Oncocyte Announces Successful GraftAssure™ Beta Launch and Q2 2024 Results

Oncocyte (Nasdaq: OCX) has successfully launched GraftAssure™, a research-use-only assay detecting graft organ damage in blood. The assay debuted in July 2024 at major transplant centers in the U.S. and Asia. The company reported Q2 2024 revenue of $104,000, a $4.5 million loss from continuing operations, and an $11 million cash balance. The GraftAssure launch is part of a strategy to capture market share in a $1 billion market, aligning with Bio-Rad's global infrastructure. Positive momentum is reported from partnerships and industry relationships. Oncocyte aims to establish over 20 transplant centers running GraftAssure by the end of 2025, targeting significant future revenue. The company is also preparing for FDA IVD clearance in late 2025. Andrea James has been appointed CFO. Additional details are in the company's updated investor deck.

Oncocyte (Nasdaq: OCX) ha lanciato con successo GraftAssure™, un saggio destinato esclusivamente alla ricerca che rileva il danno agli organi trapiantati nel sangue. Il saggio è stato presentato a luglio 2024 presso i principali centri di trapianto negli Stati Uniti e in Asia. L'azienda ha riportato un fatturato del secondo trimestre del 2024 di 104.000 dollari, una perdita di 4,5 milioni di dollari dalle operazioni continuative e un saldo di cassa di 11 milioni di dollari. Il lancio di GraftAssure fa parte di una strategia per catturare quote di mercato in un mercato da 1 miliardo di dollari, allineandosi con l'infrastruttura globale di Bio-Rad. Si segnalano slanci positivi derivanti da partnership e relazioni nel settore. Oncocyte mira a stabilire oltre 20 centri di trapianto in funzione di GraftAssure entro la fine del 2025, puntando a un significativo fatturato futuro. L'azienda si sta anche preparando per l'approvazione IVD della FDA entro la fine del 2025. Andrea James è stata nominata CFO. Ulteriori dettagli sono disponibili nella presentazione aggiornata per gli investitori dell'azienda.

Oncocyte (Nasdaq: OCX) ha lanzado con éxito GraftAssure™, un ensayo destinado únicamente a la investigación que detecta el daño en órganos trasplantados en la sangre. El ensayo se presentó en julio de 2024 en importantes centros de trasplantes en EE. UU. y Asia. La empresa reportó ingresos del segundo trimestre de 2024 de 104,000 dólares, una pérdida de 4.5 millones de dólares de operaciones continuas, y un saldo de caja de 11 millones de dólares. El lanzamiento de GraftAssure es parte de una estrategia para capturar cuota de mercado en un mercado de 1 billón de dólares, alineándose con la infraestructura global de Bio-Rad. Se reporta un impulso positivo proveniente de asociaciones y relaciones en la industria. Oncocyte tiene como objetivo establecer más de 20 centros de trasplante operando GraftAssure para finales de 2025, apuntando a ingresos futuros significativos. La empresa también se está preparando para la aprobación de IVD por parte de la FDA a finales de 2025. Andrea James ha sido nombrada CFO. Se pueden encontrar más detalles en la presentación actualizada para inversores de la empresa.

Oncocyte (Nasdaq: OCX)는 연구 전용 검사인 GraftAssure™를 성공적으로 출시하였습니다. 이 검사는 혈액에서 이식된 장기의 손상을 감지합니다. 이 검사는 2024년 7월 미국과 아시아의 주요 이식 센터에서 첫 선을 보였습니다. 이 회사는 2024년 2분기 수익이 104,000달러이며, 지속적인 운영에서 450만 달러의 손실과 1,100만 달러의 현금 잔액을 보고했습니다. GraftAssure의 출시는 10억 달러 규모의 시장에서 시장 점유율을 확보하기 위한 전략의 일환으로, Bio-Rad의 글로벌 인프라와 일치하고 있습니다. 파트너십과 산업 관계에서 긍정적인 모멘텀이 보고되고 있습니다. Oncocyte는 2025년 말까지 GraftAssure를 운영하는 20개 이상의 이식 센터를 설립하는 것을 목표로 하여, 향후 상당한 수익을 목표로 하고 있습니다. 이 회사는 또한 2025년 말 FDA의 IVD 승인을 준비하고 있습니다. Andrea James가 CFO로 임명되었습니다. 추가 세부정보는 회사의 업데이트된 투자자 프레젠테이션에서 확인할 수 있습니다.

Oncocyte (Nasdaq: OCX) a lancé avec succès GraftAssure™, un test réservé à la recherche qui détecte les lésions des organes greffés dans le sang. Le test a été présenté en juillet 2024 dans les principaux centres de transplantation aux États-Unis et en Asie. L'entreprise a rapporté des revenus de 104 000 dollars pour le deuxième trimestre 2024, une perte de 4,5 millions de dollars provenant des opérations continues et un solde de trésorerie de 11 millions de dollars. Le lancement de GraftAssure fait partie d'une stratégie visant à capter des parts de marché dans un marché de 1 milliard de dollars, s'alignant sur l'infrastructure mondiale de Bio-Rad. Un élan positif est rapporté grâce à des partenariats et des relations dans l'industrie. Oncocyte vise à établir plus de 20 centres de transplantation utilisant GraftAssure d'ici la fin 2025, ciblant des revenus futurs significatifs. L'entreprise se prépare également à l'approbation IVD de la FDA d'ici fin 2025. Andrea James a été nommée CFO. D'autres détails sont disponibles dans la présentation mise à jour pour les investisseurs de l'entreprise.

Oncocyte (Nasdaq: OCX) hat erfolgreich GraftAssure™ auf den Markt gebracht, einen ausschließlich für Forschungszwecke verwendeten Test zur Erkennung von Organschäden bei Transplantationen im Blut. Der Test wurde im Juli 2024 in wichtigen Transplantationszentren in den USA und Asien eingeführt. Das Unternehmen berichtete für das zweite Quartal 2024 von Einnahmen in Höhe von 104.000 US-Dollar, einem Verlust von 4,5 Millionen US-Dollar aus fortgeführten Betrieben und einem Kassenbestand von 11 Millionen US-Dollar. Der Launch von GraftAssure ist Teil einer Strategie, Marktanteile in einem Markt im Wert von 1 Milliarde US-Dollar zu gewinnen, die mit der globalen Infrastruktur von Bio-Rad übereinstimmt. Es wird von positivem Schwung durch Partnerschaften und Branchenbeziehungen berichtet. Oncocyte strebt an, bis Ende 2025 über 20 Transplantationszentren, die GraftAssure verwenden, zu etablieren, mit dem Ziel, signifikante zukünftige Einnahmen zu erzielen. Das Unternehmen bereitet sich außerdem auf die FDA IVD-Zulassung Ende 2025 vor. Andrea James wurde zur CFO ernannt. Weitere Details finden sich in der aktualisierten Investorenpräsentation des Unternehmens.

- Successful launch of GraftAssure™

- Partnership with Bio-Rad Laboratories

- Interest from transplant centers representing 25% of US transplant volumes

- Signed agreement with European biotechnology company

- Appointment of Andrea James as CFO

- Q2 2024 revenue of $104,000

- Loss from continuing operations at $4.5 million

- Operating expenses of $4.7 million

- R&D expenses increased by 6%

- Non-GAAP loss from operations at $5.0 million

Insights

Oncocyte's Q2 2024 results and GraftAssure launch represent a significant milestone for the company. The successful beta launch of GraftAssure in major transplant centers across multiple continents demonstrates strong market interest. The company's sales funnel now represents approximately 25% of US transplant volumes, indicating potential for substantial market penetration.

Financially, while Q2 revenue was modest at

The company's land-and-expand strategy and potential FDA clearance in late 2025 could drive significant revenue growth, with projections of

Oncocyte's GraftAssure launch marks a significant advancement in transplant diagnostics. The assay's ability to detect early evidence of graft organ damage in blood samples could revolutionize post-transplant care. The company's strategic focus on dd-cfDNA technology is supported by favorable data published in the New England Journal of Medicine, enhancing its scientific credibility.

The company's involvement in a Phase II clinical trial for antibody-mediated rejection therapy demonstrates the broader potential applications of their technology. This collaboration could lead to expanded clinical utility and future revenue streams. The planned FDA IVD clearance process, targeting late 2025, could further validate the technology and open up clinical use markets.

Oncocyte's ten-year track record in transplant technology and multiple patents strengthen its position in the field. The company's unique data showing earlier detection of AMR in kidney patients (10 months sooner than other protocols) could significantly improve patient outcomes. This scientific leadership positions Oncocyte well for future growth and adoption in the transplant diagnostics market.

Oncocyte's market strategy appears well-positioned to capitalize on the $1 billion total addressable market in transplant diagnostics. The company's focus on high-volume transplant centers is shrewd, given that fewer than 100 centers account for about 80% of US transplant volumes. This concentration allows for efficient sales and support with a team.

The partnership with Bio-Rad Laboratories significantly enhances Oncocyte's global reach, particularly in key markets like Germany and Asia. This collaboration could accelerate market penetration and revenue growth. The company's land-and-expand strategy, starting with research use and potentially transitioning to clinical use, seems well-suited to the academic and research-focused nature of major transplant centers.

The timing of Oncocyte's market entry aligns favorably with the upcoming Increasing Organ Transplant Access Model, set to roll out in January 2025. This legislation could drive increased demand for dd-cfDNA testing, potentially accelerating Oncocyte's market adoption. However, the company will need to navigate the competitive landscape and execute flawlessly on its FDA clearance timeline to fully capitalize on this market opportunity.

Interest in kidney transplant assay represents approximately

Company lays out land and expand strategy in transplant

IRVINE, Calif., Aug. 08, 2024 (GLOBE NEWSWIRE) -- Oncocyte Corp. (Nasdaq: OCX), a diagnostics technology company, today published its second quarter 2024 results and the following letter to shareholders.

Dear shareholders,

We are thrilled to report that we have successfully launched GraftAssure™, which is our research-use-only assay that can detect early evidence of graft organ damage in a patient’s blood.

On July 11, 2024, our GraftAssure assay was run at a major metropolitan transplant center and research university in the northeast United States, representing the first time our test had been run outside of an Oncocyte lab. Days later, a lab at a leading transplant center in Southeast Asia began running the test.

Though we believe this milestone is just the beginning, it’s an important proof point in an 18-month journey. To recap, in January 2023, we decided to double down on commercializing our transplant test IP, primarily by making a kitted test that relies upon a biomarker, donor-derived cell-free DNA (dd-cfDNA). Our first prototypes of GraftAssure came off the manufacturing line in December. Four months later, in April 2024, we welcomed Bio-Rad Laboratories (NYSE:BIO) as an investor and strategic partner, supporting the GraftAssure global launch.

And in June 2024, we began shipping to our launch customers. We shipped to two continents in our first week – representing major transplant centers and research universities in the U.S. and Southeast Asia. As of today, we have signed up several centers in the U.S, Europe and Southeast Asia.

We are also pleased with the momentum we are seeing coming out of the American Transplant Congress in Philadelphia in June. That conference was especially meaningful for Oncocyte this year because it coincided with the New England Journal of Medicine’s publication of favorable data regarding our centralized lab product VitaGraft Kidney1. That clinical product uses the same background IP as our GraftAssure kitted test.

We are pleased to report that our US sales funnel of confirmed interest in our transplant assay is made up of transplant centers that represent approximately

As a reminder, under our partnership, Bio-Rad and Oncocyte are co-marketing GraftAssure inside the US and Germany, with Oncocyte acting as commercial lead. Bio-Rad is acting as commercial lead outside the US and Germany, and correspondingly has been granted exclusive distribution and commercial rights in those countries.

Beyond growing our sales pipeline, momentum also continues through our industry relationships and partnerships. For example, in the second quarter, we signed an agreement with a European biotechnology company to be the provider of dd-cfDNA testing for a Phase II clinical trial for a therapeutic in antibody mediated rejection.

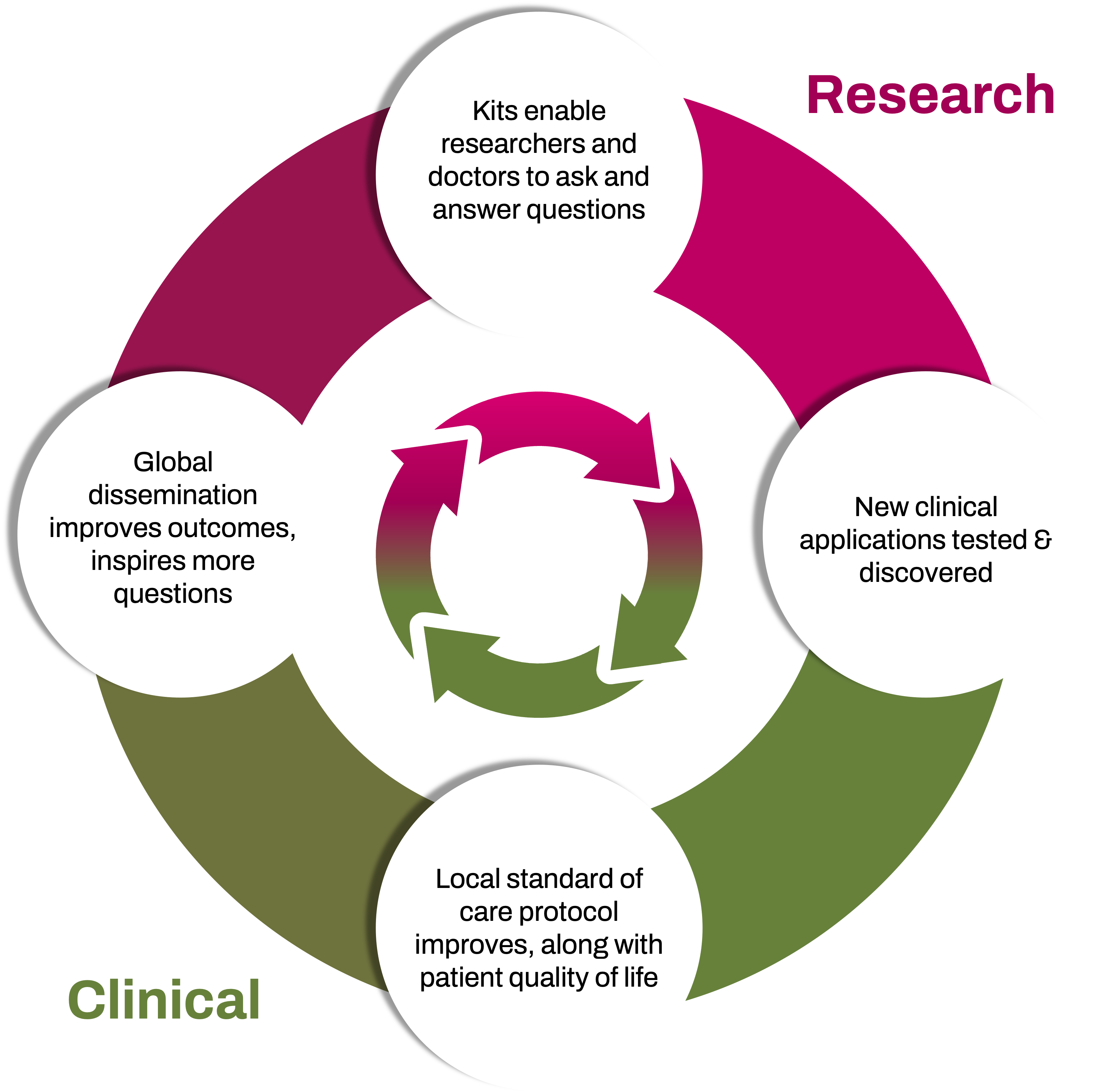

Our partnerships with the pharmaceutical industry are strategically important. First, the partnerships highlight and validate the robustness of our technology and our partnership approach to the market. These trials also advance and expand the body of science using our diagnostic technology to develop the potential for new clinical applications for our diagnostic tools.

Ultimately, the expansion of clinical utility increases the opportunity for future long-term recurring revenue. When we participate in a clinical trial, we perform the services at our clinical (CLIA) laboratory, receiving a nominal amount of revenue to cover the cost of performing the test. While these clinical trials are limited in short-term revenue generation, they lay the foundation for future revenue expansion and growth.

The dd-cfDNA test that we run at our CLIA laboratory on behalf of customers is VitaGraft Kidney. As a reminder, VitaGraft received Medicare reimbursement in 2023. We are increasing the throughput for VitaGraft in our CLIA lab by establishing higher automation with simple scaling options. This increased capacity supports ongoing clinical trials using our tests and the data generation required by our IVD program, which we discuss further below.

