OneSoft Solutions Inc. Reports Financial and Operational Results for Q2 2021; Q2 Revenue Up 70% Over Q2 Prior Year

OneSoft Solutions (OSSIF) reported impressive financial results for Q2 2021, achieving a 70% increase in revenue to $1.054M compared to $619K in Q2 2020. However, revenue for the first six months declined by 13% year-over-year due to a high benchmark from 2020. The company recorded a net loss of $1.131M, slightly improved from the $1.345M loss in Q2 2020. Deferred revenue stood at $2.346M. The company maintains a strong balance sheet with $7.2M in cash and no debt, suggesting sufficient funds for future operations.

- Q2 2021 revenue increased by 70% compared to Q2 2020, indicating growing customer adoption.

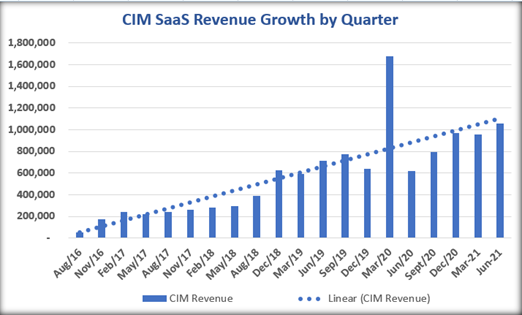

- CIM revenue growth reflects a compounded annual growth rate of 82.4% and a quarterly growth rate of 16.2%.

- Strong cash position with $7.2 million and no debt, ensuring financial stability.

- Net loss of $1.131 million, although an improvement from the previous year's loss.

- Revenue for the first six months down 13% compared to the same period last year, impacted by high revenue in Q1 2020.

Insights

Analyzing...

EDMONTON, AB / ACCESSWIRE / August 11, 2021 / OneSoft Solutions Inc. (the "Company" or "OneSoft") (TSXV:OSS)(OTCQB:OSSIF), a North American developer of cloud-based business solutions, is pleased to announce its financial results for the quarter ended June 30, 2021 ("Q2 2021"). Please refer to the interim unaudited condensed Consolidated Financial Statements and Management's Discussion and Analysis ("MD&A") for the three and six months ended June 30, 2021 filed on SEDAR at www.sedar.com for more information.

Financial Summary for Q2 Ended June 30, 2021

The following table summarizes the second quarter ended June 30, 2021, compared to June 30, 2020:

| Three months ended | Six months ended | |||||||||||

(in C$,000, per share in C$) | June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2019 | ||||||||

| $ | $ | $ | $ | |||||||||

Revenue | 1,054 | 619 | 2,008 | 2,295 | ||||||||

Gross profit | 792 | 436 | 1,500 | 1,770 | ||||||||

Net loss | (1,131 | ) | (1,345 | ) | (2,126 | ) | (1,318 | ) | ||||

Exchange (loss) gain on translation of foreign operations | 61 | (5 | ) | 53 | (21 | ) | ||||||

Comprehensive loss | (1,070 | ) | (1,350 | ) | (2,073 | ) | (1,339 | ) | ||||

Weighted average common shares outstanding - basic and fully diluted (000)'s | 116,221 | 114,645 | 116,054 | 113,878 | ||||||||

Net loss per share | (0.01 | ) | (0.01 | ) | (0.02 | ) | (0.01 | ) | ||||

OPERATIONAL HIGHLIGHTS FOR Q2 2021

- Revenue for Q2 2021 was up

70% over Q2 2020, as a result of more customers using Company solutions and a greater level of activity by all customers. A decrease in the effective average U.S. foreign exchange rate from 1.3853 last year to 1.2282 this year negatively affected Q2 revenue by approximately$125,000. - Revenue for the six months ended June 30, 2021 was

13% less than the same period last year, due to unusually high revenue generated by a large customer onboarding CIM in Q1 last year and by the effective average U.S. foreign exchange rate having decreased by8% period over period. - Deferred Revenue, consisting of pre-paid Cognitive Integrity Management ("CIM") fees, at the end of Q2 2021 totaled

$2,346,147 versus$2,560,475 and$413,546 as at March 30, 2021 and December 31, 2020, respectively. - CIM revenue continued its quarterly growth trend. Its compounded annual growth rate is

82.4% and its compounded quarterly revenue growth rate is16.2% which Management believes are salient factors to measure progress and increase future value for shareholders.

- The Company continued to increase the breadth and speed to market of CIM functionality during the quarter, including entering into a technology sharing agreement with C-FER Technologies ("C-FER"), to integrate C-FER's quantitative risk models into the CIM platform. This arrangement is expected to improve operational practices for clients through replacement of outdated qualitative risk solutions with quantitative and probabilistic models that can more accurately assess pipeline risks.

- On April 7, 2021 the Company announced that one of the largest refined products pipeline companies in the U.S.A., with pipelines spanning Texas to the North Eastern U.S seaboard, entered into a multi-year agreement to use CIM for integrity management of its pipeline operations.

- On June 23, 2021 the Company announced it had entered into a Teaming Agreement with the Advisian/Worley group who implemented the first CIM client in Australia.

- The Company held its annual general and special meeting on May 4, 2021, wherein all resolutions proposed by Management were voted on and adopted by shareholders.

- On June 24, 2021 R. David Webster, P.Eng. joined the Company as an independent Director. Mr. Webster brings significant business development and technical experience gained during a long and distinguished career in pipeline operations, consulting engineering and senior management, with areas of specialties that include pipeline design and construction, corrosion, cathodic protection, compliance, and integrity management for oil and gas and water industries.

- On July 28, 2021 the Company announced that a Canadian pipeline company contracted to use CIM for integrity management of its pipelines in Eastern and Western Canada.

BUSINESS OUTLOOK

Management is pleased with the Company's activity and progress during Q2 2021 to advance our technology and solutions, market presence and business development opportunities, which are proceeding in accordance with expectations. We remain confident that our first mover advantage in leveraging machine learning, data science and cloud computing continue to provide a strong competitive moat for the business. As well, knowledge of the high value that CIM contributes to clients is becoming better known globally through technical publications, presentations, industry conferences, and word of mouth referrals, which we believe will assist the Company to continue to gain market adoption.

Sales activities are currently underway in the U.S.A., Canada, Australia, United Arab Emirates, Brazil, Argentina and Chile with numerous CIM Production Trials planned or in various stages of completion, which we anticipate will result in completed sales in future periods. Various business development initiatives are also underway, with the objectives to recruit additional CIM resellers, enter into joint venture arrangements with synergistic companies and pursue new potential markets and revenue sources where our CIM technology and platform can be leveraged.

Given the Company's strong balance sheet with

ON BEHALF OF THE BOARD OF DIRECTORS

ONESOFT SOLUTIONS INC.

Douglas Thomson

Chair

For more information, please contact:

Dwayne Kushniruk, CEO

dkushniruk@onesoft.ca

780-437-4950

Sean Peasgood, Investor Relations

Sean@SophicCapital.com

647-494-7710

Forward-Looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expects", "believe", "will", "intends", "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers, the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally, which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks. These include but are not limited to the risks associated with the industries in which the Company operates in general such as: costs and expenses; interest rate and exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

View source version on accesswire.com:

https://www.accesswire.com/659241/OneSoft-Solutions-Inc-Reports-Financial-and-Operational-Results-for-Q2-2021-Q2-Revenue-Up-70-Over-Q2-Prior-Year