Osisko Development Reports Fourth Quarter And Year-End 2023 Results

- The company reported 2,090 ounces of gold sold in Q4 2023, generating $6.9 million in revenues.

- Osisko Development received an Environmental Assessment Certificate for the Cariboo Gold Project in October 2023.

- The company formed Electric Elements Mining Corp. with O3 Mining to explore lithium potential.

- Leadership changes were announced, with Mr. Luc Lessard retiring as COO and Mr. Éric Tremblay becoming interim COO.

- The 2024 Trixie MRE showed measured, indicated, and inferred resources for the Trixie deposit.

- A non-cash impairment charge of $160.5 million was recognized for Trixie in the company's financial statements.

- Key upcoming milestones include the completion of the bulk sample at Cariboo Gold Project and regional drilling at Tintic Project.

- A non-cash impairment charge of $160.5 million was recognized for Trixie.

- The San Antonio Gold Project was placed into care and maintenance with no production anticipated.

- Mr. Francois Vézina resigned from his position as Senior Vice President.

- The company is undergoing a strategic review of the San Antonio Gold Project.

Insights

Osisko Development Corp.'s report detailing its financial and operating results for Q4 2023 and the full year highlights several key aspects that investors should consider. The reported gold sales from their operations, totaling 2,090 ounces in Q4 and 10,743 ounces for the year, indicate a stream of operational revenue. However, the revenues of $6.9 million for the quarter and $31.6 million for the year should be juxtaposed against the cost of sales, which stood at $6.4 million for Q4 and $32.3 million for the full year. This suggests a narrow margin in Q4 and a slight loss over the entire year, which could raise concerns about cost efficiency and profitability.

The non-cash impairment charge of $160.5 million recognized for the Trixie project is a significant figure that will affect the company's balance sheet. While this does not impact cash flows, it does reflect a substantial adjustment to the asset's carrying value, which could influence investor confidence and the stock's valuation. The impairment is attributed to assumptions about future expenditures and potential mining methods, which may signal to investors that the project's future cash flows are not as robust as previously thought.

Lastly, the announcement of the $50 million Credit Facility to fund pre-construction activities at the Cariboo Gold Project is a strategic move. This influx of capital is earmarked for specific development activities, which could accelerate the project's timeline towards production. The expected permit receipt in Q2 2024 could serve as a catalyst for the stock, as it would pave the way for construction and eventual production ramp-up. Investors should weigh the potential for future revenue generation against the costs and risks associated with development.

The strategic review of the San Antonio Gold Project, including the search for a financial or strategic partner, is a noteworthy development. This decision to potentially divest or partner in the asset could unlock value and provide a cash infusion or risk-sharing arrangement. The market's reaction to such strategic shifts often hinges on the terms of the deal and the perceived fit with the company's long-term strategy. In the context of the current market, where mergers and acquisitions are prevalent in the mining sector, this move by Osisko Development could attract significant attention.

Another point of interest is the formation and capitalization of Electric Elements Mining Corp. for lithium exploration, demonstrating diversification in Osisko Development's portfolio. With the increasing demand for lithium due to the electric vehicle boom, this venture could represent a strategic pivot that might appeal to investors looking for exposure to the battery metals market. The market will likely monitor the progress of this spinout transaction and the subsequent exploration results closely, as success in this area could add a lucrative dimension to Osisko Development's valuation.

The receipt of the Environmental Assessment Certificate for the Cariboo Gold Project is a pivotal milestone in the project's development timeline. This achievement reflects a successful navigation of the environmental regulatory landscape, which is often a complex and lengthy process in the mining industry. The support from First Nations partners and the approval from provincial ministers adds a layer of social license that is increasingly important for mining operations. The anticipated permits in Q2 2024 are essential for the transition from exploration to construction and ultimately to production, which could substantially impact the company's operational outlook.

On the operational front, the suspension of test mining activities at Trixie and the shift to care and maintenance pending further technical work and funding is a critical development. This decision indicates a strategic pause, allowing for reassessment and potentially a recalibration of the project's development plan. Investors will need to monitor how this decision affects the project's timelines and capital requirements. The updated Mineral Resource Estimate for Trixie, with increased measured and indicated resources, provides a more concrete basis for evaluating the project's potential but must be balanced against the impairment charge and the need for additional funding.

