Quarterly Activities and Cashflow Report – 30 June 2024

Rhea-AI Summary

Nova Minerals (Nasdaq: NVA, ASX: NVA) has completed its US NASDAQ listing and is advancing Pre-Feasibility Study (PFS) level studies for its Estelle Gold Project in Alaska. Key highlights include:

1. Ramped up metallurgical test work with METS Engineering, including heap leach studies.

2. Commenced discussions with Steinert for advanced ore sorting test work.

3. Actively pursuing US federal and state grants for critical minerals studies and development.

4. Holds approximately $10.6m in cash and liquid investments.

5. Successfully raised US$3.3m through the NASDAQ listing.

6. Extended convertible facility with Nebari Holdings, for 12 months.

7. Commenced 2024 field program focusing on high-grade zones at RPM.

The company continues to advance towards completing the PFS and expects to provide updates on drilling results, metallurgical test work, and an updated Mineral Resource Estimate in the coming months.

Positive

- Successful completion of US NASDAQ listing, raising US$3.3m

- Advancement of PFS level studies for Estelle Gold Project

- Potential inclusion of heap leach in flowsheet, potentially improving project economics

- Exploration of advanced ore sorting techniques to potentially improve previous results

- Active pursuit of US federal and state grants for critical minerals development

- Holding of $10.6m in cash and liquid investments

- Extension of convertible facility with Nebari Holdings for 12 months

- Commencement of 2024 field program focusing on high-grade zones at RPM

Negative

- Exploration and evaluation costs of $962K during the quarter

- US listing related costs of $135K

- Payments to related parties of $221K for remuneration and fees

News Market Reaction 1 Alert

On the day this news was published, NVA declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Nova completes US NASDAQ Listing and Advances PFS Level Studies

Caufield, Australia, July 30, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” and the “Company”) (Nasdaq NVA, NVAWW) (ASX: NVA), (OTC: NVAAF) (FSE: QM3)), a gold and critical minerals exploration stage company focused on advancing the Estelle Gold Project in Alaska, U.S.A.

Highlights

Estelle Gold Project

| ● | PFS level metallurgical test work was ramped up during the three months ended June 30, 2024 with Perth based METS Engineering. Heap leach studies are currently underway with final results expected later this year. Including heap leach in the flow sheet as a processing option has wide ranging positive implications to the project, including material handling improvements more efficient resource extraction, increased gold production over the life of mine, and reduced capex. |

| ● | Further test work related to the process plant, including crushing, grinding, flotation and CIL has already commenced or is in the schedule as part of the company’s efforts to deliver a positive Pre-Feasibility Study to the market as soon as possible. |

| ● | Nova commenced discussions with Steinart to investigate next level ore sorting test work with Steinert’s multi sensor applications to potentially further improve the previous exceptional ore sorting results achieved from XRT density ore sorting alone. |

| ● | The Company is actively pursuing US federal and state grants through various funding programs focussed on supporting critical minerals studies and development. During the quarter, Company CEO, Christopher Gerteisen visited Washington DC and Juneau to meet with relevant government agencies and policy makers. The Company has also joined several industry consortiums and attended conferences related to the US Department of Defense making presentations highlighting the Estelle Project as a potential future source of critical minerals to contribute to the objective of establishing and securing US domestic supply chains. |

Snow Lake Lithium

| ● | Snow Lake Lithium, in which the Company owns a |

| ● | Snow Lake also announced in June 2024 that it has commenced exploration programs at both its Shatford Lake lithium project and its Engo Valley uranium project during the quarter. |

Corporate

| ● | Nova continues to hold circa |

| ● | During the quarter the Company advanced its US NASDAQ listing which was subsequently successfully completed on 26 July 2024 with an associated approximate US |

| ● | Following shareholder approval at the General Meeting held on 31 May 2024, Nova extended the convertible facility with Nebari Holdings, LLC for a further 12 months to 29 November 2025 |

| ● | Several directors of the Company participated in the AUD |

| ● | Notable investing and operating cash flow items during the quarter included: Exploration and evaluation costs of |

| ● | Payments to related parties in Q4 FY24 were |

| ● | Mr Richard Beazley joined the board as Non-Executive Chairman concurrent with the US listing. |

Next Steps

| ● | Commencement of the 2024 field program with a focus on the high-grade zones at RPM |

| ● | Drill results and other exploration activity from the 2024 field program |

| ● | Updates on potential critical minerals grant and funding options from the US Department of Defense and US Department of Energy |

| ● | Material PFS test work results and trade-off studies as they become available |

| ● | Updated global MRE including the drilling undertaken in both 2023 and 2024 |

| ● | Metallurgical test work ongoing |

| ● | Environmental test work ongoing |

| ● | West Susitna Access Road updates |

Nova CEO, Mr Christopher Gerteisen commented: “During the quarter market announcements were limited due to regulatory sensitivities associated with the US listing process, which has subsequently been successfully completed with the ADSs and warrants now trading on the NASDAQ under ticker symbol NVA and NVAWW, respectively. However, work activities to advance the project towards completion of the PFS continued at a steady pace during the quarter. The Company raised capital to strengthen its balance sheet in preparation for the RPM resource drilling program which is expected to commence shortly, with assay results news flow from it to be expected in the coming months. In addition, project related technical reviews and test work programs are ongoing, including advanced stage metallurgical and environmental baseline studies, which are crucial for completion of the PFS now underway. Networking and lobbying efforts also continued at the US federal and Alaska state levels to inform and build support for the project with policy makers as well as to seek funding grants to delineate and develop the antimony and other critical mineral resources within the Estelle Gold Project, which can play an important role in the US Government efforts to establish and fully secure US domestic supply chains for these elements, whilst potentially providing significant by-product credits to the project.

With the US listing on the NASDAQ now complete, the Company continues to push forward with its core mission of advancing the Estelle Gold Project with news flow to follow, including RPM resource drilling results, updated MRE, and next level metallurgical test work results, all expected to have a positive impact on the PFS now underway to deliver additional milestones on our path towards production.”

Major ASX Announcements During the June 2024 Quarter

| ● | 9 April 2024 | - Nova Completes Bridge Funding |

| ● | 16 April 2024 | - Nova Public Filing of Registration Statement for US Listing |

| ● | 16 April 2024 | - Nova Adds Experienced Mining Professional as Chairman |

| ● | 16 April 2024 | - Mineral Resource Estimate for US Listing |

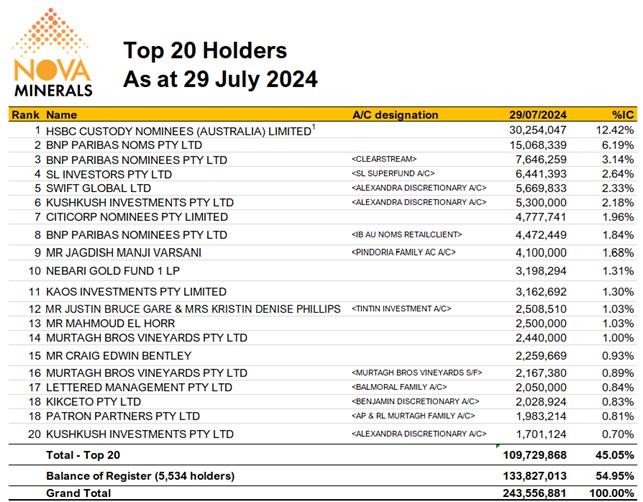

Top 20 Shareholders as at 29 July2024 (Post Closing of the US Listing)

1 HSBC Custody Nominees (Australia) Limited includes 28,500,000 ordinary fully paid shares issued to the depositary agent, which will underlie the NASDAQ listed ADS’s.

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations, presentations and videos all available on the Company’s website.

www.novaminerals.com.au

This announcement has been authorized for release by the Executive Directors.

| Christopher Gerteisen CEO and Executive Director | Craig Bentley Director of Finance, Compliance & Investor Relations | |||

| E: info@novaminerals.com.au | E: craig@novaminerals.com.au | |||

| M: +61 414 714 196 | ||||

Streamlined Competent Person Statements

Mr Vannu Khounphakdee P.Geo., who is an independent consulting geologist of a number of mineral exploration and development companies, reviewed and approves the technical information in this release and is a member of the Australian Institute of Geoscientists (AIG), which is ROPO accepted for the purpose of reporting in accordance with ASX listing rules. Mr Vannu Khounphakdee has sufficient experience relevant to the gold deposits under evaluation to qualify as a Competent Person as defined in the 2012 edition of the ‘Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Vannu Khounphakdee is also a Qualified Person as defined by S-K 1300 rules for mineral deposit disclosure. Mr Vannu Khounphakdee consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

The information in the announcement dated today that relates to exploration results and exploration targets is based on information compiled by Mr. Hans Hoffman. Mr. Hoffman, Owner of First Tracks Exploration, LLC, who is providing geologic consulting services to Nova Minerals, compiled the technical information in this release and is a member of the American Institute of Professional Geologists (AIPG), which is ROPO, accepted for the purpose of reporting in accordance with ASX listing rules. Mr. Hoffman has sufficient experience relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 edition of the ‘Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Hoffman consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

The Exploration results were reported in accordance with Clause 18 of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (2012 Edition) (JORC Code).