Transplant: Land & Expand Strategy

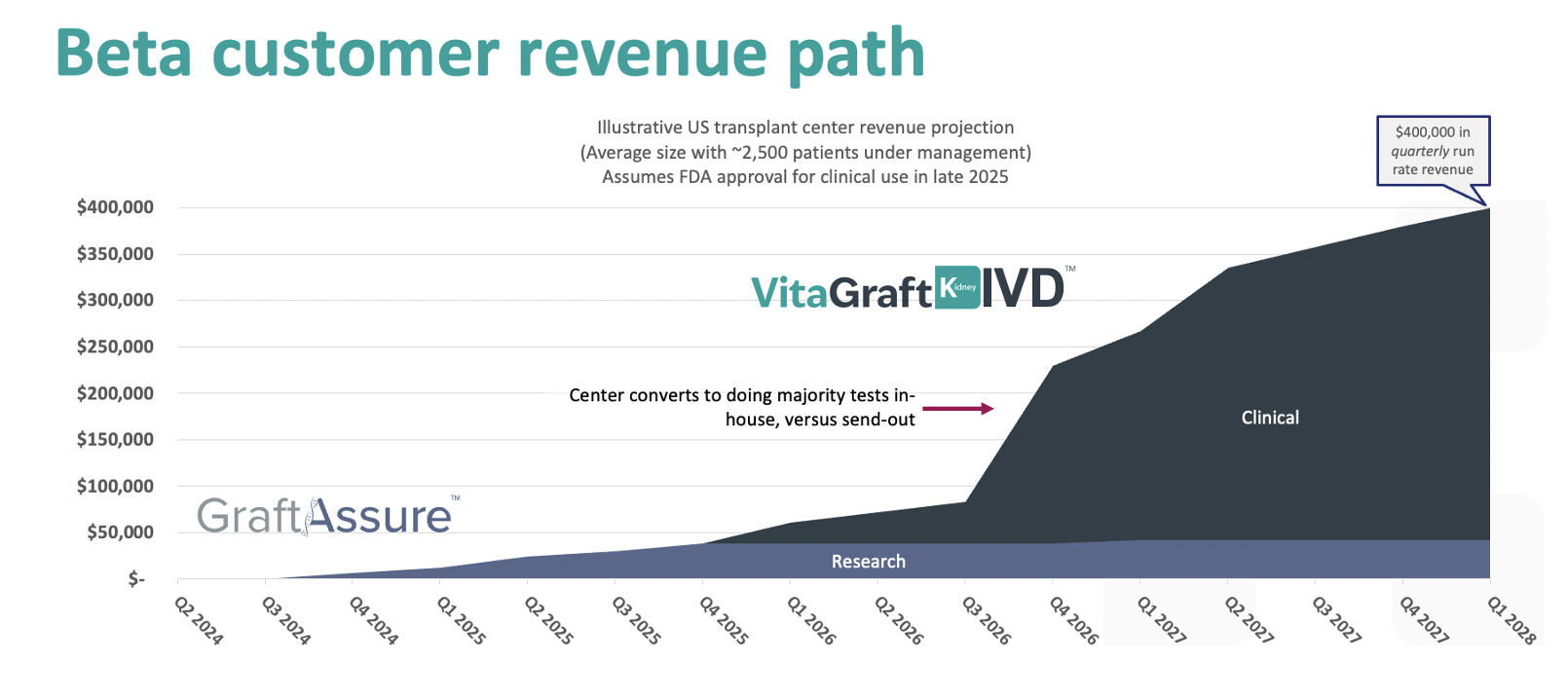

We believe that we are at an inflection point in commercializing our molecular diagnostic tests that can detect early evidence of graft organ damage in the blood. Bringing research centers up online with our GraftAssure assay is a key part of our land-and-expand strategy to drive commercial adoption of our tests and capture market share in an estimated

Simply, our strategy is to land major transplant centers and research universities with our research-use-only product. Doing so establishes our technology and increases its potential utility by enabling researchers to explore potential applications of dd-cfDNA. Then, once we have achieved FDA (Food and Drug Administration) clearance for our test kits to be used to make clinical decisions – that is, approved as an in-vitro diagnostic (IVD) – we believe that these institutions will begin using our tests to manage their patient populations, while continuing to use our GraftAssure test kit to perform research. Importantly, our GraftAssure research product may not be used to support clinical treatment decisions.

We believe that we can execute upon this strategy with a limited sales force deployed in key territories due to the favorable customer concentration of our industry. For example, fewer than 100 academic and research centers in the US account for about

We are seeing early indications of remarkable product-market fit and we are pleased with the market response to our assay. We believe that GraftAssure’s appeal is due to workflows that are easy and user-friendly3 and that market enthusiasm will translate to adoption of the IVD product once it is available. We discuss the IVD clearance process in more detail below.

Our initial beta customers sought to deploy our RUO assay as soon as we could ship it to them – which we find compelling in light of the fact that bringing our RUO assay up and running is a major undertaking for a transplant center’s research lab, requiring significant investment of time and resources. It requires performing instrument validation, running an analytical validation study, and training laboratory employees.

To support the lab’s validation process, we ship non-revenue test kits and send a team to support the lab in getting the test up and running, including troubleshooting any initial issues. The first lab to be up and running was able to complete the process in about two weeks, with some initial support from the Oncocyte team until they could run with the assay.

Our teams ensure the pre-existing equipment is calibrated to support the test and that the customer laboratory teams are trained to run it effectively. Once we’ve confirmed that the instrument and assay are performing as intended, the labs begin running their first research samples and preparing to launch new studies. Most of the customers in our funnel come to us with studies in mind that they’ve wanted to do for a long time and are excited that they’ll get a chance to move forward on their own.

Notably, some of these centers are eager to support the development of our IVD product. Whether collecting samples or producing data, the clinical researchers are excited to work with us on this process. Our openly collaborative approach is winning hearts and minds across the industry. We take our commitments and responsibility to the research community very seriously – they use our tests to advance the body of science in transplant medicine, which may save many lives over time.

We aim to have more than 20 transplant centers running GraftAssure tests through the end of 2025, including 15 in the US. We estimate that each center represents an eventual annual high-margin revenue stream of several hundred thousand dollars to

The following illustration shows a projected quarterly revenue path for one typical beta customer. The illustration shows the customer entering 2028 contributing

What’s next:

- Continued roll-out of research product: We will continue to bring transplant center customers up online running our GraftAssure assay throughout 2024 and 2025.

- Impact of legislation: We believe our timing is serendipitous as the Increasing Organ Transplant Access Model, by the Centers for Medicare and Medicaid Services, rolls out on January 1, 2025. Transplant surgeons have told us that they expect that this legislation will lead to more marginal organs being transplanted into patients and potentially higher rates of adverse events, which could increase demand for dd-cfDNA testing. As a reminder, our IVD strategy aims to empower transplant centers to perform dd-cfDNA tests in-house and submit for reimbursement for their own labs.

- Q-Sub submission: The Q-Sub process is a formal procedure in which a company submits a validation plan to the FDA for review and receives their feedback. We hope to receive feedback from the FDA by the end of 2024. We need this feedback to move forward with confidence into our clinical validation processes prior to submitting for FDA IVD clearance next year.

- FDA IVD-clearance process: Medical devices are classified into three categories based on their risk – our tests are considered Class II devices, meaning that they are considered to have a moderate level of risk6 to the patient. We will submit under the 510(k) De Novo Classification process, which is premarket submission made to the FDA for a new “device,” or in our case, test. We are aiming to achieve FDA clearance in late 2025, which is our best-case timeline. Below are some of the data points that give us confidence going into this process.

- The successful launch of GraftAssure, and the resulting engagement that we are having with the community, supports our IVD product development efforts. Many of the sites that are in our funnel have expressed interest in collecting samples and potentially being a reproducibility site to support our ultimate submission to the FDA.

- We have found recent dialogue with the FDA to be constructive. We look forward to more interactions throughout the year in the formal Q-Sub process described above.

- Key members of our team have deep FDA regulated product experience.7

- We have deep technical and clinical expertise in transplant, with a greater-than-ten-year track record of developing innovative technology and publishing novel data. It’s a history that compares favorably to any other player in the transplant rejection diagnostics space.

- Examples include:

- Patents granted in both the US and EU support the technical innovation core to the IVD development process, protecting our market opportunity.

- MolDX8 cited our publications twice when it established the LCD (Local Coverage Determination) for Medicare and Medicaid reimbursement coverage for cell free DNA testing.

- In the New England Journal of Medicine publication referenced above, we are the first company to have published randomized interventional data showing the efficacy of a transplant rejection diagnostic test along with antibody mediated rejection (AMR) therapy.

- We are also the only company to have randomized interventional clinical trial data using dd-cfDNA to detect AMR in de novo DSA+ (donor-specific antibody positive) kidney patients, finding AMR 10 months sooner9 than other monitoring protocols.

- Examples include:

- Our manufacturing partner has significant experience in the production of regulated products for both US and global distribution, and the ability to scale to meet global demand.

New CFO Appointed

In preparation for the next several years of sustained, rapid growth, we welcomed Andrea James as Chief Financial Officer in June. She has a proven track record of guiding financial strategy through multiple phases of growth, raising and stewarding capital, and building relationships with high quality institutional investors.

Prior to joining Oncocyte, Andrea served as chief communications officer and head of investor relations at Axon Enterprise, Inc. (Nasdaq: AXON). She joined Axon’s finance team in 2017 to build the company’s investor relations function and played an integral role through the company’s growth from

Prior to Axon, Andrea worked in a strategic investor relations role for Tesla, Inc., in 2016 and 2017. From 2009 to 2016 she worked as a sell-side analyst for Dougherty & Company (now Colliers Securities), becoming a vice president and senior research analyst. At Dougherty, she researched emerging technologies on behalf of institutional investors. Previously, she was a reporter at publications including Bloomberg News and the Seattle Post-Intelligencer covering a range of business and financial beats. She holds a Bachelor of Science, summa cum laude, in Computer Information Systems from American University. She also holds a Master of Science in Journalism from Northwestern University, graduating with Kappa Tau Alpha honors. While at Dougherty, her Financial Industry Regulatory Authority (FINRA) licenses included the Series 7, 86, 87 and 63.

Q2 2024 Financial Overview

- Revenue of

$104,000 in the second quarter was derived from pharma services performed in Nashville. - A gross profit of

$50,000 reflected the relatively fixed costs of operating our Nashville CLIA laboratory. These costs include labor as well as infrastructure expenses such as the depreciation of laboratory equipment, allocated rent costs, leasehold improvements, and allocated information technology costs. - Operating expenses of

$4.7 million included$386,000 in non-cash stock-based compensation expenses,$326,000 in non-cash depreciation and amortization expenses and a$1.0 million non-cash benefit from the change in fair value of contingent consideration. Excluding these non-cash items in the current and prior periods, our Q2 operating expenses decreased approximately5% sequentially and decreased9% year over year. - Research and development expense of

$2.5 million increased approximately6% sequentially. - Sales and marketing expense of

$853,000 was flat sequentially, reflecting cost discipline even as we began to ramp the commercialization of our transplant tests. - General and administrative expense of

$2.4 million fell10% sequentially, reflecting cost discipline and reductions in facilities and personnel related costs. - Loss from continuing operations was

$4.5 million , or$0.36 per share. - Non-GAAP loss from operations was

$5.0 million and excludes certain non-cash items. Please refer to the table below, “Reconciliation of Non-GAAP Financial Measure,” for additional information. - Oncocyte’s cash, cash equivalents, and restricted cash balance at the end of the second quarter was approximately

$11.0 million , up$3.7 million sequentially. This balance includes proceeds from our capital raised in April as well as$1.7 million in restricted cash.- On April 11, 2024, we entered into a private placement securities purchase agreement with certain accredited investors. The resulting net proceeds were approximately

$9.9 million , after deducting offering expenses of$539,000 and deducting$5.4 million for the redemption of all remaining shares of our Series A Redeemable Convertible Preferred Stock. These proceeds include the investment from Bio-Rad. We are pleased to be entering a growth inflection point with a streamlined capital structure. - Cash flows from operations reflected

$1.4 million in bonus and retention payments made to employees in the second quarter, mostly as part of our annual compensation cycle.

