Osisko Announces Agreement to Purchase Royalties on Spartan Resources’ Dalgaranga Gold Project in Western Australia

Rhea-AI Summary

Osisko Gold Royalties (OR: TSX & NYSE) has announced a binding agreement to acquire a 1.8% gross revenue royalty on the Dalgaranga Gold project and a 1.35% gross revenue royalty on additional regional exploration licenses in Western Australia. The total consideration for the transaction is US$50 million, with US$44 million for the Dalgaranga Royalty and US$6 million for the Exploration Royalty.

Key highlights of the transaction include:

- Exposure to a premium gold development project in Western Australia

- Near-term cash flow potential with first production likely within 2 years

- Significant geological potential with ongoing high-grade discoveries

- Fully-permitted processing plant and established infrastructure

- High-grade, long-life, and potentially low-cost future gold mine

- Large and prospective exploration licenses

The transaction is subject to approval from Australia's Foreign Investment Review Board, expected in the coming weeks.

Positive

- Acquisition of 1.8% gross revenue royalty on Dalgaranga Gold project and 1.35% on exploration licenses for US$50 million

- Exposure to a high-grade gold development project in Western Australia, a top-tier mining jurisdiction

- Near-term cash flow potential with production likely to restart within 2 years

- Fully-permitted 2.5 million tonnes per annum processing plant and established infrastructure

- High-grade mineral resource estimate of 1.393 Moz Au Indicated and 1.089 Moz Au Inferred

- Expected mine life of 12+ years with potential for low-cost production

- Large exploration potential with additional regional licenses

Negative

- Transaction subject to approval from Australia's Foreign Investment Review Board

- Spartan has the option to buy back up to 20% of both royalties until February 2027

News Market Reaction 1 Alert

On the day this news was published, OR gained 0.33%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

MONTREAL, Sept. 30, 2024 (GLOBE NEWSWIRE) -- Osisko Gold Royalties Ltd (the “Company” or “Osisko”) (OR: TSX & NYSE) is pleased to announce that it has entered into a binding agreement to acquire a

TRANSACTION HIGHLIGHTS

Exposure to a Premium Gold Development Project in a Top-Tier Mining Jurisdiction

- Dalgaranga is one of the best gold development and production re-start projects globally. The Project is located in Western Australia, one of the most prolific and well-established mining jurisdictions; and