Nova Minerals confirms that it is not aware of any new information or data that materially affects the information included in the relevant market announcements, and in the case of the exploration results, that all material assumptions and technical parameters underpinning the results in the relevant market announcement continue to apply and have not materially changed.

Forward-looking Statements and Disclaimers

This news release contains “forward-looking information” within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget” “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or indicates that certain actions, events or results “may”, “could”, “would”, “might” or “will be” taken, “occur” or “be achieved.” Forward-looking information is based on certain factors and assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, Gold and other metal prices, the estimation of initial and sustaining capital requirements, the estimation of labour costs, the estimation of mineral reserves and resources, assumptions with respect to currency fluctuations, the timing and amount of future exploration and development expenditures, receipt of required regulatory approvals, the availability of necessary financing for the Project, permitting and such other assumptions and factors as set out herein. apparent inconsistencies in the figures shown in the MRE are due to rounding

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in Gold prices; sources and cost of power and water for the Project; the estimation of initial capital requirements; the lack of historical operations; the estimation of labour costs; general global markets and economic conditions; risks associated with exploration of mineral deposits; the estimation of initial targeted mineral resource tonnage and grade for the Project; risks associated with uninsurable risks arising during the course of exploration; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support exploration activities; risks associated with changes in the mining regulatory regime governing the Company and the Project; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalisation and liquidity risks including the risk that the financing necessary to fund continued exploration and development activities at the Project may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of the Company; the risk of litigation.

Although the Company has attempted to identify important factors that cause results not to be as anticipated, estimated or intended, there can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Forward looking information is made as of the date of this announcement and the Company does not undertake to update or revise any forward-looking information this is included herein, except in accordance with applicable securities laws.

Tenement Holdings as at 30 June 2024

A list of Nova’s Tenement Holdings, as at the end of the Quarter, is presented in the schedules below, with additional notes.

| Tenement/Claim/ADL Number | Location | Beneficial % Held | |||

| 725940 - 725966 | Alaska, USA | 85 | % | ||

| 726071 - 726216 | Alaska, USA | 85 | % | ||

| 727286 - 727289 | Alaska, USA | 85 | % | ||

| 728676 - 728684 | Alaska, USA | 85 | % | ||

| 730362 - 730521 | Alaska, USA | 85 | % | ||

| 737162 - 737357 | Alaska, USA | 85 | % | ||

| 740524 - 740621 | Alaska, USA | 85 | % | ||

| 733438 - 733598 | Alaska, USA | 85 | % | ||

| 741364 - 741366 | Alaska, USA | 85 | % | ||

Rule 5.5

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

| Name of entity |

| Nova Minerals Limited (ASX: NVA) |

| ABN | Quarter ended (“current quarter”) | |

| 84 006 690 348 | 30 June 2024 |

| Consolidated statement of cash flows | Current quarter $A’000 | Year to date (12 months) $A’000 | ||||||||

| 1. | Cash flows from operating activities | |||||||||

| 1.1 | Receipts from customers | |||||||||

| 1.2 | Payments for | |||||||||

| (a) exploration & evaluation | (243 | ) | (352 | ) | ||||||

| (b) development | ||||||||||

| (c) production | ||||||||||

| (d) staff costs (directors/consultants) | (268 | ) | (1,054 | ) | ||||||

| (e) administration and corporate costs | (217 | ) | (707 | ) | ||||||

| (f) audit, tax, and legal fees | (106 | ) | (415 | ) | ||||||

| (g) other professional fees | (234 | ) | (561 | ) | ||||||

| (h) US listing fees | (135 | ) | (247 | ) | ||||||

| 1.3 | Dividends received (see note 3) | |||||||||

| 1.4 | Interest received | 36 | 263 | |||||||

| 1.5 | Interest and other costs of finance paid | (253 | ) | (719 | ) | |||||

| 1.6 | Income taxes paid | |||||||||

| 1.7 | Government grants and tax incentives | |||||||||

| 1.8 | Other (provide details if material) | |||||||||

| (a) GST & Payroll tax | 25 | 115 | ||||||||

| 1.9 | Net cash from / (used in) operating activities | (1,395 | ) | (3,677 | ) | |||||

