Orion Diversified Announces an Acquisition in the Permian Basin

Orion Diversified Holding Co (OTC PINK:OODH) has successfully completed a royalty interest acquisition of 6,360 acres in the Permian Basin, enhancing its mineral ownership to 15,640 acres in prime oil-producing areas. The properties yield approximately 35 barrels of oil and 10 mcfgpd daily. Anticipated revenues are projected to reach $100,000 in Q3 2022, driven by multiple income streams from existing wells. Management indicates ongoing negotiations for more operated properties, highlighting potential revenue growth as new wells are permitted for drilling.

- Acquisition of 6,360 acres in the Permian Basin enhances mineral ownership to 15,640 acres.

- Projected revenues are expected to reach $100,000 in Q3 2022.

- Multiple income streams established from existing Bakken wells and Oklahoma royalties.

- Significant cash flow already generated from current operations.

- None.

Insights

Analyzing...

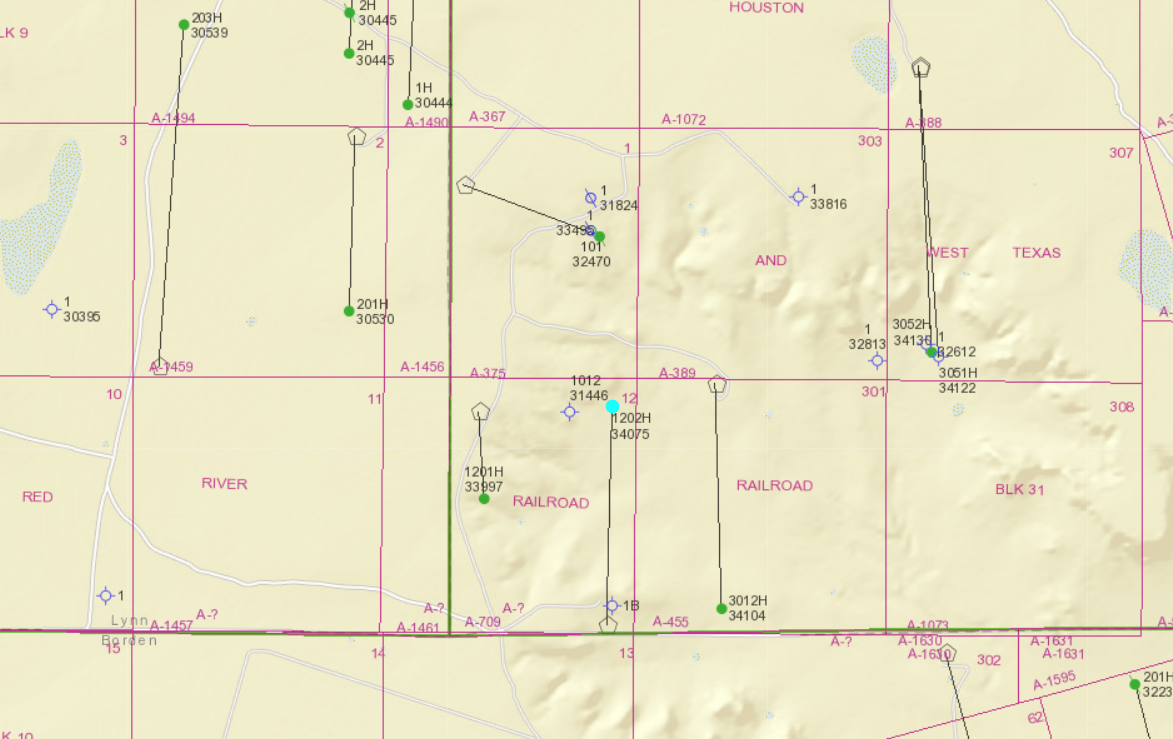

CARSON CITY, NV / ACCESSWIRE / July 28, 2022 / Orion Diversified Holding Co Inc. (OTC PINK:OODH) ("OODH" or the "Company") announced today that it has closed on an acquisition of a royalty interest in Garza and Lynn County Texas of the Permian Basin. The property consists of a royalty interest in 6,360 acres producing 35 bopd & 10mcfgpd. Orion now has mineral ownership in 15,640 Acres in the Permian Basin Wolfcamp Shale & Sprayberry fields.

ACREAGE & REVENUE HIGHLIGHTS

Orion owns mineral interest in more than 27,721 acres in the Bakken Shale, Permian Basin, Woodford Shale, Haynesville Shale, Niobrara Shale, Powder River Basin, & Eagle Ford Shale.

Revenues are on target to reach

MANAGEMENT COMMENTS

"Our Oklahoma royalties & North Dakota Bakken horizontal wells are starting to pay out. I have received checks for more than

ABOUT ORION DIVERSIFIED HOLDING CO INC.

Orion Diversified Holding Co Inc. is a company with a primary strategy of investing in operated majority working interest, non-operated working interest, and mineral interests in oil & gas properties, with a core area of focus in the premier basins within the United States. More information about Orion Diversified Holding Co Inc. can be found at www.orionenergyco.com.

SAFE HARBOR STATEMENT

This press release may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements related to anticipated revenues, expenses, earnings, operating cash flows, the outlook for markets, and the demand for products. Forward-looking statements are no guarantees of future performance and are inherently subject to uncertainties and other factors which could cause actual results to differ materially from the forward-looking statements. Such statements are based upon, among other things, assumptions made by, and information currently available to, management, including management's own knowledge and assessment of the Company's industry and competition. The Company assumes no duty to update its forward-looking statements.

CONTACT:

Orion Diversified Holding Co Inc.

Thomas Lull, President

tom@orionenergyco.com

Phone: 760-889-3435

SOURCE: Orion Diversified Holding Co Inc.

View source version on accesswire.com:

https://www.accesswire.com/710092/Orion-Diversified-Announces-an-Acquisition-in-the-Permian-Basin