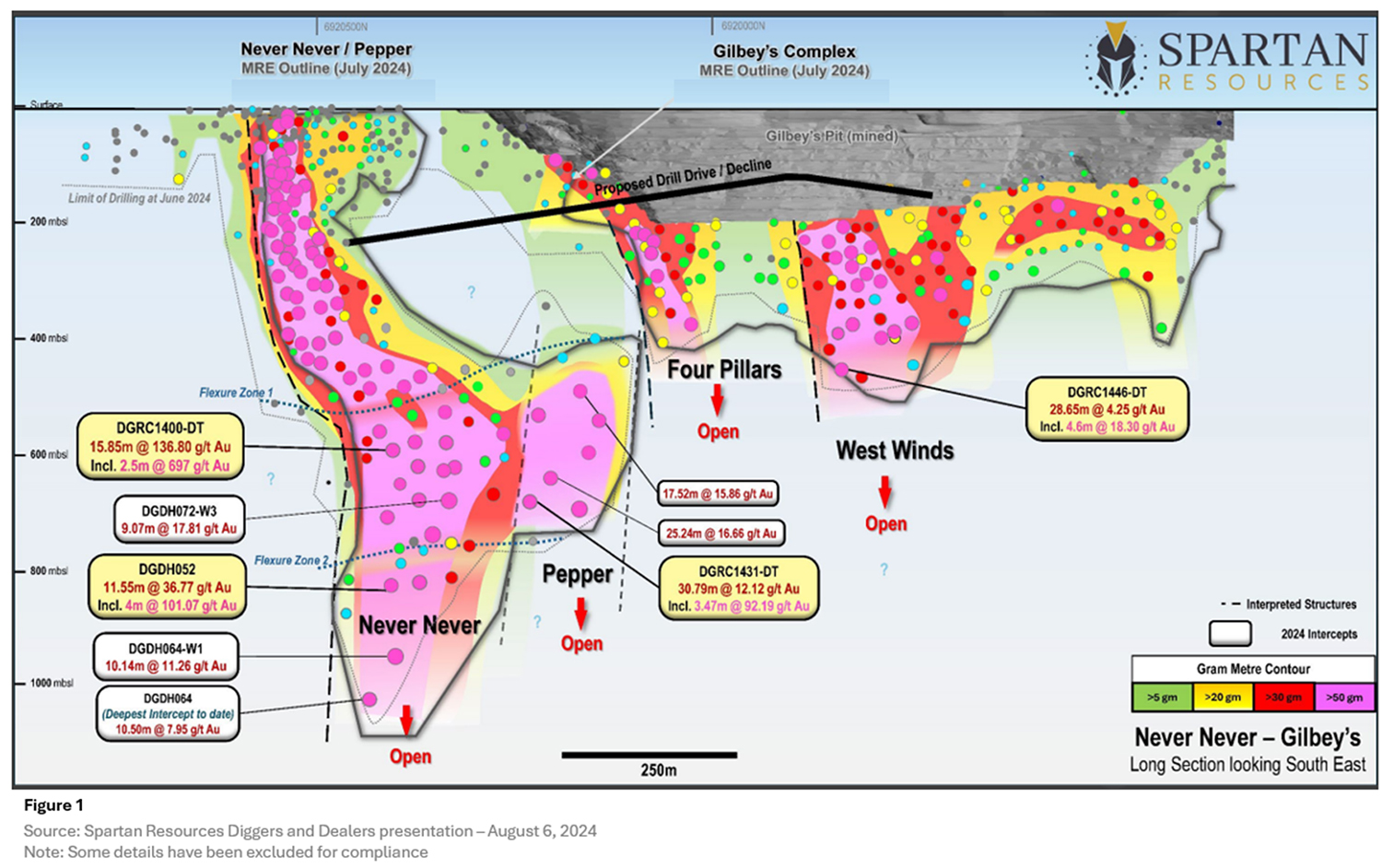

- Dalgaranga, a recently mined open pit operation, has been rejuvenated by very impressive new high-grade discoveries, most notably the Never Never and Pepper deposits, which have shifted the focus towards ore extraction via underground mining methods.

Near-Term Cash Flow Potential

- The Dalgaranga mill is fully-permitted and approvals for future underground mining are in progress, providing a clear path to near-term production. The Project is on the verge of re-starting as one of Western Australia’s next significant high-grade gold mines with first production from underground likely re-commencing within the next 2 years.

Significant Geological Potential

- High-grade discoveries at the Project continue to drive ongoing underground mineral inventory growth;

- Spartan expects to complete a Mineral Reserve Estimate update and Feasibility Study both within the first half of 2025; the new underground mine plan will serve as the basis for Spartan’s Final Investment Decision (“FID”) to re-start operations at Dalgaranga; and,

- In addition to the evolving exploration story at Dalgaranga, the Exploration Royalty provides exposure to a large prospective land package covering mineralization within trucking distance to various mills located in the Murchison Gold District.

Jason Attew, President and CEO of Osisko commented: “Osisko’s ability to uncover and execute accretive near-term cash flow precious metals transactions in Tier-1 mining jurisdictions is synonymous with our strategy. We believe that Dalgaranga is one of the most attractive gold development and re-start projects globally given its high-grade underground nature, and its location in the Murchison Gold District in Western Australia. What the Spartan team has been able to accomplish in terms of resource discovery and definition at Dalgaranga over the past two years is impressive. We believe that Spartan will move forward with an FID at the Project before the end of 2025 and that its team will continue to expand the high-grade resource at Dalgaranga. We’re extremely pleased to be associated with one of Australia’s most exciting gold development and re-start opportunities, and with an asset that boasts such exciting exploration upside potential. We look forward to our partnership with the Spartan team going forward.”

DALGARANGA ROYALTY - ASSET HIGHLIGHTS

Fully-Permitted Processing Plant in a Tier-11 Mining Jurisdiction

- With most material approvals already in place, the Project is in a position to be advanced quickly into development and construction upon FID and final project financing; and,

