Osisko Development Reports Fourth Quarter and Year-End 2024 Results

Osisko Development (NYSE: ODV) has reported its Q4 and year-end 2024 financial results, highlighting several key developments. The company maintained a strong cash position of $106.7 million as of December 31, 2024, with an outstanding loan of $36.0 million due October 2025.

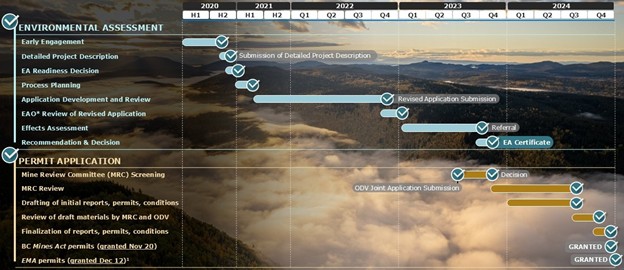

The company successfully completed two private placements in 2024: a non-brokered placement raising US$34.5 million and a brokered placement generating US$57.5 million. A significant milestone was achieved with the Cariboo Gold Project receiving full permits under both the Mines Act and Environmental Management Act of British Columbia, achieving shovel-ready status.

The company is advancing pre-construction activities, including an underground bulk sampling program with approximately 7,400 tonnes extracted to date. An optimized feasibility study is in advanced stages, aiming to enhance mine development and process flowsheet to reach 4,900 tonnes per day throughput earlier than planned.

Osisko Development (NYSE: ODV) ha riportato i risultati finanziari del quarto trimestre e dell'anno 2024, evidenziando diversi sviluppi chiave. L'azienda ha mantenuto una solida posizione di liquidità di 106,7 milioni di dollari al 31 dicembre 2024, con un prestito in sospeso di 36,0 milioni di dollari in scadenza a ottobre 2025.

L'azienda ha completato con successo due collocamenti privati nel 2024: un collocamento non mediato che ha raccolto 34,5 milioni di dollari USA e un collocamento mediato che ha generato 57,5 milioni di dollari USA. È stato raggiunto un traguardo significativo con il Cariboo Gold Project che ha ricevuto tutti i permessi ai sensi del Mines Act e dell'Environmental Management Act della Columbia Britannica, raggiungendo lo stato di pronto per l'uso.

L'azienda sta avanzando nelle attività di pre-costruzione, inclusi un programma di campionamento di massa sotterraneo con circa 7.400 tonnellate estratte fino ad oggi. Uno studio di fattibilità ottimizzato è in fase avanzata, con l'obiettivo di migliorare lo sviluppo della miniera e il flusso del processo per raggiungere una capacità di 4.900 tonnellate al giorno prima del previsto.

Osisko Development (NYSE: ODV) ha reportado sus resultados financieros del cuarto trimestre y del año 2024, destacando varios desarrollos clave. La empresa mantuvo una sólida posición de efectivo de 106,7 millones de dólares al 31 de diciembre de 2024, con un préstamo pendiente de 36,0 millones de dólares que vence en octubre de 2025.

La empresa completó con éxito dos colocaciones privadas en 2024: una colocación no mediada que recaudó 34,5 millones de dólares estadounidenses y una colocación mediada que generó 57,5 millones de dólares estadounidenses. Se logró un hito significativo con el Proyecto Cariboo Gold que recibió todos los permisos bajo la Ley de Minas y la Ley de Gestión Ambiental de Columbia Británica, alcanzando el estado de listo para usar.

La empresa está avanzando en las actividades de pre-construcción, incluyendo un programa de muestreo a granel subterráneo con aproximadamente 7,400 toneladas extraídas hasta la fecha. Un estudio de viabilidad optimizado está en etapas avanzadas, con el objetivo de mejorar el desarrollo de la mina y el flujo del proceso para alcanzar un rendimiento de 4,900 toneladas por día antes de lo planeado.

Osisko Development (NYSE: ODV)는 2024년 4분기 및 연말 재무 결과를 보고하며 여러 주요 개발 사항을 강조했습니다. 회사는 2024년 12월 31일 기준으로 1억 6700만 달러의 강력한 현금 위치를 유지하고 있으며, 2025년 10월에 만기가 도래하는 3600만 달러의 대출이 있습니다.

회사는 2024년에 두 번의 사모 배치를 성공적으로 완료했습니다: 비중개 배치로 3450만 달러를 모금하였고, 중개 배치로 5750만 달러를 발생시켰습니다. Cariboo Gold Project가 브리티시컬럼비아의 광업법 및 환경 관리법에 따라 모든 허가를 받으며 사용 준비 완료 상태에 도달한 것은 중요한 이정표입니다.

회사는 현재 약 7400톤이 추출된 지하 대량 샘플링 프로그램을 포함한 사전 건설 활동을 진행하고 있습니다. 최적화된 타당성 조사가 고급 단계에 있으며, 계획보다 빨리 하루 4900톤의 처리량에 도달하기 위해 광산 개발 및 프로세스 흐름을 개선하는 것을 목표로 하고 있습니다.

Osisko Development (NYSE: ODV) a publié ses résultats financiers pour le quatrième trimestre et l'année 2024, mettant en avant plusieurs développements clés. L'entreprise a maintenu une solide position de liquidités de 106,7 millions de dollars au 31 décembre 2024, avec un prêt en cours de 36,0 millions de dollars échéant en octobre 2025.

L'entreprise a réussi à finaliser deux placements privés en 2024 : un placement non médié qui a levé 34,5 millions de dollars américains et un placement médié qui a généré 57,5 millions de dollars américains. Un jalon significatif a été atteint avec le Cariboo Gold Project, qui a reçu tous les permis en vertu de la Loi sur les mines et de la Loi sur la gestion de l'environnement de la Colombie-Britannique, atteignant le statut prêt à l'emploi.

L'entreprise avance dans les activités de pré-construction, y compris un programme d'échantillonnage en vrac souterrain avec environ 7400 tonnes extraites à ce jour. Une étude de faisabilité optimisée est en cours, visant à améliorer le développement de la mine et le flux du processus pour atteindre un débit de 4900 tonnes par jour plus tôt que prévu.

Osisko Development (NYSE: ODV) hat seine finanziellen Ergebnisse für das vierte Quartal und das Jahr 2024 veröffentlicht und mehrere wichtige Entwicklungen hervorgehoben. Das Unternehmen hielt zum 31. Dezember 2024 eine starke Liquiditätsposition von 106,7 Millionen Dollar aufrecht, mit einem ausstehenden Darlehen von 36,0 Millionen Dollar, das im Oktober 2025 fällig ist.

Das Unternehmen hat 2024 erfolgreich zwei Privatplatzierungen abgeschlossen: eine nicht vermittelte Platzierung, die 34,5 Millionen US-Dollar einbrachte, und eine vermittelte Platzierung, die 57,5 Millionen US-Dollar generierte. Ein bedeutender Meilenstein wurde erreicht, als das Cariboo Gold Project alle Genehmigungen gemäß dem Mines Act und dem Environmental Management Act von British Columbia erhielt und den Status „einsatzbereit“ erreichte.

Das Unternehmen schreitet mit den Vorbereitungen für den Bau voran, einschließlich eines unterirdischen Großprobenprogramms, bei dem bisher etwa 7400 Tonnen entnommen wurden. Eine optimierte Machbarkeitsstudie befindet sich in fortgeschrittenen Stadien, mit dem Ziel, die Minenentwicklung und den Prozessablauf zu verbessern, um früher als geplant eine Durchsatzmenge von 4900 Tonnen pro Tag zu erreichen.

- Secured full permits for Cariboo Gold Project, achieving shovel-ready status

- Successfully raised US$92 million through private placements

- Strong cash position of $106.7 million as of December 31, 2024

- Advanced bulk sampling program with 7,400 tonnes extracted

- Delays in bulk sampling program analysis extending into Q2 2025

- No agreement reached with Xatśūll First Nation

- San Antonio Gold Project remains in care and maintenance pending Mexican government guidance

Insights

Osisko Development's Q4 2024 results reveal a significantly enhanced financial position with

The most consequential development is the complete permitting of the Cariboo Gold Project, which has achieved shovel-ready status after receiving both Mines Act and Environmental Management Act approvals. This regulatory milestone removes a critical barrier to advancement and substantially de-risks the project. The remaining transmission line approvals appear to be routine rather than major obstacles.

Pre-construction progress includes completed underground development (1,172m) and extraction of 7,400 tonnes of the planned 10,000-tonne bulk sample. The company's active pursuit of project financing solutions and preparation of an optimized feasibility study indicates they're positioning for a construction decision. The OFS's focus on accelerating throughput to 4,900 tonnes per day earlier than previously planned suggests potential for improved project economics.

While Tintic (Utah) continues early-stage exploration, the San Antonio project remains in regulatory limbo, with the company now considering potential divestiture or partnership options. This strategic pivot could allow further concentration of resources on the flagship Cariboo asset.

The recent permitting achievements for Cariboo represent the critical inflection point in this project's development timeline. Securing both the Mines Act and Environmental Management Act approvals effectively completes the regulatory gauntlet for this project, transforming it from a geological concept to an authorized development-ready asset. Many junior miners fail precisely at this permitting stage, making this a significant technical achievement.

The underground development drift (1,172m complete) provides essential geological information while reducing execution risk. Bulk sampling of 7,400 tonnes (of the planned 10,000) will allow reconciliation between geological models and actual mineralization, potentially validating or refining the resource estimates. However, the delayed assay results pushing completion to Q2 2025 represents a minor scheduling setback.

The forthcoming optimized feasibility study appears strategically focused on accelerating development to 4,900 tonnes per day capacity earlier in the project lifecycle. This engineering approach typically enhances early-year cash flows and improves project economics through faster payback periods, albeit potentially with higher upfront capital intensity.

The porphyry exploration at Tintic represents a higher-risk, higher-reward secondary initiative, with the two 2,920m deep holes providing critical vectoring information for subsequent targeting. The revised strategy at San Antonio, shifting from development to strategic review, reflects an appropriate response to Mexico's regulatory uncertainty around open-pit mining, preserving capital for deployment in more predictable jurisdictions.

(All dollar amounts are expressed in Canadian dollars, unless stated otherwise)

MONTREAL, March 28, 2025 (GLOBE NEWSWIRE) -- Osisko Development Corp. (NYSE: ODV, TSXV: ODV) ("Osisko Development" or the "Company") reports its financial and operating results for the three and twelve months ended December 31, 2024 ("Q4 2024").

Q4 2024 HIGHLIGHTS

Operating, Financial and Corporate Updates:

- As of December 31, 2024, the Company had approximately

$106.7 million in cash and cash equivalents. Approximately$36.0 million (US$25.0 million ) was outstanding as of the end of Q4 2024 under the delayed draw term loan with National Bank of Canada, which matures on October 31, 2025.

- The Company completed a non-brokered private placement of units pursuant to which it issued an aggregate of 19,163,410 units at a price of US

$1.80 per unit for gross proceeds of approximately US$34.5 million (the "2024 Non-Brokered Private Placement"). The 2024 Non-Brokered Private Placement was completed in two tranches comprised of the issuance of (i) 13,426,589 units at a price of US$1.80 per unit for gross proceeds of approximately US$24.2 million , which tranche closed on October 1, 2024, and (ii) 5,736,821 units at a price of US$1.80 per unit for gross proceeds of approximately US$10.3 million , which tranche closed on October 11, 2024. Each unit was comprised of one Common Share and one Common Share purchase warrant of the Company entitling the holder thereof to purchase one Common Share at a price of US$3.00 on or prior to October 1, 2029.

