NexGen Announces Elite Environmental and Economic Results from the Rook I Feasibility Study

NexGen Energy Ltd. announced positive results from an independent Feasibility Study on its Arrow Deposit in the Athabasca Basin, Saskatchewan. The study reveals an after-tax NPV of $3.47 billion, an after-tax IRR of 52.4%, and a rapid payback period of 0.9 years. The average annual production is forecasted at 28.8 million lbs of U3O8 in the first five years. The total pre-production capital cost is estimated at $1.3 billion CAD. The Feasibility Study reflects NexGen's commitment to environmental standards and positions the company as a leader in clean energy production.

- After-tax NPV of $3.47 billion at 8%.

- After-tax IRR of 52.4%.

- Rapid payback period of 0.9 years.

- Average annual production of 28.8 million lbs U3O8 in the first five years.

- Total pre-production capital cost estimated at $1.3 billion CAD.

- None.

VANCOUVER, BC, Feb. 22, 2021 /PRNewswire/ - NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE: NXE) is pleased to announce the positive results of an independent Feasibility Study ("FS" or the "Study"), Mineral Reserve and Mineral Resource update of the basement-hosted Arrow Deposit, located on the Company's

Leigh Curyer, Chief Executive Officer, commented:

"The environmental and economic results from the Rook I Feasibility Study place the Project as one of the leading global resource projects with an elite ESG profile. Today's delivery of the Feasibility Study is a significant milestone which transitions NexGen into the next key stage of advancement. The results will be included in the Environmental Assessment and Licensing processes which incorporates engagement, consultation, monitoring and data collection since 2013.

The NexGen team's commitment to elite standards is evident throughout all aspects of the feasibility study, and the organization as a whole. With a minimal physical and carbon footprint, NexGen is uniquely positioned to become a world leader in the production of clean energy fuel.

The global energy matrix is undertaking an enormous shift that will rely heavily on nuclear energy to deliver the decarbonization commitment for today's and future generations. It is proven to be a safe, clean and most reliably efficient form of power generation known to humankind. With all major countries signalling significant infrastructure spending, and re-prioritizing green energy policy as their major focus over this coming decade and beyond, Rook I will be a material component in the delivery of those global objectives.

I would like to take the opportunity to congratulate the entire NexGen team, and thank the local communities where we operate, as well as the Government of Saskatchewan and the Federal Government Canada for their outstanding commitment and support for execution of the Rook I Project's development to date."

Highlights

Table 1 – Summary of Arrow Deposit Feasibility Study (based on US

FS ($ CAD) | |

After-Tax NPV @ | |

After-Tax Internal Rate of Return (IRR) | |

After-Tax Payback | 0.9 Year |

Pre-Commitment Early Works Capital | |

Project Execution Capital | |

Total Pre-Production Capital Costs | |

Average Annual Production (Years 1-5) | 28.8 M lbs U3O8 |

Average Annual After - Tax Net Cash Flow | |

Average Annual Production (Life of Mine) | 21.7 M lbs U3O8 |

Average Annual After - Tax Net Cash Flow | |

Nominal Mill Capacity | 1,300 tonnes per day |

Average Annual Mill Feed Grade | |

Mine Life | 10.7 Years |

Average Annual Operating Cost ("OPEX", | (US |

1) | The economic analysis was based on the timing of a final investment decision ("FID") and does not include the Pre-Commitment Early Works Capital, which are costs NexGen intends on expending prior to the FID. Pre-Commitment Early Works scope includes site preparation and the supporting infrastructure (concrete batch plant, Phase I camp accommodations and bulk fuel storage) required to support full Project Execution Capital. |

2) | FS based on CAD |

Webcast and Conference Call

NexGen will host a webcast and conference call today, February 22, 2021 at 8:30AM Eastern Standard Time.

To join the call please dial (+1) 416 764 8659 (local/international) or (+1) 888 664 6392 (North America toll free) with passcode 89503308 and an operator will assist.

To join the webcast, please copy the following link to your browser: https://produceredition.webcasts.com/starthere.jsp?ei=1435461&tp_key=3a0aec72f1 where you will be directed to join the webcast.

Top 5 Feasibility Study Outcomes

- Enhanced Environmental Performance – Optimized facilities layout reducing the project footprint by approximately

20% and lowering on-site personnel transportation and ore haulage. Optimized shaft sizing, water useage through advanced water recycling and plant engineering, all reflecting elite environmental standards. With respect to the proposed shaft, mine workings and Underground Tailings Management Facility ("UGTMF") locations, geotechnical and hydrogeological testing validated highly competent rock with no significant alteration, no major structures, and low hydraulic conductivity. - High Return on Capital with 0.9 Year Payback Period and Life-of-Mine Production Flexibility – Incorporating a consensus US

$50 per lb uranium price over the life of the mine, provides high economic returns. A function of the Arrow Deposit geometry combined with the competent ground conditions enables decoupled production areas in both the A2 and A3 zones, allowing strategic flexibility of mine sequencing and production. - CAPEX Accuracy – Nominal

4% increase over the Pre-Feasibility Study ("PFS") or1.6% - (incorporating inflation rates of 2019:1.95% and 2020:0.62% ) increase in CAPEX from the PFS due to the following key areas: enhanced environmental performance, refined mine design, change in shaft diameter, shaft collar and freeze depths, optimized size of the power plant, paste fill plant, requirement for an additional waste rock storage area, and first principle calculations for indirect costs. The production shaft was increased to 8.0 m in diameter (from 6.5 m in diameter in PFS) to provide increased production flexibility, optimization of the radiation and ventilation management, ensuring the mine is elite from a safety perspective. - OPEX Accuracy – Average OPEX reduced by

1% per tonne. Reduction in mining, processing and G&A costs per tonne, with an increase in paste fill cost per tonne based on paste fill binder requirements. Cost per pound will be among the lowest in the sector at US$5.69 per lb. - Highest Level of Mineral Resource Confidence – First time declaration of Measured Mineral Resources of 2,183 kt grading

4.35% U3O8, containing 209.6 M lbs U3O8. Measured and Indicated Mineral Resources total 3,754 kt grading3.10% U3O8, containing 256.7 M lbs U3O8 supporting initial 10.7 year mine life (11% increase).

Mineral Resources

The updated Mineral Resource Estimate has an effective date of June 19, 2019 and builds upon the Mineral Resource Estimate used in the PFS by incorporating holes drilled in 2018 and 2019. The updated Mineral Resource Estimate is principally comprised of Measured Mineral Resources – the highest level of confidence determination within Mineral Resources – with Measured Mineral Resources of 209.6 M lbs of U3O8 contained in 2,183 kt grading

Table 2 – Arrow Mineral Resource Estimate

FS Mineral Resource | |||

Structure | Tonnage | Grade | Contained Metal |

Measured | |||

A2 LG | 920 | 0.79 | 16.0 |

A2 HG | 441 | 16.65 | 161.9 |

A3 LG | 821 | 1.75 | 31.7 |

Total: | 2,183 | 4.35 | 209.6 |

Indicated | |||

A2 LG | 700 | 0.79 | 12.2 |

A2 HG | 56 | 9.92 | 12.3 |

A3 LG | 815 | 1.26 | 22.7 |

Total: | 1,572 | 1.36 | 47.1 |

Measured and Indicated | |||

A2 LG | 1,620 | 0.79 | 28.1 |

A2 HG | 497 | 15.9 | 174.2 |

A3 LG | 1,637 | 1.51 | 54.4 |

Total: | 3,754 | 3.1 | 256.7 |

Inferred | |||

A1 LG | 1,557 | 0.69 | 23.7 |

A2 LG | 863 | 0.61 | 11.5 |

A2 HG | 3 | 10.95 | 0.6 |

A3 LG | 1,207 | 1.12 | 29.8 |

A4 LG | 769 | 0.89 | 15.0 |

Total: | 4,399 | 0.83 | 80.7 |

Notes:

1. | CIM Definition Standards were followed for Mineral Resources, Mineral Resources are reported inclusive of Mineral Reserves. |

2. | Mineral Resources are reported at a cut-off grade of |

3. | A minimum mining width of 1.0 m was used |

4. | The effective date of Mineral Resources is June 19th, 2019 |

5. | Numbers may not add due to rounding. |

6. | Mineral Resources that are not Mineral Reserves do not have demonstrated economics. |

RPA is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource Estimate.

Mineral Reserves

The FS defines Probable Mineral Reserves of 239.6 M lbs of U3O8 contained in 4,575 kt grading

Table 3 - Arrow Probable Mineral Reserves

Probable Mineral Reserves | |||

Structure | Tonnage (k tonnes) | Grade (U3O8%) | Contained Metal (U3O8 M lb) |

A2 | 2,594 | 190.0 | |

A3 | 1,982 | 49.5 | |

Total | 4,575 | 239.6 | |

Notes:

1. | CIM definitions were followed for Mineral Reserves. |

2. | Mineral Reserves are reported with an effective date of January 21, 2021. |

3. | Mineral Reserves include transverse and longitudinal stopes, ore development, marginal ore, special waste and a nominal amount of waste required for mill ramp-up and grade control. |

4. | Stopes were estimated at a cut-off grade of |

5. | Marginal ore is material between |

6. | Special waste in material between |

7. | Mineral Reserves are estimated using a long-term metal price of US |

8. | A minimum mining width of 3.0 m was applied for all long hole stopes. |

9. | Mineral Reserves are estimated using a combined underground mining recovery of |

10. | The density varies according to the U3O8 grade in the block model. Waste density is 2.464 t/m3. |

11. | Numbers may not add due to rounding. |

Stantec is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Reserve Estimate.

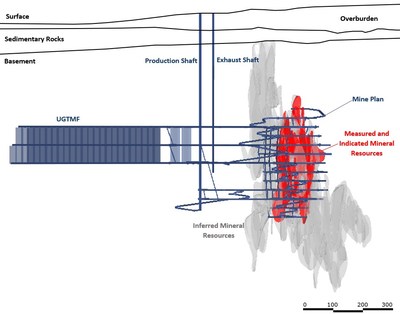

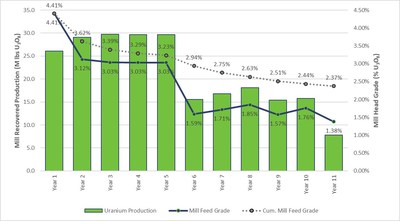

Mine Plan and Production Profile

A detailed mine plan based on conventional long-hole stope mining was engineered using Mineral Reserves only. Geotechnical studies during the FS re-emphasized the conventional long-hole stoping mining method, including the use of longitudinal and transverse stopes, 30 m level spacing, and the nominal stope strike length of 12 metres to 24 metres. This represents an excellent stope stability range for underground mining in the highly competent conditions. The FS production profile is underpinned by long-hole stopes in the transverse orientation through A2 High Grade mineralization. The ability to mine transverse long-hole stopes through the A2 High Grade will support significant scheduling flexibility, enabling NexGen to uniquely correlate supply quickly and inexpensively to market conditions.

Furthermore, given the competency and conditions of the underground environment, all waste streams from the process plant are planned to be stored underground in the Underground Tailings Management Facility ("UGTMF") while process water streams will be treated on surface in the optimized effluent treatment plant.