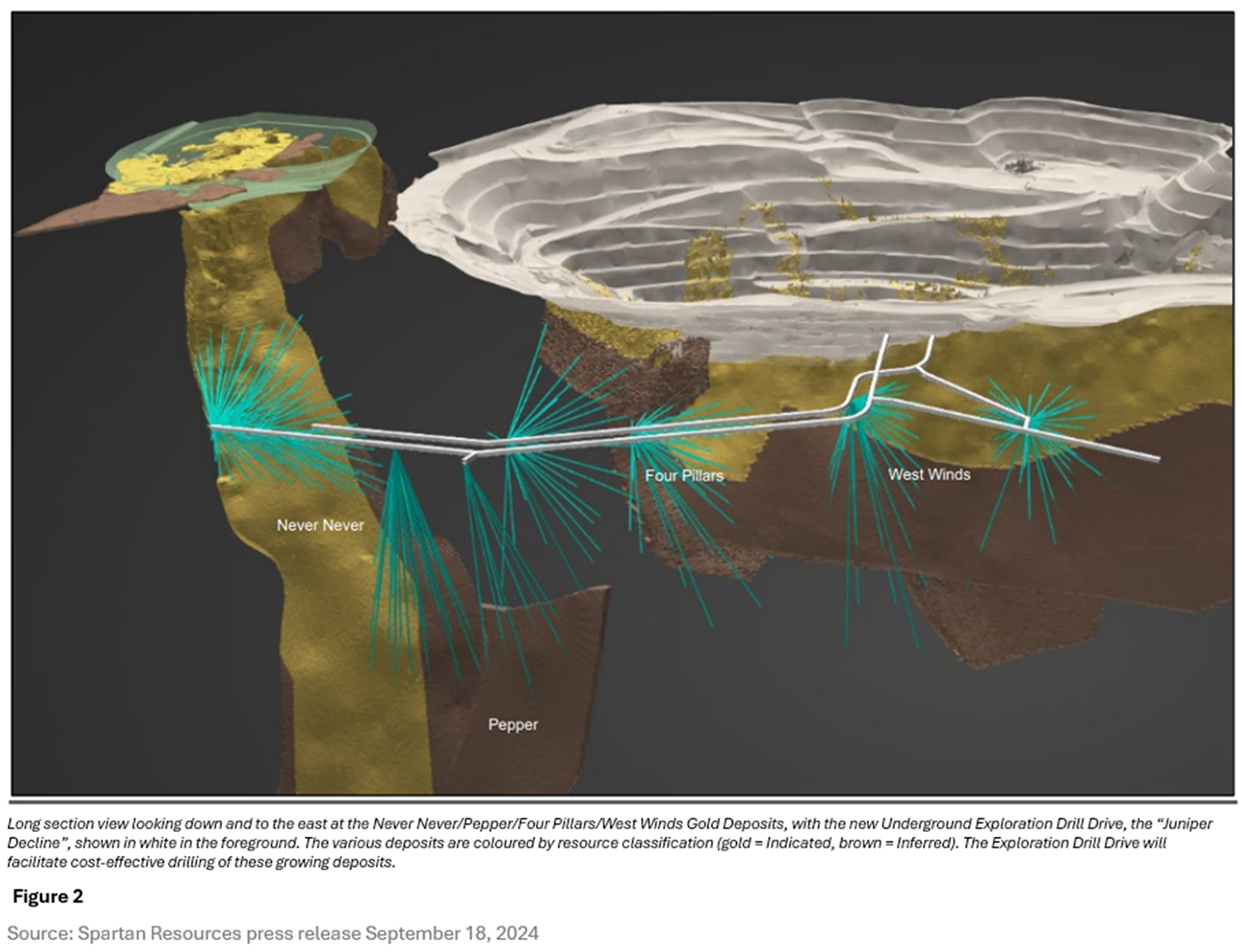

- Significant infrastructure has already been established on site, including a 2.5 million tonnes per annum sulphide processing mill (gravity and CIL) commissioned in May 2018 and operated until November 2022, and associated tailings, water, power and camp facilities to support the operations (all currently on care & maintenance). Spartan has also commenced construction of twin exploration declines, which is also likely to also be used for near-term production purposes.

High-Grade, Long Life, and Low-Cost Future Gold Mine

- Spartan’s Dalgaranga licenses cover an area of approximately 509 square kilometers (“km2”) in the prospective Murchison Gold District of Western Australia;

- As of June 30th, 2024 the global Mineral Resource Estimate (“MRE”) at Dalgaranga consisted of 8.70 million tonnes (“Mt”) grading 4.98 g/t gold (“Au”) for 1.393 million ounces (“Moz”) in the Indicated category, in addition to 7.44Mt grading 4.56 g/t Au for 1.089 Moz in the Inferred category;

- The Project’s “high-grade core,” which is spread across the Never Never and Pepper deposits, consists of 3.88Mt grading 8.74 g/t Au for 1.09 Moz in the Indicated category, and 2.86Mt grading 8.52g/t Au for 0.78 Moz in the Inferred category and currently contains

75% of the identified gold to date; as such, this area remains a key target for future MRE expansions; - Spartan is also focused on delineating higher grade underground Mineral Resources for the Four Pillars and West Winds gold prospects, situated under the historic Gilbey’s open pit;

- Based on the above MRE, Osisko currently expects a mine life of 12+ years at Dalgaranga; and,

- Due to the high-grade nature of the deposit, Osisko expects Dalgaranga to be in the lowest quartile on the global gold cost curve, once back in production.