- On April 11, 2024, we entered into a private placement securities purchase agreement with certain accredited investors. The resulting net proceeds were approximately

New investor deck published

To view our quarterly update in the context of our larger strategy, you may access a refreshed investor deck at investors.oncocyte.com or access it at: https://investors.oncocyte.com/~/media/Files/O/Oncocyte-IR/events-and-presentations/ocx-investor-deck-q2-2024.pdf.

In the deck, we outline our innovation flywheel and provide more details on our land and expand strategy, with key upcoming milestones and catalysts.

Conclusion

We are pleased to be delivering upon our commitments and are thrilled with our market momentum. After months of effort, we are seeding the market with our RUO product – which is the first step in our land and expand strategy. And we believe that we already have clear signs of remarkable product-market fit.

Our mission is to democratize access to novel molecular diagnostic testing to improve patient outcomes. We believe that combining innovative science with a simple and disruptive business model can create enormous societal and shareholder value.

We look forward to welcoming you on our growth journey and updating you on our continued progress throughout the year.

The Oncocyte Management Team

Webcast and Conference Call Information:

Conference Call and Webcast on Thursday, August 8, 2024, at 2:00 p.m. PT / 5:00 p.m. ET

You may access the live call via telephone by dialing toll-free 800-715-9871 for domestic callers. Once dialed in, ask to be joined to the Oncocyte Corporation call.

The live webcast of the call may be accessed by visiting the “Events & Presentations” section of the Company’s website at https://investors.oncocyte.com. A replay of the webcast will be available on the Company’s website.

CONFERENCE CALL DETAILS

Participant Toll-Free Dial-In Number: (800) 715-9871

Participant Toll Dial-In Number: +1 (646) 307-1963

Conference ID: 4153469

Webcast

https://events.q4inc.com/attendee/478523544

About Oncocyte

Oncocyte is a molecular diagnostics technology company. The Company’s tests are designed to help provide clarity and confidence to physicians and their patients. VitaGraft™ is a clinical blood-based solid organ transplantation monitoring test. GraftAssure™ is a research use only (RUO) blood-based solid organ transplantation monitoring test. DetermaIO™ is a gene expression test that assesses the tumor microenvironment to predict response to immunotherapies. DetermaCNI™ is a blood-based monitoring tool for monitoring therapeutic efficacy in cancer patients. For more information about Oncocyte, please visit https://oncocyte.com/. For more information about our products, please visit the following web pages:

VitaGraft Kidney™ - https://oncocyte.com/vitagraft-kidney/

VitaGraft Liver™ - https://oncocyte.com/vitagraft-liver/

GraftAssure™ - https://oncocyte.com/graftassure/

DetermaIO™ - https://oncocyte.com/determa-io/

DetermaCNI™ - https://oncocyte.com/determa-cni/

VitaGraft™, GraftAssure™, DetermaIO™, and DetermaCNI™ are trademarks of Oncocyte Corporation.

Forward-Looking Statements

Any statements that are not historical fact (including, but not limited to statements that contain words such as “will,” “believes,” “plans,” “anticipates,” “expects,” “estimates,” “may,” and similar expressions) are forward-looking statements. These statements include those pertaining to, among other things, future expansion and growth, the Company’s land-and-expand strategy to drive commercial adoption of its tests and capture market share, plans to have transplant centers running GraftAssure tests through the end of 2025, projected revenue path, IVD strategy, assumptions regarding regulatory approvals and clearances, timing and planned regulatory submissions, and other statements about the future expectations, beliefs, goals, plans, or prospects expressed by management. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization of diagnostic tests or products, uncertainty in the results of clinical trials or regulatory approvals, the capacity of Oncocyte’s third-party supplied blood sample analytic system to provide consistent and precise analytic results on a commercial scale, potential interruptions to supply chains, the need and ability to obtain future capital, maintenance of intellectual property rights in all applicable jurisdictions, obligations to third parties with respect to licensed or acquired technology and products, the need to obtain third party reimbursement for patients’ use of any diagnostic tests Oncocyte or its subsidiaries commercialize in applicable jurisdictions, and risks inherent in strategic transactions such as the potential failure to realize anticipated benefits, legal, regulatory or political changes in the applicable jurisdictions, accounting and quality controls, potential greater than estimated allocations of resources to develop and commercialize technologies, or potential failure to maintain any laboratory accreditation or certification. Actual results may differ materially from the results anticipated in these forward-looking statements and accordingly such statements should be evaluated together with the many uncertainties that affect the business of Oncocyte, particularly those mentioned in the “Risk Factors” and other cautionary statements found in Oncocyte’s Securities and Exchange Commission (SEC) filings, which are available from the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Oncocyte undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

CONTACT:

Jeff Ramson

PCG Advisory

(646) 863-6893

jramson@pcgadvisory.com

- Tables Follow -

| ONCOCYTE CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except per share data) | |||||||

| June 30, | December 31, | ||||||

| 2024 | 2023 | ||||||

| (Unaudited) | |||||||

| ASSETS | |||||||

| CURRENT ASSETS | |||||||

| Cash and cash equivalents | $ | 9,256 | $ | 9,432 | |||

| Accounts receivable, net of allowance for credit losses of | 85 | 484 | |||||

| Prepaid expenses and other current assets | 595 | 643 | |||||

| Assets held for sale | 32 | 139 | |||||

| Total current assets | 9,968 | 10,698 | |||||

| NONCURRENT ASSETS | |||||||

| Right-of-use and financing lease assets, net | 2,591 | 1,637 | |||||

| Machinery and equipment, net, and construction in progress | 3,347 | 3,799 | |||||

| Intangible assets, net | 56,551 | 56,595 | |||||

| Restricted cash | 1,700 | 1,700 | |||||

| Other noncurrent assets | 563 | 463 | |||||

| TOTAL ASSETS | $ | 74,720 | $ | 74,892 | |||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