The FS mine plan, using a

The underground workings will be accessed by two (2) shafts, with the production shaft supporting personnel movements, materials, ore, waste and fresh air. The production shaft was increased to 8.0 m in diameter (from 6.5 m in diameter in PFS) to optimize radiation and ventilation management, ensuring the mine is elite from a safety perspective. Additionally, the production shaft will have divided compartments, ensuring that fresh air and personnel entering the mine, remain isolated from ore being skipped to surface. The exhaust shaft was optimized and ultimately decreased to 5.5 m in diameter (from 6.5 m in diameter in the PFS) and will be used for exhaust air and emergency secondary egress. Mining extraction has been optimized and estimated to be

Shaft pilot holes (GAR-18-013, and GAR-18-015) were drilled vertically within the diameter of the respective planned shafts to assess the geotechnical and hydrogeological characteristics for prospective exhaust and production shaft locations. Supported by the information from GAR-18-015 the location was selected for the production shaft and likewise for GAR-18-013 for the exhaust shaft. Both holes proved to be favourable for all aspects of shaft development. Below the planned temporary freeze depth the shaft holes intersected competent rock with no uranium mineralization, no significant alteration, no major structures, and low hydraulic conductivity. These components validate the competent ground conditions of the proposed shaft locations. Figures 3 and 4 below are core photos from the production and exhaust shaft pilot holes.

Processing and Underground Tailings Management Facility

Extensive testwork and engineering has determined that proven technology in a conventional uranium processing flowsheet is most effective for the production of U3O8 from the Arrow Deposit. A key environmental differentiator for the Project regarding processing is the environmental standard of the disposal of all tailings in a purpose-built Underground Tailings Management facility ("UGTMF").

The main components of the processing plant are:

- Ore Sorting

- Grinding

- Leaching

- Liquid-Solid Separation via Counter Current Decantation and Clarification

- Solvent Extraction

- Gypsum Precipitation and Washing

- Yellowcake Precipitation and Washing

- Yellowcake Drying, Calcining and Packaging

- Tailings Preparation and Paste Tailings Plant

Metallurgical testing resulted in supporting and refining process design parameters. The FS process recovery of

The FS also confirmed that all processed waste streams can be stored in the UGTMF and no surface tailings facility is required. The UGTMF is a reflection of NexGen's industry-leading environmental design approach, contributing to the significant reduction of the Project's surface footprint, and representing an opportunity to implement best practice of progressive closure of tailings facilities during the operational phase of the mine. The FS drill program validated the geotechnical conditions and favourable conditions for the UGTMF. The Study also optimized the geotechnical design, size and sequencing of the UGTMF included in the FS mine plan. The UGTMF is an example of NexGen's commitment to advancing the Project with innovative approaches to deliver optimal environmental, social and economic performance.

FS testwork demonstrated paste fill strength meets or exceeds all requirements set in the FS design for a potential Paste-Backfill to be used for underground stope stability. The testing refined the design parameters for the Paste Tailings Plant. The Paste-Backfill testing was done at the Saskatchewan Research Council's Saskatoon facilities in 2019.

Capital Costs

A capital cost estimate (Class 3 - AACE International classification guidelines) was produced for the FS. The total pre-production CAPEX for the contemplated underground mine, process plant and supporting infrastructure at Arrow are estimated at CAD

Total Pre-production construction is envisioned to occur in two stages, i) Pre-Commitment Early Works, and ii) Project Execution.

The Pre-Commitment Early Works stage is scheduled to be completed in six (6) months with the objective of de-risking early earthworks, drilling the temporary freeze holes for shaft sinking and establishing supporting infrastructure required to maximize efficiencies for the Project Execution stage. Supporting infrastructure includes the construction of a concrete batch plant, Phase I camp accommodations and bulk fuel storage. The Project Execution stage is scheduled to be completed in three and a half (3.5) years and will include the balance of the Project scope incorporating ramp-up and commissioning.

The construction phases will be supported by a labour force consisting of skilled labour, trades people, professionals and administration. The Study determined the total personnel hours required for pre-production construction is 3,824,000 hours. The CAPEX is summarized below in Table 4.