(All monetary references are expressed in Canadian dollars, unless otherwise indicated)

MONTREAL, March 28, 2024 (GLOBE NEWSWIRE) -- Osisko Development Corp. (NYSE: ODV, TSXV: ODV) ("Osisko Development" or the "Company") reports its financial and operating results for the three and twelve months ended December 31, 2023 ("Q4 2023").

Q4 2023 HIGHLIGHTS

Operating, Financial and Corporate Updates:

- 2,090 ounces of gold sold by the Company from operating activities in the fourth quarter (10,743 ounces of gold sold in 2023), comprising of:

- 1,622 ounces of gold sold from the Trixie test mine ("Trixie") located within the Company's wider Tintic Project (4,959 ounces of gold sold in 2023);

- 468 ounces of gold sold from the Cariboo Gold Project ("Cariboo" or the "Cariboo Gold Project") by processing stockpiles at a third-party processing facility (3,272 ounces of gold sold in 2023); and

- nil ounces of gold sold from the San Antonio Gold Project ("San Antonio" or the "San Antonio Project") (2,512 ounces of gold sold in 2023).

$6.9 million in revenues ($31.6 million in 2023) and$6.4 million in cost of sales ($32.3 million in 2023) generated from operating activities in the fourth quarter.- On October 10, 2023, the Company announced that it received an Environmental Assessment ("EA") Certificate for the Company's

100% -owned Cariboo Gold Project. The EA Certificate was granted by the Environmental Assessment Office of the Province of British Columbia ("EAO") and supported by approval decisions from The Honourable George Heyman, Minister of Environment and Climate Change Strategy and The Honourable Josie Osbourne, Minister of Energy, Mines and Low Carbon Innovation. The EA process was completed in consultation with and support of the First Nations partners. - On November 15, 2023, the Company and O3 Mining Inc. ("O3 Mining") announced the successful formation and capitalization of "Electric Elements Mining Corp." ("EEM") to explore for lithium potential on certain James Bay properties in Eeyou Istchee Area, Nunavik, Québec transferred to EEM by the Company and O3 Mining (the "Spinout Transaction"). Subsequently, EEM completed an equity financing for aggregate gross proceeds to EEM of approximately

$4.1 million (the "Financing") to fund the first phase of exploration and for general corporate purposes. After giving effect to the Financing, Osisko Development and O3 Mining hold approximately47% and12% , respectively, of the outstanding EEM shares. - On December 28, 2023, the Company announced that Mr. Luc Lessard, Chief Operating Officer ("COO") would retire from the Company at the end of 2023 to pursue other personal and professional commitments. Mr. Éric Tremblay, a Director on the Board of Directors and Chair of the Environmental, Health and Sustainability Committee, has taken on the position of interim COO. Additionally, in December 2023, Mr. Chris Pharness, Vice President, Sustainable Development, departed the Company.

- As at December 31, 2023, the Company had approximately

$43.5 million in cash.

Tintic Project – Utah, U.S.A. (

- 2023 Trixie Exploration Program. During Q4 2023, the Company continued underground exploration and delineation activities on the existing Trixie deposit as part of its 2023 underground infill and exploration program.

- In 2023, a total of 6,028 meters ("m") (19,776 feet ("ft")) were drilled in 73 underground diamond drill holes, including an additional 1 geotechnical hole totalling 349 m (1,145 ft), with assay results for 17 and 8 diamond drilling holes released on October 11, 2023, and December 21, 2023, respectively. Assay results for all remaining drill holes from the 2023 exploration program were released on February 22, 2024 (see Subsequent to Q4 2023).

- Porphyry Target Drilling. An initial regional surface diamond drilling campaign to test for copper-gold-molybdenum porphyry mineralization potential, namely in the Big Hill area, commenced in early December 2023, following receipt of the required surface drill permits. An initial 3,000 meter (9,842 feet) of two drilling holes comprises phase one of the surface diamond drilling program.

- One diamond drill rig is currently active at surface testing a porphyry target at Big Hill and is at a current depth of 378 m (1,240 ft). The Company completed a first drill hole at Big Hill to a depth of 1,180 m (3,872 ft) when it transitioned out of the prospective alteration zone, and commenced the second drill hole by repositioning the drill rig at a modified angle.

