Orogen Royalties Options the Astro Gold Project to Rackla Metals

Orogen Royalties Inc. has signed an option agreement with Rackla Metals Inc. for the Astro gold project in Northwest Territories, Canada. The agreement allows Rackla to earn a 100% interest by issuing 120,000 shares, spending $250,000 on exploration, and making cash or share payments totaling $382,000 within 12 months. After acquisition, Orogen will maintain a 2.5% net smelter return royalty. The Astro project spans 288 square kilometers and shows promising gold mineralization, with surface sampling returning results up to 17.7 grams per tonne gold. This partnership aims to advance exploration efforts on the project.

- Orogen retains a 2.5% net smelter return royalty after Rackla acquires the Astro project.

- Astro project shows encouraging gold mineralization with surface sampling results up to 17.7 grams per tonne.

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / September 20, 2022 / (TSX.V:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that it has signed an option agreement (the "Agreement") with Rackla Metals Inc. (TSX.V:RAK) ("Rackla") for the Astro gold project in Northwest Territories, Canada.

Under the terms of the Agreement, Rackla can earn a

Orogen CEO Paddy Nicol commented, "The Astro project is an exciting early-stage gold property located in the Northwest Territories along the Yukon border. The project was generated from a two-year US

Orogen recognizes that the Astro project is located within the territories of the Sahtu Dene and Metis Comprehensive Land Claim and look forward to a continuation of the current positive working relationship under Rackla.

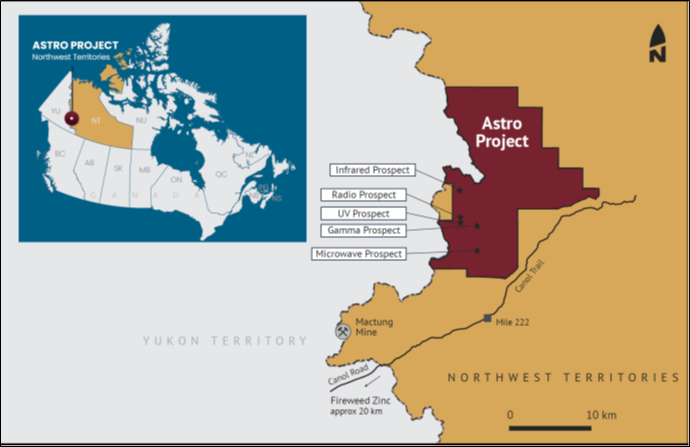

Figure 1: Location of the Astro Project

About the Astro property

The Astro Project is a 288 square-kilometre exploration property located in the Northwest Territories along the Yukon border close to the Canol Road. The property contains outcropping gold mineralization in a ten-kilometre-long structural corridor. Gold mineralization is developed within and flanking the hornfelsed aureole of the Border granodiorite pluton. Identified gold mineralization consists of gold-arsenic-antimony bearing quartz veins, gold- bismuth skarn and gold associated with disseminated sulphides in siltstone. Known gold showings exhibit structural control along a series of northwest-striking faults down dropping hornfels and sedimentary rocks on the east side of the Border pluton.

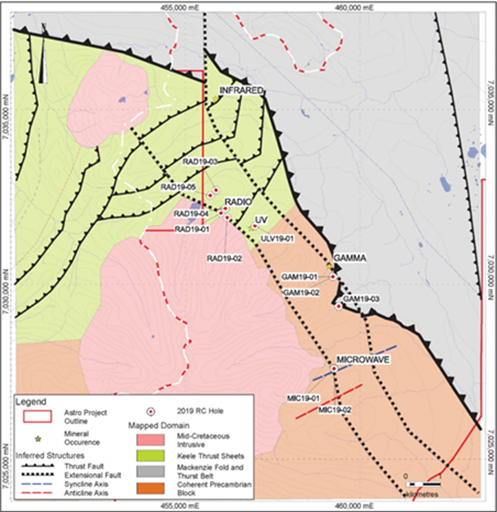

Surface sampling of gossanous showings at the Radio, Ultraviolet and Microwave prospects (Figure 1) returned chip-channel results including 17.7 grams per tonne ("g/t") gold over 30.0 metres, 6.1g/t gold over 4.0 metres, and 3.6g/t gold over 18.0 metres. Two additional prospects on the property (Infrared and Gamma) are defined by gold-in-soil anomalies along the range front prospect. Results from the RC scout drilling include 3 metres grading 3.1g/t gold in RAD 19-01, 7.6 metres grading 0.7g/t gold in RAD19-04, and 6 metres grading 1.1 g/t gold in GAM19-01.

Figure 2 - Geology map showing drill collar locations

Transaction Details

Rackla can acquire a

- Issue 120,000 common shares of Rackla within three days following the Approval Date;

- Incur

$250,000 in exploration expenditures within twelve-months from the Approval Date; and - Within twelve-months from Approval Date, make a final payment totaling

$382,000 t hrough a combination of a cash payment and/or issuance of common shares at Rackla's discretion, however, the cash payment may not exceed$191,000.

Once Rackla has exercised its option to acquire the Astro project, Orogen will retain a

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver mine in Sonora, Mexico (

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/716402/Orogen-Royalties-Options-the-Astro-Gold-Project-to-Rackla-Metals