117th Common Stock Monthly Dividend Increase Declared by Realty Income

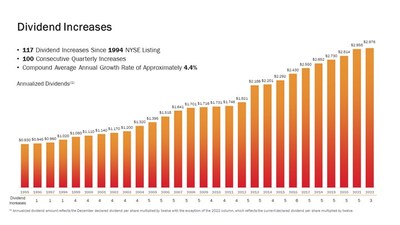

Realty Income Corporation (NYSE: O) declared a monthly cash dividend increase to $0.248 per share from $0.2475, effective October 14, 2022. This marks the 117th increase since its NYSE listing in 1994. Shareholders on record as of October 3, 2022 will receive the new dividend, with an ex-dividend date of September 30, 2022. The annualized dividend now stands at $2.976 per share compared to the previous $2.97.

- Increased monthly dividend to $0.248 signifies growth in shareholder value.

- 117 consecutive dividend increases highlight strong financial management.

- None.

SAN DIEGO, Sept. 13, 2022 /PRNewswire/ -- Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced its Board of Directors has declared an increase in the company's common stock monthly cash dividend to

"I'm pleased that Realty Income can once again increase the amount of the monthly dividend," said Sumit Roy, President and Chief Executive Officer of Realty Income. "Today's dividend declaration represents the 100th consecutive quarterly dividend increase and the 627th consecutive monthly dividend throughout our 53-year operating history."

About Realty Income

Realty Income, The Monthly Dividend Company®, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats® index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 11,400 real estate properties owned under long-term net lease agreements with commercial clients. To date, the company has declared 627 consecutive common stock monthly dividends throughout its 53-year operating history and increased the dividend 117 times since Realty Income's public listing in 1994 (NYSE: O). Additional information about the company can be obtained from the corporate website at www.realtyincome.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the words "estimated," "anticipated," "expect," "believe," "intend," and similar expressions are intended to identify forward-looking statements. Forward-looking statements also include discussions of our business and portfolio including future operations and results, strategy, plans, intentions of management including the timing and payment of dividends. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment trust; general domestic and foreign business and economic conditions; competition; fluctuating interest and currency rates; access to debt and equity capital markets; continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients' defaults under leases, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in income tax laws and rates; the continued evolution of the COVID-19 pandemic and the measures taken to limit its spread, and its impacts on us, our business, our clients, or the economy generally; the timing and pace of reopening efforts at the local, state and national level in response to the COVID-19 pandemic and developments, such as the unexpected surges in COVID-19 cases, that cause a delay in or postponement of reopenings; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; any effects of uncertainties regarding whether the anticipated benefits or results of our merger with VEREIT, Inc. will be achieved; and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements. Those forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this press release. Actual plans and operating results may differ materially from what is expressed or forecasted in this press release. We do not undertake any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/117th-common-stock-monthly-dividend-increase-declared-by-realty-income-301623616.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/117th-common-stock-monthly-dividend-increase-declared-by-realty-income-301623616.html

SOURCE Realty Income Corporation

FAQ

What is the new dividend amount for Realty Income (O)?

When will Realty Income's dividend be paid?

What is the ex-dividend date for Realty Income's October dividend?