- One diamond drill hole tested a copper-gold-porphyry target below Trixie from underground and was drilled to a depth of 759.6 m (2,492 ft) when it crossed the Eureka Lily Fault to the east and out of the prospective alteration zone. Further drill testing of a copper-gold porphyry target at depth below the Trixie deposit is recommended to the west.

- The drilling of porphyry targets continues and is expected to be completed by the end of Q2 2024, at which point the Company will provide an exploration update including any material assay results relating to the preliminary drilling program, as appropriate.

- Exploration Target Potential. The Company has advanced rehabilitation at the 750 level to allow for further underground diamond drilling to test for the down dip extent of the 756 zone and the porphyry target below Trixie. Data compilation from historic mines in the area is ongoing and is anticipated to generate additional exploration drill targets on the greater Tintic Project property.

- Test mining activities at Trixie were suspended in December 2023 and are expected to remain in care and maintenance for the foreseeable future pending completion of technical work and additional funding.

- 2024 Trixie Mineral Resource Estimate ("MRE"). Subsequent to Q4 2023, on March 15, 2024, the Company released an updated MRE for the underground Trixie deposit (the "2024 Trixie MRE") in accordance with NI 43-101 (as defined herein). The 2024 Trixie MRE incorporated an additional 1,674 underground chip samples over 1,678 m (5,507 ft) of underground development, and 7,385 m of drilling (24,229 ft) in 122 holes completed since the initial Trixie MRE (the "2023 Trixie MRE"), with an effective date of January 10, 2023. The 2024 Trixie MRE, which will be further described in the full technical report being prepared for the 2024 Trixie MRE in accordance with NI 43-101, comprises:

- Measured resources of 119,847 tonnes grading 27.36 grams per tonne ("g/t") gold ("Au") and 61.73 g/t silver ("Ag"), for a total of 105,437 ounces ("oz") Au and 237,868 oz Ag.

- Indicated resources of 124,743 tonnes grading 11.17 g/t Au and 59.89 g/t Ag, for a total of 44,811 oz Au and 240,211 oz Ag.

- Inferred resources of 201,603 tonnes grading 7.80 g/t Au and 48.55 g/t Ag, for a total of 50,569 oz Au and 314,678 oz Ag.

- Trixie Non-cash Impairment. The Company completed a review of the carrying value of its assets in accordance with International Financial Reporting Standards as at December 31, 2023. As a result of this review, a non-cash impairment gross charge of

$160.5 million ($115.9 million on a net carrying value basis) was recognized for Trixie in the Company's consolidated financial statements for the year ended December 31, 2023.- As previously disclosed, the impairment charge is primarily a result of, among other things, assumptions related to required future exploration and capital expenditures, potential mining and processing methods, and average processed gold grades related to the gold targets only.

- The asset impairment charge relates only to Trixie and is a non-cash item and, for the avoidance of doubt, has no impact on Company's cash flows.

