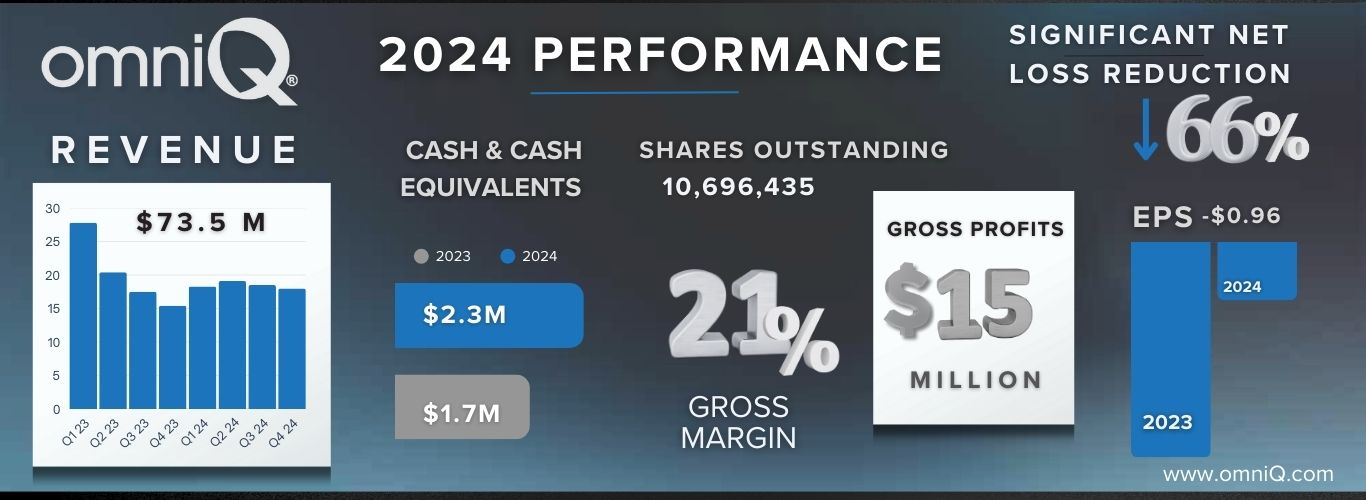

OMINQ Reports Revenues of $73.5 Million in 2024

OMNIQ (OMQS) reported its 2024 financial results with revenue of $73.5 million, down 9% from $81 million in 2023. Despite revenue decline, the company showed significant operational improvements with a 74% reduction in operating losses to $6.9 million from $26.2 million in 2023.

Key financial metrics include stable gross profit at $15.4 million (vs $15.7M in 2023), reduced SG&A expenses by 15% to $19.5 million, and a decreased comprehensive loss of $9.3 million (down 68% from 2023). Operating expenses decreased by 47% to $22.3 million.

The company expanded its technology portfolio with the introduction of seeQ SaaS product and launched various pilot programs including homeland security initiatives and fintech kiosk deployments. The IoT division secured multiple large purchase orders totaling over $10.8 million across retail, transportation, and bioscience sectors.

OMNIQ (OMQS) ha riportato i risultati finanziari per il 2024 con un fatturato di 73,5 milioni di dollari, in calo del 9% rispetto agli 81 milioni di dollari nel 2023. Nonostante la diminuzione del fatturato, l'azienda ha mostrato significativi miglioramenti operativi con una riduzione del 74% delle perdite operative a 6,9 milioni di dollari rispetto ai 26,2 milioni di dollari nel 2023.

I principali indicatori finanziari includono un utile lordo stabile a 15,4 milioni di dollari (rispetto ai 15,7 milioni nel 2023), una riduzione delle spese SG&A del 15% a 19,5 milioni di dollari, e una perdita complessiva diminuita a 9,3 milioni di dollari (in calo del 68% rispetto al 2023). Le spese operative sono diminuite del 47% a 22,3 milioni di dollari.

L'azienda ha ampliato il proprio portafoglio tecnologico con l'introduzione del prodotto seeQ SaaS e ha lanciato vari programmi pilota, inclusi iniziative di sicurezza nazionale e implementazioni di chioschi fintech. La divisione IoT ha ottenuto numerosi ordini di acquisto di grandi dimensioni per un totale superiore a 10,8 milioni di dollari nei settori del retail, dei trasporti e delle bioscienze.

OMNIQ (OMQS) informó sus resultados financieros de 2024 con ingresos de 73,5 millones de dólares, una disminución del 9% respecto a los 81 millones de dólares en 2023. A pesar de la caída en los ingresos, la compañía mostró mejoras operativas significativas con una reducción del 74% en las pérdidas operativas a 6,9 millones de dólares desde los 26,2 millones de dólares en 2023.

Las métricas financieras clave incluyen un beneficio bruto estable de 15,4 millones de dólares (frente a 15,7 millones en 2023), una reducción del 15% en los gastos SG&A a 19,5 millones de dólares, y una pérdida integral disminuida de 9,3 millones de dólares (una disminución del 68% desde 2023). Los gastos operativos se redujeron en un 47% a 22,3 millones de dólares.

La compañía amplió su cartera tecnológica con la introducción del producto seeQ SaaS y lanzó varios programas piloto, incluidas iniciativas de seguridad nacional y despliegues de quioscos fintech. La división de IoT aseguró múltiples órdenes de compra grandes que totalizan más de 10,8 millones de dólares en los sectores de retail, transporte y biociencia.

OMNIQ (OMQS)는 2024년 재무 결과를 보고하며 수익이 7350만 달러로 2023년 8100만 달러에서 9% 감소했다고 발표했습니다. 수익 감소에도 불구하고, 회사는 운영 손실을 690만 달러로 2620만 달러에서 74% 줄이는 등 상당한 운영 개선을 보여주었습니다.

주요 재무 지표에는 1540만 달러의 안정적인 총 이익(2023년 1570만 달러 대비), SG&A 비용을 15% 줄여 1950만 달러로, 그리고 포괄적 손실을 930만 달러로 줄여 2023년 대비 68% 감소한 결과가 포함됩니다. 운영 비용은 2230만 달러로 47% 감소했습니다.

회사는 seeQ SaaS 제품을 도입하여 기술 포트폴리오를 확장하고, 국가 안보 이니셔티브 및 핀테크 키오스크 배치를 포함한 다양한 파일럿 프로그램을 시작했습니다. IoT 부문은 소매, 운송 및 생명과학 분야에서 총 1080만 달러 이상의 대규모 구매 주문을 확보했습니다.

OMNIQ (OMQS) a publié ses résultats financiers pour 2024 avec un chiffre d'affaires de 73,5 millions de dollars, en baisse de 9 % par rapport à 81 millions de dollars en 2023. Malgré la baisse des revenus, l'entreprise a montré des améliorations opérationnelles significatives avec une réduction de 74 % des pertes d'exploitation à 6,9 millions de dollars contre 26,2 millions de dollars en 2023.

Les indicateurs financiers clés incluent un bénéfice brut stable à 15,4 millions de dollars (contre 15,7 millions en 2023), une réduction de 15 % des dépenses SG&A à 19,5 millions de dollars, et une perte globale diminuée à 9,3 millions de dollars (en baisse de 68 % par rapport à 2023). Les dépenses d'exploitation ont diminué de 47 % à 22,3 millions de dollars.

L'entreprise a élargi son portefeuille technologique avec l'introduction du produit seeQ SaaS et a lancé divers programmes pilotes, y compris des initiatives de sécurité nationale et des déploiements de kiosques fintech. La division IoT a sécurisé plusieurs commandes importantes totalisant plus de 10,8 millions de dollars dans les secteurs du commerce de détail, des transports et des biosciences.

OMNIQ (OMQS) hat seine Finanzzahlen für 2024 veröffentlicht, mit einem Umsatz von 73,5 Millionen Dollar, was einem Rückgang von 9% gegenüber 81 Millionen Dollar im Jahr 2023 entspricht. Trotz des Rückgangs des Umsatzes zeigte das Unternehmen erhebliche betriebliche Verbesserungen mit einer Reduzierung der Betriebskosten um 74% auf 6,9 Millionen Dollar von 26,2 Millionen Dollar im Jahr 2023.

Wichtige Finanzkennzahlen beinhalten einen stabilen Bruttogewinn von 15,4 Millionen Dollar (im Vergleich zu 15,7 Millionen Dollar im Jahr 2023), eine Reduzierung der SG&A-Ausgaben um 15% auf 19,5 Millionen Dollar und einen gesunkenen umfassenden Verlust von 9,3 Millionen Dollar (68% Rückgang im Vergleich zu 2023). Die Betriebskosten sanken um 47% auf 22,3 Millionen Dollar.

Das Unternehmen erweiterte sein Technologieportfolio mit der Einführung des seeQ SaaS Produkts und startete verschiedene Pilotprojekte, darunter Initiativen zur nationalen Sicherheit und die Bereitstellung von Fintech-Kiosken. Die IoT-Abteilung sicherte sich mehrere große Bestellungen im Gesamtwert von über 10,8 Millionen Dollar in den Bereichen Einzelhandel, Transport und Biowissenschaften.

- 74% reduction in operating losses ($19.3M improvement)

- Stable gross profit maintained at $15.4M despite revenue decline

- 15% reduction in SG&A expenses ($3.5M savings)

- 47% decrease in operating expenses ($19.6M reduction)

- Secured over $10.8M in new IoT division orders

- Improved loss per share from $3.50 to $0.94

- 9% decrease in revenue from $81M to $73.5M

- Net loss of $10M despite improvements

- Delay in major software project affecting revenue

- Operating at a loss despite cost reductions

Stable Profits and Continued Gains in Efficiency

SALT LAKE CITY, March 31, 2025 (GLOBE NEWSWIRE) -- OMNIQ Corporation (OTCMKTS: OMQS) ("OMNIQ" or "the Company") reports year-end 2024 revenue of

FINANCIAL HIGHLIGHTS:

- Decrease in Loss from Operations: loss from operations of

$6.9 million in 2024 compared to$26.2 million in 2023, representing reduction of$19.3M , a74% decrease. - Revenues decreased from

$81M in 2023 to$73.5M in 2024, a reduction of approximately9% - Gross Profit Stability: gross profit recognized in 2024 was

$15.4M vs$15.7M in 2023 - Reduced Selling, General & Administrative Expense: SG&A was reduced to

$19.5 million in 2024 from$23 million in 2023, or a reduction of$3.5M or15% in 2024.

2024 Financial Results

For the year ended December 31, 2024, the Company reported consolidated revenue of

Cost of goods sold totaled

Although revenue decreased year-over-year by

Loss from operations improved year-over-year, with the Company posting a loss of

Comprehensive loss for 2024 was

Selling, General and Administrative expenses were

For the years ended December 31, 2024 and 2023, operating expenses totaled

The weighted-average number of common shares outstanding used to calculate basic earnings per share was 10,694,366 in 2024 and 8,412,494 in 2023.

Net loss attributable to OMNIQ Corp common stockholders was

OMINQ NEWS AND RECENT EVENTS

Strategic Expansions: Introducing New Technologies and Advancing Key Pilots

In 2024, OMNIQ introduced several new technologies, including the seeQ SaaS product, and launched pilot programs across a variety of industries. The Company expanded its role in public safety and critical infrastructure through key security-focused projects, including a homeland security initiative and a collaborative project with NEC. These efforts underscore OMNIQ’s capabilities in delivering advanced, mission-critical technology solutions. Additional pilots included fintech kiosk deployments at Ben-Gurion Airport and a major restaurant chain, international work with Nestlé, and select implementations with partners such as Spar Israel.

Our ground-breaking AI-based vision solutions are currently in use for sensitive Homeland Security anti-terror projects and automated parking solutions. Inspired by time-critical “friend or foe” decision-making processes, our patented algorithms are based on a combination of cognitive science and machine-learning-based pattern-recognition technology which is arbitrated through a multi-layered decision-making process that offers both speed and accuracy.

Strong IoT Business: Sustained Demand Reflected in New Orders

The IoT division continued to perform well, supported by multiple large purchase orders. Highlights included

Strategic Business Moves: Focusing on Long-Term Value and Differentiation

Throughout the year, the Company took steps to refine its business model—prioritizing integrated solutions over commodity hardware sales and deepening partnerships with fintech providers such as SHVA and Ingenico. The company also supported infrastructure upgrades at DFW Airport and medical centers in Texas and Ohio. By focusing on consultative engagement and tailored deployments, OMNIQ continues to strengthen its position in a competitive landscape.

LETTER TO SHAREHOLDERS

OMNIQ continues to execute on its strategic plan, focusing on cost optimization and operational excellence. We’ve seen improvements due to this strategy throughout the year 2024 and it is largely reflected in our year end numbers. We have successfully reduced operating expenses and improved profitability, demonstrating disciplined financial management while continuing to invest in long-term growth.

Key priorities include enhancing gross profit through efficiencies in cost of goods sold, expanding AI-based offerings for Traffic Management, Safe Cities, retail automation, and supply chain solutions, and launching targeted marketing and product initiatives to drive revenue. The Company is also assessing its debt structure to reduce interest costs and improve financial flexibility.

Revenue for the period was negatively impacted by fewer deliverables and a delay in a major software project; however, our gross profits remained relatively stable due to large cost reductions. We remain confident in the strategy and are actively pursuing growth opportunities in both existing and new markets.

OMNIQ’s proprietary machine vision technologies—used in Homeland Security and parking automation—set the Company apart through speed, accuracy, and a multi-layered cognitive decision-making process. In competitive markets, OMNIQ’s consultative, integrated approach continues to be a key differentiator.

As global markets consolidate, we are evaluating strategic acquisitions in mobile systems, data collection, and integration technologies to expand its portfolio and strengthen its position as a leading specialty integrator.

We are also closely monitoring the Israel-Hamas conflict. At this time, minimal operational impact is expected, but OMNIQ remains vigilant given the fluid nature of the situation.

We have been successful in integrating mission-critical mobile-computing and data-collection solutions for small businesses up to Fortune 500 companies. The needs of our customers continue to evolve as they require new mobile and wireless technologies and services to make their business more competitive and profitable. The result is a continuous flow of opportunities to assist customers in evaluating, choosing, implementing, and supporting the right mobile and data-collection solutions.

We seek to utilize our expertise and software solutions in markets which provide the greatest opportunity to increase margins. Within the Supply Chain Management market, we believe we can further develop our existing customer base who need to replace their legacy systems.

“We believe the strategies we’ve put in place—to reduce costs and drive smart growth—are delivering strong results. Each quarter has shown meaningful progress, and that momentum is clear as we close the year,” said Shai Lustgarten, CEO of OMNIQ Corp. “Looking ahead to 2025, we expect this upward trend to continue, with several major projects already in motion or entering pilot phases. I’m proud of our dedicated, forward-thinking team and the impact we’re making together.”

ABOUT OMNIQ

OMNIQ Corp. provides computerized and machine vision image processing solutions that use patented and proprietary AI technology to deliver real time object identification, tracking, surveillance, and monitoring for Supply Chain Management, Public Safety, and Traffic Management applications. The technology and services provided by the Company help clients move people, and objects and manage big data safely and securely through airports, warehouses, schools, and national borders and in many other applications and environments.

OMNIQ’s customers include government agencies and leading Fortune 500 companies from several sectors, including manufacturing, retail, distribution, food and beverage, transportation and logistics, healthcare, and oil, gas, and chemicals. Since 2014, annual revenues have more than doubled, reaching

The Company currently addresses several billion-dollar markets with double-digit growth, including the Global Smart City & Public Safety markets.

For more information about OMNIQ and its suite of AI-driven solutions, please visit www.OMNIQ.com or contact ir@OMNIQ.com.

INFORMATION ABOUT FORWARD LOOKING STATEMENTS

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Statements in this press release relating to plans, strategies, economic performance and trends, projections of results of specific activities or investments, and other statements that are not descriptions of historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

This release contains “forward-looking statements” that include information relating to future events and future financial and operating performance. The words “anticipate,” “may,” “would,” “will,” “expect,” “estimate,” “can,” “believe,” “potential” and similar expressions and variations thereof are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements.

Examples of forward-looking statements include, among others, statements made in this press release regarding the closing of the private placement and the use of proceeds received in the private placement. Important factors that could cause these differences include, but are not limited to: fluctuations in demand for the Company’s products particularly during the current health crisis, the introduction of new products, the Company’s ability to maintain customer and strategic business relationships, the impact of competitive products and pricing, growth in targeted markets, the adequacy of the Company’s liquidity and financial strength to support its growth, the Company’s ability to manage credit and debt structures from vendors, debt holders and secured lenders, the Company’s ability to successfully integrate its acquisitions, and other information that may be detailed from time-to-time in OMNIQ Corp.’s filings with the United States Securities and Exchange Commission. Examples of such forward-looking statements in this release include, among others, statements regarding revenue growth, driving sales, operational and financial initiatives, cost reduction and profitability, and simplification of operations. For a more detailed description of the risk factors and uncertainties affecting OMNIQ Corp., please refer to the Company’s recent Securities and Exchange Commission filings, which are available at SEC.gov. OMNIQ Corp. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless otherwise required by law.

Contact

IR@OMNIQ.COM