| 2. | Cash flows from investing activities | |||||||||

| 2.1 | Payments to acquire or for: | |||||||||

| (a) Entities | ||||||||||

| (b) Tenements | ||||||||||

| (c) property, plant and equipment | (7 | ) | (256 | ) | ||||||

| (d) exploration & evaluation | (962 | ) | (12,398 | ) | ||||||

| (e) investments | - | (1,071 | ) | |||||||

| (f) other non-current assets | ||||||||||

| 2.2 | Proceeds from the disposal of: | |||||||||

| (a) entities | ||||||||||

| (b) tenements | ||||||||||

| (c) property, plant and equipment | ||||||||||

| (d) investments | - | 51 | ||||||||

| (e) other non-current assets | ||||||||||

| 2.3 | Cash flows from loans to other entities | - | 352 | |||||||

| 2.4 | Dividends received (see note 3) | |||||||||

| 2.5 | Other (provide details if material) | |||||||||

| 2.6 | Net cash from / (used in) investing activities | (969 | ) | (13,322 | ) | |||||

| 3. | Cash flows from financing activities | 997 | 997 | |||||||

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | |||||||||

| 3.2 | Proceeds from issue of convertible debt securities | |||||||||

| 3.3 | Proceeds from exercise of options and warrants | |||||||||

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | |||||||||

| 3.5 | Proceeds from borrowings | |||||||||

| 3.6 | Repayment of borrowings | |||||||||

| 3.7 | Transaction costs related to loans and borrowings | |||||||||

| 3.8 | Dividends paid | |||||||||

| 3.9 | Corporate advisory costs | |||||||||

| 3.10 | Net cash from / (used in) financing activities | 997 | 997 | |||||||

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | |||||||||

| 4.1 | Cash and cash equivalents at beginning of period | 4,529 | 19,241 | |||||||

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (1,395 | ) | (3,677 | ) | |||||

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (969 | ) | (13,322 | ) | |||||

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | 997 | 997 | |||||||

| 4.5 | Effect of movement in exchange rates on cash held | (12 | ) | (89 | ) | |||||

| 4.6 | Cash and cash equivalents at end of period | 3,150 | 3,150 | |||||||

| 5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter $A’000 | Previous quarter $A’000 | |||||||

| 5.1 | Bank balances | 3,150 | 4,529 | |||||||

| 5.2 | Call deposits | |||||||||

| 5.3 | Bank overdrafts | |||||||||

| 5.4 | Other (provide details) | |||||||||

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 3,150 | 4,529 | |||||||

| 6. | Payments to related parties of the entity and their associates | Current quarter $A’000 | ||||

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 221 | ||||

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - | ||||

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments.

| 7. | Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end $A’000 | Amount drawn at quarter end $A’000 | |||||||

| 7.1 | Convertible facilities(1) | Up to US | US | |||||||

| 7.2 | Credit standby arrangements | |||||||||

| 7.3 | Other (please specify) | |||||||||

| 7.4 | Total financing facilities | Up to US | US | |||||||

| 7.5 | Unused financing facilities available at quarter end | |||||||||

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. |

| (1) - Convertible Facility | ||

| ● | Amount: Up to US | |

| ● | Term: 36 months from the closing date (29 November 2025) | |

| ● | Discount: Original issue discount of | |

| ● | Coupon: | |

| ● | Setup Fee: | |

| ● | Conversion: Nebari has the option to convert up to | |

| ● | Forced Conversion: If Nova’s share price is greater than | |

| ● | Voluntary Prepayment: In addition to voluntary prepayment in cash, Nova may repay up to | |

| 8. | Estimated cash available for future operating activities | $A’000 | ||||

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (1,395 | ) | |||

| 8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (962 | ) | |||

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (2,357 | ) | |||

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 3,150 | ||||

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | - | ||||

| 8.6 | Total available funding (item 8.4 + item 8.5) | 31,50 | ||||

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 1.34 | ||||

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | |

| 8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: |

| 8.8.1 | Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | |

| Answer: | Yes, the Company expects expenditure to be in line with prior quarters, subject to forecasting | |

| 8.8.2 | Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | |

| Answer: | Yes, the Company completed a US | |

| 8.8.3 | Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | |

| Answer: | Yes, Refer 8.8.2 and 8.8.3 above. The Company expects to be able to continue its operations and meet its business objectives on a going concern basis. | |

| Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | ||

Compliance statement

| 1 | This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A. |

| 2 | This statement gives a true and fair view of the matters disclosed. |

| Date: | 30 July 2024 | |

| Authorised by: | Executive Directors | |

| (Name of body or officer authorising release – see note 4) |

Notes

| 1. | This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so. |

| 2. | If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report. |

| 3. | Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity. |

| 4. | If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. |

| 5. | If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively. |

| ASX Listing Rules Appendix 5B (17/07/20) | |

| + See chapter 19 of the ASX Listing Rules for defined terms. |