Cariboo Gold Project – British Columbia, Canada (

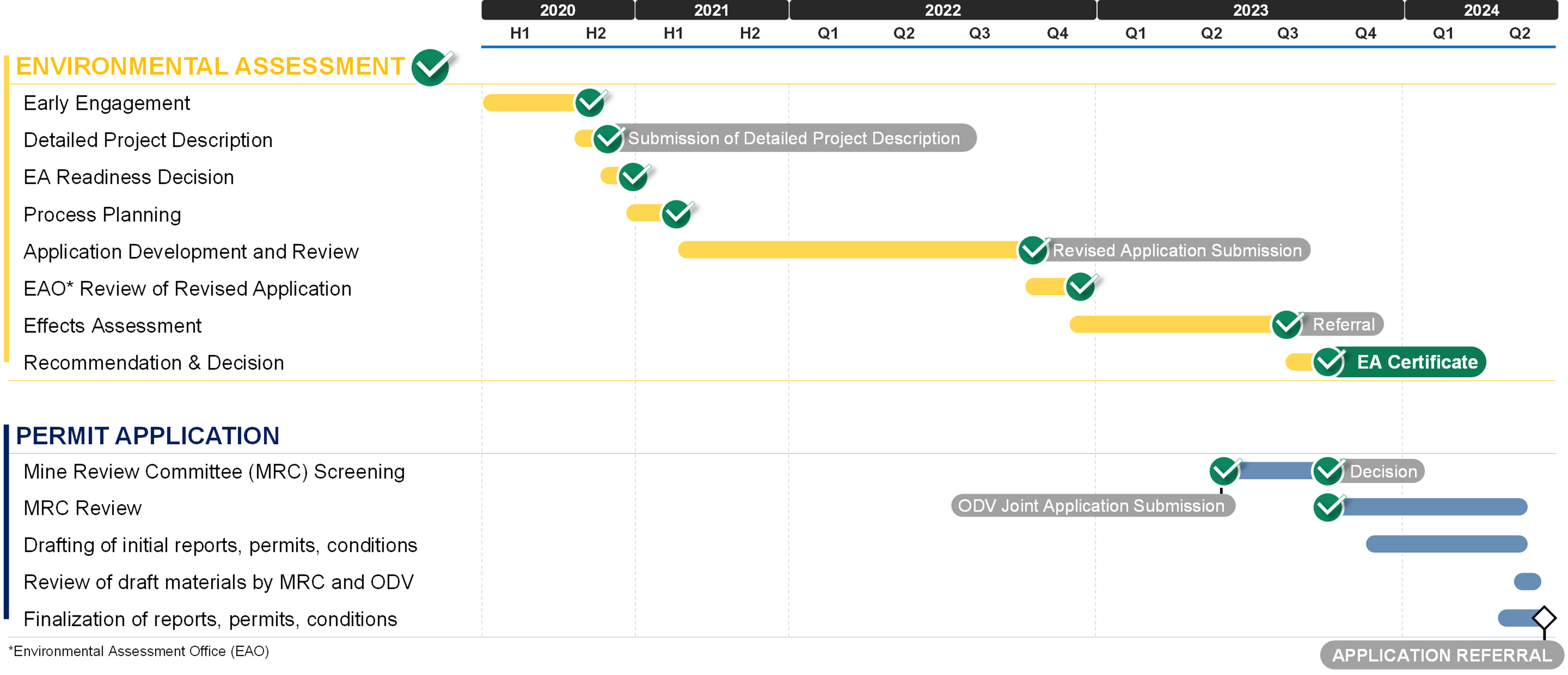

- Permitting Progress. Receipt of the EA Certificate in October 2023 successfully concludes the EA process for the Cariboo Gold Project, which was launched in October 2019 (see Figure 1). A Joint Permit Application for the BC Mines Act / Environmental Management Act is in progress, and the Company is currently advancing through round 3 of the Mine Review Committee review period. The Company anticipates receiving permits in Q2 2024 which would enable construction of the Cariboo Gold Project. The Company continues to explore its options, including sourcing a fully-funded solution for the Cariboo Gold Project.

Figure 1: Cariboo Gold Project – Permitting Timeline Summary

- Pre-Construction Activities. Subsequent to Q4 2023, the Company secured a US

$50 million Credit Facility (as defined herein), which will be exclusively used to fund ongoing detailed engineering and pre-construction activities at the Cariboo Gold Project. This includes the commencement of an underground development drift from the existing Cow Portal into the Cariboo Gold Project's mineral deposit at Lowhee Zone and extraction of 10,000 tonnes of material under an existing provincial permit expected to be completed by the end of Q4 2024.

San Antonio Gold Project – Sonora State, Mexico (

- Following completion of processing of the remaining stockpile inventory from the heap leach pad in Q3 2023, the San Antonio Gold Project was placed into care and maintenance, with no production anticipated henceforth.

- The Company awaits next steps from the government of Mexico with respect to the permitting process and the status of open pit mining in the country.

- Strategic Review. The Board of Directors of the Company has authorized a strategic review of the San Antonio Gold Project, which includes exploring the potential for a financial or strategic partner in the asset or for a full or partial sale of the asset. The Company has engaged a financial advisor in connection with such strategic review.

SUBSEQUENT TO Q4 2023

- On February 2, 2024, the Company announced that Mr. Francois Vézina resigned from his position as Senior Vice President, Project Development, Technical Services and Environment effective as of March 1, 2024 to pursue outside interests in the mining sector.