| CURRENT LIABILITIES | |||||||

| Accounts payable | $ | 1,051 | $ | 953 | |||

| Accrued compensation | 1,309 | 1,649 | |||||

| Accrued royalties | 1,116 | 1,116 | |||||

| Accrued expenses and other current liabilities | 379 | 452 | |||||

| Accrued severance from acquisition | 2,314 | 2,314 | |||||

| Right-of-use and financing lease liabilities, current | 1,029 | 665 | |||||

| Current liabilities of discontinued operations | - | 45 | |||||

| Total current liabilities | 7,198 | 7,194 | |||||

| NONCURRENT LIABILITIES | |||||||

| Right-of-use and financing lease liabilities, noncurrent | 2,638 | 2,204 | |||||

| Contingent consideration liabilities | 42,181 | 39,900 | |||||

| TOTAL LIABILITIES | 52,017 | 49,298 | |||||

| Commitments and contingencies | |||||||

| Series A Redeemable Convertible Preferred Stock, no par value; stated value | - | 5,126 | |||||

| SHAREHOLDERS’ EQUITY | |||||||

| Preferred stock, no par value, 5,000 shares authorized; no shares issued and outstanding | - | - | |||||

| Common stock, no par value, 230,000 shares authorized; 13,368 and 8,261 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | 326,201 | 310,295 | |||||

| Accumulated other comprehensive income | 37 | 49 | |||||

| Accumulated deficit | (303,535 | ) | (289,876 | ) | |||

| Total shareholders’ equity | 22,703 | 20,468 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 74,720 | $ | 74,892 | |||

| ONCOCYTE CORPORATION UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) | |||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||

| June 30, | June 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net revenue | $ | 104 | $ | 463 | $ | 280 | $ | 760 | |||||||

| Cost of revenues | 32 | 169 | 141 | 434 | |||||||||||

| Cost of revenues – amortization of acquired intangibles | 22 | 22 | 44 | 44 | |||||||||||

| Gross profit | 50 | 272 | 95 | 282 | |||||||||||

| Operating expenses: | |||||||||||||||

| Research and development | 2,453 | 2,435 | 4,765 | 4,562 | |||||||||||

| Sales and marketing | 853 | 805 | 1,699 | 1,500 | |||||||||||

| General and administrative | 2,407 | 3,531 | 5,080 | 6,943 | |||||||||||

| Change in fair value of contingent consideration | (1,031 | ) | 1,795 | 2,281 | (16,512 | ) | |||||||||

| Impairment loss | - | - | - | 4,950 | |||||||||||

| Impairment loss on held for sale assets | - | - | 169 | 1,283 | |||||||||||

| Total operating expenses | 4,682 | 8,566 | 13,994 | 2,726 | |||||||||||

| Loss from operations | (4,632 | ) | (8,294 | ) | (13,899 | ) | (2,444 | ) | |||||||

| Other (expenses) income: | |||||||||||||||

| Interest expense | (8 | ) | (14 | ) | (23 | ) | (25 | ) | |||||||

| Unrealized (loss) gain on marketable equity securities | - | (24 | ) | - | 97 | ||||||||||

| Other income (expenses), net | 110 | (1 | ) | 263 | (2 | ) | |||||||||

| Total other income (expenses) | 102 | (39 | ) | 240 | 70 | ||||||||||

| Loss from continuing operations | (4,530 | ) | (8,333 | ) | (13,659 | ) | (2,374 | ) | |||||||

| Loss from discontinued operations | - | - | - | (2,926 | ) | ||||||||||

| Net loss | $ | (4,530 | ) | $ | (8,333 | ) | $ | (13,659 | ) | $ | (5,300 | ) | |||

| Net loss per share: | |||||||||||||||

| Net loss from continuing operations - basic and diluted | $ | (4,587 | ) | $ | (8,644 | ) | $ | (13,922 | ) | $ | (2,915 | ) | |||

| Net loss from discontinued operations - basic and diluted | $ | - | $ | - | $ | - | $ | (2,926 | ) | ||||||

| Net loss attributable to common stockholders - basic and diluted | $ | (4,587 | ) | $ | (8,644 | ) | $ | (13,922 | ) | $ | (5,841 | ) | |||

| Net loss from continuing operations per share - basic and diluted | $ | (0.36 | ) | $ | (1.07 | ) | $ | (1.32 | ) | $ | (0.41 | ) | |||

| Net loss from discontinued operations per share - basic and diluted | $ | - | $ | - | $ | - | $ | (0.42 | ) | ||||||

| Net loss attributable to common stockholders per share - basic and diluted | $ | (0.36 | ) | $ | (1.07 | ) | $ | (1.32 | ) | $ | (0.83 | ) | |||

| Weighted average shares outstanding - basic and diluted | 12,870 | 8,090 | 10,567 | 7,030 | |||||||||||

| ONCOCYTE CORPORATION UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) | |||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||

| June 30, | June 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||||||

| Net loss | $ | (4,530 | ) | $ | (8,333 | ) | $ | (13,659 | ) | $ | (5,300 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||||||

| Depreciation and amortization expense | 304 | 435 | 617 | 885 | |||||||||||

| Amortization of intangible assets | 22 | 22 | 44 | 44 | |||||||||||

| Stock-based compensation | 386 | 834 | 804 | 1,668 | |||||||||||

| Equity compensation for bonus awards and consulting services | 50 | - | 96 | - | |||||||||||

| Unrealized gain on marketable equity securities | - | 24 | - | (97 | ) | ||||||||||

| Change in fair value of contingent consideration | (1,031 | ) | 1,795 | 2,281 | (16,512 | ) | |||||||||

