Ohmyhome Announces Growth Updates Following Successful Acquisition of Property Management Business Simply Sakal

- None.

- None.

Insights

The acquisition of Simply Sakal Pte. Ltd. by Ohmyhome and its renaming to Ohmyhome Property Management represents a strategic move to diversify revenue streams and solidify market presence in the property management sector. The reported Compound Annual Growth Rate (CAGR) of 57% in the property management business indicates a robust growth trajectory, which could be a positive indicator for investors looking at the long-term value creation potential of Ohmyhome. The integration of services into the Simple App could enhance user experience and lead to increased customer retention, which is critical in the competitive proptech landscape.

Furthermore, the entry into the more lucrative private condominium market signals an expansion strategy that leverages existing infrastructure to tap into higher-value transactions. The potential for cost synergies through office consolidation and back-office integration is noteworthy as it suggests a focus on operational efficiency that may improve profit margins over time.

Ohmyhome's announcement of an Annual Recurring Revenue (ARR) of over $2.7 million is a significant metric that investors use to gauge the predictable and stable nature of revenue streams in SaaS businesses. The introduction of Vehicle Management Systems as a new SaaS offering, coupled with the Internet of Things (IoT) integrations, could be a growth catalyst by providing differentiated services in a traditionally manual industry. This technological edge has the potential to increase market share and justify a premium valuation.

However, investors should also consider the costs associated with these technological advancements and the time required to achieve full integration and market penetration. The successful implementation of these IoT solutions could result in cost savings for clients and competitive advantages, but it requires careful monitoring of the execution risks involved.

The strategic acquisition by Ohmyhome indicates a significant shift in the company's focus from the HDB resale market to the more premium private condominium sector. This move is not only likely to increase the average revenue per transaction but also positions the company within a different customer segment. The emphasis on a property SuperApp and the integration of IoT solutions for vehicle management reflect an innovative approach to property management, which is traditionally a conservative and low-tech industry.

Given the high property values in Singapore, the company's growth strategy to offer end-to-end property solutions, including higher-margin renovation services, could cater to an unmet need in the market. Stakeholders should monitor customer adoption rates and the scalability of these integrated services to assess the long-term impact on the company's market position.

- Units under management reached 6,746 units, with an Annual Recurring Revenue (ARR) of over

$2.7 million (SGD 3.6 million), and additional SaaS revenue streams.

Singapore, Feb. 08, 2024 (GLOBE NEWSWIRE) -- Ohmyhome Ltd. (NASDAQ: OMH, “Ohmyhome”), a one-stop-shop property technology platform providing end-to-end property solutions and services to buy, sell, rent, and renovate homes, as well as property management services for condominiums in Singapore, is pleased to announce significant developments and milestones following its acquisition of Simply Sakal Pte. Ltd.

Simply Sakal Pte. Ltd. is now renamed as Ohmyhome Property Management further enhancing the one-stop brand of Ohmyhome.

This strategic transaction has not only expanded Ohmyhome's service offerings to include a non-cyclical recurring revenue stream, but also established a strong position in the condominium property management sector in Singapore with close to 6,800 units under management and an ARR reaching

The property management business has historically grown its business at

Integration and Potential Synergies

Ohmyhome’s suite of services are now fully integrated and accessible in the Simple App, the property management mobile application used by the homeowners and residents of the units managed by Ohmyhome Property Management. In addition to the property management revenue stream to Ohmyhome as a combined entity, there are also significant potential synergies arising from the customers residing in the condominium units.

Simple App with Ohmyhome’s Services Integrated

Historically, Ohmyhome has primarily been active in the Housing Development Board (HDB) resale market where home values are around

Kenneth Chong, CEO of Ohmyhome Property Management (Left) with Race Wong and Rhonda Wong, Co-founders of Ohmyhome (Right)

Following the acquisition, Ohmyhome Property Management has relocated its office to merge with Ohmyhome's headquarters at 11 Lor 3 Toa Payoh, Jackson Square Block B #04-17, Proptech Innovation Centre, Singapore 319579. This creates cost synergies through the consolidation of office spaces as well as back-office functions, which streamlines operations and enhances efficiency across both companies.

New Revenue Streams and IoT Integrations

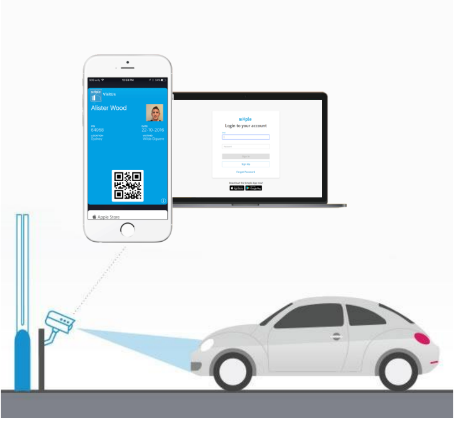

To redefine property management, Ohmyhome Property Management has also introduced Vehicle Management Systems for condominiums as a new Software-as-a-Service (SaaS) revenue source in Q4 2023 through the integration of Internet of Things (IoT) solutions. We believe this new service, focusing on resident and visitor vehicle management on a subscription model, represents a leap forward in enhancing property security and efficiency.

Illustration of Ohmyhome Property Management’s Vehicle Management System

The IoT solutions streamline vehicle entry and exit processes, allowing for pre-registered vehicles to enter and exit the estates freely without the need for human security details. We believe this offers a modern, secure, and seamless experience for both residents and property managers, and leads to savings for the Management Corporation Strata Titles (MCSTs), and further solidifies Ohmyhome Property Management as an industry leader in bringing technology to property management, where the industry is mostly paper-based and manpower intensive. As a technology player in the property management industry, Ohmyhome Property Management has the capability to integrate additional IoT solutions and services beyond its current functionalities to provide more convenience to the residents.

A Property SuperApp and Expected Growth Ahead

This post-acquisition phase marks the beginning of a new era for Ohmyhome, further propelling the growth of the combined company to become a property SuperApp. With a combined portfolio of services and customers, we believe the Company is set to deliver value and service to its clients, and additional growth curves from the ever expanding customer base of homeowners and home seekers.

Rhonda Wong, CEO and Co-founder of Ohmyhome, stated “We are extremely excited about the opportunities ahead of us with the successful integration of our new property management arm headed by a talented and dedicated team of seasoned professionals.”

About Ohmyhome

Ohmyhome is a one-stop-shop property technology platform in Singapore that provides end-to-end property solutions and services to buy, sell, rent, and renovate homes, as well as property management services for condominiums in Singapore. Since its launch in 2016, Ohmyhome has transacted over 14,500 properties, and has over 5,800 units under management as of June 30, 2023. It is also the highest-rated property transaction platform, with more than 8,000 genuine reviews, and an average rating of 4.9 out of 5 stars.

Ohmyhome is dedicated to bringing speed, ease, and reliability to property-related services and to becoming the most trusted and comprehensive property solution for everyone.

For more information, visit: https://ohmyhome.com/en-sg/

Safe Harbor Statement

This press release contains forward-looking statements. In addition, from time to time, we or our representatives may make forward-looking statements orally or in writing. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Such forward-looking statements relate to future events or our future performance, including: our financial performance and projections; our growth in revenue and earnings; and our business prospects and opportunities. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms. In evaluating these forward-looking statements, you should consider various factors, including: our ability to change the direction of the Company; our ability to keep pace with new technology and changing market needs; and the competitive environment of our business. These and other factors may cause our actual results to differ materially from any forward-looking statement.

Forward-looking statements are only predictions. The forward-looking events discussed in this press release and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties, and assumptions about us. We are not obligated to publicly update or revise any forward-looking statement, whether as a result of uncertainties and assumptions, the forward-looking events discussed in this press release and other statements made from time to time by us or our representatives might not occur.

For more information

Email: ir@ohmyhome.com

Visit the Investor Relation Website: ir.ohmyhome.com

Subscribe to the latest news alerts at: https://ir.ohmyhome.com/subscribe/

Attachments