- On February 22, 2024, the Company disclosed the remaining assay results from 14 diamond drilling holes and chip samples from new development areas as part of its 2023 exploration program at Trixie. Select assay results highlights included (see news release dated February 22, 2024):

- 66.04 g/t Au and 167.64 g/t Ag over 8.99 m in hole TRXU-DD-23-072A (1.93 troy ounces per short ton ("oz/t") Au and 4.89 oz/t Ag over 29.50 ft).

- On March 4, 2024, the Company announced that the Company, as guarantor, and Barkerville Gold Mines Ltd., its wholly-owned subsidiary, as borrower, entered into a credit agreement dated March 1, 2024 with National Bank of Canada in connection with a US

$50 million delayed draw term loan (the "Credit Facility"). The Credit Facility will be exclusively used to fund ongoing detailed engineering and pre-construction activities at the Cariboo Gold Project. On March 1, 2024, an amount of US$25.0 million ($33.9 million ) was drawn under the Credit Facility, net of US$1.0 million ($1.4 million ) of fees.

KEY UPCOMING MILESTONES

| Key Milestones for Projects | Expected Timing of Completion | Anticipated Remaining Costs* | ||

| Cariboo Gold Project | ||||

| Environmental Assessment Certificate(1) | Completed – Q4 2023 | — | ||

| Preparatory Work for Bulk Sample(2) | Completed – Q4 2023 | — | ||

| Bulk Sample(4) | Q4 2024 | |||

| Water and Waste Management | Q2 2024 | |||

| Electrical and Communication | Q2 2024 | |||

| Surface Infrastructure | Q2 2024 | |||

| Management, environmental, and other pre-permitting work | Q2 2024 | |||

| Detailed engineering and permitting(3) | Q2 2024 | |||

| Tintic Project | ||||

| Ramp Development – 1st stage | Completed – Q3 2023 | – | ||

| Regional Drilling | Q4 2023 – Q2 2024 | |||

| Updating mineral resource estimates | Completed – Q1 2024 | |||

| *as at December 31, 2023 | ||

| Notes: | ||

| (1) | On October 10, 2023, the Company received an Environmental Assessment Certificate for the Cariboo Gold Project, which was granted by the Environmental Assessment Office of the Province of British Columbia and is supported by approval decisions from The Honourable George Heyman, Minister of Environment and Climate Change Strategy and The Honourable Josie Osbourne, Minister of Energy, Mines and Low Carbon Innovation. Receipt of the Environmental Assessment Certificate concludes the environmental assessment process for the Cariboo Gold Project, which was initiated in October 2019. | |

| (2) | This refers to the preparatory work as commenced in Q3 2023 following the Environmental Assessment Certificate to prepare for the bulk sample with an associated cost of approximately C | |

| (3) | These are activities contributing towards the completion of permitting activities, which is presently expected to be completed in Q2 2024. Additional costs and time relating to engineering, including water and waste management and electrical and communication, will be required in the construction phase (after a positive construction decision is made and project financing is obtained). | |

| (4) | The bulk sample expenditures include up until the end of June 2024 and were approved by the Board of Directors. | |

Consolidated Financial Statements

The Company's audited consolidated financial statements (the "Financial Statements") and management's discussion and analysis ("MD&A") for the three and twelve months ended December 31, 2023 are available on the Company's website at www.osiskodev.com, on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Maggie Layman, P.Geo., Vice President, Exploration of Osisko Development, a "qualified person" within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Technical Reports

Information relating to the Cariboo Gold Project and the Cariboo FS is supported by the technical report titled "Feasibility Study for the Cariboo Gold Project, District of Well, British Columbia, Canada", dated January 10, 2023 (amended January 12, 2023) with an effective date of December 30, 2022) prepared for the Company by independent representatives BBA Engineering Ltd. and supported by independent consulting firms, including InnovExplo Inc., SRK Consulting (Canada) Inc., Golder Associates Ltd. (amalgamated with WSP Canada Inc. on January 1, 2023, to form WSP Canada Inc.), WSP USA Inc., Falkirk Environmental Consultants Ltd., Klohn Crippen Berger Ltd., KCC Geoconsulting Inc., and JDS Energy & Mining Inc. (the "Cariboo Technical Report"). Reference should be made to the full text of the Cariboo Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

Certain scientific and technical information relating to the Tintic Project and the updated mineral resource estimate for the Trixie deposit (the "2024 Trixie MRE"), is supported by the news release disseminated by the Company on March 15, 2024 (titled "Osisko Development Announces Mineral Resource Update for the Trixie Deposit, Tintic Project") (the "MRE Update News Release"). The key assumptions, parameters, qualifications, procedures and methods underlying the 2024 Trixie MRE, certain of which are described in the above-noted news release, will be further described in the full technical report being prepared for the 2024 Trixie MRE in accordance with NI 43-101, and will be available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile within 45 days from the date of the MRE Update News Release. Information relating to the 2024 Trixie MRE provided herein is qualified in its entirety by the full text of the MRE Update News Release which is available electronically on the Company's website or on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under the Company's issuer profile, including the assumptions, qualifications and limitations therein.

