Orogen Royalties Sells the Kalium Canyon Gold Project to Green Light Metals

Orogen Royalties Inc. has closed a deal with Green Light Metals Inc. to sell the Kalium Canyon Gold Project for $30,000 cash and 1,000,000 shares valued at $400,000. Orogen retains a 3% net smelter return (NSR) royalty and a potential $5 million payment upon commercial production. The project includes significant mineralized structures with historic drilling results showcasing promising gold grades. The acquisition strengthens Orogen's royalty portfolio and maintains potential upside through future mineral production.

- Orogen retains a 3% NSR royalty on the Kalium Canyon Gold Project.

- Potential for a one-time payment of up to $5 million upon commercial production based on gold equivalent ounces.

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / September 26, 2022 / (TSX.V:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that the Company has entered into and closed a purchase and sale agreement (the "Agreement") pursuant to which Green Light Metals Inc. ("Green Light") and its subsidiary Green Light Wisconsin LLC ("GLW") have acquired a

Under the terms of the Agreement, GLW has acquired a

About the Kalium Canyon Gold Project

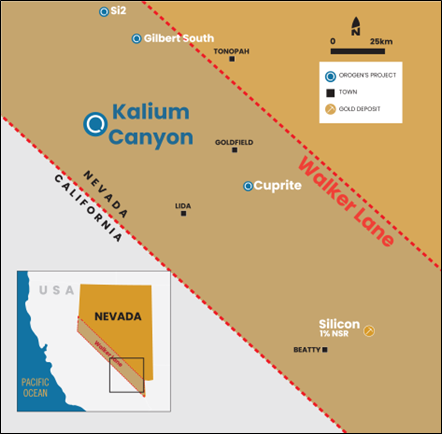

The Project covers 135 claims in the Walker Lane trend (Figure 1) where many low sulfidation epithermal gold discoveries in Nevada have been found, including AngloGold Ashanti NA's Silicon deposit and Merlin area (where Orogen holds a

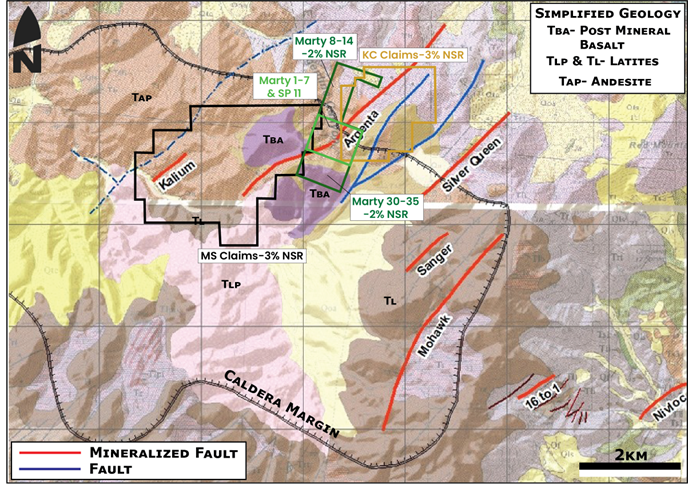

The Project contains the Kalium and Argenta zones, northeast trending mineralized structures that run parallel to the historic 16-1, Nivloc, and Mohawk mines where production came from large continuous veins underground. (Figure 2).

The Kalium structure is an undrilled, one- to two-kilometre-long corridor overlain by a steam heated cell of alunite-kaolinite alteration. The Argenta structure to the southeast is approximately four to five kilometres long and hosts a known gold-rich stockwork vein system with historic chip channel samples from 1947 of 15 metres grading 3.74 grams per tonne ("g/t") gold and later reverse circulation drilling returning up to 46 metres grading 1.2 g/t gold. The mineralization is hosted by high-angle breccias which are open to depth. Siliceous sinters exposed at the surface attest to the shallow level of exposure of this structural zone, similar to the shallow style of alteration exhibited by the Kalium structure.

Both structural zones have potential for hosting precious metal mineralization beneath shallow caps, and past drilling has been limited to small portions of these systems.

Transaction Details

GLW has acquired a

- Should the listing price of Green Light be less than

$0.40 per common share, Green Light will issue additional top-up shares such that the total share issuance value equals$400,000. - In the event Green Light is not listed on a recognized Canadian exchange within two years, Green Light shall pay Orogen an additional

$100,000 cash.

Orogen will retain a

On the Marty 1-7 and SP 11 claims, Orogen will receive a one-time payment of US

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver mine in Sonora, Mexico (

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/717330/Orogen-Royalties-Sells-the-Kalium-Canyon-Gold-Project-to-Green-Light-Metals