Spartan is a Mid-Sized and Experienced Australian Underground Miner

- Spartan is a mid-sized and well-capitalized miner (~A

$90 million in cash at June 30, 2024), led by a management team with a history of exploration success, mine development and operational expertise; - Spartan has access to Western Australia’s renowned, highly-skilled and trained local mining workforce; and,

- Spartan’s key shareholders include Ramelius Resources Limited (

18% ) and Tembo (10% ).

Additional Information

- Spartan has the ability to buy back up to

20% of the Dalgaranga Royalty, as well as20% of the Exploration Royalty for a total of A$3.15 million until February 2027.

___________________________

1 “Tier-1 Mining Jurisdiction” defined as Australia, Canada, or USA

EXPLORATION ROYALTY HIGHLIGHTS

Large Land Packages and Highly Prospective Exploration Licenses

- The Exploration Royalty covers the 685 km2 Yalgoo Licenses, in addition to ~1000 km2 of other prospective licenses (including the advanced Glenburgh and Mt Egerton exploration properties, which have the potential to be a second production hub);

- Yalgoo is approximately 110 kilometers (“km”) Southwest via road from Dalgaranga and hosts the Melville gold deposit which consists of an open pit MRE which contains 3.35 Mt grading 1.49 g/t Au for 160 thousand ounces (“koz”) in the Indicated category, and 1.88Mt grading 1.37 g/t Au for 83koz in the Inferred category, within a granted Mining Lease;

- Spartan is progressing with permitting of Yalgoo, which is expected to provide feed to supplement the high-grade ore from Never Never and Pepper;

- Glenburgh is a 768 km2 land package, approximately 300km North of Dalgaranga, and contains 13.5Mt grading 1.0 g/t Au for 431koz in the Indicated category, and 2.80Mt grading 0.90 g/t Au for 79koz in the Inferred category, spread across 11 separate near-surface deposits, 10 of which are on a granted Mining Lease; and,

- Mt Egerton is a 237 km2 land package, approximately 300km North of Dalgaranga, and contains 0.23Mt grading 3.40 g/t Au for 25koz in the Indicated category, spread across two existing deposits (Hibernian and Gaffney’s Find), both of which are located within granted Mining Leases.

For more information, please refer to https://spartanresources.com.au/.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Guy Desharnais, Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold Royalties Ltd, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Osisko Gold Royalties Ltd.

Osisko Gold Royalties Ltd is an intermediate precious metal royalty company which holds a North American focused portfolio of over 185 royalties, streams and precious metal offtakes, including 20 producing assets. Osisko’s portfolio is anchored by its cornerstone asset, a

Osisko’s head office is located at 1100 Avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, H3B 2S2.

For further information, please contact Osisko Gold Royalties Ltd:

| Grant Moenting Vice President, Capital Markets Tel: (514) 940-0670 #116 Mobile : (365) 275-1954 Email: gmoenting@osiskogr.com | Heather Taylor Vice President, Sustainability & Communications Tel: (514) 940-0670 #105 Email: htaylor@osiskogr.com |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release may be deemed “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking statements are statements other than statements of historical fact, that address, without limitation, future events, the obtaining of the required approval to close the Transaction, that the Project, including the Never Never and Pepper deposits will continue to be developed and will achieve near-term production re-start within 2 years, that exploration will be successful and that high-grade discovery will continue to drive growth of mineral inventories, that a Mining Reserve Estimate update and Feasibility Study will be delivered by the first half of 2025, that exploration potential on land covered by the Exploration Royalty will materialize, that a FID to re-start operations will be made by Spartan before the end of 2025 and that final project financing will be achieved, that delineation of higher grade underground Mineral Resources for the Four Pillars and West Winds gold prospects will be achieved, that Osisko’s expectation of a mine life of 12+ years at Dalgaranga at the lowest quartile on the global cost curve will be accurate, that Spartan will continue to be well capitalized and have access to highly-skilled workforce, that Spartan may exercise its right to buy back

For additional information on risks, uncertainties and assumptions, please refer to the most recent Annual Information Form of Osisko filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov which also provides additional general assumptions in connection with these statements. Osisko cautions that the foregoing list of risk and uncertainties is not exhaustive. Investors and others should carefully consider the above factors as well as the uncertainties they represent and the risk they entail. Osisko believes that the assumptions reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be accurate as actual results, and prospective events could materially differ from those anticipated such the forward-looking statements and such forward-looking statements included in this press release are not guarantee of future performance and should not be unduly relied upon. In this press release, Osisko relies on information publicly disclosed by a third party pertaining to its assets and, therefore, assumes no liability for such third-party public disclosure. These statements speak only as of the date of this press release. Osisko undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by applicable law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/dd586297-5251-4166-889c-4db2ec30320a

https://www.globenewswire.com/NewsRoom/AttachmentNg/29587cfa-087b-4f17-a6f0-b07ee364d483