Until a technical report relating to the 2024 Trixie MRE is filed on SEDAR+, the current technical report (within the meaning of NI 43-101) on the Tintic Project is the technical report titled "NI 43-101 Technical Report, Initial Mineral Resource Estimate for the Trixie Deposit, Tintic Project, Utah, United States of America" dated January 27, 2023 (with an effective date of January 10, 2023) (the "2023 Trixie MRE"), which was prepared by William J. Lewis, P. Geo, Ing. Alan J. San Martin, MAusIMM (CP) and Richard Gowans, P. Eng (the "Tintic Technical Report"). The full text of the 2023 Trixie MRE is available electronically on the Company's website or on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under the Company's issuer profile, including the assumptions, qualifications and limitations therein. Once a technical report in respect of the 2024 Trixie MRE is filed on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile, it will automatically supersede the Tintic Technical Report.

Information relating to San Antonio is supported by the technical report titled "NI 43-101 Technical Report for the 2022 Mineral Resource Estimate on the San Antonio Project, Sonora, Mexico", dated July 12, 2022 (with an effective date of June 24, 2022) prepared for the Company by independent representatives of Micon International Limited (the "San Antonio Technical Report", collectively with the Trixie Technical Report and Cariboo Technical Report, the "Technical Reports"). Reference should be made to the full text of the San Antonio Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company's objective is to become an intermediate gold producer by advancing its

For further information, visit our website at www.osiskodev.com or contact:

| Sean Roosen | Philip Rabenok |

| Chairman and CEO | Director, Investor Relations |

| Email: sroosen@osiskodev.com | Email: prabenok@osiskodev.com |

| Tel: +1 (514) 940-0685 | Tel: +1 (437) 423-3644 |

CAUTIONARY STATEMENTS

Cautionary Statement Regarding Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The mineral resource estimate disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards on Mineral Resources and Mineral Reserves" incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

Cautionary Statement Regarding Financing Risks

The Company's development and exploration activities are subject to financing risks. At the present time, the Company has exploration and development assets which may generate periodic revenues through test mining, but has no mines in the commercial production stage that generate positive cash flows. The Company cautions that test mining at its operations could be suspended at any time. The Company's ability to explore for and discover potential economic projects, and then to bring them into production, is highly dependent upon its ability to raise equity and debt capital in the financial markets. Any projects that the Company develops will require significant capital expenditures. To obtain such funds, the Company may sell additional securities including, but not limited to, the Company's shares or some form of convertible security, the effect of which may result in a substantial dilution of the equity interests of the Company's Shareholders. Alternatively, the Company may also sell a part of its interest in an asset in order to raise capital. There is no assurance that the Company will be able to raise the funds required to continue its exploration programs and finance the development of any potentially economic deposit that is identified on acceptable terms or at all. The failure to obtain the necessary financing(s) could have a material adverse effect on the Company's growth strategy, results of operations, financial condition and project scheduling.

Cautionary Statement Regarding Test Mining Without Feasibility Study

The Company cautions that its prior decision to commence small-scale underground mining activities and batch vat leaching at the Trixie test mine was made without the benefit of a feasibility study, or reported mineral resources or mineral reserves, demonstrating economic and technical viability, and, as a result there may be increased uncertainty of achieving any particular level of recovery of material or the cost of such recovery. The Company cautions that historically, such projects have a much higher risk of economic and technical failure. Small scale test-mining at Trixie was suspended in December 2022, resumed in the second quarter of 2023, and suspended once again in December 2023. If and when small-scale test-mining recommences at Trixie, there is no guarantee that production will continue as anticipated or at all or that anticipated production costs will be achieved. The failure to continue production may have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations. Failure to achieve the anticipated production costs may have a material adverse impact on the Company's cash flow and potential profitability. In continuing operations at Trixie after closing, the Company has not based its decision to continue such operations on a feasibility study, or reported mineral resources or mineral reserves demonstrating economic and technical viability.