- On November 12, 2024, the Company completed a brokered private placement pursuant to which it issued an aggregate of 31,946,366 units at a price of US

$1.80 per unit for aggregate gross proceeds of approximately US$57.5 million , including the exercise in full of the option granted to the agents (the "2024 Brokered Private Placement"). Each unit was comprised of one Common Share and one Common Share purchase warrant of the Company entitling the holder thereof to purchase one Common Share at a price of US$3.00 on or prior to October 1, 2029. In connection with the 2024 Brokered Private Placement, the agents were paid a cash commission equal to4.5% of the aggregate gross proceeds.

- On December 5, 2024, Mr. Stephen Quin was appointed as independent director to the Company's board of directors and, in connection thereof, was subsequently granted 80,000 deferred share units of the Company on December 19, 2024.

- On December 12, 2024, Ms. Marina Katusa resigned from the Company's board of directors.

Cariboo Gold Project – British Columbia, Canada (

- Fully Permitted Status. On November 20, 2024, the Company was granted permits pursuant to the Mines Act (British Columbia) for its Cariboo Gold Project. Subsequently, on December 12, 2024, the Company was granted permits pursuant to the Environmental Management Act (British Columbia) for the Cariboo Gold Project. Together with the Mines Act (British Columbia) permits, these approvals mark the successful completion of the permitting process for key approvals, solidifying the Cariboo Gold Project's shovel-ready status.

- The Mines Act (British Columbia) permits grant the Company the ability to proceed with the construction, operation and reclamation activities on each of the sites outlined within the scope of the Project. The Environmental Management Act (British Columbia) permits pertain to any project-related discharges to the environment, including water and air, and the framework and limitations thereof, within the areas outside of the immediate mine site boundaries.

- Work is ongoing with the Ministry of Water, Land and Resource Stewardship and the Ministry of Forests on obtaining all necessary approvals for the construction of the transmission line.

- On November 7, 2024, the Company announced that, while it had yet to reach an agreement with the Xatśūll First Nation, it remained committed to ongoing engagement and consultation.

- Project Financing. The Company is actively engaged in ongoing discussions on various funding options, including a comprehensive project construction financing package, for the development of the Cariboo Gold Project.

- Pre-Construction Activities. During Q1 2024, under an existing provincial permit, the Company commenced an underground development drift from the existing Cow Portal into the Cariboo Gold Project's Lowhee Zone to extract a bulk sample of up to 10,000 tonnes of mineralized material.

100% of the underground development has been successfully completed, totalling approximately 1,172 m, to access the target area.- The extraction, sampling, assaying, and analysis of mineralized material from the target zone is currently ongoing. Approximately 7,400 tonnes of material has been extracted to date. Lengthy timeframes for receipt of assays and analysis of the results have extended completion of the bulk sampling program into Q2 2025. Once all information is available, a reconciliation process to compare the bulk sample results with the predicted tonnes and grade will be undertaken.

- Optimized Feasibility Study. The Company is in advanced stages of completing an optimized feasibility study ("OFS") for the Cariboo Gold Project. The OFS will incorporate opportunities to enhance and streamline mine development and the process flowsheet, supporting an accelerated development timeline to reach 4,900 tonnes per day throughput earlier than previously contemplated. It will also reflect updated metal price and foreign exchange assumptions. Additionally, the OFS will integrate updated operating and capital cost estimates, while considering ways to reduce and mitigate any potential capital and operating cost pressures. The OFS base case will remain aligned with the existing permitting framework.

Figure 1: Cariboo Gold Project – Permitting Timeline Summary

Tintic Project – Utah, U.S.A. (

- Phase I Regional Drilling. In 2024, the Company completed two surface diamond drill holes totalling approximately 2,920 m (9,581 ft) at the Big Hill target area testing for copper-gold-molybdenum porphyry mineralization potential. Based on the geological information from these drill holes, the Company identified several high-priority targets for a next phase of the porphyry exploration program.

