OriginClear Sets Aside First $1 Million for Water Capital Programs

Water Like An Oil Well™ can generate long-term royalties from private water treatment

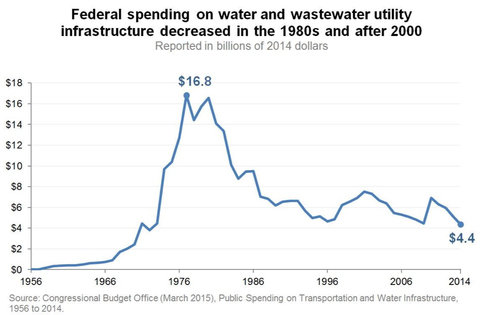

In recent years, the Federal government has contributed progressively less money (see graph) to municipalities, leading to underfunded infrastructure and the need for industry and agriculture to do more water treatment on their own. (Source: Federal Budget Office)

This milestone is the first capital set aside from a private placement of up to

“For decades, everyday investors have earned generational royalties from oil and gas partnerships,” said

“Delivering water systems as a managed service is not new,” continued Eckelberry. “What’s new is the idea of enabling accredited investors to directly invest in clean water.”

To expand rapidly,

The Company is currently evaluating opportunities to fund private water treatment sites using Water On Demand capital. One potential client has a 50,000 gallon per day waste water treatment requirement. While no project is guaranteed, it represents an ideal pilot opportunity.

“Due to the growing ability to work remotely, families are moving from cities to rural and semi-rural locations,” said

“There are many cases where onsite water treatment is preferable, and capital is lacking,” continued Marchesello. “We see an investing opportunity that over time, could become a principal way for businesses to deal with water treatment problems that are just not their core business.”

In recent years, the Federal government has contributed progressively less money (see graph) to municipalities, leading to underfunded infrastructure and the need for industry and agriculture to do more water treatment on their own.

In

About

For more information, visit the company’s website: www.OriginClear.com

Follow us on Twitter

Follow us on LinkedIn

Like us on Facebook

Subscribe to us on YouTube

Sign up for our Newsletter

OriginClear Safe Harbor Statement:

Matters discussed in this release contain forward-looking statements. When used in this release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein.

These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with our history of losses and our need to raise additional financing, the acceptance of our products and technology in the marketplace, our ability to demonstrate the commercial viability of our products and technology and our need to increase the size of our organization, and if or when the Company will receive and/or fulfill its obligations under any purchaser orders. Further information on the Company's risk factors is contained in the Company's quarterly and annual reports as filed with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20220323005364/en/

Media Contact:

lais@thepontesgroup.com

www.thepontesgroup.com

Investor Relations and Press Contact:

Toll-free: 877-999-OOIL (6645), Ext. 3

International: +1-323-939-6645, Ext. 3

Fax: 323-315-2301

ir@OriginClear.com

www.OriginClear.com

Source: