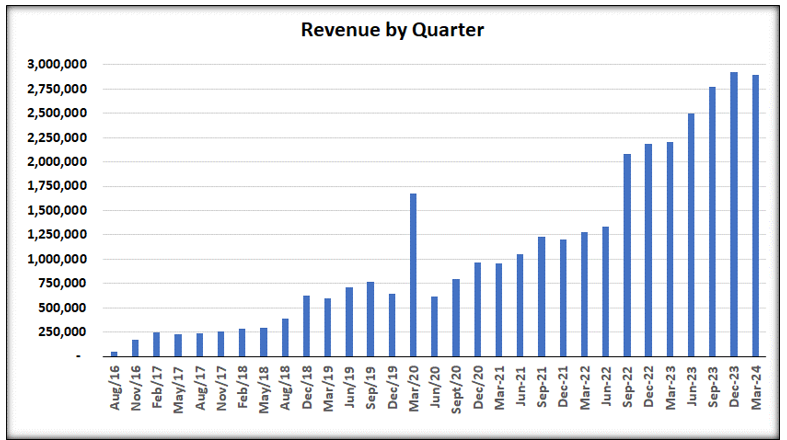

$3.2 million to$8.0 million as at March 31, 2024. - The chart below shows quarterly revenue for the past 7.75 years. Quarterly revenue generally continues to increase in accordance with Management's expectations, as a result of expanded use of the Company's software and IM Operations services by existing customers.

BUSINESS UPDATE

The Company continued to develop new functionality modules that integrate with the CIM platform, including External Corrosion Management ("ECM"), Crack Management ("CM"), Probabilistic Risk Management ("RM") and Geohazard Strain Management ("GS"). A product manager for RM was recruited in the quarter and whose employment commenced April 1, 2024. Management believes this addition to staff will accelerate the pace of development of RM. The Company announced commercial availability of its first version of a new Crack Management ("CM") module, wherein input from initial users will be used to iterate deeper functionality into subsequent versions of CM.

Several customers continued to expand their use of CIM by ingesting additional miles and adopting the new functionality offered to them, including the Internal Corrosion ("IC") module that generated new subscription revenue and associated service revenue in the quarter.

Management is optimistic that these modules, after they are completed and fully commercialized, will be embraced by current and future customers. This is based on expressions of interest from customers and input from the formalized steering committee initiated at the October 2023 user group event that is comprised of senior industry personnel whose roles include direct integrity management functions and control of the associated budgets.

The Company encountered several administrative delays by prospective customers which delayed the signing of new CIM contracts in Q1 2024, and which Management believes will occur in Fiscal 2024.

The Company attended the Pipeline Pigging and Integrity Management tradeshow and exhibition event in Houston, TX ("PPIM") in Q1 and prepared to attend the Pipeline Technology Conference in Berlin, Germany in April 2024, concurrent with establishing a sales office in England to target potential customers in the European, Middle East and African Regions ("EMEA"). Company personnel presented white paper research at both events, which garnered interest in our solutions from new prospective customers.

The Company's client services team engaged in numerous customer projects involving integrity management and compliance, geographic information system ("GIS") integrations, loading of ILI assessments into CIM, migrating data from legacy systems into CIM, integrating with various customer software applications and CIM training. This work resulted in services revenue increasing over Q1 2023.

The Company's employee roster increased by 8 new hires since Q1 2023 and employee retention remains high.

CORPORATE UPDATE

Management attended the CEM AlphaNorth Capital Event investor conference in Nassau, Bahamas in January 2024 and hosted numerous one-on-one meetings with current and prospective shareholders of OneSoft during the quarter.

Management and Directors continued to seek and consider business development with potential reseller partners to generate organic revenue growth and M&A strategies that could foster inorganic revenue growth. In Q1 2024, the Company incurred approximately

FISCAL 2024 GUIDANCE

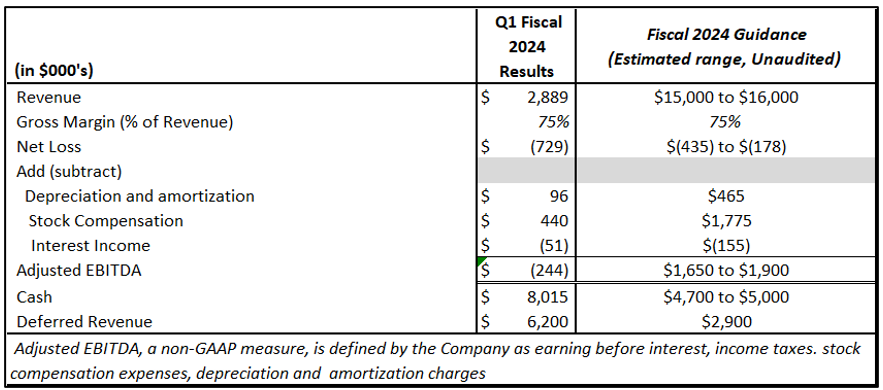

The following table reflects the Fiscal 2024 financial guidance published on February 20, 2024 and actual results for Q1. Fiscal 2024 guidance is not being changed at this time.