- Phase II Regional Drilling. As part of the ongoing Phase II regional drilling program initiated in December 2024, the Company is advancing the completion of two drill holes on the Big Hill West and Zuma porphyry targets, expected to be completed in the coming months.

San Antonio Gold Project – Sonora State, Mexico (

- The San Antonio Gold Project remains in care and maintenance.

- The Company is awaiting further guidance from the Mexican government regarding the permitting process and the status of open-pit mining in the country.

- The Company continues to conduct a strategic review of the project and engaged a financial advisor in connection thereof. The strategic review includes, among others, exploring the potential for a financial or strategic partner in the asset or a full or partial sale of the asset.

KEY UPCOMING MILESTONES

| Key Project Milestones | Expected Timing of Completion | Anticipated Remaining Costs* | ||

| Cariboo Gold Project(1) | ||||

| Permitting | Completed – Q4 2024 | $nil | ||

| Electrical and Communication | Q1 2025 | |||

| Bulk Sample | Q2 2025 | |||

| CGP Underground Development | Q2 2025 | |||

| Updated CGP Feasibility | Q2 2025 | |||

| Environmental, other pre-construction work & roadheader | Q2 2025 | |||

| Water and Waste Management | Q4 2025 | |||

| Tintic Project | ||||

| Regional Drilling – Phase I | Completed – Q2 2024 | $nil | ||

| Regional Drilling – Phase II | Q2 2025 | |||

*as at December 31, 2024

Notes:

| (1) | The expenditures disclosed in this table include amounts approved by the Board of Directors up until the end of June 2025. Additional expenditures will be required to complete certain of the milestones and are subject to approval by the Board of Directors. |

SUBSEQUENT TO Q4 2024

- On January 9, 2025, the Company announced that Mr. David Rouleau was appointed as Vice President, Project Development, and Mr. Éric Tremblay resigned from his position as Chief Operating Officer of the Company.

- On February 3, 2025, the Company released drilling results from its 2024 initial exploration and historic data validation infill drill campaign at its Quesnel River Mine Prospect located within the Company's wider Cariboo Gold Project.

- On March 26, 2025, the Company appointed Philip Rabenok as Vice President, Investor Relations. Mr. Rabenok joined Osisko Development in November 2022 as Director, Investor Relations.

2024 Year-End Disclosure Documents

The Company's annual information form ("AIF") for the year ended December 31, 2024, audited consolidated financial statements (the "Financial Statements") and related management's discussion and analysis ("MD&A") for the three and twelve months ended December 31, 2024 have been filed with Canadian securities regulatory authorities. Osisko Development has also filed its Annual Report Form 40-F consisting of its AIF, Financial Statements and MD&A for the year ended December 31, 2024 with the U.S. Securities and Exchange Commission.

These filings are available on the Company's website at www.osiskodev.com, on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile. Hard copies of these documents will be provided to shareholders of the Company upon written request to the Company's Investor Relations department, 1100, Av. des Canadiens-de-Montreal, Suite 300, Montreal, Quebec, Canada H3B 2S2 or to ir@osiskodev.com.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Daniel Downton, P.Geo., Chief Resource Geologist of Osisko Development, a "qualified person" within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Technical Reports

Information relating to the Cariboo Gold Project and the current feasibility on the Cariboo Gold Project is supported by the technical report titled "Feasibility Study for the Cariboo Gold Project, District of Well, British Columbia, Canada", dated January 10, 2023 (amended January 12, 2023) with an effective date of December 30, 2022 (the "Cariboo Technical Report").

Information relating to the Tintic Project and the current mineral resource estimate for the Trixie deposit (the "2024 Trixie MRE") is supported by the technical report titled "NI 43-101 Technical Report, Mineral Resource Estimate for the Trixie Deposit, Tintic Project, Utah, United States of America" dated April 25, 2024 (with an effective date of March 14, 2024) (the "Tintic Technical Report").

Information relating to San Antonio Gold Project is supported by the technical report titled "NI 43-101 Technical Report for the 2022 Mineral Resource Estimate on the San Antonio Project, Sonora, Mexico", dated July 12, 2022 (with an effective date of June 24, 2022) (the "San Antonio Technical Report", collectively, with the Tintic Technical Report and the Cariboo Technical Report, the "Technical Reports").

For readers to fully understand the information in the Technical Reports, reference should be made to the full text of the Technical Reports in their entirety, including all assumptions, qualifications and limitations thereof. The Technical Reports are intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Reports were prepared in accordance with NI 43-101 and are available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

End Notes (excluding tables)

1. In this news release the Company uses certain abbreviations, including: meters ("m"); feet ("ft").

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company's objective is to become an intermediate gold producer by advancing its flagship fully permitted

For further information, visit our website at www.osiskodev.com or contact:

| Sean Roosen | Philip Rabenok |

| Chairman and CEO | Vice President, Investor Relations |

| Email: sroosen@osiskodev.com | Email: prabenok@osiskodev.com |

| Tel: +1 (514) 940-0685 | Tel: +1 (437) 423-3644 |

CAUTIONARY STATEMENTS

Cautionary Statement Regarding Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The mineral resource estimate disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards on Mineral Resources and Mineral Reserves" incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

Cautionary Statement Regarding Financing Risks

The Company's development and exploration activities are subject to financing risks. At the present time, the Company has exploration and development assets which may generate periodic revenues through test mining, but has no mines in the commercial production stage that generate positive cash flows. The Company cautions that test mining at its operations could be suspended at any time. The Company's ability to explore for and discover potential economic projects, and then to bring them into production, is highly dependent upon its ability to raise equity and debt capital in the financial markets. Any projects that the Company develops will require significant capital expenditures. To obtain such funds, the Company may sell additional securities including, but not limited to, the Company's shares or some form of convertible security, the effect of which may result in a substantial dilution of the equity interests of the Company's Shareholders. Alternatively, the Company may also sell a part of its interest in an asset in order to raise capital. There is no assurance that the Company will be able to raise the funds required to continue its exploration programs and finance the development of any potentially economic deposit that is identified on acceptable terms or at all. The failure to obtain the necessary financing(s) could have a material adverse effect on the Company's growth strategy, results of operations, financial condition and project scheduling.

Cautionary Statement Regarding Test Mining Without Feasibility Study

The Company cautions that its prior decision to commence small-scale underground mining activities and batch vat leaching at the Trixie test mine was made without the benefit of a feasibility study, or reported mineral resources or mineral reserves, demonstrating economic and technical viability, and, as a result there may be increased uncertainty of achieving any particular level of recovery of material or the cost of such recovery. The Company cautions that historically, such projects have a much higher risk of economic and technical failure. Small scale test-mining at Trixie was suspended in December 2022, resumed in the second quarter of 2023, and suspended once again in December 2023. If and when small-scale test-mining recommences at Trixie, there is no guarantee that production will continue as anticipated or at all or that anticipated production costs will be achieved. The failure to continue production may have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations. Failure to achieve the anticipated production costs may have a material adverse impact on the Company's cash flow and potential profitability. In continuing operations at Trixie after closing, the Company has not based its decision to continue such operations on a feasibility study, or reported mineral resources or mineral reserves demonstrating economic and technical viability.

Cautionary Statement to U.S. Investors

The Company is subject to the reporting requirements of the applicable Canadian securities laws and as a result reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, in accordance with Canadian reporting requirements, which are governed by NI 43-101. As such, such information concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the U.S. Securities and Exchange Commission ("SEC").