Cautionary Statement to U.S. Investors

The Company is subject to the reporting requirements of the applicable Canadian securities laws and as a result reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, in accordance with Canadian reporting requirements, which are governed by NI 43-101. As such, such information concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the U.S. Securities and Exchange Commission ("SEC").

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including the assumptions, qualifications and limitations relating to the significance of the high-priority target drilling; the utility of modern exploration techniques; the potential for parallel high-grade gold fissure zones; the potential of Tintic to host a copper-gold porphyry center; the significance of regional exploration potential; the results of the 2024 Trixie MRE; the potential for unknown mineralized structures to extend existing zones of mineralization; category conversion; the timing and status of permitting; the Company's ability to prepare and file a technical report in respect of the 2024 Trixie MRE within 45 days from March 15, 2024; the capital resources available to Osisko Development; the ability of the Company to execute its planned activities, including as a result of its ability to seek additional funding or to reduce planned expenditures; the ability of the Company to obtain future financing and the terms of such financing; management's perceptions of historical trends, current conditions and expected future developments; the utility and significance of historic data, including the significance of the district hosting past producing mines; future mining activities; the potential of high grade gold mineralization on Trixie and Cariboo; the results (if any) of further exploration work to define and expand mineral resources; the ability of exploration work (including drilling) to accurately predict mineralization; the ability to generate additional drill targets; the ability of management to understand the geology and potential of the Company's properties; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the timing and ability of the Company to complete upgrades to the mining and mill infrastructure at Trixie (if at all); continuation of test mining activities at Trixie (if at all); the timing and ability of the Company to ramp up processing capacity at Trixie (if at all); the ability of the Company to complete its exploration and development objectives for its projects in 2024 in the timing contemplated and within expected costs (if at all); the ongoing advancement of the deposits on the Company's properties; the deposit remaining open for expansion at depth and down plunge; the ability to realize upon any mineralization in a manner that is economic; the Cariboo project design and ability and timing to complete infrastructure at Cariboo (if at all); the ability and timing for Cariboo to reach commercial production (if at all); the ability to adapt to changes in gold prices, estimates of costs, estimates of planned exploration and development expenditures; the ability of the Company to obtain further capital on reasonable terms; the profitability (if at all) of the Company's operations; the Company being a well-positioned gold development company in Canada, USA and Mexico; the ability and timing for the permitting at San Antonio; the impact of permitting delays at San Antonio; the outcome of the strategic review of the San Antonio Project; sustainability and environmental impacts of operations at the Company's properties; as well as other considerations that are believed to be appropriate in the circumstances, and any other information herein that is not a historical fact may be "forward looking information". Material assumptions also include, management's perceptions of historical trends, the ability of exploration (including drilling and chip sampling assays, and face sampling) to accurately predict mineralization, budget constraints and access to capital on terms acceptable to the Company, current conditions and expected future developments, regulatory framework remaining defined and understood, results of further exploration work to define or expand any mineral resources, as well as other considerations that are believed to be appropriate in the circumstances. Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to capital market conditions and the Company's ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company's properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; the ability of exploration activities (including drill results and chip sampling, and face sampling results) to accurately predict mineralization; errors in management's geological modelling; the ability to expand operations or complete further exploration activities; the timing and ability of the Company to obtain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company's annual information form for the year ended December 31, 2023 as well as the financial statements and MD&A for the year ended December 31, 2023, which have been filed on SEDAR+ (www.sedarplus.ca) under Osisko Development's issuer profile and on the SEC's EDGAR website (www.sec.gov), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company's believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/70845b50-7726-4951-94c9-1c479d74760b

FAQ

How many ounces of gold were sold by Osisko Development in Q4 2023?

What was the revenue generated by Osisko Development in Q4 2023?

When did Osisko Development receive an Environmental Assessment Certificate for the Cariboo Gold Project?

What is the 2024 Trixie MRE?

What was the non-cash impairment charge recognized by Osisko Development for Trixie?

Who retired as Chief Operating Officer of Osisko Development in December 2023?