Notes regarding 2024 Guidance:

- Fiscal 2024 revenue is estimated to be in the range of

$15 million to$16 million , representing a44% to54% increase, respectively, over Fiscal 2023 revenue. Revenue in Q1 2024 was below expectation due to delayed signing of new customers in the quarter. Management believes the Q1 2024 revenue gap will be overcome and is confirming its Fiscal 2024 revenue guidance at this time. - The Net Loss and Adjusted EBITDA results for Q1 2024 include

$344,000 of expenses incurred in Q1 for M&A investigation. Although a portion of these expenses were not contemplated when the Fiscal 2024 guidance was published, Management is not changing its Fiscal 2024 Guidance at this point but will review this after the conclusion of Q2 2024 to determine if any revisions to its Guidance estimates are warranted. - As expected, many customers renewed their CIM contracts during Q1 2024 and paid the subscription price at the start of the contract period. This caused cash and deferred revenue to exceed their respective year-end values forecast in the Fiscal 2024 guidance. Management anticipates that payment of expenses prior to 2024 year-end and realization of deferred revenue in 2024 should cause these values to reduce by year-end to those stated in the Guidance. Deferred revenue may vary materially from Guidance due to CIM utilization by customers and is also dependent upon achieving planned revenue and closing of sales to new customers during 2024.

OUTLOOK

Fiscal 2023 was a pivotal year for OneSoft, with the Company achieving its key objectives of: (a) exceeding

The Company's sales pipeline continues to strengthen, irrespective that closing of sales for certain prospective customers has encountered delays. Management is optimistic that these expected customer additions are only delayed rather than lost and that OneSoft is well positioned to capitalize on its first mover technology advantage to deliver enhanced benefits to customers and increase value for shareholders.

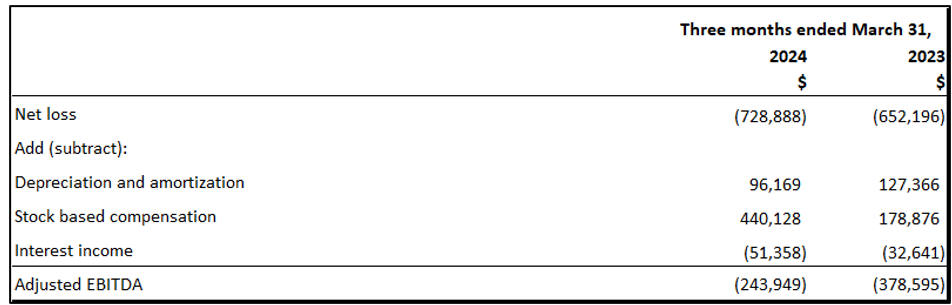

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA

Q1 2024 EARNINGS WEBCAST / CONFERENCE CALL

OneSoft's CEO Dwayne Kushniruk and CFO Paul Johnston will host a live webcast on Friday, May 24, 2024 at 11:00 am ET to review the results, provide Company updates, and answer investor questions following the presentation. Webcast / Conference call details are as follows:

DATE: Friday, May 24, 2024

TIME: 11:00am ET (8:00am PT)

WEBCAST: Webcast Link

OPTIONAL PARTICIPANT TELEPHONE NUMBERS:

- Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 473719

Callers should dial in 5 - 10 min prior to the scheduled start time and simply ask to join the OneSoft Solutions call.

REPLAY: Available at: https://www.onesoft.ca/

ANNUAL GENERAL AND SPECIAL MEETING OF THE SHAREHOLDERS MAY 28, 2024

The Annual General and Special Meeting of the Shareholders will be held May 28, 2024 at 1:00 pm Mountain time and may be attended by clicking this link https://agm.issuerdirect.com/oss or by telephone access at 1-888-506-0062 or 1-973-528-0011 using access code 808507. After the formal portion of the Meeting, Management will answer shareholder questions.

ABOUT ONESOFT AND ONEBRIDGE

OneSoft has developed software technology and products that have capability to transition legacy, on-premises licensed software applications to operate on the Microsoft Azure Cloud Platform. Our business strategy is to seek opportunities to incorporate Data Science and Machine Learning, business intelligence and predictive analytics to create cost-efficient, subscription-based software-as-a-service solutions. Visit www.onesoft.ca for more information.

OneSoft's wholly owned OneBridge subsidiaries develop and market revolutionary new SaaS solutions that use advanced Data Sciences and Machine Learning to analyze big data using predictive analytics to assist Oil & Gas pipeline operators to predict pipeline failures and thereby save lives, protect the environment, reduce operational costs, and address regulatory compliance requirements. Visit www.onebridgesolutions.com for more information.

For more information, please contact.

OneSoft Solutions Inc.

Dwayne Kushniruk, CEO

dkushniruk@onesoft.ca

587-416-6787

Sean Peasgood, Investor Relations

Sean@SophicCapital.com

647-494-7710

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of OneSoft Solutions Inc. (the "Company") and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expects", "believe", "will", "intends", "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers; the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally and which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks. These include but are not limited to the risks associated with the industries in which the Company operates in general such as: costs and expenses; interest rate and exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities within the United States. The securities to be offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of such Act or other laws.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

View the original press release on accesswire.com