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including the assumptions, qualifications and limitations relating to the Cariboo Gold Project being fully permitted and shovel ready; the ability of the Company to obtain project finance for the development of the Cariboo Gold Project; proposed pre-construction activities; the results of the OFS, including assumptions relating to updated metal prices and foreign exchange assumptions; Phase I and II regional drilling at Tintic and related priority targets; the long-term prospects of San Antonio, including the permitting process, status on care and maintenance and status of the strategic review; the significance of target drilling; the ability of the Company to complete a follow-up targeted geophysical survey and the exploration success thereof (if any); the potential impact of tariffs and other trade restrictions (if any); the Company being construction and operation ready; unlocking Cariboo's potential for shareholders, Indigenous nations and other stakeholders; the ability of the Company to complete the optimized feasibility study and the scope, results and timing of thereof; progress and timing in respect of pre-construction activities at Cariboo including bulk sample and underground development work; category conversion; the timing and status of permitting; the future development and operations at the Cariboo Gold Project; the results of ongoing stakeholder engagement; the capital resources available to the Company; the ability of the Company to execute its planned activities, including as a result of its ability to seek additional funding or to reduce planned expenditures; the ability of the Company to obtain future financing and the terms of such financing including a fully-funded solution for the Cariboo Gold Project; management's perceptions of historical trends, current conditions and expected future developments; the utility and significance of historic data, including the significance of the district hosting past producing mines; future mining activities; the potential of high grade gold mineralization on Trixie and Cariboo; the ability and timing for Cariboo to reach commercial production (if at all); sustainability and environmental impacts of operations at the Company's properties; the results (if any) of further exploration work to define and expand mineral resources; the ability of exploration work (including drilling) to accurately predict mineralization; the ability to generate additional drill targets; the ability of management to understand the geology and potential of the Company's properties; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the ability of the Company to complete its exploration and development objectives for its projects in the timing contemplated and within expected costs (if at all); the ongoing advancement of the deposits on the Company's properties; the impact of permitting delays at San Antonio Gold Project; the outcome of the strategic review of the San Antonio Gold Project; sustainability and environmental impacts of operations at the Company's properties; the ability and timing for Cariboo to reach commercial production (if at all); the ability to adapt to changes in gold prices, estimates of costs, estimates of planned exploration and development expenditures; the ability of the Company to obtain further capital on reasonable terms; the profitability (if at all) of the Company's operations; as well as other considerations that are believed to be appropriate in the circumstances, and any other information herein that is not a historical fact may be "forward looking information". Material assumptions also include, management's perceptions of historical trends, management's understanding of the permitting process and status thereof, the ability of exploration (including drilling and chip sampling assays, and face sampling) to accurately predict mineralization, budget constraints and access to capital on terms acceptable to the Company, current conditions and expected future developments, regulatory framework remaining defined and understood, results of further exploration work to define or expand any mineral resources, as well as other considerations that are believed to be appropriate in the circumstances. Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to third-party approvals, including the issuance of permits by the government, capital market conditions and the Company's ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company's properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; the ability of exploration activities (including drill results and chip sampling, and face sampling results) to accurately predict mineralization; errors in management's geological modelling; the ability to expand operations or complete further exploration activities; the timing and ability of the Company to obtain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Osisko Development is confident a robust consultation process was followed in relation to its received BC Mines Act and Environmental Management Act permits for the Cariboo Gold Project and continues to actively consult and engage with Indigenous nations and stakeholders. While any party may seek to have the decision related to the BC Mines Act and/or Environmental Management Act permits reviewed by the courts, the Company does not expect that such a review will impact its ability to proceed with the construction and operation of the Cariboo Gold Project in accordance with the approved BC Mines Act and Environmental Management Act permits. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company's annual information form for the year ended December 31, 2024 as well as the financial statements and MD&A for the year ended December 31, 2024, which have been filed on SEDAR+ (www.sedarplus.ca) under Osisko Development's issuer profile and on the SEC's EDGAR website (www.sec.gov), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company's believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e1a6c8e8-a44c-491b-9470-66cb93b45ddc