Back From the Brink: Home Buyers Retreat from Record-High Down Payments, According to Realtor.com®

Rhea-AI Summary

Realtor.com's bi-annual down payment report reveals that home buyers are retreating from record-high down payments. In Q3 2024, nationwide down payments reached an average of 14.5% and a median amount of $30,300, down from Q2 2024's historical peak of 14.9% and $32,700. This decline is attributed to easing mortgage rates and improved affordability conditions.

Key findings include:

- Down payments remain historically high, more than double the pre-pandemic median

- Northeast states saw climbing down payments, with Maine and Rhode Island increasing the most

- Down payments shrank annually in half of the U.S. states

- Florida experienced a 24% year-over-year drop in down payments

- The District of Columbia saw the largest absolute decline, with down payments dropping over $17,000 year-over-year

Experts suggest that easing demand and increasing inventory gave buyers more flexibility, leading to slightly lower down payments. However, it's too early to determine if this is the beginning of a lasting downward trend.

Positive

- None.

Negative

- None.

News Market Reaction

On the day this news was published, NWSA declined 0.84%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Down payments reached an average of

"The annual decline in down payments is the result of less buyer competition in the third quarter. Easing demand and increasing inventory gave buyers more flexibility last quarter, which led to slightly lower down payments," said Hannah Jones, senior economic research analyst, Realtor.com®. "The recent drop in mortgage rates could pave the way for more competition in the coming months, especially if rates fall further, but we haven't yet seen that reflected in home sales or down payment trends."

Primary Residence | Avg Down Payment as % of Purchase Price | Med. Down Payment ($ amt) | ||||||

2021 Q3 | 2022 Q3 | 2023 Q3 | 2024 Q3 | 2021 Q3 | 2022 Q3 | 2023 Q3 | 2024 Q3 | |

12.5 % | 13.8 % | 14.7 % | 14.5 % | |||||

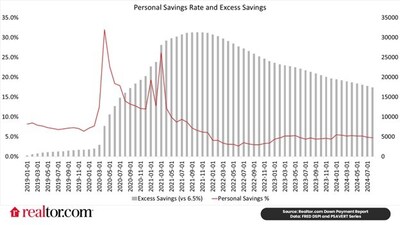

Homebuyers Continue to Utilize Pandemic-Era Savings

Large accumulations of pandemic savings are likely still helping some home buyers put down a large down payment, especially buyers who also have the benefit of record high existing home equity that can boost a down payment. The typical down payment dollar amount is more than double the pre-pandemic median and the typical down payment as a share of purchase price was more than 3 percentage points higher.

Looking Forward

Down payments fell as both a share of purchase price and as a dollar amount in 2024 Q3 relative to one year prior and to the 2024 Q2 peak.

"It is too early to tell if this is the beginning of a lasting downward trend in down payments. While down payments have started to trend lower with lower demand, they remain historically high," said Jones. "Easing mortgage rates may bring more buyers back into the market, potentially increasing competition – and down payments – once again if for-sale inventory fails to keep pace with demand."

As long as housing market competition continues, down payments are likely to remain elevated nationally, but distinct trends may emerge in different markets as local competitiveness varies. Shoppers looking to navigate these trends may find that relatively affordable markets offer the opportunity to achieve homeownership and limit interest payments by using their existing savings to put a larger amount down as a down payment on a home.

Key Regional Data

Northeast States See Climbing Down Payments

At the state-level, the increase in down payment as a percent of price increased the most (1.8 percentage points) in

States with Largest Down Payment Growth in 2024 (%)

State | 2023 Q3 | 2024 Q3 | 2024 Change |

16.0 % | 17.8 % | 1.8 pp | |

16.6 % | 18.4 % | 1.8 pp | |

16.6 % | 17.8 % | 1.2 pp | |

17.5 % | 18.6 % | 1.1 pp | |

18.1 % | 19.1 % | 1.0 pp |

In terms of down dollar payment amount,

States with Largest Down Payment Dollar Growth Q3 2023-2024

State | 2023 Q3 Avg Down Payment % | 2024 Q3 Avg Down Payment % | YY (percentage pts) | 2023 Q3 Median Down Payment $ | 2024 Q3 Median Down Payment $ | YY | $ YY |

16.6 % | 18.4 % | 1.80 % | 33.3 % | ||||

17.0 % | 17.6 % | 0.60 % | 32.8 % | ||||

15.0 % | 15.9 % | 0.90 % | 25.2 % | ||||

15.0 % | 15.1 % | 0.10 % | 22.8 % | ||||

12.3 % | 12.8 % | 0.50 % | 22.8 % |

Down payments shrank annually in half of the states in the

In Q3 2024, down payments as a share of purchase price fell in 24 states, and down payment dollar amounts fell in 21 states. The lists of places with the largest decline in the percentage down and dollars down has significant overlap. Pandemic-era hotspots like

States with Biggest Down Payment Declines (%)

State | % Down 2024 Q3 | YY (percentage pts) |

17.10 % | -3.80 % | |

14.20 % | -1.70 % | |

19.10 % | -1.10 % | |

11.10 % | -1.10 % | |

19.90 % | -1.10 % | |

15.80 % | -1.00 % | |

14.50 % | -0.90 % | |

11.30 % | -0.90 % | |

19.20 % | -0.80 % | |

12.00 % | -0.70 % |

States with Biggest Down Payment Declines ($)

State | % Down 2024 Q3 | YY | $ YY |

-24.0 % | - | ||

-23.2 % | - | ||

-22.3 % | - | ||

-17.7 % | - | ||

-16.4 % | - | ||

-16.0 % | - | ||

-15.5 % | - | ||

-14.1 % | - | ||

-13.2 % | - | ||

-12.9 % | - |

To learn more, read the full report here.

Methodology:

Down payment trends analyzed at the national-, state- and top 150-metro level through Q3 2024 using Optimal Blue data. Down payment as a share of sale price is calculated as an average across the data. Down payment as a dollar amount is calculated by taking the median across the data. All comparisons are between the first quarter of the current and previous years unless otherwise stated. International viewership data is from Realtor.com Cross-Market Demand data.

About Realtor.com®

Realtor.com® is an open real estate marketplace built for everyone. Realtor.com® pioneered the world of digital real estate more than 25 years ago. Today, through its website and mobile apps, Realtor.com® is a trusted guide for consumers, empowering more people to find their way home by breaking down barriers, helping them make the right connections, and creating confidence through expert insights and guidance. For professionals, Realtor.com® is a trusted partner for business growth, offering consumer connections and branding solutions that help them succeed in today's on-demand world. Realtor.com® is operated by News Corp [Nasdaq: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. For more information, visit Realtor.com®.

Media Contact: Mallory Micetich, press@realtor.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/back-from-the-brink-home-buyers-retreat-from-record-high-down-payments-according-to-realtorcom-302282231.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/back-from-the-brink-home-buyers-retreat-from-record-high-down-payments-according-to-realtorcom-302282231.html

SOURCE Realtor.com