| Impairment loss | - | - | - | 4,950 | |||||||||||

| Loss on disposal of discontinued operations | - | - | - | 1,521 | |||||||||||

| Impairment loss on held for sale assets | - | - | 169 | 1,283 | |||||||||||

| Changes in operating assets and liabilities: | - | - | |||||||||||||

| Accounts receivable | 76 | 185 | 399 | 296 | |||||||||||

| Prepaid expenses and other assets | 12 | (52 | ) | (50 | ) | 567 | |||||||||

| Accounts payable and accrued liabilities | (1,240 | ) | (1,657 | ) | (386 | ) | (4,319 | ) | |||||||

| Lease assets and liabilities | (27 | ) | (85 | ) | (123 | ) | (118 | ) | |||||||

| Net cash used in operating activities | (5,978 | ) | (6,832 | ) | (9,808 | ) | (15,132 | ) | |||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||||||||||

| Proceeds from sale of equipment | - | 123 | - | 123 | |||||||||||

| Construction in progress and purchases of furniture and equipment | (191 | ) | - | (215 | ) | - | |||||||||

| Cash sold in discontinued operations | - | - | - | (1,372 | ) | ||||||||||

| Net cash used in investing activities | (191 | ) | 123 | (215 | ) | (1,249 | ) | ||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||||||

| Proceeds from sale of common shares | 15,807 | 13,848 | 15,807 | 13,848 | |||||||||||

| Financing costs to issue common shares | (538 | ) | (427 | ) | (538 | ) | (427 | ) | |||||||

| Redemption of redeemable convertible Series A preferred shares | (5,389 | ) | (1,118 | ) | (5,389 | ) | (1,118 | ) | |||||||

| Repayment of financing lease obligations | (33 | ) | (29 | ) | (33 | ) | (57 | ) | |||||||

| Net provided by financing activities | 9,847 | 12,274 | 9,847 | 12,246 | |||||||||||

| NET CHANGE IN CASH, CASH EQUIVALENTS (INCLUDES DISCONTINUED OPERATIONS) AND RESTRICTED CASH | 3,678 | 5,565 | (176 | ) | (4,135 | ) | |||||||||

| CASH, CASH EQUIVALENTS (INCLUDES DISCONTINUED OPERATIONS) AND RESTRICTED CASH, BEGINNING | 7,278 | 13,503 | 11,132 | 23,203 | |||||||||||

| CASH, CASH EQUIVALENTS (INCLUDES DISCONTINUED OPERATIONS) AND RESTRICTED CASH, ENDING | $ | 10,956 | $ | 19,068 | $ | 10,956 | $ | 19,068 | |||||||

| Oncocyte Corporation Reconciliation of Non-GAAP Financial Measure Consolidated Adjusted Loss from Operations | |||||||||||

| Note: In addition to financial results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), this press release also includes a non-GAAP financial measure (as defined under SEC Regulation G). We believe the adjusted amounts are more representative of our ongoing performance. The following is a reconciliation of the non-GAAP measure to the most directly comparable GAAP measure: | |||||||||||

| Three Months Ended | |||||||||||

| June 30, | March 31, | June 30, | |||||||||

| 2024 | 2024 | 2023 | |||||||||

| (unaudited) | (unaudited) | (unaudited) | |||||||||

| (In thousands) | |||||||||||

| Consolidated GAAP loss from operations | $ | (4,632 | ) | $ | (9,267 | ) | $ | (8,294 | ) | ||

| Stock-based compensation | 386 | 418 | 816 | ||||||||

| Depreciation and amortization expense | 326 | 335 | 457 | ||||||||

| Change in fair value of contingent consideration | (1,031 | ) | 3,312 | 1,795 | |||||||

| Impairment losses | - | - | - | ||||||||

| Impairment loss on held for sale assets | - | 169 | - | ||||||||

| Consolidated Non-GAAP loss from operations, as adjusted | $ | (4,951 | ) | $ | (5,033 | ) | $ | (5,226 | ) | ||

1 Oncocyte’s Drs. Ekke Schuetz and Julia Beck, inventors of the technology, are among the authors of the study. VitaGraft Kidney was used to monitor graft injury in a phase 2 double-blind, placebo-controlled study (NCT05021484) of the investigational drug felzartamab, a fully human CD38 monoclonal antibody, for antibody-mediated rejection (AMR), a leading cause of kidney allograft failure.

2 The centers in our U.S. funnel who have confirmed interest in GraftAssure represent more than 11,000 transplants per year, which is about

3 Bio-Rad’s QX600 Droplet Digital PCR (ddPCR) System – which is its new six color instrument – allows us to create a simple workflow for the lab technician, delivering a result in four to eight hours, compared with ≥30 hours for competitors that are using NGS technology. Further, testing a single sample is an affordable option, given that the batch size – in contrast to NGS – does not alter the price per result.

4 The revenue build is purposely limited in scope to the current clinical utility established for VitaGraft Kidney. Incremental revenue opportunities could come from additional claims, such as additional tissue types like heart and lung, anti-CD38 drug monitoring, and high-risk patient monitoring. Notably, our best-case FDA clearance timeline should not be confused with our best-case revenue opportunity.

5 MolDX is a program that identifies and establishes coverage and U.S. government reimbursement for molecular diagnostic tests.

6 An example of a Class I, or low risk, device, would be a bandage and an example of a Class III, or high risk, device would be an implantable device like a cardiac pacemaker.

7 As an example, our Chief Technology Officer, Johnson Chiang, has successfully led or participated in numerous IVD submissions to the US FDA and the EU under IVDD

8 Source: https://www.cms.gov/medicare-coverage-database/view/lcd.aspx?lcdId=38671&ver=4

9 For more information: https://investors.oncocyte.com/news-releases/2023/09-18-2023

Images accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3d35970e-bf96-46e3-8332-a3bb4be502da

https://www.globenewswire.com/NewsRoom/AttachmentNg/d81dce54-0028-4dc0-892c-36bf67648d0d