Omega Increases the GIC Copper-Gold Target to 12 Km Through Strategic Acquisition and Additional Staking

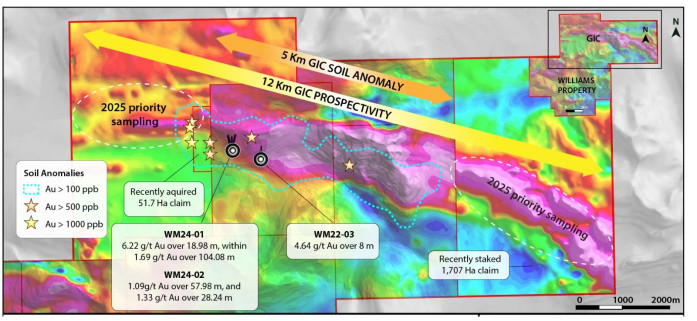

Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) has expanded its Williams property in BC's Golden Horseshoe through strategic acquisition and staking. The company acquired a 51.7 Ha claim west of its 2024 drilling area, with historical soil sampling showing up to 12 g/t gold and 0.1% copper. Additionally, Omega staked a 1,707 Ha claim adjoining Williams to the east. These acquisitions create a contiguous land package across the GIC Prospect, extending its overall strike length to 12 km. The expansion provides an uninterrupted 5 km of gold-in-soil anomalism. CEO Jason Leikam emphasized the significance of this expansion for future exploration programs. The company is also proceeding with the second anniversary payment for the Lekcin Property option agreement.

Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) ha espanso la propria proprietà Williams nella Golden Horseshoe della BC attraverso acquisizioni strategiche e staking. L'azienda ha acquisito un richiamo di 51,7 Ha a ovest della sua area di perforazione 2024, con campionamenti storici del suolo che mostrano fino a 12 g/t di oro e 0,1% di rame. Inoltre, Omega ha registrato un richiamo di 1.707 Ha adiacente a Williams a est. Queste acquisizioni creano un pacchetto di terreni contiguo attraverso il GIC Prospect, estendendo la sua lunghezza totale a 12 km. L'espansione fornisce un anomalia di oro nel suolo ininterrotta per 5 km. Il CEO Jason Leikam ha sottolineato l'importanza di questa espansione per i futuri programmi di esplorazione. L'azienda sta anche procedendo con il pagamento del secondo anniversario per l'accordo di opzione sulla proprietà Lekcin.

Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) ha expandido su propiedad Williams en la Golden Horseshoe de BC a través de adquisiciones estratégicas y staking. La compañía adquirió un reclamo de 51,7 Ha al oeste de su área de perforación 2024, siendo el muestreo de suelo histórico indicado hasta 12 g/t de oro y 0,1% de cobre. Adicionalmente, Omega registró un reclamo de 1,707 Ha adyacente a Williams hacia el este. Estas adquisiciones crean un paquete de tierras contiguo a lo largo del GIC Prospect, extendiendo su longitud total a 12 km. La expansión proporciona 5 km ininterrumpidos de anomalía de oro en el suelo. El CEO Jason Leikam destacó la importancia de esta expansión para futuros programas de exploración. La compañía también está avanzando con el pago del segundo aniversario del acuerdo de opción para la propiedad Lekcin.

오메가 퍼시픽 리소스(주) (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F)는 전략적 인수 및 스테이킹을 통해 BC의 골든 호스슈에 있는 윌리엄스 부지를 확장했습니다. 회사는 2024년 시추 구역 서쪽에 위치한 51.7 헥타르의 청구권을 인수했으며, 과거 토양 샘플링 결과 최대 12g/t의 금과 0.1%의 구리가 확인되었습니다. 또한 오메가는 윌리엄스 동쪽에 1,707 헥타르의 청구권을 등록했습니다. 이러한 인수로 인해 GIC 프로스펙트 전역에 걸쳐 연속적인 토지 패키지가 생성되어 전체 극장 길이가 12킬로미터로 연장됩니다. 이 확장은 중단 없이 5킬로미터의 금-토양 이상 현상을 제공합니다. CEO 제이슨 레이캄은 향후 탐사 프로그램을 위해 이 확장이 갖는 중요성을 강조했습니다. 회사는 또한 렉신 부동산 옵션 계약의 2주년 지불을 진행하고 있습니다.

Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) a élargi sa propriété Williams dans la Golden Horseshoe de la BC par le biais d'acquisitions stratégiques et de staking. L'entreprise a acquis un titre de 51,7 Ha à l'ouest de sa zone de forage 2024, avec des échantillons de sol historiques montrant jusqu'à 12 g/t d'or et 0,1 % de cuivre. De plus, Omega a enregistré un titre de 1 707 Ha adjacent à Williams à l'est. Ces acquisitions créent un paquet de terres contigu à travers le GIC Prospect, étendant sa longueur de faction totale à 12 km. L'expansion fournit 5 km ininterrompus d'anomalie d'or dans le sol. Le PDG Jason Leikam a souligné l'importance de cette expansion pour les futurs programmes d'exploration. L'entreprise procède également au paiement du deuxième anniversaire pour l'accord d'option sur la propriété Lekcin.

Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) hat sein Williams-Grundstück im Golden Horseshoe in BC durch strategische Akquisitionen und Staking erweitert. Das Unternehmen hat einen 51,7 Hektar großen Anspruch westlich seines Bohrgebiets 2024 erworben, wobei historische Bodenproben bis zu 12 g/t Gold und 0,1% Kupfer ergeben haben. Darüber hinaus hat Omega einen 1.707 Hektar großen Anspruch östlich von Williams registriert. Diese Akquisitionen schaffen ein zusammenhängendes Landpaket im GIC Prospect und verlängern die gesamt Strike-Länge auf 12 km. Die Expansion bietet unterbrochene 5 km Gold-an-Soil-Anomalie. CEO Jason Leikam betonte die Bedeutung dieser Expansion für zukünftige Explorationsprogramme. Das Unternehmen setzt zudem die Zahlung des zweiten Jubiläums für die Lekcin-Optionvereinbarung fort.

- Acquisition of 51.7 Ha claim with historical high-grade gold (12 g/t) and copper (0.1%) soil samples

- Staking of 1,707 Ha claim extending the property eastward

- Increase of GIC Prospect's overall strike length to 12 km

- Creation of an uninterrupted 5 km gold-in-soil anomalism

- Expansion of exploration potential in a tier 1 mining jurisdiction

- Cash and share payments required for Lekcin Property option agreement

VANCOUVER, BC / ACCESSWIRE / October 16, 2024 / Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) ("Omega Pacific" or the "Company") is pleased to provide an overview and update on its recent acquisition of additional claims at the Williams property, located in BC's Golden Horseshoe as previously reported (see Omega Press Release dated May 24, 2024).

Highlights

The Company recently acquired a 51.7 Ha claim located 400 m west of Omega's 2024 drilling

Historical soil sampling on the claim returned anomalous copper and gold with assays as high as 12 g/t gold and

0.1% copperCompletes a contiguous land package across the whole GIC Prospect

Newly staked 1,707 Ha claim which adjoins Williams to the east

Geology of the GIC prospect trends directly through the new claim

These acquisitions give Omega an uninterrupted strike length of 5 km of gold-in-soil anomalism and increases GIC's overall strike length GIC to 12 km.

Omega Pacific's CEO Jason Leikam commented, "These new claims significantly expand the opportunity of the GIC gold target. The recently acquired claim was previously a small but important gap of ground directly west of the drill collars from our recent drill program. With this claim now under our control we can trace the complete and expansive geophysical anomaly at GIC. We have already confirmed a robust gold system in our 2024 drill program, and we have a clear vision for the expansion of gold mineralization at GIC in upcoming programs."

New Claims

Omega Pacific has successfully acquired an additional claim (51.7 hectares) from a third party within the Williams Project, providing a contiguous land package for the western extent of the GIC prospect. This newly acquired claim is located within the property's GIC prospect, which has returned strong drill intercepts and notable, untested gold-in-soil anomalies. The GIC prospect currently has a gold- and copper-soil anomaly and coincident magnetics measuring >5 km in length, including this new claim, which remains open at the eastern and western extents. Sampling to extend these anomalies will be a priority for the 2025 exploration work. This acquisition not only increases the scope of ongoing exploration activities but also strengthens the company's ability to focus on highly prospective target zones within its claims.

The Williams Property was extended to the east through staking of an additional 1,707 hectares. This staking covers the eastern extent of the same geology and geophysical signature which comprises the GIC prospect where the Phase 1 2024 drill program was executed. This new area has seen very little historical exploration and will be the focus of some reconnaissance sampling early in the 2025 exploration season.

This acquisition enhances Omega Pacific's footprint in a tier 1 mining and exploration jurisdiction, offering a more robust platform for future development. With the expansion of the targeted zones, the company is well-positioned to capitalize on the region's rich geological setting, further advancing its efforts to unlock the project's mineral potential. This move aligns with Omega Pacific's broader strategy of securing high-value assets in prime mining regions, thereby boosting its long-term growth prospects.

Lekcin Property Option

Omega Pacific also announces, pursuant to an option agreement (the "Lekcin Option") dated August 10, 2022, the Company is proceeding with the second anniversary property payment for the Lekcin Property. Second anniversary payments include

Qualified Person

Robert L'Heureux (P.Geol.), Director of Omega Pacific Resources, is the "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects and has reviewed, validated and approved the scientific and technical information contained in this news release. Mr. L'Heureux oversees exploration planning and execution at the Williams Property.

About Omega Pacific

Omega Pacific is a mineral exploration company focused on the development of mineral projects containing base and precious metals. The Company is actively exploring its British Columbia located properties and continues to evaluate assets globally for further acquisitions.

For more information, please contact:

Omega Pacific Resources Inc.

Jason Leikam, Chief Executive Officer & Director

Tel: +1 (778) 650 4255

Email: jason@omegapacific.ca

Cautionary Statement

Certain statements contained in this press release constitute forward-looking information under the provisions of Canadian securities laws including statements about the Company's plans. Such statements are necessarily based upon a number of beliefs, assumptions, and opinions of management on the date the statements are made and are subject to numerous risks and uncertainties that could cause actual results and future events to differ materially from those anticipated or projected. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors should change, except as required by law.

Neither the CSE nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Contact Information

Jason Leikam

CEO

jason@omegapacific.ca

7788588085

SOURCE: Omega Pacific Resources

View the original press release on accesswire.com