Table 4 – Summary of Capital Cost Estimates

Capital Cost Description | Capital Cost ($ CAD |

Pre-Commitment Early Works | 158 |

Project Execution Capital | |

UG Mining | 240 |

Processing | 216 |

Site Development | 28 |

On-Site / Off-Site Infrastructure | 119 |

Indirect Costs | 327 |

Owners Costs | 98 |

Contingency – Project Execution | 115 |

Total Project Execution Capital | 1,142 |

Total Pre-Production Capital | 1,300 |

Notes:

1. | Numbers may not add due to rounding. |

2. | Pre-Commitment Early Works capital includes contingency. |

Sustaining Capital and Decommissioning Costs

The Sustaining Capital through the life-of-mine, including Decommissioning Costs, is estimated to be

Table 5 – Summary of Sustaining Capital and Decommissioning Cost Estimates

Sustaining Cost Description | Sustaining |

UG Mining Equipment | 62 |

UG Mine Development | 108 |

UG Infrastructure | 78 |

UGTMF | 40 |

Surface Infrastructure | 28 |

Process Plant | 15 |

Indirect Costs | 32 |

Total Sustaining Capital Costs | 362 |

Decommissioning Costs | 70 |

Total Capital Costs | 432 |

Notes:

3. | Numbers may not add due to rounding. |

4. | Decommissioning costs are net of salvage values. |

Operating Costs

The OPEX estimate is based on a shaft-accessed underground mine with a conventional longitudinal and transverse long-hole stope mining method, a conventional processing facility, and a UGTMF. While in operation the FS defines a peak required workforce of approximately 470 persons – 290 would be on-site at any one time; the expertise required ranges from skilled labour, equipment operators, mining professionals, technical professional, management and administrative. NexGen's community-first approach ensures all opportunities are prioritized within the local region. The OPEX is summarized below in Tables 6.

Table 6 – Unit Operating Cost Estimates

OPEX | $ CAD/t Milled | $ CAD/lb U3O8 |

Mining | 151.09 | 2.96 |

Mineral Processing | 141.41 | 2.77 |

Tailings and Paste | 31.46 | 0.62 |

General and Administration | 62.84 | 1.23 |

Total Operating Costs | 386.80 | 7.58 |

Note: | Numbers may not add due to rounding. |

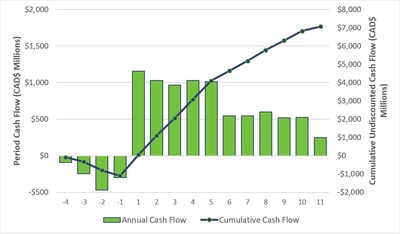

Economic Results

The Study was based on a uranium price estimate of US

The economic analysis was based on the timing of a final investment decision ("FID") and does not include the Pre-Commitment Early Works Capital, which are costs NexGen intends on expending prior to the FID. The economic analysis is based on a Project Execution Capital Cost estimate of

The Feasibility Study returned an after-tax NPV8% of

Table 7 – NPV and IRR Sensitivity to Uranium Price

Uranium Price ($ USD/lb U3O8) | After-Tax NPV8 | After-Tax IRR |

CAD | ||

CAD | ||

CAD | ||

CAD | ||

CAD | ||

CAD |

About NexGen

NexGen is a British Columbia corporation with a focus on developing the Rook I Project located in the south western Athabasca Basin, Saskatchewan, Canada into production. NexGen has a highly experienced team of uranium industry professionals with a successful track record in the discovery of uranium deposits and in developing projects through discovery to production. NexGen also owns a portfolio of highly prospective uranium properties in the south western Athabasca Basin, Saskatchewan, Canada.

Technical Disclosure

The technical information in this news release with respect to the FS has been reviewed and approved by Mark Hatton, P.Eng. of Stantec, Paul O'Hara, P.Eng. of Wood, and Mark B. Mathisen, C.P.G. of RPA, each of whom is an independent "qualified person" under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI-43-101").

All technical information in this news release has been reviewed and approved by Anthony (Tony) George, P.Eng, NexGen's Chief Project Officer, who is a qualified person under National Instrument 43-101.

A technical report in respect of the FS will be filed on SEDAR (www.sedar.com) and EDGAR (www.sec.gov/edgar.shtml) shortly.

Cautionary Note to U.S. Investors

This news release includes Mineral Reserves and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and the Mineral Resources estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the Securities and Exchange Commission ("SEC") set the SEC's rules that are applicable to domestic United States reporting companies. Consequently, Mineral Reserves and Mineral Resources information included in this news release is not comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

Forward-Looking Information

The information contained herein contains "forward-looking statements" within the meaning of applicable United States securities laws and regulations and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to mineral reserve and mineral resource estimates, the 2021 Arrow Deposit, Rook I Project and estimates of uranium production, grade and long-term average uranium prices, anticipated effects of completed drill results on the Rook I Project, planned work programs, completion of further site investigations and engineering work to support basic engineering of the project and expected outcomes. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Statements relating to "mineral resources" are deemed to be forward-looking information, as they involve the implied assessment that, based on certain estimates and assumptions, the mineral resources described can be profitably produced in the future.

Forward-looking information and statements are based on the then current expectations, beliefs, assumptions, estimates and forecasts about NexGen's business and the industry and markets in which it operates. Forward-looking information and statements are made based upon numerous assumptions, including among others, that the mineral reserve and resources estimates and the key assumptions and parameters on which such estimates are based are as set out in this news release and the technical report for the property , the results of planned exploration activities are as anticipated, the price and market supply of uranium, the cost of planned exploration activities, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment, supplies and governmental and other approvals required to conduct NexGen's planned exploration activities will be available on reasonable terms and in a timely manner and that general business and economic conditions will not change in a material adverse manner. Although the assumptions made by the Company in providing forward looking information or making forward looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate in the future.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements of NexGen to differ materially from any projections of results, performances and achievements of NexGen expressed or implied by such forward-looking information or statements, including, among others, the existence of negative operating cash flow and dependence on third party financing, uncertainty of the availability of additional financing, the risk that pending assay results will not confirm previously announced preliminary results, conclusions of economic valuations, the risk that actual results of exploration activities will be different than anticipated, the cost of labour, equipment or materials will increase more than expected, that the future price of uranium will decline or otherwise not rise to an economic level, the appeal of alternate sources of energy to uranium-produced energy, that the Canadian dollar will strengthen against the U.S. dollar, that mineral resources and reserves are not as estimated, that actual costs or actual results of reclamation activities are greater than expected, that changes in project parameters and plans continue to be refined and may result in increased costs, of unexpected variations in mineral resources and reserves, grade or recovery rates or other risks generally associated with mining, unanticipated delays in obtaining governmental, regulatory or First Nations approvals, risks related to First Nations title and consultation, reliance upon key management and other personnel, deficiencies in the Company's title to its properties, uninsurable risks, failure to manage conflicts of interest, failure to obtain or maintain required permits and licences, risks related to changes in laws, regulations, policy and public perception, as well as those factors or other risks as more fully described in NexGen's Annual Information Form dated March 11, 2020 filed with the securities commissions of all of the provinces of Canada except Quebec and in NexGen's 40-F filed with the United States Securities and Exchange Commission, which are available on SEDAR at www.sedar.com and Edgar at www.sec.gov.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or statements or implied by forward-looking information or statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned not to place undue reliance on forward-looking information or statements due to the inherent uncertainty thereof.

There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/nexgen-announces-elite-environmental-and-economic-results-from-the-rook-i-feasibility-study-301232246.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/nexgen-announces-elite-environmental-and-economic-results-from-the-rook-i-feasibility-study-301232246.html

SOURCE NexGen Energy Ltd.

FAQ

What are the results of the Feasibility Study for NXE's Arrow Deposit?

What is the estimated payback period for the Arrow Deposit project by NXE?

What is the average annual production forecast for NXE's Arrow Deposit?

What is the total capital cost for NXE's Arrow Deposit project?