OMNI-LITE INDUSTRIES REPORTS FOURTH QUARTER AND FISCAL 2023 RESULTS AND CONFERENCE CALL FOR INVESTORS: APRIL 19, 2024, AT 11:00 AM EDT

- Strong revenue growth in Q4 2023 driven by organic growth in electronic components business

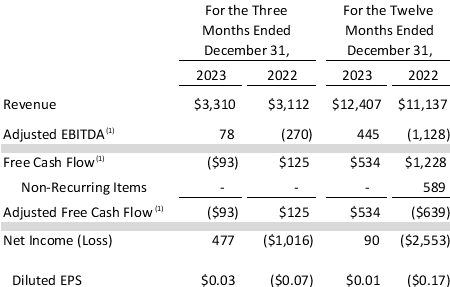

- Adjusted EBITDA improved to US$78,000 in Q4 2023 compared to US$(270,000) in Q4 2022

- Net income for Q4 2023 was US$477,000, impacted by non-recurring items

- Record backlog of US$7.0 million at the end of December 31, 2023

- Revenue for fiscal year 2023 increased by 11% to approximately US$12.4 million

- Adjusted EBITDA for fiscal year 2023 was US$445,000 compared to US$(1,128,000) in the prior year

- Adjusted Free Cash Flow for 2023 was US$534,000 after capital expenditures

- Net income for 2023 was US$90,000, a significant improvement from the US$2.6 million loss in 2022

- CEO David Robbins expressed optimism for further growth in 2024, especially from DP Cast and Cal Nano

- Expectations of continued organic revenue growth and strong performance in aerospace and defense bookings

- None.

- Fiscal 2023 Marks a Return to Organic Revenue Growth and Positive EBITDA(1)

- Record Breaking Backlog of US

$7.0 million , Almost Doubling the Prior Year Performance - Q1 of Fiscal 2024 Expected to Show Strong Revenue Growth

TSXV: OML

OTCQX: OLNCF

LOS ANGELES, CALIFORNIA, April 18, 2024 (GLOBE NEWSWIRE) -- Omni-Lite Industries Canada Inc. (the "Company" or “Omni-Lite”; TSXV: OML) today reported results for the fourth quarter and fiscal year ending December 31, 2023. Full financial results are available at sedar.com.

Fourth Quarter Fiscal 2023 Results

Revenue for the fourth quarter of fiscal 2023 was approximately US

Adjusted EBITDA (1) was approximately US

Net income for the quarter was US

Bookings in the fourth quarter of 2023 were approximately US

Fiscal Year 2023 Results

Revenue for the fiscal year ending December 31, 2023, was approximately US

Omni-Lite reported a 2023 net income of US

Bookings for the year were US

Management Comments

David Robbins, Omni-Lite’s CEO, stated “2023 was a turnaround year for Omni-Lite. We achieved solid organic revenue growth and materially grew our backlog to historically high levels. Importantly, we returned to both positive Adjusted EBITDA (1) and positive Adjusted Free Cash Flow (1).

“While we made good progress in 2023 on profitability, we expect further improvement during 2024. Notably, DP Cast had a negative financial impact on 2023, but is currently on an improvement trajectory. We expect DP Cast to make a positive EBITDA contribution in second or third quarter of 2024. The decision to reduce the DP Cast goodwill was made based on casting business not having yet passed a contribution threshold in 2023, but we see light at the end of the tunnel as DP Cast is on pace to be an important and durable contributor to Omni-Lite’s platform.”

"We also anticipate continuing organic revenue growth driven by conversion of backlog and strength in our bookings pipeline. We finished 2023 with a well-balanced and record level backlog of US

“We are pleased with Cal Nano’s progress and our investment, a combination of senior secured loan and common shares in Cal Nano; it is a very meaningful asset of Omni-Lite. While we remain supportive of Cal Nano, we’ll continue to monitor and evaluate our investment in the context of our capital allocation needs, and to date, our investment has been a positive for Omni-Lite.”

“We recently completed our first quarter of the 2024 fiscal year. While we will not be in a position to release our financial results until mid-May, the Company expects to generate sequential quarterly revenue growth of over

Financial Summary

All figures in (US

Investor Conference Call [DIFFERENT DATE FOR CALL NEEDED]

Omni-Lite will host a conference call for investors on April 19, 2024, beginning at 11:00 A.M. (EDT) to discuss the Fiscal 2023 results and review of its business and operations. To join the conference call, 888-437-3179 in the USA and Canada, or 862-298-0702 for all other countries. Please call five to ten minutes prior to the scheduled start time. A replay of the conference call will be available 48 hours after the call and archived on the Company’s investors page of the Company’s website at www.omni-lite.com for 12 months.

(1) Adjusted EBITDA is a non-IFRS financial measure defined as earnings before interest, taxes, depreciation, amortization, stock- based compensation provision, gains (losses) on sale of assets, and non-recurring items, if any. Free Cash Flow is a non-IFRS financial measure defined as cash flow from operations minus capital expenditures. Adjusted Free Cash Flow is a non-IFRS financial measure defined as Free Cash Flow excluding special items, among others, gains (losses) on sale of assets and non- recurring items, net of tax effects, if any. These are non-IFRS financial measures, as defined herein, and should be read in conjunction with IFRS financial measures and they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. The non-IFRS financial measures used herein may not be comparable to similarly titled measures reported by other companies. We believe the use of Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash Flow along with IFRS financial measures enhances the understanding of our operating results and may be useful to investors in comparing our operating performance with that of other companies and estimating our enterprise.

(2) Excluded items from Fiscal 2022 Adjusted Free Cash Flow(1) included approximately US

Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash Flow are also useful tools in evaluating the operating results of the Company given the significant variation that can result from, for example, the timing of capital expenditures and the amount of working capital in support of our customer programs and contracts. We also use Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash Flow internally to evaluate the operating performance of the Company, to allocate resources and capital, and to evaluate future growth opportunities.

Please see 2023 Management Discussion and Analysis for additional notes and definitions.

About Omni-Lite Industries Canada Inc.

Omni-Lite Industries Canada Inc. is an innovative company that develops and manufactures mission critical, precision components utilized by Fortune 100 companies in the aerospace and defense industries.

For further information, please contact:

Mr. David Robbins Chief Executive Officer

Tel. No. (562) 404-8510 or (800) 577-6664

Email: d.robbins@omni-lite.com Website: www.omni-lite.com

Forward Looking Statements

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intent”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information in this press release includes, but is not limited to, the expected future performance of the Company. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance, or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward- looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward- looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, governmental regulation, including environmental consents and approvals, if and when required; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR at www.sedar.com. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.